OGJ Newsletter

GENERAL INTEREST — Quick Takes

Energy-investment rise seen in MENA region

Total energy investments over the next 5 years in the Middle East and North Africa (MENA) will reach $900 billion, according to Arab Petroleum Investments Corp. (APICORP).

The estimate is up $145 billion from a projection made in 2015, APICORP said.

Committed projects under execution in the MENA region account for $289 billion of the expected investment. The remaining $611 billion is for planned projects.

APICORP said Saudi Arabia, Kuwait, and the UAE will lead regional investment with projects spanning the energy value chain. Iraq and Iran, the development bank said, "will play catch-up and are determined to push their ambitious oil and gas plans forward but will face many above-ground challenges."

Algeria has announced aggressive investment plans, and the giant Zohr offshore natural gas discovery and related power development will boost spending in Egypt (OGJ Online, Mar. 10, 2016).

Morocco, Tunisia, and Jordan will invest in renewable energy projects to meet rising power demand.

While noting the region's strong link between investment and oil prices, APICOR said some countries, including those leading the investment plans, have said they'll proceed even if prices stay low.

Countries with low fiscal buffers and other claims on revenue, especially Iraq, "may have to reconsider their ambitious capacity-expansion programs," the report said.

APICORP also pointed out that creditworthiness has deteriorated in the MENA region and that conflicts and instability will discourage investment.

Merit Energy to buy Marathon's Wyoming assets

Merit Energy Co., Dallas, has agreed to acquire all of the upstream and midstream assets in Wyoming that belong to Marathon Oil Corp., Houston, for $870 million, a Marathon official confirmed to OGJ on Apr. 12.

The upstream properties, comprised primarily of waterflood developments in the Big Horn and Wind River basins, averaged 16,500 boe/d during the first quarter. The assets also include the 570-mile Red Butte pipeline, the only export line in the area, Marathon says.

The deal is effective Jan. 1, and expected to close midyear.

"Since August 2015, we have now announced or closed noncore asset sales of approximately $1.3 billion, surpassing our targeted range of $750 million to $1 billion," said Lee Tillman, Marathon Oil president and chief executive officer.

Sanders: Ban hydraulic fracturing nationwide

Sen. Bernie Sanders (I-Vt.), seeking to become the Democratic Party's candidate in this year's presidential election, has called for a nationwide ban on hydraulic fracturing.

In a press statement, he contrasted his stand with "Hillary Clinton's shifting stand on the extreme and risky method of drilling for oil and gas."

Clinton, a former secretary of state and senator from New York, leads Sanders in the Democratic primary campaign.

Sanders on Apr. 11 released a television advertisement entitled "No Fracking Anywhere."

Exploration & Development — Quick Takes

Rawicz-15 well flows 3.6 MMscfd of gas in Poland

San Leon Energy PLC, Dublin, reported that the Rawicz-15 development well on the 742-sq-km Rawicz concession in Poland's southern Permian basin was stimulated and flowed at an average rate of more than 3.6 MMscfd over the main flow period of several days.

The well is now shut and pressure build-up information will be analyzed, interpreted, and used to update the reservoir model, the firm says.

The Rawicz project is operated by Palomar Natural Resources LLC, Littleton, Colo., with 65% interest. Completion of testing of Rawicz-15 means that Palomar's interest has been fully earned and future work will be funded according to participating interests. San Leon holds the remaining 35% of the concession.

Field development continues to progress and Palomar is finalizing a full development plan to be submitted to the Polish government for approval. Pipeline, facility, and final project engineering are nearly complete, while all required permits, rights-of-way and regulatory approvals are being obtained.

Gas off-take agreements are being negotiated with several groups. The operator's development plan now envisages at least three wells available for first production, including Rawicz-12 and Rawicz-15, now expected in early 2017.

A competent persons report (CPR) from Ryder Scott Co. in 2015 estimated gross proved plus probable reserves from Rawicz gas field of 50.3 bcf based upon a five-well development plan (OGJ Online, May 19, 2015).

