OGJ Newsletter

GENERAL INTERESTQuick Takes

US to end sanctions waivers for Iranian oil importers

The White House confirmed Apr. 22 that it will end all waivers from Iran sanctions when they expire on May 2. When the US reimposed sanctions in November, 6-month waivers were granted to China, India, Japan, South Korea, Taiwan, Turkey, Italy, and Greece. US Sec. of State Mike Pompeo said Washington’s aim was to bring Iran’s crude exports “to zero.” Importers would also face US sanctions if they continued to import Iranian oil after the waivers are withdrawn.

The US said it has committed, along with Saudi Arabia and the United Arab Emirates, to ensuring that global markets remain adequately supplied.

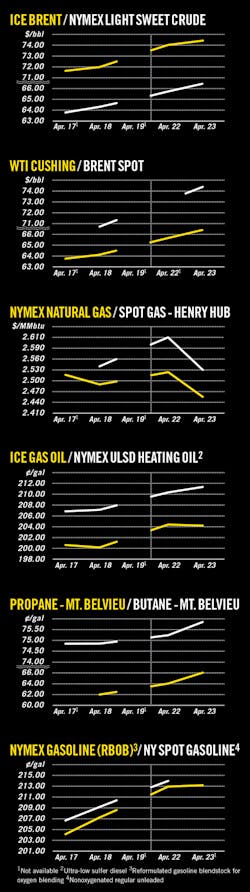

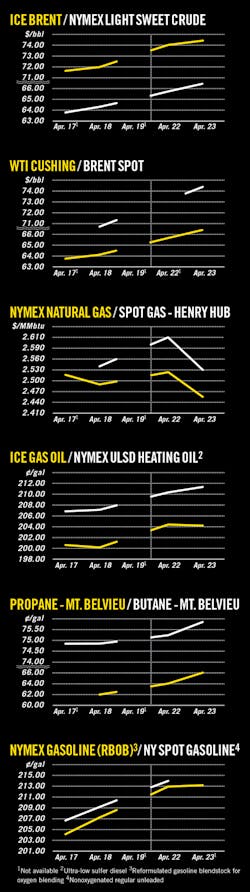

With oil markets already tightening and conflict flaring in Libya, WTI crude oil jumped 2.4% following the news to $65.58/bbl, the highest since October, while Brent moved up 2.6% to $73.89/bbl.

Wasserman Schultz bill would ban leasing off Florida

US Rep. Debbie Wasserman Schultz (D-Fla.) introduced legislation which would close the US Outer Continental Shelf off Florida to oil and gas leasing and development. The Apr. 22 measure came 9 years after the Deepwater Horizon drilling rig sank in the Gulf of Mexico and triggered a massive crude oil spill after the Macondo deepwater well blew out and exploded, killing nine people, she noted.

“Protecting Florida’s shores from another Deepwater Horizon is vital for our state’s ecosystems and economy,” Wasserman Schultz said. “The Sunshine State’s coasts provide abundant marine life habitat and a destination for beach-lovers worldwide. They are an irreplaceable treasure and ecological necessity – risking our coasts for dangerous oil and gas drilling is unacceptable.”

The bill comes at a critical time for Florida’s coasts since the Trump administration is expected to release a revised federal offshore oil and gas leasing schedule soon which reportedly includes areas off Florida, she continued. The administration also wants to reverse the Well Control rule and other regulatory protections, said Wasserman Schultz, who has introduced similar bills in the past.

Cosponsors from Florida’s House delegation include Reps. Matthew L. Gaetz (R), Vernon G. Buchanan (R), and Debbie Mucarsel-Powell (D). The Natural Resources Defense Council, Oceana, the Sierra Club’s Florida Chapter, and the National Parks Conservation Association have endorsed the measure.

Sturt becomes CEO of PetroNeft Resources

David Sturt has become president of PetroNeft Resources PLC, Dublin, replacing Karl Johnson, vice-president of operations, who became interim CEO last year after a retirement (OGJ Online, Nov. 20, 2018).

Sturt has been a nonexecutive director of the company, which has oil and gas interests in the Tomsk region of Russia, since 2016. He has been a senior vice-president of Azimum Ltd. since 2012 and has served on the boards of other countries with interests in Russia.

