OGJ Newsletter

GENERAL INTERESTQuick Takes

PSAC again trims Canadian drilling outlook

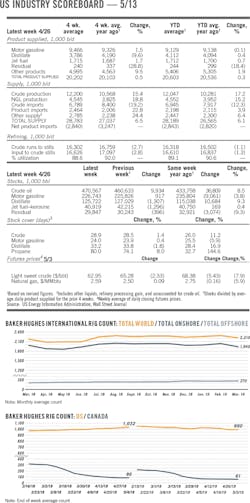

The outlook for oil and gas drilling in Canada continues to darken. The Petroleum Services Association of Canada (PSAC) again has lowered its forecast for 2019 drilling—to 5,300 wells drilled from 6,600 in the original forecast published last November. In January, it lowered the forecast to 5,600 wells, which it measures as rigs released (OGJ Online, Jan. 31, 2019).

The new update assumes an average natural gas price of $1.65 (Can.)/Mcf at the AECO hub, a West Texas Intermediate crude oil price of $57 (US)/bbl, and an average value of the Canadian dollar of 75¢ (US).

Compared with the original forecast, PSAC expects declines to 2,685 wells from 3,532 in Alberta, to 375 from 382 in British Columbia, and to 1,960 from 2,422 in Saskatchewan. It expects increases to 260 wells from 255 originally forecast for Manitoba and to 20 from 9 in eastern Canada.

The group said investment is discouraged by lingering delays in pipeline projects that would relieve a transportation bottleneck in Alberta as well as federal proposals for regulations that would hamper work.

Duncan Au, PSAC chair and president and chief executive officer of CWC Energy services, said Canadian investment in oil production hasn’t benefited from recent cash-flow gains at exploration and production companies.

“E&P companies are reducing debt, paying dividends, buying back their own shares, and investing elsewhere rather than reinvesting in this country,” he said.

Total, Tatweer eye E&P, LNG cooperation

Total and Tatweer Petroleum-Bahrain Field Develop Co., have signed a memorandum of understanding for cooperation in oil and gas exploration, knowledge sharing, and supply of LNG to Bahrain. Bahraini King Mohamed bin Khalifa bin Ahmed Al-Khalifa said areas of cooperation including “sharing of experience, expertise, and support on ongoing exploration and production activities in the recently discovered unconventional Khalij Al-Bahrain basin.”

The kingdom earlier was reported to be discussing development of the 2018 offshore discovery with US companies (OGJ Online, Feb. 28, 2019).

Denbury Onshore agrees to settle EPA allegations

Denbury Onshore LLC agreed to implement an injunction relief program including a risk-based program to prevent future crude oil spills and pay a $3.5 million fine to settle US Environmental Protection Agency charges that it violated the federal Clean Water and Oil Pollution Acts, EPA’s Region 4 in Atlanta reported late last month. The proposed settlement days earlier covered 26 CWA discharges that occurred between Aug. 8, 2008, and Nov. 11, 2015, which resulted in 7,000 bbl of crude and produced water being released, EPA said.

Plano, Tex.-based Denbury Onshore owns and operates US onshore properties in the Rocky Mountains and along the Gulf Coast. The 26 alleged violations took place at 10 different facilities in Region 4, one in Alabama, and nine in Mississippi, EPA said. Most of the discharges were the result of internal corrosion of pipes and flow lines, breaks in old lines, and failed equipment, it said.

Petroceltic renamed Sunny Hill Energy

Petroceltic International PLC, London, has been renamed Sunny Hill Energy. The privately held investment company holds a large interest in Ain Tsila gas and condensate field under development in Algeria and owns oil and gas concessions in Egypt, a gas production-to-storage conversion project offshore Bulgaria, and an exploration license in Italy.

Exploration & DevelopmentQuick Takes

OTC: Murphy group eyes appraisal of strike off Mexico

Murphy Oil Corp. and partners are considering the drilling of an appraisal well of their Cholula discovery in deep water offshore Mexico as well as two exploration wells on the same Salina basin block next year.

