Tubular goods suppliers strive to extend 2004's strong performance into 2005

Exploration and production equipment suppliers can be among the last businesses to benefit from higher oil and gas prices - unless their product plays a vital part in E&P. Then they can be among the first.

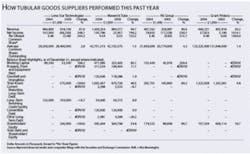

2004 clearly was a better year for US oil country tubular goods suppliers than 2003. The four main companies were significantly more profitable as they rebounded to nearly $427.3 million of combined earnings last year from a more than $57.7 million loss as a group in the previous 12 months. Revenue climbed 55.4 percent year-to-year to nearly $3.86 billion from more than $2.48 billion.

Wall Street’s interest in the group grew as year-end share prices climbed by between 54 and 186.6 percent. Robert Ford, who follows service and supply companies for Sanders Morris Harris Inc. in Houston, noted that the Philadelphia Stock Exchange’s oil service index rose by about 32 percent.

Excluding Grant Prideco Inc., whose OCTG business represents a relatively smaller part of its total business than those of Maverick Tube Corp., Lone Star Technologies Inc. and NS Group Inc., he said that the three main companies had approximately a 122 percent return last year because of their significant operating leverage.

“Tubulars, over the course of the cycle, are generally some of the better performing stocks,” Ford said. “If we look back to when the OSX bottomed in late September 2001 and go forward to Feb. 16, 2005, the OSX rose 135 percent and the three major tubular stocks, on average, were up 354 percent.

“Land drillers and the tubular goods suppliers are going to be the best to own from trough to peak,” he added. “They also are going to be the most painful to hold from peak to trough.”

Executives of all four companies were pleased with last year’s record results. “Energy sales reflect the continuing robust drilling environment in both the United States and Canada,” said Maverick Tube chairman and chief executive C. Robert Bunch. “Despite substantial price increases, we have maintained our OCTG market share in both countries.”

The St. Louis company’s line pipe, couplings, coiled tubing, and umbilical products operations also contributed to its energy products results, which improved more than its industrial products business during the year. “As we move into 2005, US OCTG inventories are relatively low at about 4.1 months’ supply or 1.2 million tons at the end of 2004. We anticipate another strong year for North American drilling activity,” Bunch said.

“We are pleased with our record results, which reflect continued robust demand for our premium oilfield products,” said Rhys J. Best, chairman and chief executive of Lone Star Technologies. He also credited yield and productivity initiatives that the Houston-based company implemented during the third quarter for the improved full-year performance.

“Looking ahead, we anticipate continued strong demand for our tubular products and related services, and believe that demand for large diameter, alloy-grade OCTG could also begin to improve by the middle of the year,” Best said.

“Strong demand for our energy products, coupled with relatively low levels of tubular product inventory in the marketplace, resulted in an increase in shipments and higher selling prices for both our seamless and welded energy products,” observed René J. Robichaud, NS Group’s chairman and chief executive. The Newport, Ky.-based company’s employees also achieved “numerous record performances” in safety, productivity, product yield, quality and customer service, he added.

Robichaud forecast a continued strong outlook for 2005 due to relatively low total OCTG inventories and continued higher drilling rates in response to increased oil and gas prices. “Imports captured approximately 30 percent of the US OCTG market during 2004, and we expect they will continue to be a significant factor going forward,” he said. “The cost of steel coil and scrap should continue at relatively high levels this year. All things considered, demand for our energy tubular products is expected to be strong in 2005.”

Grant Prideco’s tubular technology and services division showed a bigger improvement in operating income (207 percent to $23.1 million from $7.6 million) than its drill-bit unit (20 percent to $70 million from $58.4 million) this past year. But its year-to-year operating income gain was not as great as that of the Houston-based service and supply company’s drilling products and services division (391 percent to $92.2 million from $18.8 million).

Michael McShane, chairman and CEO of the Houston-based company, said that Grant Prideco’s drilling products revenues and margins were as high during 2004’s final three months as the company reached during the most recent oil and gas production peak in 2001 despite 21 percent lower volumes. “Our tubular technology segment continued to improve its operating income margins,” he said. “Additionally, we ended the year with record backlog levels.”

Increased North American drilling was the most obvious cause of the four companies’ 2004 improvements. Maverick cited Baker Hughes Inc. figures for the full-year average US rig count (1,190 in 2004 versus 1,031 in 2003), North American workover rigs (1,850 versus 1,479) and international rig count (836 versus 771). The Canadian rig count, meanwhile, declined slightly to an average 369 in 2004 from 372 in 2003, it indicated.

In a presentation to Goldman Sachs and Co.’s global energy conference in January, Best of Lone Star Technologies explained that tubular goods inventories have been declining because producers have been drilling deeper wells. Using Smith International Inc.’s surveys, he said that the number of US rigs drilling deeper than 15,000 feet averaged 127.5 in the first half of 2003, 167.5 in the second half of that year, 185 in the first half of 2004 and 206 in last year’s final six months.

Deeper wells consume more premium products and tubular goods, Best continued. “An oil well drilled to a depth of 5,000 feet consumes 10,800 feet of tubing having a total weight of 50 tons. A gas well drilled to a depth of 10,000 feet consumes 29,000 feet of tubing having a total weight of 600 tons. A gas well drilled to a depth of 15,000 feet consumes 57,000 feet of tubing having a total weight of 1,100 tons,” he said.

The companies also had to contend with higher steel prices last year. Lone Star estimated that its average steel costs during 2004’s fourth quarter were 111 percent more than the comparable 2003 period. Ford suggested, however, that this could have been more of a benefit than hindrance.

“They got hit hard with steel prices in the first three quarters,” the Sanders Morris Harris analyst explained. “But they also might not have had as much of a margin increase on a per ton basis without those higher steel prices. The OCTG manufacturers did a good job of expanding their margins more than their steel costs, sometimes by a month or two.

“And because the prices for tubulars have gone so high, the distributors have kept their inventories fairly lean. There hasn’t been a lot of speculation this time because they don’t want to be caught with a lot of high-cost inventory if prices start to come down,” he continued.

Ford said that the outlook for the OCTG manufacturers is very good for the next six months despite the group having significantly more variables than other parts of the service and supply sector. “Steel prices are still kind of a wild card, making them the least variable influence,” he said. “But demand is improving along with the rig count. Inventories are low. And obviously, the end-use customers have increased their budgets year-over-year and are sitting on a lot of cash.” OGFJ