Energy companies talk strategic moves at Barclays 2025 CEO Energy-Power Conference

Energy companies with operations in the upstream, midstream, and downstream gathered in New York Sept. 2-4, 2025, for the Barclays 39th Annual CEO Energy-Power Conference. Companies discussed market volatility, growth and transition, diversification, and operational and financial strategies.

Oil & Gas Journal compiled takeaways from a handful of companies:

SM Energy

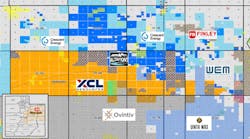

SM Energy Inc. chief financial officer Wade Pursell told the conference—much as he did at a late-spring gathering hosted by Bank of America—that company leaders are looking for other acquisitions in Utah’s Uinta basin (and maybe another region, too) to supplement the operator's 2024 purchase of XCL Resources assets.

Any aquisitions would need to meet high returns thresholds, he said, while an improving regulatory picture should make things easier than in past years.

“So much of the crude is now railed out of the […] state and the administration may be a little friendlier to that,” Pursell said. “We wouldn’t count on it but it feels intuitively like it probably is.”

Speaking to the XCL buy, Pursell praised SM’s technical teams for identifying the potential of the Uinta and its 90% oil output—which helps the basin produce profits on par with SM’s operations in Texas. Looking ahead, he added, SM will put 90% of its 2025 Uinta capital into the deepest of three cubes but move beyond that in 2026.

“You’ll see us testing more the upper cube next year, I’m quite sure,” he said. “And it’s not just the way we drill and complete the wells but it’s […] our philosophy of co-developing [that] we think will also make the overall asset much more valuable at the end of the day versus just focusing on intervals that we know first.”

EOG Resources

Ezra Yacob, chairman and chief executive officer of EOG Resources Inc., spoke to the Barclays audience about the company’s track record of being “a first mover” in many of the regions where it is active. The most recent case, he said, is the Utica basin in Ohio, where the operator this year paid $5.6 billion for Encino Acquisition Partners.

Notable: Yacob said that deal materialized after EOG teams had investigated the basin for the third time in about a decade.

“I think what we’ve captured in this company is something that’s very sustainable and more than just a static look in time at our current 12 billion barrels of equivalent resource,” he said of the big picture. “The sustainability of the company is the culture and commitment to continue to utilize data and technology to unlock new resources.”

Might more merger and acquisition activity follow for EOG, Barclays analyst Betty Jiang asked. Yacob was clear in his response: Encino was one of those first-mover opportunities that don’t come along often and have the potential for big returns.

“You need to have low cost and you have to have significant undrilled upside that we can bring forward to help the returns profile of the company,” he said. “What that means typically is, in an emerging asset, you kind of get one shot to do it. Because once you do that, the market has been moved, obviously.”

Devon Energy

Looking for an artificial-intelligence (AI) evangelist to speak at your next event? You’ll be hard pressed to beat the enthusiasm Clay Gaspar can bring to the table.

“Count me as an absolute AI bull,” Devon Energy Corp. president and chief executive officer told the Barclays audience. “Whatever hyperbole you want to lay out there, I think it’s going to be bigger than that.”

Gaspar dove into details, telling those gathered about Devon’s AI push with an internal platform launched in May 2023. That initiative, called ChatDVN, last month hit a milestone in that 50% of Devon’s employees—geoscientists and engineers as well as attorneys and accountants—now use the technology.

One result? Gaspar said the platform has produced “a 3x multiplier on the productivity of those employees,” whose use of AI has been driven by inverting the old time-use maxim that we spend about 75% of our time looking for data and only 25% analyzing that data.

That improvement includes performance in the field, where Devon is shortening drill times and reducing bit destruction. Over time, that is expected to turn into real financial savings: Gaspar placed ChatDVN inside the Devon team’s $1 billion plan to spend more wisely and said combining “genius human beings” with AI is lowering the company’s base declines and improving resource recovery.

“The maintenance capital required, the number of sticks, the amount of that precious inventory that we consume every year gets a little bit lighter lift each year” through that process, he said. “So think of the business optimization is also an inventory enhancer.”

Coterra Energy

Company culture was a notable part of the conversation between Barclays’ Jiang and Tom Jorden, the chairman, president, and chief executive officer of Coterra Energy Inc. Jorden, whose next birthday will be his 68th, said he gets a kick out of being “surrounded by people that you have to work really hard to keep up with” and lauded Coterra’s “aggressive” intern program that has brought a lot of young talent through its doors.

The idea of youth carried over into Jiang’s question about the person who’ll take over from Jorden, who has led Coterra since 2021 when the company was created via the merger of Cabot Oil & Gas and Cimarex Energy Co.

“It’s probably apparent to anybody who looks at Coterra that my successor will be a fair amount younger than I was when I took the job,” Jorden said. “The thing that I tell our board is, ‘Don’t ever get distracted by somebody’s age.’”

Coterra has some great internal candidates in large part because the company has built “a high-trust environment” where talented people are pushed early.

“I’ll take a 30-year-old at Coterra and put them against anybody in our industry because they’ve managed multimillion-dollar projects. They’ve had to stand and make recommendations,” Jorden said. “They’ve also been challenged with dealing with failure and they know how to adapt.”

