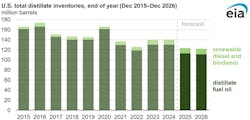

US distillate inventories to end 2025, 2026 at multi-year lows

Key Highlights

- US distillate inventories are expected to be lower in 2025 and 2026 due to a combination of reduced domestic production and increased exports.

- Refinery closures, including one in Houston and two in California, will decrease US petroleum distillate output, impacting inventory levels.

- A significant inventory draw in first-half 2025 was driven by lower renewable diesel and biodiesel supply, leading to increased reliance on petroleum-based distillates.

- Strong international demand, especially from European hubs, has supported US distillate exports, further reducing domestic inventories.

- increased renewable diesel production in 2026 will partially offset the decline in distillate fuel oil production.

Total US distillate inventories in 2025 and 2026 are predicted to be lower than in previous years due to a significant inventory draw in 2025, strong export demand, and reduced domestic production due to refinery closures. The forcast was presented by the US Energy Information Administration (EIA) in its September Short-Term Energy Outlook (STEO).

Distillates include motor diesel fuel and home heating oil. Drawdowns in distillate inventories increase the risk of price increases and price volatility from supply disruptions, particularly during periods of high demand, such as the fall harvest and winter heating season.

EIA uses total distillates to examine the combination of distillates and biomass-based distillates, which are alternatives to distillates, including renewable diesel and biodiesel.

A key factor in the low inventory forecast is the sharp inventory draw in first-half 2025. During this period, total US distillate inventories fell by 17%, or about 22 million bbl, exceeding the average decline of 10%, or 14 million bbl, over the same period in the previous 4 years.

A primary factor contributing to the significant inventory draw in first-half 2025 is the reduced supply of renewable diesel and biodiesel, driven by lower production and lower net imports of these fuels. This reduced supply of renewable diesel and biodiesel leads to increased demand for petroleum-based distillates to fill the gap. While renewable diesel and biodiesel consumption in first-half 2025 decreases by 124,000 b/d, or 35%, compared with first-half 2024, petroleum distillate fuel oil consumption increases by around 170,000 b/d, or 5%.

“We expect the first-half 2025 drop in biofuels consumption to be a short-term departure from the longer-term trend of biofuels increasing as a share of distillate consumption. We forecast renewable diesel and biodiesel consumption to partially recover in the second half of 2025 to meet existing and future production mandates under the Renewable Fuel Standard (RFS). We expect an increase in renewable diesel and biodiesel production will partially offset the increase in total distillate fuel oil consumption that we forecast in 2026, resulting in essentially flat distillate fuel oil inventories between December 2025 and December 2026,” EIA said.

Another factor contributing to the significant inventory draw in first-half 2025 is above-average distillate exports, supported by strong international demand. Since 2023, major European hubs such as the Netherlands and the UK have been importing more distillate from the US to replace Russian product.

According to EIA data, during first-half 2025, US distillate exports averaged 1.2 million b/d, 7% above the previous 5-year average. Strong international distillate demand is expected to continue to exert downward pressure on US inventories through 2026.

US refinery closures also contribute to the low distillate inventory figures in 2026.

LyondellBasell's Houston refinery closed in early 2025, and two other California refineries (with a combined refining capacity of 284,000 b/d) are scheduled to close over the next 2 years.

This loss of refining capacity is likely to lead to a decline in US production of petroleum products, including distillate fuel oil, reducing the volume available to replenish distillate inventories.

According to EIA, increased renewable diesel production in 2026 will partially offset the decline in distillate fuel oil production.