Waterfracs prove successful in some Texas basins

Several operators have found that waterfracs with minimal proppants effectively stimulate low-permeability gas formations in several Texas basins.

These less-costly treatments may also find use in other basins, outside of Texas, that contain unconventional gas reservoirs.

Although certain geologic limitations apply, numerous candidate formations exist in the US, and operators likely will attempt waterfrac stimulations in them.

US natural gas producers rely increasingly on unconventional reservoirs to replace and grow their natural gas reserves. Tight (low permeability) and naturally fractured formations are now common geological targets for exploration and development, particularly if the reserves are known to exist but are uneconomical to explore, develop, and produce with conventional technology.

At current prices for tight gas, operators depend on breakthrough technology and economy of scale to bring such reserves to the surface.

Waterfracs may also have potential for restimulating reservoirs with poor gas production per well. But integrated geological and engineering reservoir characterization of candidate reservoirs is key for determining appropriate strategies.

Waterfracs

For decades, operators have applied "slick-water," hydraulic fracturing treatments as an alternative to acid and conventional fracs. The waterfrac reincarnates the slick-water frac as a large fluid volume, minimal proppant treatment that reduces stimulation costs for wells completed in low-permeability reservoirs.1

Such reservoirs typically require extended-length fractures to maximize fracture-face surface area, thereby, improving production volumes and rates.

Conventional fracturing achieves extended fractures with large proppant volumes, placed at high concentrations by viscous gelled-fluid systems.

Recently, several innovative, cost-conscious operators lowered high fracturing costs of tight reservoirs by reducing proppant concentrations in large treatments. These operators realized savings because of less proppant, and likewise, less-expensive, less-viscous, proppant-carrying fluids.

Lower-viscosity fluids have the added benefit of potentially not decreasing fracture conductivity. Conventional fracs leave behind gel residue that tends to shorten effective fracture length.

Today, typical waterfracs include large freshwater volumes (1,000-2,500 bbl/gross ft of pay, lightly treated with friction reducer, surfactant, and clay stabilizer) and low sand concentrations (0.25-0.5 ppg).

Frac designs typically ramp-up sand concentrations at the end of the job to ensure communication between the fracture and near-wellbore area.

Waterfrac basics

Rock fractures have rough surfaces. When fracture walls are offset by shear slip of microscopic proportions (a microfault motion), fractures are prevented from healing completely as they close.2 3

The resulting linked apertures between the fracture faces may have conductivity to gas rivaling that of conventional gel-damaged, proppant-packed fractures.1

Hydraulic fractures in brittle formations also tend to form microscopic rubble within the fracture, resulting in a self-propping phenomenon that further enhances fracture conductivity.

Stimulation companies tout the benefit that waterfracs may maximize fracture length while minimizing fracture height. Fracture height is modeled as a function of fracture width, and width is largely controlled by proppant concentration.

This is an important consideration in formations that with conventional methods tend to fracture vertically out of zone.

Few papers on waterfracing have been published, although the technology has been in use since at least 1995. This may be due partly to the fact that waterfracs represent a 180° turn in the well-stimulation industry. The industry typically focuses its research on designing more-effective methods for carrying and placing proppant packs.

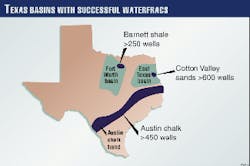

Petroleum engineers greeted the waterfrac concept with a mix of caution and excitement when it was first presented at an SPE meeting under the dubious title "Proppants, we don't need no proppants."1 Since then, the technology has been tried in several formations and basins in Texas (Fig. 1).

Attitudes have evolved to the extent that some operators have embraced the method while others see its potential for stimulating a number of formations in US basins.

Operators have successfully applied waterfracs in the tight East Texas Cotton Valley sands (Jurassic-Cretaceous) in which Union Pacific Resources, Pennzoil, and others have stimulated more than 600 wells.

Also, Mitchell Energy, Enre Corp., Republic Energy, and others have successfully waterfraced the source rock and reservoir Barnett shale (Mississipian) in more than 250 wells in the Fort Worth basin.1 4-7

In both cases, operators report production rates similar to large sand fracs. Waterfracs appear to have made these marginally economic plays more feasible.

Waterfracs also have stimulated successfully an estimated 450 wells in the naturally fractured Austin chalk (Cretaceous) in South Texas.8

Barnett shale

The Mississippian Barnett shale is a black, organic rich, soft, and typically, microfractured shale in the Fort Worth basin. The shale is gas productive in Wise, Denton, and Tarrant counties where it is thermally mature for gas.

