Predicted shift in world's LPG trade occurs

LPG demand growth in Far East economies, especially China, over the last year has exceeded growth in available supplies from the Middle East and will likely pull volumes from Atlantic Basin producers to compensate.

That message from S. Craig Whitley of Purvin & Gertz, Houston, kicked off the firm's annual Latin American LPG Seminar late last year in Ft. Lauderdale, Fla.

The Middle East, primarily Saudi Arabia, has been the traditional leader in supplying LPG to the Far East. But this greater-than-expected Asian demand growth, in combination with Middle East petrochemical demand drawing off production, has forced suppliers in the Atlantic Basin, especially in the North Sea and Algeria, to divert LPG to the East.

The result is that, for the first time since the birth of large-cargo LPG trade, Far East LPG markets are in a deficit position for LPG supplies. The situation will likely worsen in 2001 and 2002 before the trade imbalance begins to improve in 2004.

Whitley said the imbalance could last for several years beyond 2004 if new LPG supply projects are not built in the Eastern Hemisphere as predicted.

West vs. East

The situation is one the firm has been predicting for several years. And it has important consequences for Western Hemisphere LPG demand.

Since 1985, with the Suez Canal as the dividing point for worldwide LPG trade, supplies to the West of Suez markets have been losing ground to East of Suez markets, Whitley said (Fig. 1).

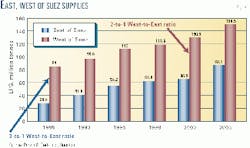

By volume, West of Suez LPG supplies have held a 3-1 ratio lead as late as 1998. But Purvin & Gertz numbers indicate that in 2000, that relationship narrowed to 2-1 (Fig. 2).

And the reasons are not hard to find.

LPG market growth rates in the East of Suez market were almost three times greater than those in the West of Suez over 1985-2000. Since 1985, the average 5-year growth rate for West of Suez LPG markets has been 13.3%, while East of Suez markets have grown 36%, Purvin & Gertz data show (Fig. 3).

Driving this growth in the 1980s was Japan, among other Eastern markets, as has been consistently reported. But in the 1990s, the LPG markets of South Korea, Taiwan, Southeast Asia, China, and India improved sharply as their economies improved, said Whitley.

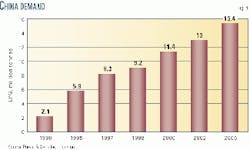

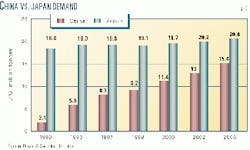

Of the group, China was the unexpected leader (Fig. 4).

As a portion of Japanese LPG market demand, China stood at 11.4% in 1990: 2.1 million tonnes compared with 18.8 million tonnes. By 2000, that portion had leaped to nearly 58%: 11.4 million tonnes in China vs. 19.7 million tonnes in Japan.

Whitley predicted that, by 2005, Chinese LPG demand as a portion of Japanese demand will reach 74%, or 15.4 million tonnes, compared with Japanese demand of 20.8 million tonnes (Fig. 5).

Tight Western supplies

For West of Suez markets, the supply situation threatens to tighten.

With some Atlantic Basin supplies diverted to East of Suez markets in the near term and, Whitley said, several Latin American LPG supply projects not as far along as expected or on hold altogether, total demand in Latin America will exceed supply this year by nearly 4 million tonnes.

And by 2005, the surplus of supply that Purvin & Gertz has been projecting for the region will shrink to slightly less than 2 million tonnes from more than 4.1 million tonnes.

Nonetheless, total Atlantic Basin LPG export volumes are on track to reach 31.5 million tonnes in 2010, up from a projected 21.8 million tonnes this year. These figures include production from Latin America-including the Caribbean-West Africa, and the North Sea.

Latin American projects lead in this growth trend. Whitley said that export supplies available from the region by 2010 will reach 9.6 million tonnes, up from 4.3 million tonnes, or a growth of more than 123%.

West Africa supplies will grow to 11.4 million tonnes in 2010 from 8.4 million tonnes in 2000. North Sea export volumes, meantime, will grow to 10.5 million tonnes from 9.1 million tonnes in 2000.