Gabriel Gomez, Murphy’s Mexico country manager, reported the as yet-unapproved plans during a session May 7 at the Offshore Technology Conference in Houston.

Gomez said the Cholula 1EXP well, drilled to 8,825 ft TD in 2,300 ft of water in the southeast corner of Block 5, encountered 185 ft of net Upper Miocene hydrocarbon pay.

Interpretation of wide-azimuth seismic data has identified 34 leads and prospects on the block, which the group acquired in Mexico’s 2016 deepwater licensing round.

Strat test probes gas hydrates in Alaska

A stratigraphic test operated by BP Exploration (Alaska) Inc. at Prudhoe Bay has confirmed two gas hydrate reservoirs for further testing in a three-well joint program of the US Geological Survey, US Department of Energy’s National Energy Technology Laboratory, and Japan Oil, Gas, and Metals National Corp.

USGS said the test confirmed “highly saturated gas hydrate-bearing reservoirs” designated Unit B and Unit D.

Drilling by the Parker 272 rig encountered Unit B at 2,770 ft below surface. The hydrate was interpreted to fill 65% to more than 85% of porosity in the upper 40 ft of the unit, composed of well-sorted, very fine-grained sand to coarse silts.

Unit D, occurring at about 2,300 ft, has similar saturation ranges. The shallower unit also has a water-bearing section at its base. Cores were cut in the units and maintained at reservoir pressure and temperature for analysis in the US and Japan.

USGS said the three-well program is designed to test response of the gas-hydrate reservoirs to controlled depressurization. It’s part of a 35-year cooperative research program evaluating potential of gas hydrate in Alaska. In 2008, USGS estimated the technically recoverable gas hydrate resource on the Alaskan North Slope at 85 tcf of natural gas.

USGS also has participated in drilling to investigate gas hydrate potential offshore India and in the Gulf of Mexico and is conducting other research.

PetroNeft eyes Russian field development

PetroNeft Resources PLC, Dublin, said state approval of reserves estimates for Cheremshanskoye oil field in West Siberia allows it to evaluate development options.

The estimates follow testing of the C-4 appraisal well on License 67 in the Tomsk region. Gross explored (C1) and estimated (C2) reserves total 19.26 million bbl in the Upper Jurassic J1 and Lower Jurassic J14 intervals.

PetroNeft said the estimates do not reflect full Jurassic potential of the 46-sq-km structure with four-way dip closure in the southern part of the license. The company is assessing potential of Cretaceous strata in Cheremshanskoye and Ledovoye field in the northwestern part of the license.

PetroNeft acquired the license in 2010 to develop potential bypassed in two Soviet-era wells. Its C-3 delineation well, drilled in 2011, tested oil in the J14 and J1 intervals.

It drilled the C-4 well last year after acquiring 3D seismic data over the field. In addition to flowing oil on tests of the Jurassic intervals, the well logged oil pay in the Lower Cretaceous B-18 interval, which was not tested.

Eni in agreement to explore off Bahrain

Eni SPA has entered an exploration and production-sharing agreement with the National Oil and Gas Authority for Block 1 offshore Bahrain. Eni signed a memorandum of understanding envisioning the agreement in January. The block covers more than 2,800 sq km off northern Bahrain with water depths of 10-70 m. Work plans weren’t reported.

New Zealand makes delayed onshore permit offer

The New Zealand government’s New Zealand Petroleum and Minerals section has finally launched its delayed “Block Offer 2018” tender for petroleum exploration permits.

About 2,200 sq km of land in the onshore Taranaki basin of the country’s North Island is being offered for oil and gas exploration. The acreage has been restricted to the onshore Taranaki by the government’s decision late last year to ban drilling outside Taranaki as well as any new offshore exploration.

Although it represents twice the total acreage that was offered in the region in 2017, the new offer restricts access to conservation land, except for minimal impact activities, and imposes an additional “engagement” requirement on bidders.

