Efficiency, integration successes helping trim EOG capex budget

The 2026 capital budget of EOG Resources Inc., Houston, is likely to be about $100 million smaller than early forecasts, the company’s chief financial officer told an investment bank’s gathering Jan. 7.

Speaking at the Goldman Sachs Energy, CleanTech & Utilities Conference, Ann Janssen said her team now expects capex this year to be “closer to $6.5 billion” versus last fall’s estimate of $6.6 billion. Two factors are to thank for that, she added. EOG teams continue to improve the efficiency of the company’s operations in the Delaware basin and the work to integrate Encino Acquisition Partners LLC—acquired last year for $5.6 billion—is “going at a much faster clip” than expected.

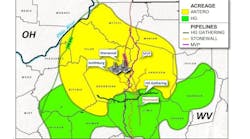

Buying Encino grew EOG’s presence in the Utica basin into what executives are now calling a foundational asset that, spanning 1.1 million net acres, stands alongside their holdings in the Delaware and the Eagle Ford. The company finished 2025 running four rigs and three completion crews in the basin and last fall was on pace to complete more than 60 wells there.

Bringing Encino’s operations into the EOG has so far generated $150 million in savings, Janssen said, “and we’re looking for more.” At the same time, the company has opened an office in Columbus to serve as its base for the region, where it will primarily focus on exploiting the volatile oil window before paying more attention to natural gas.

Janssen told the Goldman crowd that the roughly $6.5 billion capital spend—which will be up from $6.3 billion in 2025—should translate into “low to no growth” in production this year compared to the just-completed fourth-quarter 2025.

Regarding cost savings elsewhere in EOG’s legacy operations, Janssen said the company continues to make progress thanks to new technology and approaches.

“You look at two of our foundational assets, the Eagle Ford and the Delaware Basin, and we’re continuing to see cost improvements there,” she said. “You would think that, after a while, you kind of exhaust that. But it’s quite the opposite. It’s not happening by accident. It’s by us investing in infrastructure, investing in learnings and trying to grow those and get better. […] US shale [still] has a lot of opportunity.”

Shares of EOG (Ticker: EOG) were down 1.5% to $103 and change in midday trading Jan. 7. They have lost about 13% of their value over the past 6 months, which has trimmed the company’s market capitalization to about $56 billion.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.