The formation can be locally divided into upper and lower units that both yield gas. Total thickness is about 300-500 ft in the area where it is productive.

The tight Marble Falls lime caps the formation that is underlain by the tight Viola lime. Both formations have a higher frac gradient than the Barnett and provide both a "ceiling" and "floor" to keep fracs in zone.9

The Barnett log characteristics indicate a typical source rock shale because of its elevated gamma radiation, high resistivity, and low density.10 Similar formations are the Michigan basin Antrim shale, Illinois basin New Albany shale, Anadarko basin Woodford shale, and Appalachian basin Devonian shales. Each shale produces gas because of the large amount of adsorbed gas within the rock and free gas within natural fractures.11

The first recorded Barnett completion was in 1981, and fewer than 100 wells were completed in the first 10 years of play activity.12

Beginning in 1985, operators commonly performed massive fracs in the Barnett. These fracs amounted to 30-40% of total well completion costs because of the large volumes of gelled fluids (typically 500,000 gal) and proppant (1.2-1.5 million lb).

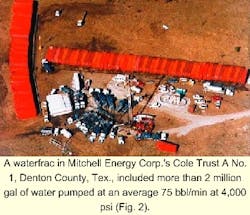

Favorable results from the Cotton Valley play caused Mitchell Energy & Development Corp. to experiment with waterfrac technology in 1997.7 Since that time, Mitchell has embraced the technology as the key to economic success (Fig. 2).

Mitchell, in 1999, noted that North Texas operations account for about 50% of the company's production.13 14 A major portion of this production is from the Barnett shale that its exploration and production team has proved to contain more reserves than previously booked.

The increase in reserves is attributable to lower unit cost using waterfracs. Fracturing costs were reduced by about $140,000/well. In addition, and seemingly most important to economic considerations, waterfracs have extended production into the upper Barnett in which conventional fracs would not be viable.

In September 1999, the company reported that it expects an accelerated infill-drilling program to double or triple daily production. It attributed the increased development activity to successful application of lower-cost, "light-sand" fracture stimulations that substantially enhanced economic returns from the Barnett shale.

Mitchell has drilled and recompleted hundreds of wells and has identified about 750 proved undeveloped and probable locations in the Barnett.13 14 Such a level of economic and technical success was unattainable prior to the waterfrac-type stimulations.

Success not universal

But not all applications of waterfracs have been successful.

An attempt to waterfrac the Travis Peak sands (Cretaceous) in East Texas apparently was unsuccessful because of its higher permeability compared to Cotton Valley sands. Permeability-related frac fluid leak-off results in failure to maintain fracture growth and effectively recover frac fluid.

A multiwell attempt to waterfrac the Marble Falls lime (Morrowan) in the Fort Worth basin in 1999 by the Cumming Co. has been marginally economic because of formation water production. The operator, however, hopes that better prospect screening combined with low drilling costs of shallow Marble Falls wells will improve economics.15

Future applications

Because waterfracs have proven effective in certain cases, operators are searching for new formations and basins that would benefit from this technology.

The authors' review of published papers, anecdotal evidence, and personal experience suggest that waterfracs will not yield technical or economic success in most conventional reservoirs.

Instead, waterfracs are a niche technology applicable to those reservoirs such as low permeability and naturally fractured unconventional reservoirs. These include:

- US tight-gas plays, particularly those involving thick lower Paleozoic shale formations, are obvious potential candidates because of source rock quality and maturity.16 17

- Cretaceous shale and tight-sand formations of the Rocky Mountain region may also hold promise because of their great thickness and depth of burial in some Laramide basins.

- Cretaceous Lewis and Mancos shales of the San Juan basin, based on preliminary research, hold promise as a significant undeveloped resource that can be brought into production with waterfrac technology.

Screening criteria

Screening criteria for unconventional resources where waterfracs may be the key for development should include past successes and failures. The criteria require most or all of the following geological characteristics:

- Dry gas saturated. Formation fluids block pore throats and reduce fracture conductivity in low permeability rock.

- Low permeability. These rocks require large surface-area fractures achieved through fracture extension and tend not to bleed off.

- Naturally fractured. Microfractured rocks may be ideal candidates but prospects should be carefully screened for fracture potential and impact on frac success.

- Thick or good presence of high-frac-gradient "floor" and "ceiling." This will keep the frac in-zone.

- Low level of fluid sensitivity. Clay-type analysis is critical.