Ilana Miller, national manager for petroleum and minerals at the Ministry of Business, Innovation, and Employment, says the new condition explicitly requires permit holders to engage with local iwi (Maori tribes) on an ongoing basis. She added that there are specific early engagement requirements in relation to activities to be carried out within 200 m of areas of significance to iwi. Proposals for the new acreage must be lodged by Aug. 28.

Exploration interest in New Zealand has fallen sharply since the world oil price collapse in 2014. Only one permit has been awarded in each of the offers made since then and no onshore acreage at all was awarded in the 2017 offer.

Onshore fields produced about 37% of the country’s natural gas in 2018. During the same period gas was used to generate about 12% of New Zealand’s electricity.

Drilling & ProductionQuick Takes

BP sanctions second phase of Thunder Horse expansion

BP PLC has sanctioned development of Phase 2 of the Thunder Horse South expansion project in the deepwater Gulf of Mexico.

The project—which at peak is expected to add 50,000 boe/d gross of production from the existing Thunder Horse platform—is due for startup in 2021.

This project will add two subsea production units 2 miles south of the existing Thunder Horse platform, with two production wells to be added in the near term. Eventually, eight wells will be drilled as part of the overall development, BP said.

This latest expansion comes on the heels of several other expansion projects at the Thunder Horse platform in recent years. An earlier South expansion project at the field started up ahead of schedule and under budget in early 2017 and raised output at the facility by an additional 50,000 boe/d. In October 2018, the Thunder Horse Northwest expansion project came online and is expected to boost production by 30,000 boe/d. BP in 2016 started up a water injection project at Thunder Horse to enhance oil production from the field.

ExxonMobil finances Liza Phase 2 project off Guyana

ExxonMobil Corp. has financed the Liza Phase 2 development offshore Guyana after receiving government and regulatory approvals. Liza Phase 2 will produce as much as 220,000 b/d, and ExxonMobil forecasts the Stabroek block will produce more than 750,000 b/d by 2025.

Six drill centers are planned to host about 30 wells, including 15 production, 9 water injection, and 6 gas injection wells. Phase 2 startup is expected in mid-2022.

Liza Phase 2 is expected to cost $6 billion, including a lease capitalization cost of $1.6 billion for the Liza Unity floating production, storage, and offloading vessel.

Liza Phase 1 remains on schedule to come on stream by first-quarter 2020. It will produce as much as 120,000 b/d of oil at peak, utilizing the Liza Destiny FPSO, which is expected to arrive offshore Guyana in the third quarter.

Pending government and regulatory approvals, a final investment decision is expected later this year for Phase 3 of development, Payara, which is expected to produce 180,000-220,000 b/d with startup as early as 2023.

ExxonMobil is evaluating additional development potential in other areas of the Stabroek block, including at the Turbot area and Hammerhead. By Dec. 31, ExxonMobil expects to be operating four drillships offshore Guyana.

Equinor to decommission Statfjord A platform

Equinor announced May 2 plans to shut production at the Statfjord A platform in the North Sea, one of the oldest platforms on the Norwegian continental shelf. Statfjord A went on stream in 1979 and had been scheduled for shutdown in 1999, but it has since received numerous upgrades.

An impact assessment for the Statfjord A removal was issued for public consultation during 2018 while preparations for shutdown and decommissioning have been under way. Equinor plans to submit a disposal plan to authorities.

Equinor let a contract for engineering work and preparations for topside removal and disposal to Excalibur Marine Contractors. Excalibur hired Kvaerner to dismantle and recycle the topside onshore at Stord. Allseas’ heavy lift will remove the topside structure from the concrete legs in a single lift.

Statfjord A, 84 m long and 54 m wide, works in 149 m of water in Statfjord field. Equinor plans to start permanent plugging of wells on Statfjord A this year.

Two other platforms on the field, Statfjord B from 1982 and Statfjord C from 1985, will remain on stream until at least 2025, Equinor said.