Woodside to explore offshore permit in Bonaparte basin

Woodside Petroleum Ltd. has been awarded permit WA-522-P in the offshore Bonaparte basin. It lies between the Petrel, Frigate, Tern, and Blacktip gas fields on the east and the Prometheus-Rubicon fields to the west.

The area covers the Londonderry High and Petrel sub-basin and is well placed to provide natural gas east to Darwin or west and south to supply its LNG projects offshore eastern Australia.

The 7,800-sq-km permit is only 20 km from shore at its closest point and just 400 km west of Darwin. Only one well has previously been drilled within the new block-Kuwait Foreign Petroleum Exploration Co.'s Torrens-1 wildcat about 90 km offshore. It has oil and gas shows.

Eni SPA's Blacktip gas field is on stream via pipeline into the Northern Territory grid, but the Petrel, Tern, and Frigate fields remain undeveloped despite Santos-GDF Suez attempts to establish a floating LNG project. Those fields are thought to hold 2-3 tcf of gas reserves.

Oil and gas discoveries also have been made in the onshore Bonaparte basin in the last 30 years, although there has been no commercial development to date.

Woodside has taken note of expanding systems, including recent proposals for a northern gas pipeline linking the Northern Territory with eastern Australia.

Noble Energy to drill Katmai appraisal well

Noble Energy Inc., Houston, is mobilizing a rig to Green Canyon Block 39 in the Gulf of Mexico for appraisal drilling at the Katmai oil discovery after drilling a dry hole with its Silvergate exploration well on Mississippi Canyon Block 339.

The firm says the well is designed to test additional gross resource potential beyond the 40-60 million boe already discovered. Results from the well are expected in the early part of the fourth quarter.

Noble Energy in 2014 discovered a total of 154 net ft of crude oil pay in multiple reservoirs from Katmai, including 117 net ft in Middle Miocene and 37 net ft in Lower Miocene reservoirs, according to wireline logging data (OGJ Online, Aug. 28, 2014). The discovery well was drilled to a total depth of 27,900 ft in 2,100 ft of water.

At the time, the firm estimated total gross resources at Katmai to fall between 40-100 million boe, including the 40-60 million boe already discovered.

Potential development at Katmai would likely involve a subsea tie-back into existing infrastructure. Noble Energy operates Katmai with 38% interest in the appraisal well.

Noble Energy's total exploration expense in the first quarter is now expected to be toward the upper end of the previously-provided $130-170 million guidance range.

Drilling & Production — Quick Takes

Solan oil field starts up offshore Scotland

Solan oil field in the West of Shetland area offshore Scotland has started production (OGJ Online, Apr. 25, 2012).

Premier Oil PLC, the operator during development, said the first of two production wells is flowing naturally at restricted rates before start-up of an electric submersible pump.

Output will be suspended for commissioning of a water-injection plant, tie-in of a second water-injection well, and preparation for tie-in of a second production well.

The Diamond Offshore Ocean Valiant semisubmersible rig is drilling the second production well, which has cut 1,500 ft of what Premier describes as high-quality sands in the Jurassic Solan formation. The wells have 5,000-6,000-ft horizontal sections and need wire-wrap screens for sand control.

The second producer is to be completed, also with an ESP, and tied in by midyear.

Both producer-injector pairs are to be on stream in the second half of the year, when production is to reach 20,000-25,000 boe/d. Reserves are estimated at 44 million bbl.

The wells, completed subsea in 135 m of water on Block 205/26a, produce to a nearby conventional steel platform not permanently staffed. From the platform the oil flows into a subsea tank with 300,000 bbl of capacity connected to tanker-loading facilities.

Premier holds 60% interest in the Solan development. Chrysaor Holdings Ltd., London, holds 40%.

Turret bearing damaged on FPSO for Jubilee field

Tullow Oil PLC said oil production from the floating production, storage, and offloading vessel in Jubilee field offshore Ghana will restart in about 2 weeks.

