Oil, fundamental analysis

Conflicting supply/demand market signals this week had oil prices gyrating daily. The second-consecutive weekly inventory gain was offset by new geopolitical risks, OPEC’s increased global demand outlook and the new Trump tariffs being delayed again. WTI reached a High of just under $69/bbl on Tuesday ($68.94) with the weekly Low of $65.40 set on Wednesday. Prices have consolidated between $64-68.94 for the past 2 weeks.

Brent crude had a weekly Low of $67.20/bbl Monday and a High of $70.70 Wednesday. For the past 2 weeks, prices have also consolidated but in a higher range of $66.35-70.70/bbl. Meanwhile, the Brent-WTI spread has tightened to ($3.00).

Houthi rebels are once again attacking ships in the Red Sea and deploying a varied arsenal to halt them which is adding a small geopolitical risk element to pricing. Meanwhile, OPEC+ startled the market by agreeing to increase output by 548,000 b/d in August, higher than the expected increase of 411,000 claiming current healthy market fundamentals and low inventories.

Furthermore, the International Energy Agency (IEA) is reporting that Saudi Arabia actually produced 700,000 b/d over its allocation in June while increasing its exports to China to a 2-year high. The kingdom also recently raised its price for deliveries to Asia. 80% of the original 2.2 million b/d cuts have been restored and market observers believe the group may unwind the remaining 550,000 b/d in September. And, while near-term demand is seen as robust, analysts foresee a surplus starting as early as fall as the IEA’s monthly forecast indicated global oil supply will outpace demand this year. The Paris-based agency reduced its demand forecast to +700,000 b/d while increasing supply from +1.8 million b/d to +2.1 million b/d.

The ever-pending tariff threats by President Trump continue to cause demand concerns due to the economic impacts should they be formalized. It is expected that blanket tariffs of 15% or 20% will be imposed on most US trade partners. However, in addition to a 50% import tariff on copper, an announced US tariff of 50% on Brazilian exports could send their 200,000 b/d US-bound cargoes elsewhere.

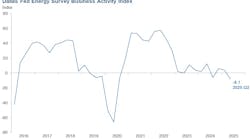

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week increased 7.1 million bbl. The Strategic Petroleum Reserve gained 240,000 bbl to 403 million bbl. Total US oil production held at 13.4 million b/d vs. 13.3 last year at this time. The Dallas Fed Energy Survey last week indicated that most US shale producers in Texas and New Mexico see oil production declining over the coming year should prices remain around $60/bbl.

Despite a lower-than-expected unemployment benefits report, the Trump tariff threats continue to spook the market as the Dow and the S&P are both down on the week while the NASDAQ is positive. The USD has made some gains this week after being down as much as 10% for the year. That may provide a cap on any crude rally.

Oil, technical analysis

August NYMEX WTI Futures prices are trading around the 8- and 13- and 20-day Moving Averages. Volume is below the recent average at 145,000. The Relative Strength Indicator (RSI), a momentum indicator, is in neutral territory at 56. Resistance is now pegged at $68.95 (week’s High) while near-term Support is $66.50 (13-day MA).

Looking ahead

Thus far, the Houthi rebels have targeted cargo ships and not oil tankers. The market will be monitoring further actions taken by the rebel group. Their backing by Iran will have to be part of any peace negotiations with Israel. As with the many back-and-forths associated with Trump’s tariffs, the market has an initial reaction to the announcements but must wait for the dust to settle and ascertain the specific impact on oil prices.

If the consensus is that OPEC+ will increase output again in September, the market can price that in ahead of time. So, tariff talks, Israel-Iran, Houthis and possible increased supply will dominate market movements in the coming week. On the demand side, it’s still summer.

Natural gas, fundamental analysis

August NYMEX Henry Hub futures are lower on the week despite increased power generation due to hotter temperatures as storage volumes continue to grow at seasonally above-normal levels. The week’s High of $3.47/MMbtu occurred Monday with the week’s Low of $3.15 on Wednesday.

Supply last week was -0.8 bcfd to 112.5 bcfd vs. 113.3 the prior week. Demand was +0.8 bcfd to 104.7 bcfd vs. 103.9 bcfd the week prior, with the biggest increase in power generation.

Exports to Mexico were 6.6 bcfd vs. 6.6 the prior week. LNG exports were 16 bcfd vs. 15.9 bcfd the prior week as capacity returns from maintenance outages. European natural gas prices were most recently lower at $10.50/MMbtu equivalent. The EIA’s Weekly Natural Gas Storage Report indicated an injection of 53 bcf, below the forecasted 58 bcf increase and a 5-year average of an additional 53 bcf. Total gas in storage is now 3.006 tcf, dipping to 5.8% below last year and 6.1% above the 5-year average. EIA is now forecasting an injection season-ending total of 3.9 tcf.

Natural gas, technical analysis

August 2025 NYMEX Henry Hub Natural Gas futures have slipped below the 13- and 20-day Moving Averages but hovering around the 8-day MA. Volume was 95,000 and lower than the recent average. The RSI is neutral at 42. Support is pegged at $3.30 (Friday’s Low) with Resistance at $3.45 (13-day MA).

Looking ahead

Egypt continues to increase its need for LNG imports with July expected to be a new record for the country. However, it currently lacks enough FSRUs (floating, storage and re-gasification vessels) to handle the increased imports. More countries are in talks with US LNG exporters regarding long-term supply deals with Saudi Arabia the latest to approach a US firm.

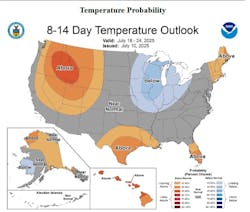

Near-term, prospects for natural gas-fired power generation look seasonally normal with a few pockets of above-normal temperatures. Although Tropical Storm Chantal did not impact the Gulf of Mexico, its rapid development could indicate a more intense hurricane season. Colorado State University’s latest predictions call for 16 storms, 8 of which will become hurricanes with 4 of those reaching Cat-3 status or higher.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.