M&A activity contracts in Q1 as natural gas deals dry up

The value of deals announced in the global oil and gas industry reached $33 billion during the first quarter of 2012, according to Eoin Coyne of London-based Evaluate Energy, which tracks worldwide mergers and acquisitions. The value falls short of the quarterly average observed over the past three years of $43 billion, as both the prolonged global economic slowdown and continued slump in the North American gas price stifled demand for deals.

Some sellers squeezed by low gas price

When the US gas price began its descent in 2009, the assumed fair price the market was willing to pay soon followed the same path. Companies with a strong balance sheet chose to keep their assets off the market rather than sell them for a fraction of the value they were worth in 2008. Since this time, the war of attrition between gas realizations and solvency has forced some companies to cut their losses and sell at a low price with private equity firms often reaping the benefits.

Among the lowest of these deals was the sale by Carrizo Oil & Gas of a large portion of its Barnett shale assets for just $0.61 per proven Mcfe, despite the reserves being in production and 57% developed. Likewise, the price that Apollo Management paid to acquire assets in its purchase of El Paso's E&P division ($1.79 per Mcfe, adjusted for land value) would have been far lower if a portion of El Paso's reserves had not consisted of liquids. Roughly 30% of El Paso's proven reserves are composed of liquids, which if we assume are worth $20 per barrel, would bring down the cost per proven Mcf of gas to $1.20.

On the other end of the scale, Asian companies that have been farming into shale resources in North America are using far different valuations for their acquisitions. These shale deals are composed of early stage resources with a low amount of proven resources, which makes conventional analysis using the cost per boe misleading.

Mitsubishi's farm-in of the Montney play in Canada from EnCana implied a cost per undeveloped acre of just under $18,000. A more traditional cost for a resource of this type, such as the Marcellus shale, by a public company would be less than half this level.

The other large Asian farm-in, which gave an insight into how far the Chinese are willing to go to be involved in North American shale plays, came from Sinopec, which paid Devon Energy $3,400 per acre to farm into five US shale plays. Since the plays have thus far indicated they are liquids rich, the price per acre wouldn't raise eyebrows if they had already been proven commercial. However, the plays in question - the Tuscaloosa Marine, Utica, Mississippian, Michigan and Niobrara -are all in their infancy and thus wouldn't command such a high premium from any other type of acquiring company.

North America dominates global activity

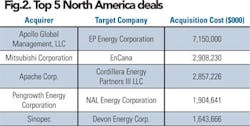

Assets in North America attracted the vast majority of the global deal value during the quarter with $26 billion worth of announced deals. This represented 79% of the global total, with the United States accounting for $16.8 billion and Canada $9.2 billion.

Much of the US value came from one deal, as El Paso divested its upstream segment to Apollo Global Management LLC and Riverstone Holdings LLC for $7.15 billion. The deal is a consequence of Kinder Morgan's takeover of El Paso Corp. where the non-midstream assets were deemed surplus to requirements. The adjusted cost per proven Mcfe was just $1.79, reflecting the strong gas weighting in El Paso's producing portfolio.

The next largest US deal came from Apache Corp., which acquired a private company, Cordillera Energy Partners III LLC, for $2.85 billion. Cordillera's main assets are mature, liquids-rich production from the Anadarko basin of Oklahoma and Texas. Although this is primarily a deal for mature conventional assets, Apache will also be gaining access to a large portfolio of unconventional targets, such as the Granite Wash. This is an example of a tight resource that is opening up via the use of horizontal drilling techniques mastered during US shale play development. Previously, these plays would be exploited by vertical wells with only a modest payback. However, the vastly improved economics gained from horizontal drilling is opening up large areas of previously discarded assets that are likely to feature prominently on the M&A market in the coming year.