Oil production and gas export from the field can continue but under revised operating and offtake procedures, including use of a dynamically positioned shuttle tanker with a capacity of 250,000 bbl and a storage tanker with a capacity of 1 million bbl. Tullow said the two tankers are in place, but that additional time is required to implement new procedures and receive required approvals.

Earlier this year Tullow said it had notified the government of Ghana and partners that it was reducing the degree of rotation of the Kwame Nkrumah FPSO following an inspection of the turret area, but that oil production and gas export were continuing as normal (OGJ Online, Feb. 18, 2016).

A subsequent technical investigation confirmed the turret bearing on the FPSO has been damaged and is no longer able to rotate as originally designed. A project team is working on a permanent solution.

Tullow's production guidance will be reissued once the new operating arrangements have stabilized. The company did not provide a current field production number. Its full-year results for 2015 indicated gross production from Jubilee in 2015 averaged 102,600 b/d, with 36,400 b/d net to Tullow. Its forecast for 2016 was 101,000 b/d.

The company said it has hull and machinery insurance and business interruption insurance.

Schlumberger trims operations in Venezuela

Schlumberger Ltd. has joined other service companies trimming work in Venezuela because of payment problems.

"This measure is a result of insufficient payments received in recent quarters and a lack of progress in establishing new mechanisms that address past and future accounts receivable," the company said in a statement.

The cutback will occur this month "and will be made in close coordination with all customers in Venezuela to continue servicing those customers with available cash flow while allowing for a safe and orderly wind-down of operations for others."

Schlumberger didn't name state-owned Petroleos de Venezuela SA, which has a cash-flow dilemma.

Barclays analysts J. David Anderson and William Thompson said in a research note that Schlumberger's decision "simply demonstrates Venezuela's predicament: PDVSA doesn't have the cash flow to pay oil field service companies, and yet it needs oil field service companies to maximize production to increase cash flow."

The analysts noted that Baker Hughes Inc. trimmed work in Venezuela in 2014 and that Weatherford reduced operations there and in Ecuador last quarter.

PDVSA issued a statement denying that Schlumberger has reduced operations in Venezuela and lamenting "the smear campaign by the media with the intention of tarnishing the broad business relations between the company and Schlumberger."

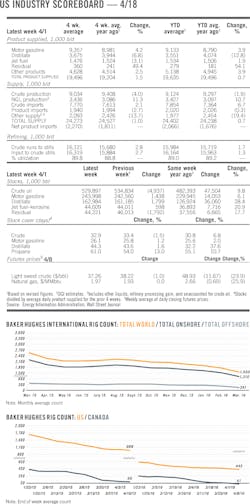

EIA: US shale oil output to drop 114,000 b/d in May

Crude oil production in May from the seven major US shale regions is expected to fall 114,000 b/d month-over-month to 4.84 million b/d, according to the US Energy Information Administration's latest Drilling Productivity Report (DPR).

The DPR focuses on the Bakken, Eagle Ford, Haynesville, Marcellus, Niobrara, Permian, and Utica, which altogether accounted for 95% of US crude production increases and all US natural gas production increases during 2011-13.

More than half of the total decline is expected to come from the Eagle Ford, which is forecast to fall 62,000 b/d to 1.18 million b/d. The Bakken is projected to drop 31,000 b/d to 1.05 million b/d, and the Niobrara is projected to decrease 16,000 b/d to 404,000 b/d.

For the second straight month, EIA anticipates a decline in the Permian. With a forecast drop of 4,000 b/d, output from the basin is to total 2.03 million b/d.

New-well oil production/rig in May across the seven regions is expected to fall by a rig-weighted average of 9 b/d to 532 b/d.

Gas production from the regions is forecast to shed 491 MMcfd during the month to average 45.93 bcfd, led by a 213-MMcfd loss in the Eagle Ford to 6.19 bcfd. The Niobrara is seen down 83 MMcfd to 4.13 bcfd, Haynesville down 63 MMcfd to 6.04 bcfd, and Marcellus down 60 MMcfd to 17.28 bcfd.