ExxonMobil

ExxonMobil’s to-do list at the beginning of this year included 10 start-up projects around the world. Speaking at the Barclays conference, senior vice-president Jack Williams said seven of that group—including the Guyana Yellowtail project and a carbon capture and sequestration (CCS) operation at a CF Industries plant in Louisiana—have begun operating and the remaining three are on track.

Those projects, he added, sets the stage for $3 billion in incremental profits in 2026—“kind of a good down payment, if you will, on our 2030 story.”

Exxon’s story into the next decade, Williams said, will continue to include the Permian basin—the company runs more than 30 rigs there—as well as the booming Guyana project. The potential of the latter project has been pegged at 11 billion bbl.

Barclays analyst Jiang asked when that figure might be adjusted upward. Williams said “it’s not for lack of trying” that that hasn’t yet happened.

“Most of the resource in the Stabroek block […] that we’re developing is focused on the southeast portion of it. So there’s still exploration running room out to the west, northwest that we have yet to really fully exploit,” he said.

“We’ll continue to work on it. But right now, 11 billion barrels is the best number we have for our resource system in Guyana and we’re quite proud of it. It’s a big number.”

ONEOK

Sheridan Swords, executive vice-president and chief commercial officer at Oneok Inc., spoke about growth in the Permian basin and the strategic rationale behind the Eiger Express Pipeline JV.

"We saw a need as we look at our growth out of our [gathering and processing] and the growth we're seeing on other [gathering and processing] players coming to our system as well as growth across the whole Permian basin that more natural gas egress needed to come out of the basin," he said.

Couple that with "the increased demand from LNG that's going to happen along the Gulf Coast, that was the location we thought was the best to go," he continued.

Swords said ONEOK has added gathering and processing plants into the Permian basin, adding, "we need the cheapest gas takeaway we can get for those plants to keep netbacks for our producers...so it's just natural that we participated in the Eiger project...we're excited about that."

He said the project can grow up to 2.5 bcf.

"We are very excited about the natural gas business, especially if you look into Louisiana with the natural gas business that we bought from EnLink...it's kind of the last mile into the river corridor."

Industrial demand is growing in the area, he said, with ammonia plants and hydrogen plants coming online, and also an opportunity to work with some of the Louisiana LNG players, he noted.

In addition to the growth opportunity in Louisiana, Swords said there's a lot of potential in the company's legacy Oklahoma and West Texas areas, as demand growth from AI contines.

"We have some data centers that we're very close to getting some things done with...that are very close to our system." While they're not "huge needle movers...you're going to get a nice return on that as we can afford."

"You've got growing supply, growing demand, and that's what midstream does best, put those two together," he said.

Kinder Morgan

Kinder Morgan Inc. revised its oulook for natural gas demand, increasing its forecast to 28 bcfd of growth between 2025 and 2030. Its year-ago forecast predicted 20 bcfd, chief executive officer and director Kimberly Dang said at the conference.

Dang said Kinder Morgan historically used a natural gas demand forecast compiled by Wood Mackenzie, but said as its own projections began to diverge about a year ago.

Right now, she said, WoodMac's projection is 22 bcfd.

"The biggest difference between those two [projections] is [Kinder Mogan] project LNG export growth of 20 bfcd...that's a huge percentage of the 28 versus WoodMac at 15 [bcfd]. And if you look right now at the projects that are actually under construction plus one project that was recently FID [final investement decision], you're over the WoodMac number, and you're starting to approach our number." On top of that, she said, there have been a number of supply agreement announced in 2025 that are not yet FID, but are seen as more and more likely.

Factors in Kinder Morgan's projections include US administration support, growing power demand from data centers, population shifts south, reshoring of factories, and renewables backup needs.

The renewable development element related to the power growth estimate is one that likely differentiated Kinder Morgan's projections versus WoodMac's, she said.

WoodMac's projections were done prior to the current administration's reconciliation bill. "I think there was an expectation prior to that that there was going to be more renewable development. And now I think natural gas, predominantly, will have to fill that hole. And so I think there's probably upside to what we've forecasted on the power side," Dang said.

"I think it is a very nice environment to be a natural gas infrastructure company," she said, reiterating a point she made in the company's second-quarter earnings call. "I've been at Kinder Morgan, approaching 25 years, and this is the best opportunity set that I've seen during my career at Kinder Morgan."

In January, the midstream operator sanctioned construction of the $1.8-billion Trident Intrastate Pipeline project designed to move 2 bcfd of natural gas to the US Gulf, an LNG and industrial corridor.

The 216-mile, 48- and 42-in. OD line will run from Katy, Tex., to Port Arthur, Tex., terminating at Golden Pass LNG, a committed anchor shipper.

WIth expansion opportunities on the LNG side, the 20 bcfd growth, Dang said, "there's going to be nice opportunities to potentially expand that pipe." Currently, she said, Kinder Morgan moves about 45% of gas going to LNG plants. Right now, she said, "we've got about 8 bcfd contracted. That will go to 12 bcfd based on Trident and some other projects where we have signed contracts."

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.