He earlier was a founding shareholder of VistaTex Energy, a US oil and gas producer sold in 2014 to Dome Energy.

Exploration & DevelopmentQuick Takes

Santos confirms gas off Western Australia

Corvus field appraisal drilling confirmed more gas resources offshore Western Australia. Drillers reported a 2,093-ft gross interval, one of the largest columns to be discovered on the North West Shelf, said Santos Ltd. of Adelaide.

The Noble Tom Prosser jack up drilled the Corvus-2 well in 207 ft of water in the Carnarvon basin WA-45-R permit in which Santos has 100% interest.

TD was 13,117 ft for Corvus-2, which is 56 miles northwest of Dampier. Wireline logging indicated 804 ft of net pay across North Rankin and Mungaroo formations at 11,023-13,117 ft.

Drillers encountered higher permeability zones than in the Corvus-1 discovery well, 2 miles to the northeast. Santos reported Corvus-2 showed a condensate-gas ratio of up to 10 bbl/MMcf with carbon dioxide content of 7%.

Santos executives said Corvus could be tied back to either Devil Creek or Varanus Island gas plants.

Appraisal results lower Verbier potential

A dry well drilled to appraise Equinor’s Verbier oil discovery in the Moray Firth off Scotland lowers resource potential to the lower end of the initially estimated range, a partner reported earlier this month (OGJ Online, Oct. 9, 2017).

Jersey Oil & Gas, which holds an 18% interest in the P2170 license, said the 20/05b-14 appraisal well went to 3,784 m TD without encountering expected Upper Jurassic sands.

The initial resource estimate was 25-130 million boe of oil and gas.

Jersey said a large part of the mapped area of the Verbier discovery northwest of the appraisal well and deeper-pool potential remain untested.

Equinor, the operator, holds 70% of the license. CIECO V&C (UK) Ltd. holds the remaining 12%.

Smart Oil signs PSC for Bohai Bay block

Smart Oil Investment Ltd. of China will operate exploration of the Bohai 09/17 block offshore China under a production-sharing contract with CNOOC Ltd.

The 509.3-sq-km block is in the Qikou sag under Bohai Bay in China. Water depths are 5-10 m.

CNOOC has the right to a participating interest of as high as 51% in any commercial discoveries.

Neptune to develop Seagull field off UK

Neptune Energy and partners plan to start production from high-pressure, high-temperature Seagull oil field in the Central UK North Sea by the end of 2021.

Neptune, the operator, said they have made the final investment decision and applied to the Oil and Gas Authority for development via tie-back to BP’s ETAP Central Processing Facility 17 km north of the field.

Seagull, on Block 22/29C, holds proved and probable reserves of 50 million boe of oil and natural gas.

The field is expected initially to produce 50,000 boe/d, 80% oil.

Seagull plans to develop the field with as many as four subsea wells drilled through a new manifold. A new 5-km subsea pipeline will connect the manifold with the Hebron pipeline system, which will carry produced fluids to the ETAP facility.

Seagull oil will flow from there through the Forties pipeline system to the Kinneil Terminal at Grangemouth, Scotland. Gas will move through the Central Area Transmission System to the processing terminal at Teesside.

Seagull interests are Neptune, 35%; BP, 50%; and Japan Petroleum Exploration Co. Ltd., 15%.

Neptune acquired its Seagull interest from Apache North Sea Ltd. last year (OGJ Online, Aug. 13, 2018).

Apache announced the Seagull discovery in 2015, saying an appraisal well confirmed 672 ft of net oil pay in a 1,092-ft column in Triassic sands. The well flowed at equipment-constrained rates of 8,700 b/d of oil and 16 MMcfd of natural gas with very low pressure drawdown.

Drilling & ProductionQuick Takes

BHP Petroleum plans more appraisal drilling off Mexico

BHP Petroleum plans additional appraisal drilling on Trion block offshore Mexico during this year’s second half, the company said in an operational update. Previously, BHP sold its US shale operations to focus on conventional oil and gas in the US Gulf of Mexico and Australia.

Oil and gas holdings also include properties in Trinidad and Tobago, Algeria, and UK.