PROCESSING — Quick Takes

Braskem begins production at Mexican petchem project

Braskem Idesa SAPI, a 75-25 joint venture of Braskem SA, Sao Paulo, and Groupo Idesa SA de CV, Mexico City, has started production of polyethylene (PE) at the Etileno XXI petrochemical complex in the Coatzacoalcos-Nanchital region of the Mexican state of Veracruz (OGJ, July 7, 2014, p. 90; July 1, 2013, p. 90).

The complex's first high-density PE (HDPE) plant produced its initial batch of HDPE on Apr. 6, Braskem said.

Startup of the HDPE unit comes as part of the gradual commissioning process for the complex, which began in 2015 (OGJ Online, June 11, 2015).

In December 2015, Braskem Idesa entered the complex's utility plants (electricity, water, and steam) into operation, with startup of the 1.05 million-tonne/year ethylene cracker initiated in March 2016, the JV said.

Braskem said it expects to commission the remaining two PE plants-including another HDPE unit as well as a low-density PE (LDPE) unit-before the end of April and achieve the complex's overall PE production capacity of 1.05 million tpy within the coming months.

The $5.2-billion Etileno XXI project, which began precommissioning and testing of equipment and systems in early 2015 (OGJ Online, May 12, 2015), receives 66,000 b/d of ethane under a 20-year supply agreement with state-owned Petroleos Mexicanos to feed the complex's cracker (OGJ, July 4, 2011, p. 100).

Chinese petchem firm commissions second PTA unit

China Prosperity (Jiangyin) Petrochemical Co. Ltd., a wholly owned subsidiary of Jiangyin Chengxing Industrial Group Co. Ltd., has commissioned a second purified terephthalic acid (PTA) unit at its petrochemical production plant in Shizhuang Petrochemical Industrial Zone in Jiangyin City, Jiangsu Province, China.

Equipped with Invista Performance Technologies' (IPT) proprietary E2R, Solvent Interchange, and R2R PTA process technologies, the 2.2 million tonne/year line began producing on-spec PTA within 24 hr of its Mar. 14 startup, Invista said.

The second PTA unit joins China Prosperity's existing 600,000-tpy PTA unit at the site, which began operating in January 2011 and also is equipped with IPT's PTA technologies, the technology licensor said.

China Prosperity, which invested 6.55 billion yuan renminbi ($1 billion) in the PTA expansion, began construction on the PTA expansion project on Dec. 5, 2013, with trial operations of the unit at that time scheduled to start by October 2015, according to December 2013 release from the government of Jiangyin City.

Last month, Chengxing signed a syndicated loan in the amount of 2.9 billion yuan renminbi ($446.7 million) with a consortium of seven banks to further its investments into expanding operations in the region, Jiangyin City's government said in a Mar. 29 release.

First gas reported from Tanzanian Kiliwani North field

Aminex PLC subsidiary Ndovu Resources Ltd. has started gas production from its Kiliwani North field on Songo Songo Island, 15 km off mainland Tanzania (OGJ Online, Apr. 15, 2011; June 7, 2008).

Initial production began from the Kiliwani North-1 (KN-1) well on Apr. 4, with output to rise to an anticipated rate of 25-30 MMcfd during the next 90-100 days, Aminex said.

Tied into the regional pipeline system, KN-1 will deliver gas to Tanzania Petroleum Development Corp.'s (TPDC) newly expanded Songo Songo gas processing plant for distribution under a take-or-pay agreement to supply the local power market, according to the company.

With certified reserves of 45 bcf of gas (OGJ Online, Aug. 19, 2015), KN-1 lies just 2 km from the Songo Songo field gas plant that in turn is connected to the mainland and the key Ubungo power plant that generates about 50% of Tanzania's electricity capacity.

TPDC completed expansion and upgrading projects costing $151.7 million for the 140-MMcfd Songo Songo gas processing plant and $197.9 million for the 210-MMcfd Mnazi Bay gas plant by late 2015, according to a release from Tanzania's Ministry of Energy and Minerals.

The plant expansions were designed to accommodate increased demand for gas-fired electrical power in the country.

