BOEM outlines plans for December offshore Gulf Lease Sale 262

Correction: The Bureau of Energy Management (BOEM) reduced the shallow-water royalty rate for upcoming Lease Sale 262 to 16.66% from the most recent lease sale (Lease Sale 261), conducted in December 2023, which was 18.75%. Oil & Gas Journal had reported that the upcoming shallow-water rate had increased from 12.5%, which was the royalty rate for lease sales held from 2017-2023.

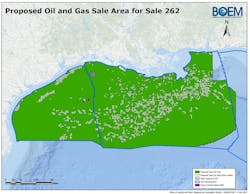

The US Bureau of Ocean Energy Management (BOEM) will offer 15,000 unleased blocks, covering 80 million acres across the Gulf’s western, central and eastern planning areas for oil and gas development under a proposed notice of sale (PNOS) for Lease Sale 262, the agency said June 25.

The proposed tracts lie 3-231 miles offshore in water depths from 9 ft to more than 11,000 ft.

BOEM proposed to reduce the royalty rate for deepwater leases (water depths 200 m or deeper) to 16.66% from the current 18.75%, the lowest deepwater rates since 2007, it said, “to support robust industry participation, lower production costs, and unleash the full potential of the Gulf of America’s offshore energy reserves.”

Lease Sale 262 represents the first federal offshore oil and natural gas lease sale since 2023 and the first non-congressionally directed sale since 2021.

While the PNOS includes the Eastern Gulf, BOEM acknowledged that “certain areas may be excluded from this lease sale.” These would include blocks in the eastern planning area offshore Florida and parts of Alabama that are blocked from leasing through 2032 under a previous Trump-era moratorium, blocks adjacent to or beyond the US Exclusive Economic Zone in the northern portion of the Eastern Gap, and blocks within the current boundaries of the Flower Garden Banks National Marine Sanctuary.

The sale, scheduled for Dec. 10, 2025, is the first of three planned Gulf lease sales under the 2024–2029 Outer Continental Shelf (OCS) oil and gas leasing program. BOEM also is developing a new 5-year OCS plan that will include additional leasing opportunities, it said.

"Offshore oil and gas play a vital role in our nation's energy portfolio, with the Gulf of America supplying 14% of domestically produced oil," said BOEM’s Principal Deputy Director Matt Giacona.

The Gulf’s continental shelf spans about 160 million acres and is estimated to contain around 48 billion bbl of undiscovered, recoverable oil and 141 tcf of natural gas.

After the agency publishes the PNOS in the Federal Register on June 27, affected state governors and local governments will have 60 days to comment before BOEM issues a final notice of sale at least 30 days before the December auction.

“This is welcome news and a timely step that reaffirms America’s commitment to offshore energy leadership,” said Erik Milito, president of the National Ocean Industries Association. "We commend Secretary Burgum and the administration for advancing this process and restoring much-needed predictability to the offshore leasing program.”

About the Author

Cathy Landry

Washington Correspondent

Cathy Landry has worked over 20 years as a journalist, including 17 years as an energy reporter with Platts News Service (now S&P Global) in Washington and London.

She has served as a wire-service reporter, general news and sports reporter for local newspapers and a feature writer for association and company publications.

Cathy has deep public policy experience, having worked 15 years in Washington energy circles.

She earned a master’s degree in government from The Johns Hopkins University and studied newspaper journalism and psychology at Syracuse University.