In Mexico, BHP encountered oil with the Trion-2DEL appraisal well in 2018. This was followed by a downdip sidetrack that encountered oil and water, further appraising the field and delineating the resource.

An additional appraisal well (3DEL) is planned yet this year to delineate resources (OGJ Online, Feb. 13, 2019).

Elsewhere, the Deepwater Invictus rig will drill three wells in Trinidad and Tobago Phase 3 deepwater operations. Drilling will test three prospects in BHP’s northern licenses around the Bongos discovery.

Bele-1, the first of these wells, was spudded on Mar. 2. Drilling continues.

For the 9 months ended Mar. 31, BHP’s crude oil, condensate, and natural gas liquids production decreased by 5% to 42 MMboe. Executives said natural field decline and a 70-day planned dry dock maintenance program at Pyrenees, Australia, contributed to the liquids decline.

Natural gas production increased by 4% to 299 bcf.

BHP said US Gulf operations partially offset its overall declining oil, condensate, and NGL production.

In February, the BHP board approved development of Atlantis Phase 3. BHP holds 44% interest in Atlantis, operated by BP PLC, which previously sanctions Phase 3 (OGJ Online, Jan. 14, 2019).

BPH spent $438 million on exploration during the 9 months ended Mar. 31 The company plans to spend $750 million on exploration and appraisal throughout its financial year this year.

Report estimates tight oil, gas in China’s Sichuan basin

China’s Sichuan basin contains an estimated 1.2 billion bbl of tight oil and 29.1 tcf of tight gas, the US Geological Survey said in a report released Apr. 15. The estimates could help determine whether additional unconventional exploration and production takes place there, the US Department of the Interior agency said.

The findings from the late 2018 research of Mesozoic nonmarine clastic rocks found tight gas in the Upper Triassic Xujiahe formation and tight oil in Lower Jurassic lacustrine strata of the Lianggaoshan formation and the Da’anzhai Member of the Ziliujing formation.

Chinese national oil companies currently produce tight gas from the Xujiahe formation and tight oil from the Da’anzhai and Lianggaoshan in the central part of the Sichuan basin, the report noted.

The Sichuan basin was strongly influenced by Cenozoic uplift and erosion that caused leakage of hydrocarbons, a fundamental aspect of the geologic models discussed in the report. The basin underwent 1.3–4 km of uplift in the past 40 million years, according to a 2008 assessment.

Fracturing and faulting associated with this late uplift broke up the strata along the basin margins (especially the northwest margin) and affected the central part of the basin to a lesser degree, the report said. There is a hydrocarbon leakage risk associated with this late fracturing and faulting, it said.

Buru mobilizes rig for Ungani field drilling program

Buru Energy Ltd., Perth, reported that the rig for a three-well program in its Ungani field onshore Canning basin and surrounding exploration area in the Kimberley region of Western Australia was mobilized from Perth. All 44 containers holding the modularized rig will be at the Ungani-6 location soon.

Buru said it plans to drill to the top of the Ungani reservoir and then move on to drill and case the equivalent pre-reservoir section with Ungani-7 in early May. That will be followed by the drilling of the Yakka Munga-1 exploration well to evaluate a sandstone reservoir that was oil-bearing in the nearby Ungani Far West-1 well.

Once that program is completed by mid-June, a coiled tubing underbalanced drilling package will be mobilized to drill the respective underbalanced horizontal reservoir sections in the Ungani-6 and Ungani-7 development wells.

Ungani oil field in licenses L20 and L21 is 90 km east of Broome. It was discovered by Buru in 2011 when the Ungani-1 wildcat found oil in the upper 57-m section of a Lower Carboniferous dolomite reservoir. The field is now producing from four wells at around 1,200 b/d of 37 API oil and trucked to the Port of Wyndham for ongoing shipment to market.

Buru has 50% interest and operatorship. Roc Oil Co. Ltd. farmed in to the field last year and holds the other 50%.

Lundin Petroleum submits Solveig development plans

Lundin Norway AS and its partners have submitted a plan for development and operation (PDO) of Solveig field to the Norwegian Ministry of Petroleum and Energy, Lundin Petroleum AB reported. Previously, Solveig was known as Luno II field.