- Nondepleted reservoir pressure. The reservoir must have sufficient pressure to recover fracturing fluids.

- Separation laterally by distance and vertically by thickness or barrier from water-bearing-permeable formations and fracture systems. Otherwise, the well may produce excessive water.

- Separation laterally by distance and vertically by thickness or barrier from depleted formations and fracture systems. Otherwise, the frac will be lost to these zones.

- Other related criteria such as availability of inexpensive, large volumes of formation-compatible water and low-risk candidates where past large fracs were volumetrically successful, but economically marginal.

References:

- Mayerhofer, M.J., Richardson, M.F., Walker, R.N., Meehan, D.N. Oehler, M.W., and Browning, R.R. "Proppants? We don't need no proppants," Paper No. SPE 38611, 1997.

- Olsson, W.A., and Brown, S.R., "Hydromechanical response of a fracture undergoing compression and shear," International Journal of Rock Mechanics and Mineral Science and Geomechanical Abstracts, Vol. 30, No. 7, 1993, pp. 845-51.

- Yeo, I.W., De Freitas, M.H., and Zimmerman, R.W., "Effect of shear displacement on the aperture and permeability of a rock fracture," International Journal of Rock Mechanics and Mineral Science, Vol. 35, No. 8, 1998, pp. 1051-70.

- Mayerhofer, M.J., Richardson, M.F., Walker, R.N., Meehan, D.N., Oehler, M.W., and Browning, R.R., "Are proppants really necessary?" JPT, Vol. 50, No. 3, 1998, pp. 36-37.

- Mayerhofer, M.J., and Meehan, D.N., "Waterfracs-results from 50 Cotton Valley wells," Paper No. SPE 49104, 1998.

- Walker, R.N. Jr., Wilkinson, J., and Thompson, J., "Waterfracs reaping results in tight gas sands," Petroleum Technology Council Case Study Summary, 1998, http://www.pttc.org/98casestuds/casestudy2.htm.

- Walker, R,N., Hunter, J.L., Brake, A.C., Fagin, P.A., and Steinsberger, N., "Proppants, We still don't need no proppants-a perspective of several operators," Paper No. SPE 49106, 1998.

- Meehan, D.N., "Technology vital for horizontal well success," OGJ, Dec. 11, 1995, pp. 39-46.

- Lancaster, D.E., McKetta, S.F., Hill, R.E., Guidry, F.K., and Jochen, J.E., "Reservoir evaluation, completion techniques, and recent results from Barnett Shale development in the Fort Worth basin," Paper No. SPE 24884, 1992, pp. 225-36.

- Henry, J.D., "Stratigraphy of the Barnett Shale (Mississippian) and associated reefs in the northern Fort Worth basin," Petroleum geology of the Fort Worth basin and Bend arch area, Martin, C.A., editor, Dallas Geological Society, 1982, pp. 157-77.

- Kuuskraa, V.A., Koperna, G., Schmoker, J.W., and Quinn, J.C., "Barnett shale rising star in Fort Worth basin," OGJ, May 25, 1998, pp. 67-76.

- Lancaster, D.E., McKetta, S., and Lowry, P.H., "Research findings help characterize Fort Worth basin's Barnett shale," OGJ, Mar. 8, 1993, pp. 59-64.

- Mitchell Energy & Development Corp, press releases are accessible by website: http://www.mitchellenergy.com.

- Petzet, G.A., "Mitchell hikes Barnett shale reserves, Forth Worth basin output in N. Texas," OGJ, Sept. 27, 1999, p. 89.

- Dwight Cumming, The Cumming Co., Fort Worth, Tex., personal communication.

- Kuuskraa, V.A., and Reeves, S.H.,"How unconventional gas prospers without tax incentives," OGJ, Dec. 11, 1995, pp. 76-81.

- Reeves, S.R., Kuuskraa, V.A., and Hill, D.G., "New basins invigorate U.S. gas shales play," OGJ, Jan. 22, 1996, pp. 53-58.

The Authors

Brian S. Brister is a petroleum geologist at the New Mexico Bureau of Mines & Mineral Resources, Socorro, NM. He has 10 years of industry experience as an exploration and production geologist. His current research focuses on unconventional natural gas resources of New Mexico. Brister has a PhD in geology from New Mexico Tech.

Lance Lammons is technical representative for Fort Worth accounts, BJ Services Co. He has 8 years of industry experience. Lammons has a BS in petroleum engineering from Texas Tech.