The value of petroleum resources: analyses of cash-flows and uncertainties

Imre Szilágyi

Exploration geologist and petroleum economist

Budapest, Hungary

NOTE FROM THE AUTHOR: Following guidelines from the Society of Petroleum Engineers (SPE), most oil companies disclose 1P and/or 2P Reserves. It is, however, ascertainable that cash-flow forecasts based on these reported volumes are less than what investors can expect on the grounds of the probability theory. Furthermore, the uncertainty of the estimations is apparently ignored as an investment risk due to the fact that resources, regardless of their uncertainties, are discounted by the same rates. This article analyses the consequences of these two oddities on the valuation of petroleum resources.

In economic evaluations, cash-flow forecasts are normally based on the Mean values of the variables determining future revenues, expenditures, and costs, while the associated investment risk is taken into account in the cost of capital. To assist investors in assessing their cash-flow and risk expectations, oil and gas companies disclose all the information related to the fundamentals on what the actual asset pricing is taking place. In this view, the Reserves are the most important fundamentals of upstream business ventures.

Questions on resource evaluations

The disclosure of reserves is meticulously elaborated in the regulations and guidelines of the Securities and Exchange Commission (SEC) and SPE with the outspoken objective of the protection of investors' security interests. Led by this rationale, the listed oil companies are obliged to report those portions of undeveloped and developed resource volumes for what the commerciality is thought unquestionable. However, volumes of discovered resources subject to appraisal are not reported as reserves despite the fact that the positive NPV of the appraisal projects should obviously add to the company's value. How much value can investors attribute to the appraisal projects if they have no information on the discovered volumes to be appraised?

On the other hand, the reported reserves are always based on a technically recoverable volume that is less than the Mean value of the estimate. Presuming the proportionality of the recoverable resources and the cash-flow expectations of the field development projects, we can conclude that the cash-flows based on the Mean would be more than those based on a less recoverable volume.

The current practice seems like a precautionary measure that serves to diminish investor risk that arise from the fact that estimation of recoverable volumes is uncertain. However, is that the best way to manage such risks?

Evaluation of the uncertainty of resource estimates is one of the most important issues affecting the petroleum industry, but interestingly it does not have any effect on resource valuation. Nevertheless, it is the conclusion to be drawn from the fact that recoverable resource volumes, regardless of the uncertainty, are discounted at the same rate. Is it really true that appraisal, green and brown field development projects, are characterized by the very same investment risk? To have the answers, we have to see the details.

Probability-driven reserve reporting and the expected value

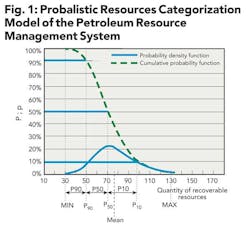

Most publicly-traded oil companies follow the Petroleum Resources Management System (PRMS) guidelines for petroleum resources categorization. The PRMS defines the technically recoverable volume of a discovered petroleum accumulation as a random variable with lognormal distribution (See Figure 1).

Under the terminology used by the PRMS, the P50 is the estimated quantity of petroleum for what there should be at least 50% probability that the quantities actually recovered will equal or exceed the estimate. P90 and P10 are the minimum quantities with at least 90% and 10% probabilities, respectively. Deterministically approached, the probabilistic P90, P50 and P10 are replaced by the Low, Best and High Estimates (LE, BE and HE).

The Reserves are the commercial (economic and marketable) subsets of the resources. The Proved (1P) Reserves are derived from the P90/LE volumes, the Proved and Probable (2P) Reserves are subsets of the P50/BE estimates, while the Proved, Probable and Possible (3P) are given based on the P10/HE resource category. Annual reports most often present the 2P Reserves and some companies disclose the 1P, too.

That is fine, but….once we start thinking about the lognormal behavior of the random variable recoverable resource volumes (Figure 1) the obviousness of taking the P50/BE estimate for the base of economic evaluation is questioned. It is found that the Expected Value (Mean) of the recoverable volumes differs from the P50/BE. The separation of the P50/BE and the Mean is attributed to the right-hand side skewness of the lognormal Probability Density Function.

From one point it seems correct to consider the P50/BE because this is the volume that is most likely forecasted to produce. However, that may not be correct because the Mean is the quantity of petroleum that is in fact expected to recover. An argument on behalf of using the Mean instead of the BE/P50 could be that in future predictions usually the statistical Mean is relied upon if the distribution of the random variable is other than normal (e.g. Poisson, binomial or exponential).

In the case of probabilistic analyses, the Mean is automatically calculated. In deterministic estimations, it can well be assessed using the Swanson formula where it is given as the weighted average of the Low, Best and High Estimates (Mean≈ 0.3xLE + 0.4xBE + 0.3HE).