Orphan-well load cited in firm’s failure

A small Calgary natural gas producer is ceasing operation, saying a January decision by the Canadian Supreme Court on responsibility for orphan wells aggravated its financial problems.

Trident Exploration Corp., which produced gas from coalbeds and shallow formations in western Canada, said it is transferring 4,700 wells to the Alberta Energy Regulator and Orphan Well Association. It estimated its abandonment and reclamation obligations at $329 million.

“Behind these obligations, we do not anticipate any recovery for shareholders and unsecured creditors,” it said in a press release. “Likewise, any recovery for secured lenders is highly uncertain.”

Trident said, “Extremely low natural gas prices and high surface lease and property tax payments…exhausted the liquidity of the company.” Amplifying its trouble was the January “Redwater decision” in which the Supreme Court overturned Alberta court decisions allowing receivers and trustees to renounce unprofitable assets and escape well-abandonment obligations.

“As many have speculated and we have now unfortunately proven, the Redwater decision has had the unintended consequence of intensifying Trident’s financial distress and accelerating unfunded abandoned-well obligations,” it said. “We fear that many other companies may falter without clear, sound policy-making post-Redwater.”

Warning of capital flight from Canada because of regulatory uncertainty, it said, “We expect that the Orphaned Well Association may grow exponentially.”

PROCESSINGQuick Takes

ExxonMobil outlines Baytown chemical plant expansion

ExxonMobil Corp. is planning a $2-billion investment to expand its Baytown, Tex., chemical plant.

Scheduled for startup in 2022, the expansion will include a performance polymer unit that will produce about 400,000 tonnes/year of Vistamaxx polymers, ExxonMobil said.

The project also will enable ExxonMobil to enter the linear alpha olefins market with a unit slated to produce about 350,000 tpy of linear alpha olefins.

The proposed Baytown expansion comes in addition to the company’s 10-year, $20-billion “Growing the Gulf” investment initiative that, launched in 2017, outlined plans to build and expand manufacturing installations along the US Gulf Coast.

ExxonMobil Chairman and CEO Darren W. Woods said the company’s recent investments, such as a major expansion of oil and gas production in the Permian basin and the planned expansion at Baytown, will continue to boost the US economy.

Located on about 3,400 acres along the Houston Ship Channel, about 25 miles east of Houston, ExxonMobil’s Baytown complex includes a 584,000-b/d refinery, integrated chemical, olefins, and plastics plants, as well as a global technology center.

ExxonMobil Chemical Co. most recently started up its 1.5 million-tpy ethane steam cracker at the Baytown complex, which provides ethylene feedstock for two 650,000-tpy high-performance polyethylene lines that began production in fall 2017 at the company’s plastics plant in Mont Belvieu, Tex.

Aramco to buyout Shell’s interest in Sasref JV

Saudi Aramco has reached a deal to acquire Royal Dutch Shell PLC’s share of the partners’ 50-50 joint venture Saudi Aramco Shell Refinery Co. (Sasref), which operates the 305,000-b/d refinery at Jubail, Saudi Arabia.

As part of the deal, Aramco will purchase Shell’s 50% interest in the JV for $631 million in a transaction that, subject to regulatory approval, is scheduled to close later this year, Aramco and Shell said in a joint release.

Aramco said the acquisition comes as part of a plan to increase the complexity and capacity of its refineries as part of the company’s broader long-term downstream growth strategy.

Shell’s decision to shed its interest in the downstream venture forms part of the company’s ongoing effort to focus its refining portfolio to further integrate with Shell Trading hubs and chemicals, the operator said.

Kuwait lets contract for Al-Zour integrated complex

Kuwait Petroleum Corp. (KPC) subsidiary Kuwait Integrated Petroleum Industries Co. (KIPIC) has let a contract to McDermott International Inc. to provide technology for a new unit at KIPIC’s grassroots 615,000-b/d Al-Zour integrated refining and petrochemical complex under construction in southern Kuwait (OGJ Online, June 21, 2018).