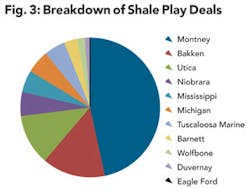

Unlike previous quarters, with only 24% of North America's total value, shale plays didn't drive deal activity in the continent during the quarter. Lack of deals among shale resources was partly due to the depressed gas price that declined from 2011 to just $2 per Mcf by the end of the quarter.

Shale resource deals lose momentum

Deals in the shale resource sector simmered during the quarter to just $6.6 billion worth of activity. Although liquids-rich plays have emerged in the past couple of years, North America's shale resources are still weighted strongly towards gas, which ended the quarter in the US with a benchmark price of just $2 per Mcf. This has made investment in shale gas plays uneconomic, and the excitement that greeted plays such as the Marcellus shale a couple of years ago has died down to a whimper.

There were, however, two shale deals in the quarter greater than a billion dollars. Both involved large Asian companies. The largest was Mitsubishi's $2.9 billion farm-in of over 400,000 acres in the Montney play. An expanded selection of the same assets was subject to an earlier $5.4 billion deal by PetroChina, but PetroChina and EnCana failed to agree on terms following a year of negotiation. Both had the same intention: to source gas to feed the Kitimat LNG export terminal in British Columbia, under construction on Canada's rugged west coast.

The second large Asian farm-in was Sinopec's entry into a third of Devon's interests in five US plays. These include the Tuscaloosa Marine, Utica, Mississippian, Michigan, and Niobrara shale plays - all prospective for liquids as well as gas.

Among the remaining shale deals, liquids-rich plays such as the Bakken and Utica featured prominently. Only one deal in the Marcellus play made the top 30 shale deals by value.

Asia's expansion continues

Asian national oil companies (NOCs) and conglomerates played their usual, prominent role during the quarter with $7.4 billion in deals outside their domestic markets. The most notable of these were the large shale play farm-ins by Mitsubishi in Canada and Sinopec in the US.

Other than the traditional foreign resource asset grab, China also entered into two landmark agreements to develop its own shale resource. China's aggressive accumulation of foreign oil and gas assets over the years arose from its need to feed a burgeoning economy without easily extractable domestic resources.

Confirmation of shale as a commercially viable industry in North America has shifted some of China's focus to its own resources. The IEA estimates that with recoverable resources of 1,275 tcf, China holds more shale resources than the US. The agreements included Shell's first ever shale gas production sharing contract and Shell's shale oil exploration agreement with Hess Corp.

African discoveries attract attention

News of commercial discoveries across much of Africa continued to flow during the quarter, including sharply increased gas reserve estimations in Tanzania and Mozambique. There was also a large oil discovery onshore Kenya and an oil discovery offshore Angola. The transformation of these frontier exploration regions into confirmed sources of oil and gas is being noted by the majors, especially when many blocks are owned by small-cap companies seeking an exit strategy upon proving up reserves.

The most significant discovery was offshore Mozambique in the Rovuma basin, where Anadarko Petroleum reported an estimated 30 tcf of recoverable gas. This resulted in a bidding war for Cove Energy, the smallest equity partner in the asset with an 8.5% interest and little other tangible assets.

Royal Dutch Shell started with a $1.6 billion offer, only to be usurped by PTTEP's $1.75 billion offer two days later. Just as the bidding war looked as it would develop further with the entry of Indian NOC's GAIL and ONGC, uncertainty arose following comments from the Mozambique government over a special capital gains tax on the sale. The bidding still has not reached a conclusion. France's Total also tried to get a foothold in the region when it approached Wessex Exploration, owners of a 70% interest in an exploration block offshore Mozambique, among other assets.

Oil sands back in focus

Following 16 oil sands deals in 2011, the year 2012 started more briskly with seven deals in the first quarter. The resource's attractiveness has improved given the price of oil has hovered around $100 per barrel despite the turbulent financial backdrop. The largest deal was PetroChina's acquisition of the remaining 40% interest in the Mackay River Oil Sands project from Athabasca Oil Sands Corp. for $680 million.

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com