New hypermart entrants to challenge existing US gasoline marketers

The entry of hypermarts into the US gasoline retail business shifted into high gear in 2000 and will continue its pace in the next decade.

Hypermart companies include supermarkets, mass merchandisers, and discount chains. Warehouse and club memberships are a subset of these retail companies.

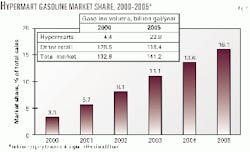

The current US hypermart-gasoline market identified by Energy Analysts International Inc. (EAI) has more than 4.0 billion gal/year of sales and 3.3% of the market. About 1,240 locations generate this sales volume.

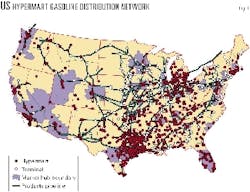

Fig. 1 shows the distribution of these hypermart-gasoline sites. About 26 hypermart companies have active gasoline retail sites, while at least 10 other companies are considering entry into the business.

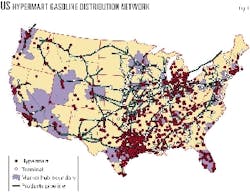

Fig. 2 shows some of the major hypermarts pursuing gasoline retailing in the US along with key business drivers for site development and performance. Collectively, the group consists of 36 companies and 21,600 store sites across the US.

Table 1 summarizes the overall distribution of these hypermart fuel sites by region.

The Midwest and Gulf Coast regions have the highest density of hypermart fuel sites, representing more than 60% of all US fuel sites in 2000. The Northeast states, where there is a high concentration of conventional retail and c-stores, have the lowest density of hypermart fuel sites based on relative regional population.

High-volume convenience store (c-store) businesses compete directly with hypermart-gasoline marketing sites. The incentive for c-store operations to enter the gasoline retailing business is to attract new customers and achieve an uplift in merchandise and in-store grocery sales.

Market share growth

Traditional lines of merchandising are generally moving towards the hypermart or mass merchandise-type of store operation.

There are few true mass merchandisers other than BJ's, Costco, Meijer, and Sam's Club, who offer a wide variety of products including soft goods, hard goods, and groceries. Supermarkets and discount stores, however, continue to add new merchandise and services to provide customers with a "one stop" shopping experience.

Entry of the hypermarts into gasoline retailing is still at an early stage. They are competing with conventional gasoline retail stores and c-stores rather than with other hypermarts.

As the hypermart presence in the gasoline business grows, each site will be less unique. The continued installation of gasoline retail facilities will become more of a defensive move than an offensive one.

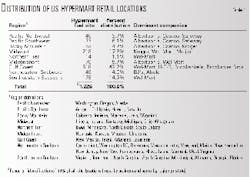

Overall, the hypermart-gasoline marketing business will grow from 1,240 sites in 2000 to 3,027 sites in 2002 and to 5,360 sites by 2005.

These numbers do not include a large number of companies that have not made any announcements regarding entry into the gasoline marketing business. These companies could add another 1,800 locations by 2005 (Fig. 3).

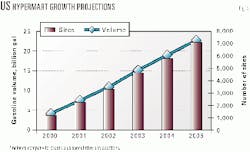

Based on an assessment of each company's average gasoline throughput per site and gasoline-site implementation plans, the overall hypermart-gasoline marketing business will increase to sales of 11.0 billion gal in 2002 and 22.8 billion gal in 2005.

This forecast includes the base companies that are currently pursuing fuel-retail facilities plus those companies that are considered candidates to enter the fuel-retail business.

As Fig. 4 shows, the hypermart-gasoline market share will increase to 8.1% and 16.1% in 2002 and 2005, respectively. This outlook can vary depending on a number of factors:

- Several large national and regional companies are in the pilot mode of operation and have not yet committed to an expansion plan. If they are aggressive, then the aforementioned forecast could be conservative.

- The average gallons per site used in the hypermart sales forecast could vary depending on the specific sites considered, shifts in street-pricing policy, and changes in how the competition responds in the market. Most hypermarts are aggressive in competitive pricing during the early phases of operation when they are building traffic and volume.

- EAI made assumptions about the number of existing site conversions that can accommodate fuel-retail facilities. A designated factor varies from 0% for companies that are only building fuel-retail facilities in new stores to 100% for companies that are committed to having gasoline retail operations at all existing sites.

- The overall economy drives new hypermart store builds and relocations. The US economy has been strong during the past 5-7 years depending on the regions considered. A downturn in the national economy could slow hypermart store growth and associated fuel-retail facility growth.

- Increasing store competition and potential shifts in the economy could cause hypermart companies to reduce their aggressive allocation of capital for expansions, rebuilds, and relocations.

