Permian assets drive US dealmaking surge while fee lands steal the show in Canada

DAVID MICHAEL COHEN, PLS INC., HOUSTON

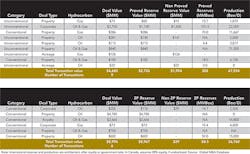

PLS REPORTS that the US upstream deal markets saw a significant upturn during the period from June 17 to July 16, 2015, with a focus on the Permian Basin highlighting this region's standout profitability in the current price environment. Among these transactions was the second multibillion-dollar deal this year: WPX Energy's $2.75 billion acquisition of privately held Permian driller RKI E&P. Like Noble Energy's $3.85 billion agreement in May to acquire Rosetta Resources, the WPX/RKI deal represents a new play entry for the buyer.

RKI has net production of 22,000 boe/d (53% oil, 16% NGLs) and 92,000 net acres (98% HB) targeting 12 prospective horizons in the Delaware Basin. More than 3,600 risked locations have been identified on the leasehold, which according to WPX equates to over 670,000 "effective" net acres based on multi-zone development. WPX attributes $1.1 billion of the deal value to existing production at ~$50,000 per boe/d, $1.15 billion to net acreage at $12,500 per acre and $500 million to owned and operated infrastructure in place.

Linn Energy sold the last of its Wolfcamp assets in Howard County, Texas, for $281 million. The assets include 133 wells producing 2,000 boe/d and 6,400 net acres prospective for horizontal Wolfcamp development. This deal concludes a monetization process that has been underway since Linn closed its $4.9 billion acquisition of Berry Petroleum in December 2013, which left Linn with a ~60,000-net-acre Wolfcamp position that was a poor fit for its dividend-driven MLP structure.

Fellow MLP Legacy Reserves is taking a different approach to its unconventional Permian acreage, signing a JV with private equity firm TPG's credit arm TPG Special Situations Partners (TSSP) to fund horizontal Spraberry, Wolfcamp and Bone Spring drilling. For Legacy, the deal is structured to convert high-decline unconventional production into stable long-term production and cash flow more appropriate for the MLP model. TSSP will fund 95% of D&C costs in exchange for a high initial stake in the wells during the early production period, decreasing in stages as production declines. Linn has a similar deal with Blackstone credit arm GSO Capital Partners, but has not yet identified assets to be developed.

In Canada, the Ontario Teachers Pension Plan is spending $2.67 billion to acquire Cenovus Energy's royalty business, which consists of one of the country's largest fee title acreage positions. Fee title assets have been in high demand because of the ability to generate cash flow without requiring additional capital investment, as highlighted by Penn West's $255 million sale of mostly fee title acreage in Alberta to Freehold Royalty in April. Momentum for royalty deals generally has been building since Encana's $4.2 billion spinoff of PrairieSky Royalty last year, and now all eyes are on Canadian Natural Resource Ltd., which owns one of the only remaining legacy large fee title blocks in Western Canada and has expressed a desire to monetize those assets.

Internationally, BP strengthened its relationship with Rosneft despite US and EU sanctions, buying a 20% stake in eastern Siberia's Srednebotubinskoye oil and gas condensate field for $750 million. The partners will further develop the field, which produces 20,000 bbl/d from 51 wells, and also jointly explore a 115,000-sq-km AMI in the region.

Meanwhile, Kazakh national oil company KazMunaiGaz plans to sell half of its 16.8% stake in the giant-but currently offline-Kashagan oil field to Kazakhstan's sovereign wealth fund Samruk-Kazyna for $4.7 billion. The deal will reduce by $2.2 billion KazMunaiGaz's debt related to development of the sour crude field, which has been plagued by technical difficulties and was quickly shut in as a result of leaks in corroded pipelines after initially coming online in 2013. The Kashagan partners now expect a restart in late 2016. Sovereign wealth funds have had a growing presence in the international upstream deal markets over the past two years, joining opportunistic buyers like private investment vehicles and commodities traders to take over projects left behind as US drillers focus on shale resources back home.