During 2018, Lundin acquired Equinor’s 15% interest in PL359, aligning ownership interests of PL359 (Solveig) and PL338 (Edvard Grieg) licenses.

Lundin operates both licenses with 65% working interest. Partners are OMV 20% and Wintershall 15%.

The Solveig oil discovery, on PL359, is 15 km south of Edvard Grieg field. Plans call for Solveig to be developed via a subsea tie-back to the Edvard Grieg platform (OGJ Online, Jan. 30, 2019).

Solveig is scheduled to come on stream during the first quarter of 2021. Development costs are estimated at $810 million of which Lundin’s share is $527 million. Plans call for a breakeven below $30/boe. Additional phases could be considered following Phase 1 completion.

A Rolvsnes extended well test will be developed in parallel with Solveig’s Phase 1 development.

Solveig Phase 1 contains an estimated 57 million boe of gross proved plus probable reserves, with 37 million boe net to Lundin. Plans call for three horizontal oil wells and two water injection wells.

Lundin Norway let a contract to Rosenberg WorleyParsons to modify the Edvard Grieg field infrastructure. For the subsea system, Lundin Norway let TechnipFMC a lump sum engineering, procurement, construction and installation contract.

Earlier this year, Northern Drilling received a contract for its West Bollsta harsh-environment newbuild semisubmersible to handle the drilling for Lundin Petroleum in Solveig.

PROCESSINGQuick Takes

ExxonMobil takes FID on UK refinery expansion

ExxonMobil Corp. has taken final investment decision to proceed with an expansion project to increase production of ultralow-sulfur diesel by nearly 45% at subsidiary Esso Petroleum Co.’s 270,000-b/d Fawley refinery near Southampton, UK (OGJ Online, Sept. 20, 2018).

Intended to help reduce the need to import diesel into the UK—which imported about half of its supply in 2017—the more than $1-billion investment includes a hydrotreater unit to remove sulfur from fuel, supported by a hydrogen plant that, combined, will also help improve the refinery’s overall energy efficiency, ExxonMobil said on Apr. 24.

In addition to logistics improvements, the project will increase ULSD production at the site by 38,000 b/d.

With detailed engineering and design already under way, construction on the project is scheduled to begin late this year, with startup targeted for 2021 pending regulatory approval, according to the company.

Situated on the western side of Southampton Water, the Fawley refinery—the UK’s largest—features a mile-long marine terminal that annually handles about 2,000 ship movements and 22 million tonnes of crude and other products.

ExxonMobil said the Fawley expansion project comes as part of the company’s broader plans to increase earnings potential of its global downstream business by 2025 (OGJ Online, Oct. 31,2018).

OMV Petrom commissions unit at Petrobrazi refinery

OMV Petrom SA, Bucharest, has started up a new unit that converts LPG components into Euro 5-quality gasoline and middle distillates at its 90,400-b/d Petrobrazi refinery in the southeast region of Romania, near Ploiesti City (OGJ Online, Dec. 21, 2016).

At a final cost of €65 million, the new Polyfuel unit—which began production in March and is based on Axen SA’s proprietary PolyFuel technology—enables the refinery to shift as much as 50,000 tonnes of its current production of LPG components into higher-quality gasoline and diesel using a catalytic process, OMV Petrom said.

As originally planned, the Polyfuel unit—on which construction began in 2017—was to include three main reactors, several adsorbers, as well as columns and pumps, working together to convert LPGs and light-cracked naphtha from the refinery’s fluid catalytic cracking unit into diesel (OGJ Online, July 19, 2017; July 14, 2017).

Uganda approves contractor for proposed refinery

The government of Uganda has approved a plan by the Albertine Graben Refinery Consortium (AGRC)—comprised of YAATRA Africa LLC, Mauritius; Lionworks Group Ltd.; Mauritius; Baker Hughes General Electric’s (BHGE) Italian subsidiary Nuovo Pignone International SRL; and Saipem SPA of Italy—to have Saipem move forward with both front-end engineering design (FEED) as well as engineering, procurement, and construction (EPC) of a grassroots 60,000-b/d refinery in Kabaale, in western Uganda’s Hoima district (OGJ Online, Apr. 12, 2018).