Company breakdown

EAI developed the aforementioned market-share forecast on a company-by-company analysis basis. There are a number of key observations regarding the company mix and their positions:

- EAI identified 62 companies and 33,735 store sites (not including sites for the Independent Grocers Association) as candidates for entering the gasoline retailing business.

According to the Food Marketing Institute, more than 31,500 supermarkets in the US have annual sales greater than $2 million. The 33,735 targets identified in this study consisted of 18,231 supermarket sites and 15,504 sites that include mass merchandise and discount chain stores.

- The highest rate of hypermarket growth in gasoline retailing will occur in the West Coast, Rocky Mountains, and Eastern Seaboard market areas. The Midwest and West Coast will likely become the lead hypermart markets with respect to gasoline sales by 2003.

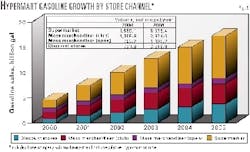

- Fig. 5 shows the outlook for gasoline sales by hypermart channel. Supermarkets will control more than 53% of the hypermart-gasoline market by 2005, or 8.3% of the hypermart-gasoline market. The club stores and major discount stores will control most of the remaining hypermart market.

- Eight of the 62 companies analyzed will be responsible for greater than 74% of the gasoline sales by 2005. These companies either have or are pursuing fuel facilities.

- Additional companies, which have been identified but are not known to be pursuing fuel-retail facilities, will increase their gasoline retail presence from 150 sites in 2001 to 1,818 sites by 2005. These companies will represent 5.45 billion gal of gasoline sales by 2005, which is 25% of the total forecasted sales by all hypermart companies.

Business models

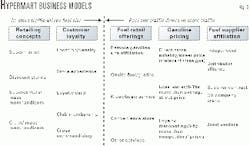

There are a number of business models that define various hypermart company approaches to fuel marketing.

Fig. 6 summarizes the various business characteristics that contribute to the hypermart business model. The characteristics to the left of the figure are more associated with the core-store operation. The characteristics listed to the right in the figure are primarily associated with the fuel marketing operation.

Hypermart companies use these business characteristics in various combinations to create a wide range of approaches to pursue fuel marketing. For example, they can use gasoline retailing as a core business or as a loss leader to generate in-store sales.

The primary objective for hypermart companies that have ventured into the fuel-retail business is to increase their store customers' loyalty and shopping-trip frequency. The basic business models employed vary significantly in how this is achieved, what level of additional in-store traffic is generated, and how gasoline is priced.

EAI's research and observations reveals that the performance of the various business models differ in the following ways:

- The supermarket sites with no loyalty card, no cross merchandising, and no gasoline site amenities depend more on gasoline margins than in-store sales lift. They tend to behave like a conventional gasoline retail store. One major advantage of these operations is that they already own the land for the gasoline-retail site.

- Those supermarkets falling in the category above but having a loyalty card may be more aggressive in pricing for customers with a loyalty card. Prices for these customers are generally 3-5 ¢/gal less than those of the local competition.

- The joining of supermarkets with third-party gasoline operations to establish a cross merchandising option for their customers is a new twist in the hypermart fuel marketing business.

Both Albertson's (with ARCO in the Bakersfield, Calif., area) and SuperValu-Farm Fresh (with Miller Mart in Virginia) are pursuing cross merchandising or fuel reward programs in which the supermarket customer gets a gasoline voucher to use at a remote gasoline retail location.

This business model is interesting since the incremental fuel-site costs are zero except for the cross merchandising software and profit sharing. It remains to be seen what level of cross merchandising sales uplift these supermarkets achieve using this business model.

This concept is particularly advantageous for the supermarket or discount store with land or permitting constraints that limit construction of a fuel-retail facility.

- The supermarkets employing on-site gasoline retailing, basic kiosk, and cross merchandising will have the greatest impact on gasoline sales and pricing for three reasons:

- Supermarkets have a high market density and excellent customer reach.

- Customer-trip frequency to supermarkets (without fuel) is high at 2.2 trips/person/week.

- Cross merchandising and fuel rewards programs allow the operation to post reasonable street prices.

At the same time, they provide customers with huge gasoline-price discounts by giving them fuel vouchers based on purchase of a number of selected products in the store. Thus, the supermarket can dramatically reduce the customer's gasoline purchase price and offset the reduction with more in-store sales.

- The mass merchandise/club membership stores, such as Costco, BJ's, and Sam's Club, have fairly basic gasoline retail operations but are the most aggressive regarding fuel price. This strategy follows their basic store formats of high volume, low wholesale prices for their customers.

These stores do not have high market density and have low customer-trip frequencies (about once per month but increasing). The stores influence a much larger market radius than a discount store or supermarket, however, and the customers are extremely loyal.

EAI's site research showed that the store fuel-retail cross-traffic for mass merchandisers is very high, about 60-70%. The addition of gasoline marketing increases customer loyalty, attracts new club members, and contributes to a high membership renewal rate.

