Why competition is heating up for LNG

Jason Reimbold

The Theseus Group

In recent years, there has been much discussion about the impact developing economies will have on the global energy markets. Economic growth in Asia has already heightened global competition for oil; now, the United States is experiencing the same competition for natural gas. A new consumer is preparing to enter the LNG market–the Middle East.

The recent economic development of the Middle East is likely to strain already tight supplies of LNG. In fact, the IMF projects GDP growth of 95% in the Middle East over the next five years, and this development is likely to be fueled by significant increases in natural gas consumption. Long-term projections by the Energy Information Administration suggest gas consumption in the Middle East will increase by about 91% through 2030 while consumption in the United States is estimated to increase by only 16.5%.

The combination of fuel subsidies, increasing population, and rapid economic growth in some Middle Eastern countries is making it difficult for them to meet their rising demand for electricity. Low oil prices during the 1990s lead to gross underinvestment in infrastructure, and today, the region is racing to maintain the pace with growing demand.

Oil exporting nations such as Saudi Arabia, the United Arab Emirates, Kuwait, and Oman are struggling to acquire the natural gas needed to supply their electricity and gas demands. Of all the Middle Eastern nations, only Iran and Qatar possess immense gas reserves. Unfortunately, political interference has prevented the much-needed development of Iran’s gas production and transportation capacity leaving Qatar to supply the region.

The gas crunch being felt in the region is no more evident than in Oman. Due to supply commitments initiated in the 1990s, Oman currently exports nearly half of its gas production to the Far East by LNG transport. However, Oman now depends on gas being imported by pipeline from Qatar to meet its domestic demand. Other Middle Eastern nations feeling the crunch include Kuwait and Dubai, which both announced deals earlier this year to import LNG from Qatar.

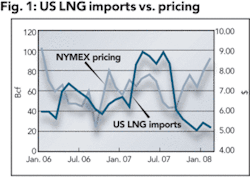

Through April of 2008, US LNG imports totaled 115 bcf representing a 59% decline from imports of 283 bcf for the same period last year. Recent events including drought conditions in Spain and nuclear plant outages in Japan have spiked the demand for LNG, and despite $10 to $11 gas in the US, exporters of LNG are able to command prices ranging from $11.50 to $13.00 per MMBtu in Spain and Asia respectively. This has resulted in formidable competition for LNG deliveries to the US, and it does not appear this will be a short-lived trend.

The impact of demand spikes in Spain and Japan are indicative of supply challenges the United States could encounter as Middle Eastern countries become LNG consumers. The EIA recently revised its forecast of US LNG imports from 680 bcf to 580 bcf representing a 25% decease from imports of 771 bcf in 2007, and if US LNG imports remain low, the country could be facing a significant shortage of natural gas for the remainder of the year.

High oil prices are bringing economic prosperity to the Middle East, and this is introducing a new dynamic to global competition for LNG. As the world’s most prolific oil and gas producing region increases its consumption of LNG, global supply challenges are likely to remain intense.

About the author

Jason Reimbold is vice president of The Theseus Group (www.thetheseusgroup.com), an energy M&A consulting firm based in Tulsa, Okla. In 2005, Reimbold founded www.GlobalOilWatch.com, an energy research portal for industry analysts and investors. In 2007, he co-authored The Braking Point: America’s Energy Dreams and Global Economic Realities (www.thebrakingpoint.com) with Mark A. Stansberry.