Permian Resources updates guidance post Centennial-Colgate deal close

Permian Resources Corp., Midland, Tex., the combine of the now-closed merger of Centennial Resource Development Inc. and Colgate Energy Partners III LLC, expects to deliver total equivalent production of 140,000-150,000 boe/d (52% oil) in this year’s fourth quarter.

Assuming 38-42 gross wells spudded and completed, total capital expenditures are estimated at $300-325 million during the quarter, the company said in a release Sept. 1.

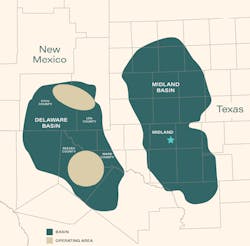

The company updated guidance following closing of the $7-billion deal signed in May to create the largest pure-play exploration and production company in the Permian Delaware basin (OGJ Online, May 19, 2022). Assets are concentrated in Reeves and Ward Counties, Texas, and Eddy and Lea Counties, New Mexico, consisting of about 180,000 net leasehold acres and 40,000 net royalty acres.

Operations

Permian Resources is operating an eight-rig drilling program and expects to reduce to a seven-rig program in November.

For full-year 2023, the company plans to spud and complete about 145 and 150 gross wells, respectively, with an average working interest of 80% and 8/8ths net revenue interest of about 78%. Total daily production for 2023 of 150,000-165,000 boe/d (52% oil; 71% liquids) is expected with total capital expenditures of $1.15-1.35 billion.

The company will start 2023 with a seven-rig drilling program with the potential to reduce the rig count during the year, assuming expected operational efficiencies are achieved, the company said. Crude oil production growth of about 10% is planned in fourth-quarter 2023 compared with fourth-quarter 2022.

Operating activity is expected to be split relatively evenly between New Mexico and Texas. In New Mexico, activity will focus on second and third Bone Spring sand intervals, while Texas development will concentrate on the third Bone Spring sand and Wolfcamp intervals.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.