Also, the fuel offering plus other products and services is contributing to increasing customer frequency.

- The only known hypermart to have adopted existing gasoline brands is Wal-Mart. It has arrangements with Murphy Oil Corp. (South east and Midwest regions), Tesoro Petroleum Corp. (Rocky Mountains and western states), and Sunoco Inc. (Northeast region).

All other hypermart companies marketing gasoline use independent brand names.

Future expansion

EAI analyzed two major metropolitan markets: Dallas-Ft. Worth (DFW) and Denver.

The DFW market is probably the most mature hypermart-gasoline market in the US and represents the future for other market areas. The Denver market is a relatively new market with respect to hypermart-gasoline marketing.

The greatest penetration of hypermart-gasoline sales will occur in the newer markets, such as the West Coast, Southeast, and Rocky Mountains as well as the Gulf Coast where supply options are numerous. The hypermarts are adding new stores in these areas faster than in the more mature parts of the country, such as in the Northeast.

In the Denver metropolitan market area, hypermart companies could attain a gasoline market share of 12.5% with 48 total hypermart fuel sites. This represents more than 21% of the total hypermart population of 222 sites in 2000.

More than 48% of the sites would be located in an area defined by EAI as the urban core, which represents the older part of Denver where land and permitting constraints may be more limiting.

The 48 potential hypermart fuel sites would represent greater than 40% of the sites located in the newer city and suburban areas. This is a very high fraction considering that a number of the existing supermarket sites are not amenable to accommodating 10,000 sq ft fueling operations without a c-store.

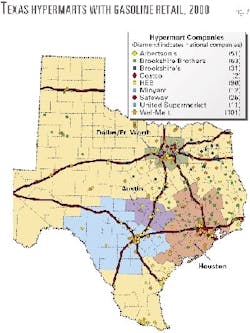

Fig. 7 shows the hypermart-gasoline site distribution for Texas as of January 2001. The mature DFW market had 72 hypermarts with gasoline retail operations as of January 2001.

EAI estimates that the hypermart gasoline sales in the DFW market make up 13,400 b/d of 148,000 b/d total regional gasoline sales. Hypermart-gasoline sales in Texas is 67,600 b/d and controls more than 9.7% of the Texas gasoline market.

A glimpse of the DFW market indicates how the hypermart-gasoline marketing business will evolve in other areas of the country. One caveat in comparing the DFW and other Texas markets to other areas of the country is that DFW is a fairly new and growing market that has a multiplicity of product supply sources.

Another comparison that is often made is the US hypermart business to the hypermart phenomenon in Europe. In Europe, the hypermart-gasoline business owns more than 50% of the retail gasoline market in France and 25% in the UK.

Several factors prevent the hypermart business from reaching these European percentages in the US.

First, petroleum-marketing techniques in the US have been more aggressive than those of European marketers. For example, there is no major gasoline c-store presence in Europe such as QuikTrip, RaceTrac, and some of the major chains that have advanced in the US.

The technology used in existing stations in the US is also more advanced than that used in the European facilities that were overwhelmed by the hypermarts. Zoning laws in many US markets limit installation of motor-fuel facilities in existing locations, forcing hypermarts to install motor-fuel facilities at only a fraction of their existing sites and concentrating on new construction sites.

The entry of the hypermart-gasoline market will continue its rapid pace well into this decade and will fundamentally change the gasoline marketing business.

Significantly lower site development costs, employment of the latest technology, and cross merchandising will place new competitive pressures on the existing US gasoline retail business.

Differentiation of services and products and the adoption of new technology and loyalty programs will be the key to maintaining the hypermart's competitive position in the conventional gasoline marketing business.

The hypermarts will experience new challenges as their gasoline market share increases and they enter an era of market saturation. This will occur first in the DFW market.

Fuel purchasing and supply-chain management requirements for hypermart companies will also increase and play a more important role in overall performance.

The authors-

Joseph Leto is cofounder and president of Energy Analysts International Inc. He has consulted with more than 100 companies in the areas of petroleum logistics, market strategy, refinery planning, and business development. He led the development of computer applications to support EAI's consulting services, both for use internally and by EAI clients. Leto holds a BS and an MS in chemical engineering and has studied mineral economics at the graduate level.

Paul Rolniak is principal and vice-president of Energy Analysts International Inc. His expertise includes refined product supply and distribution at the pipeline and terminal market level, integration of companies and markets, feedstock impact on refineries, upgrading technology and economics, and crude oil and natural gas production, distribution, and pricing. Previously, Rolniak worked with Exxon Research & Engineering Co. and Exxon Donor Solvent Coal Liquefaction Laboratory in Baytown, Tex. Rolniak holds a BS in chemical engineering from the University of Arkansas, Fayetteville, and a PhD in chemical engineering from Rice University, Houston.