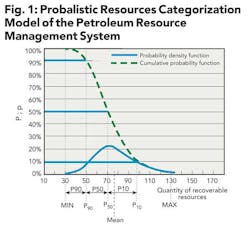

As shown in Figure 1, due to the lognormality the Mean, it is always more than the BE/P50. Is the difference relevant? It depends on the "flatness" and the "skewness" of the Probability Density Function of the distribution. ("Flatness" can be given as the ratio of the Minimum and the Best Estimate; while "Skewness" is the ratio of the Maximum minus Best Estimate and the Best Estimate minus Minimum differences).

Figure 2 presents that the difference of the Mean and the BE/P50 ranges between 2-15% in a flatness and skewness domains being typical of recoverable resources. I think a 2-15% difference is relevant.

Logically, if the Mean of the recoverable resource is more than the BE/P50 estimate the Reserve based on the Mean would be more than the 2P. Assuming the proportionality between resource volumes, reserves, and cash generation estimations, we can conclude that the Mean-based cash-flows might be 2-15% more than those of the 2P-based. The conclusion suggests that the prevailing (2P) reserve reporting practice may devaluate the investors' cash-flows at the NPV calculations. The devaluation is even more if cash-flow expectations are set based on the 1P reports.

In special circumstances, there may be logic behind relying upon a value that is less than "normally" expected. The rationale behind this consideration might obviously be a kind of risk aversion. Cash-flow is usually cut back if the investor perceives extra risk over the market risk. I think in our case the logic is false. The uncertainty of the resource volume estimations is as "natural" as it is for example the uncertainty of estimates made on prices, revenues, or costs. Therefore it seems a bit of unnecessary precaution to devaluate cash-flows just because the estimations of resource volumes are uncertain.

Resources subject to appraisal

So far we have been talking about recoverable resources that are ready for field development. Are the assumptions above extendable for those resources that have been discovered but still require appraisal? As these volumes also have a lognormal behavior the P90/LE, P50/BE and P10/HE recoverable quantities, as well as the Mean can be given.

The PRMS characterizes these resources that are immature for field development and therefore suggests categorizing them as contingent resources. The approach is apparently correct, but… the appraisal project targeting these resources must have a positive NPV, otherwise management would not approve them. If the NPV is there, it adds to the company value. Should we want the investors to valuate these NPV during the asset pricing, exercising the disclosure of the recoverable resources subject to appraisal seems to be justified.

Resources subject to appraisal are attributed with relevant uncertainties and risks, including but not limited to their commerciality, but I doubt those uncertainties should block the disclosure. I think the investors will be able decide whether and how the risks and uncertainties should be treated.

Correlation of uncertainty and investment risk

When talking about risks I want to clearly separate project and investments risks. Technical, economic, and commercial risks are project risks that are managed by well-known evaluation methodologies and are quantifiable with a standard sensitivity analyses resulting in several types of thresholds. Under the scope of this study, I am dealing with the investment risk that is interpreted in the investor's portfolio context. The proper question is whether the uncertainty of the resource estimations represents an investment risk or not.

Regarding the uncertainty of the resources, the PRMS advises companies to determine the P90/P50/P10 or the LE/BE/HE. In fact, it is a genuine categorization of the recoverable resource volume of an accumulation, but it may not be a proper answer for the question as to how much risk, based on the volume estimation's uncertainty we face against our investments.

Considering the uncertainty, it may be better to use the term "randomness" that we humans in general feel something the more uncertain the greater deviations we can perceive from the "average." In financing and engineering, as well as in the natural and social sciences, the measure of the uncertainty (randomness) is always the variance (or its square root, the standard deviation). Why is it not like that in the field of petroleum resources management?

The variance could easily be determined, but unfortunately it would not be very informative on the uncertainty of the actual recoverable volume. If we had a global database of petroleum accumulations populated with the variances, it would be very easy to set up an "objective" uncertainty categorization guideline. However, no such database is available, and therefore a variance figure alone tells us little about the overall uncertainty of a resource volume.

Although we can quantify that, in fact we are relying on our perceptions when we "classify" the uncertainty. In the case of recoverable volumes of discovered petroleum accumulations, our perception on the uncertainty is connected to the quantity and quality (reliability and relevancy) of the available information on the reservoir and the fluids. Once a discovery is made by a wildcat well, the actual purpose of the resource evaluation is to decide what the next step reasonably should be.

