EOG Resources Inc., Houston, has agreed to buy Encino Acquisition Partners LLC, the largest oil producer in Ohio, for $5.6 billion. Executives say the plan will grow EOG’s Utica Shale holdings into a 275,000 boe/d operation and turn it from a developing asset into a foundational one.

EOG chairman and chief executive officer Ezra Yacob said May 30 that his team has been working in the Utica with and alongside Encino for years and added that both leadership teams “found ourselves at a point where it made a lot of sense going forward to consolidate these positions.” Encino Acquisition Partners was launched in 2017 by Encino Energy, also of Houston, and the Canada Pension Plan Investment Board when they acquired the Utica operations of what was then Chesapeake Energy Corp.

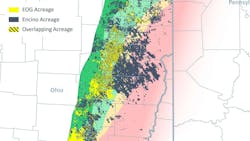

EOG today controls about 460,000 net acres in eastern Ohio and is producing about 40,000 boe/d while Encino owns about 675,000 acres and is producing 235,000 boe/d. When combined—the cash-and-debt acquisition is expected to close in the second half of this year—the operations will control more than 2 billion boe of reserves.

“This acquisition is not merely about scaling up. It’s about enhancing the quality and depth of our portfolio,” Yacob said on a conference call with analysts.

About 45% of the companies’ prospective joint production in the Utica will be gas. Oil will account for roughly a quarter of production with natural gas liquids accounting for the remaining 30%. Yacob said he expects EOG to apply some of its technologies to Encino’s operations—since 2022, EOG’s average production per foot drilled in the volatile oil window has been about 10% higher than Encino’s—and thinks both entities’ teams should be able to bring learnings from their work on liquids to gas operations.

Buying Encino is expected to add 10% to EOG’s annualized earnings before interest, taxes, depreciation and amortization. Additionally, the team expects lower capital, operating and debt financing costs will generate $150 million in savings in the first year the companies are under the same umbrella.

EOG executives last year began regularly discussing the company’s Utica potential: In early September, chief operating officer Jeff Leitzell told a Barclays conference that the basin “absolutely has the opportunity to be a foundational play” after early development work met or topped expectations (OGJ Online, Sept. 5, 2024).

Andrew Dittmar, principal analyst at Enverus Intelligence Research, said the Encino deal lets EOG—which hasn’t made a big acquisition since buying Yates Petroleum in 2016—accumulate inventories in an energy market that has seen other players strike big deals in recent years (OGJ Online, Sept. 9, 2016).

“Targeting this area provided for a significantly less expensive acquisition cost for undeveloped locations than what could be found in the Permian while also getting a much less developed asset than what would be available at scale in areas like the Eagle Ford and Williston Basin,” Dittmar said.

“While M&A has been rare for EOG, this looks like the kind of deal we would expect the company to make," he continued.

On the conference call, Yacob told analysts that EOG will integrate the three to four rigs and two completion crews Encino is running today and added that it’s too early to outline production targets for 2026.

Shares of EOG (Ticker: EOG) were down 1.5% to about $108 in afternoon trading May 30, in line with the broader market. Over the past 6 months, shares have lost nearly 20% of their value, a move that has trimmed the company’s market capitalization to about $59 billion.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.