With the government’s Mar. 12 formal approval now in place, AGRC plans to advance FEED activities to ensure completion of all preliminary activities necessary for a final investment decision (FID) on the project, which is due by yearend 2020, Saipem said.

Approval of Saipem as FEED and EPC contractor follows AGRC’s initial $68-million FEED contract award to the service provider in August 2018 following the consortium’s original project framework agreement (PFA) for the proposed refinery signed with Uganda’s Ministry of Energy & Mineral Development and state-owned Uganda National Oil Co. earlier that year (OGJ Online, Aug. 3, 2018).

Under the 2018 PFA, the BHGE-led AGRC will be responsible for funding all pre-FID activities for the project as well as construction and operation of the refinery, which is to be developed as a commercially viable venture with a regional market focus.

Previously slated for startup in 2020, the refinery project aims to create greater independence for the domestic Ugandan market by reducing imports of oil and refined products from other countries, as well as ensure a hub for refined products for the East African market.

Once completed, the refinery—which is to be equipped with the latest processing technologies and environmental controls and designed to process crude from Uganda’s oil fields currently under development—will produce kerosine, gasoline, diesel, heavy fuel oils, and other products for supply to the Ugandan and regional markets.

Overall cost of the proposed refinery project is estimated at about $3-4 billion, Irene Muloni, Uganda’s minister of energy, said last year.

While AGRC has yet to officially confirm a revised timeline for anticipated commissioning of the refinery, local media outlets have reported that, if approved, construction on the project would be completed by 2023.

TRANSPORTATIONQuick Takes

Qatar Petroleum tenders for 60-100 new LNG carriers

Qatar Petroleum issued an invitation to tender for construction of the LNG carrier fleet for its North Field Expansion (NFE) project. The invitation foresees initial delivery of 60 LNG carriers, with the potential to exceed 100 new carriers over the next 10 years. The tender would increase the global LNG fleet by 11-19%. International Gas Union counted 525 LNG carriers at end-2018.

In addition to addressing shipping requirements for NFE, the tender covers shipping requirements for LNG that will be purchased and offtaken by Ocean LNG—a joint venture between Qatar Petroleum (70%) and ExxonMobil (30%)—from the Golden Pass LNG export project in Port Arthur, Tex., which is under construction and planned to start by 2024. The tender also includes options for replacement requirements for Qatar’s existing LNG fleet.

NFE will increase Qatar’s LNG production capacity to 110 million tonnes/year (tpy) starting in 2024 from 77 million tpy. The project will include construction of four new 8.25 million tpy LNG trains, which Qatar Petroleum tendered earlier this month (OGJ Online, Apr. 15, 2019).

Qatargas will execute the LNG ship building program on Qatar Petroleum’s behalf.

Canada delays Trans Mountain decision

The Canadian government has delayed until June 18 its decision on the contested expansion of the Trans Mountain crude oil and products pipeline between Alberta and British Columbia.

Amarjeet Sohi, federal minister of natural resources, said the government needed more time to fulfill consultation commitments with indigenous groups.

The government ordered the National Energy Board last September to reconsider its prior approval of the project, which is opposed in British Columbia.

The NEB reported its new approval in February, subject to 156 conditions (OGJ Online, Mar. 28, 2019). The original deadline for the government’s decision was May 23.

The government bought the existing Trans Mountain system, which has capacity of 300,000 b/d, and the stymied 590,000-b/d expansion project from Kinder Morgan in May 2018 (OGJ Online, May 29, 2018).

Tellurian’s Driftwood receives FERC authorization

The US Federal Energy Regulatory Commission has issued the order granting authorization for Tellurian Inc.’s proposed Driftwood LNG export project and an associated pipeline in Louisiana. The project would produce as much as 27.6 million tonnes/year of LNG for export.

The Driftwood LNG project consists of two main components: the construction and operation of the LNG facility, which includes five LNG plant facilities to liquefy natural gas, three tanks to store the LNG, LNG carrier loading/berthing facilities, and other appurtenant facilities at a site near Carlyss, Calcasieu Parish, La.; and the construction and operation of about 96 miles of pipeline, three new compressor stations, and 15 new meter stations.

Construction is expected to begin this year with first LNG anticipated in 2023.