Centennial, Colgate to merge in Permian pure-play deal valued at $7 billion

In a deal valued at $7 billion, Centennial Resource Development Inc., Denver, Co., and Colgate Energy Partners III LLC, Midland, Tex., agreed to merge to create a large, pure-play Delaware basin company, Centennial said in a release May 19.

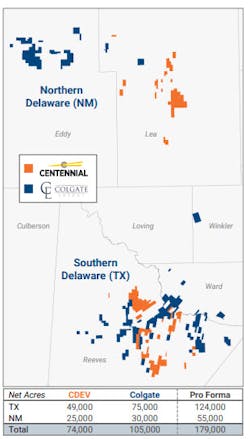

The combine, which will operate under a new name to be announced prior to closing, will be headquartered in Midland. The Denver office will remain open “for the foreseeable future,” Centennial said. Together, the new company will hold some 180,000 net leasehold acres and 40,000 net royalty acres, with total current production of about 135,000 boe/d in the Permian basin sub-basin. Assuming the current drilling pace, the combine will hold over 15-years of drilling inventory.

Preliminary fourth-quarter production for the combine is estimated at 145,000 boe/d. Detailed forward-looking guidance is expected following the deal’s close (anticipated in this year’s second half subject to customary conditions and shareholder and regulatory approvals.)Centennial holds about 75,000 net acres in the Delaware basin in Reeves County, Texas, and Lea County, New Mexico (97% operated, 50% oil). Colgate has total current production of 70,000 boe/d, with 105,000 net leasehold acres, and 25,000 net royalty acres in the Delaware basin, with its position concentrated in Reeves and Ward Counties, Texas, and Eddy County, New Mexico. The acreage position is 90% operated, with a 75% average working interest. The company is currently operating five rigs and two full-time completion crews.

The deal values Colgate at about $3.9 billion and is comprised of 269.3 million shares of Centennial stock, $525 million in cash, and the assumption of $1.4 billion of Colgate’s outstanding net debt.

Management

Sean Smith, currently chief executive officer of Centennial, will serve as executive chair of the board of directors and Will Hickey and James Walter, currently co-chief executive officers of Colgate, will lead the company as co-CEOs, and both will serve on the board. Matt Garrison, Centennial’s current chief operating officer, and George Glyphis, Centennial’s current chief financial officer, will continue to serve in their respective roles at the combined company.

Immediately following the closing, existing Centennial shareholders will own about 53% of the combined company, and existing Colgate owners will own about 47% of the combined company.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.