If we perceive that the available data in terms of quantity and/or quality are insufficient to start the field development, we propose to capture additional data and information in hopes that our uncertainty will lessen. The project to start at this point is the appraisal. Once the uncertainty of the resource estimation is perceived "low enough" to launch the field development, we propose that.

Upon completion of the field development after a certain period of production with a careful onward monitoring, we may try to perform a new resource evaluation by reservoir simulation or by a non-volumetric estimation method (material balance, decline curve analyses). Obviously the uncertainty of these estimations is much lower than it is prior to or in the course of the early production.

In light of the above assumptions, I conclude that the uncertainty categorization of the recoverable resources is in fact based on a perception of the uncertainty. Our perception relies on the quality and quantity of the available information, with other words on the maturity. In this regard, three uncertainty categories may be proposed as follows (Figure 3):

High Uncertainty Resources are those discovered volumes that are subject to further appraisal before the field development may commence.

Medium Uncertainty Resources are volumes subject to field development and/or are under early (immature) production. The term "early" refers to the judgment that the captured production information may not result in considerably lower uncertainty than that perceived prior to the field development phase.

Low Uncertainty Resources are volumes estimated on the ground of a non-volumetric production forecast method in the mature production stage. The term "mature" refers to the judgment that the captured production data allows the relevant reduction of uncertainty compared to the earlier "immature" production phase.

In line with the antecedents above, the quantities of the High, Medium, and Low Uncertainty Resources are the respective Mean values. In my approach the Means are subject to economic analyses, and the cash-flows of the given projects represent the investors' expectations.

Now we have arrived at the question as to whether the resource estimation uncertainty has any effect on the risk of upstream project investment. Currently, in a company with the same weighted average cost of capital (WACC), this estimation is applied to the NPV calculations regardless of the project maturity status (appraisal, field development, or mature production). It suggests that investors may find all three upstream project types equally risky. Is it an agreement based on common sense, or is it just a slap-dash routine?

Some arguments may be aligned to challenge the approach above. We should consider that the exposure of the appraisal projects might be much higher to economic cycles or to oil price expectations than that of the field development projects (and, accordingly, field development projects might be more sensitive to market variations than the mature production projects are). In other words, investments made into appraisals seem riskier than the field development projects, which are riskier than the investments in mature production. If that be the case, higher risks should see higher costs of capital.

The cost of capital is the function of the beta being the indicator of the investment's relevant risk (the higher the beta is the more sensitive the investment is to market variations). Should we accept that the uncertainty of resources estimations triggers a kind of relevant risk, we might conclude that it is be reasonable to introduce different "project betas" for the different uncertainty categories. The project betas may increase with the growth of resource uncertainty.

The other option to modify the cost of capital might be the introduction of a risk premium. Should we accept that the currently applied discount rate matches the risk of "normal" field developments targeting Medium Uncertainty Resources, the High Uncertainty Resources (subject to appraisal) might be discounted by a rate with a positive premium while in case of the Low Uncertainty Resources (subject to mature production) the premium could be negative.

I must admit here that at the moment I can quantify neither the "project betas" nor the magnitudes of risk premium. My assumptions are merely theoretical. Empirical evidences would be of a great importance. Unfortunately, if companies continue reporting their 1P and/or 2P Reserves only, and the Mean values of the Low, Medium and High Resources remains shadowed the evidences shall never be surfaced.

Summary and conclusions

Most publicly-traded oil companies report reserves according to the guidelines laid down in the SPE's Petroleum Resources Management System. In the study above, I demonstrated that – besides Reserves – the disclosure of the Mean value of the technically recoverable resources may better assist investors in setting cash-flow expectations.

Discussing the uncertainty of resource estimations I conclude that in fact it is connected to the maturity status of the actual project. Under this categorization approach, resources subject to appraisal are named as High Uncertainty Resources. Accordingly, recoverable volumes subject to field development and early production are referred as Medium Uncertainty Resources while the category name for the quantities of mature production could be Low Uncertainty Resources.

The correlation between the resource estimations' uncertainty and the investment risk of the appraisal, field development, and mature production projects is still questionable. The dissimilar sensitivity of the different project types to economic cycles suggests that the correlation exists. However, empirical evidence would be gained if oil companies would disclose the High, Medium, and Low Uncertainty resource volumes, allowing the investment community to properly valuate them.

About the author

Imre Szilágyi is an exploration geologist and petroleum economist based in Budapest, Hungary. He currently works as an independent advisor and lecturer. Szilágyi recently completed a study dealing with petroleum resources' valuations. He holds an MS degree in geology from Eötvös Loránd University of Budapest and an MBA from Budapest University of Technology and Economics. He can be reached at [email protected].