As part of the contract, McDermott will deliver basic engineering, technology licensing, and catalyst for an integrated low-pressure recovery (LPR) and olefins conversion technology (OCT) unit at the complex as part of the site’s broader petrochemical refinery integration project (PRIZe), which will add a gasoline block, an aromatics block, OCT unit, polypropylene units, as well as associated utility and offsite installations to the existing refinery site, the service provider said.

Once completed, the LPR-OCT unit will produce 330,000 tonnes/year of polymer-grade propylene using refinery by-product streams, according to McDermott.

The new PRIZe units will be closely integrated with the refinery and LNG projects, which will be operated as an integrated site once completed.

While McDermott did not disclose a specific value of the order, the company said the contract would be reflected in its first-quarter 2019 backlog.

KIPIC most recently said the first unit of the Al-Zour integrated complex is scheduled to be completed by May 2019, with pipelines for delivery of feedstock to the refinery to be ready by October 2019 (OGJ Online, Nov. 1, 2018; Jan. 22, 2018).

TRANSPORTATIONQuick Takes

Official: Normal Druzhba flow due mid-May

The Druzhba oil pipeline between Russia and Europe will resume normal operations in mid-May after a month-long curtailment responding to contamination, according to Russian Energy Minister Aleksandr Novak in a report by Radio Free Europe/Radio Liberty.

The system cut operations after Belneftekhim of Belarus on Apr. 19 reported organochloride content many times above allowable levels.

The 220,000-b/d Naftan refinery at Novopolotsk and 241,000-b/d Slavneft refinery at Mozyr were reported to have cut throughput by half and on Apr. 23 halted product exports to Ukraine, Poland, and the Baltic countries.

Poland, Germany, Ukraine, and Slovakia suspended crude deliveries from the Druzhba system, according to TASS.

Transneft, the state-owned oil pipeline operator, said the contamination was deliberate, occurring at its Samaratransneft Terminal in southwestern Russia. The terminal receives crude oil from local producers.

Novak on May 7 said four persons had been arrested.

Chinese companies due Arctic LNG 2 stakes

CNOOC Ltd. and China National Oil & Gas Exploration & Development Co., a wholly owned subsidiary of China National Petroleum Corp., have signed agreements to acquire 10% interests each in the Arctic LNG 2 plant to be built by Novatek on the Gydan Peninsula of Russia.

Novatek plans three liquefaction trains with capacities of 6.6 million tonnes/year each on gravity-based structure platforms. Gas will come from Utrenneye field.

Total earlier acquired a direct 10% interest in Arctic LNG 2 (OGJ Online, Mar. 5, 2019).

Rangeland Midstream plans Alberta pipeline project

A Rangeland Midstream Canada Ltd. subsidiary expects new crude oil and condensate pipelines and related facilities it plans to design, construct, and operate in the Marten Hills region of north central Alberta to be in service in second-quarter 2020.

Rangeland Energy III LLC’s 85-km Marten Hills Pipeline System is anchored by long-term transportation agreements with three regional crude oil producers who have committed a minimum volume of 40% of the system’s capacity as well as acreage dedications totaling 450,000 acres.

The system will gather crude oil production from the Clearwater and deliver blended crude oil to an existing third-party takeaway pipeline which serves the Edmonton, Alta., hub and refining market. Condensate will be received from a third-party pipeline and delivered to production batteries for diluent blending.

TransCanada will become TC Energy

TransCanada Corp. shareholders, representing 99.55% of votes cast, have approved a special resolution authorizing the company to amend its articles to change its name to TC Energy Corp.

The company’s common shares will continue to trade on the Toronto Stock Exchange and the New York Stock Exchange under its existing trading symbol, TRP. The company’s preferred shares also will continue to trade on the TSX under their existing trading symbols.

The change will be effective upon issuance of a certificate of amendment by the director under the Canada Business Corporations Act.

Articles of Amendment for the name change have been filed with Corporations Canada.