Alongside operator Ndovu Resources (Aminex) 51.75%, partners in the Kiliwani North development license include RAK Gas LLC 23.75%, Bounty Oil & Gas NL 9.5%, Solo Oil PLC 10%, and TPDC 5% following Aminex's disposal of 3.825% on Apr. 4 of its previous working interest in license.

TRANSPORTATION — Quick Takes

Mechanical issues halt production at Gorgon LNG

Chevron Australia Pty. Ltd. reported on Apr. 6 that LNG production at the Gorgon project on Barrow Island offshore northwestern Western Australia has been temporarily halted due to mechanical issues with the propane refrigerant circuit on Train 1 at the plant site.

The propane refrigerant circuit is a closed system used to cool gas supplied to the plant. Work necessary to complete the repairs is ongoing while the site team continues equipment inspection and assessment.

Chevron said the initial findings of an assessment team suggest the repair work is of a "routine nature" and that all the needed materials and equipment for the job are already on site at Barrow Island. A restart of the plant could take as long as 2 months.

LNG production from Train 1-the only one of the planned three to be brought on stream so far-began Mar. 7, with peak output reaching 90,000 boe/d (OGJ Online, Mar. 7, 2016). Train 1 ramp-up to full capacity is still expected to occur over 6 to 8 months from initial start-up. Construction activities continue to progress on Trains 2 and 3 with timing not affected by the work on Train 1.

The first and only LNG cargo departed Barrow Island on Mar. 21 and was delivered on Apr. 6 to Chubu Electric Power Co. Inc. in Japan (OGJ Online, Mar. 21, 2016).

The Chevron-operated Gorgon project is a joint venture of the firm's Australian subsidiaries with 47.3% interest, ExxonMobil Corp. and Royal Dutch Shell PLC each with 25%, Osaka Gas Co. Ltd. 1.25%, Tokyo Gas Co. Ltd. 1%, and Chubu Electric Power Co. Inc. 0.417%.

TransCanada restarts South Dakota crude pipeline

TransCanada Oil Operations Inc. resumed limited operations of a 43.1-mile segment of its Keystone Mainline No. 2 crude oil pipeline near Freeman, SD, on Apr. 10 after shutting it down when a leak was detected on Apr. 2.

The TransCanada Corp. subsidiary did so after receiving permission from the US Pipeline and Hazardous Materials Safety Administration, which issued a corrective action order (CAO) on Apr. 9 in connection with the incident.

"The restart comes after around-the-clock operations and excavation identified a small leak approximately 4 miles from the Freeman pump station," a spokesman said on Apr. 10. "As previously mentioned, onsite specialists and regulators have not observed any significant environmental impact."

The line is part of a 2,639-mile system running from Hardisty, Alta., to Patoka, Ill., and Port Arthur, Tex.

The CAO said that the 400-bbl leak's cause was initially identified on Apr. 7 as a girth weld anomaly at the bottom of a transition weld. The specific section of the 30-in. diameter pipeline that failed was installed in 2009.

TransCanada to expand Mexican gas pipeline network

Mexico's state-owned power company Comision Federal de Electricidad (CFE) has chosen TransCanada Corp. to build, own, and operate the Tula-Villa de Reyes natural gas pipeline in Mexico.

TransCanada expects to invest $550 million in the 36-in. OD, 420-km pipeline and anticipates an in-service date of early 2018. Construction is supported by a 25-year gas transportation service contract for 886 MMcfd.

The pipeline will begin in Tula, Hidalgo, and terminate in Villa de Reyes, San Luis Potosi, transporting gas to power generation facilities in the central portion of the country. The project will interconnect with TransCanada's Tamazunchale and Tuxpan-Tula pipelines as well as with other transporters in the region.

The Tula-Villa de Reyes pipeline is the most recent addition to TransCanada's expanding portfolio in Mexico. TransCanada was awarded the Tuxpan-Tula pipeline in November (OGJ Online, Nov. 11, 2015). By 2018, TransCanada will be operating six major gas pipeline systems in Mexico representing an overall investment of $3.6 billion.