More E&P firms trim 2026 capex plans, says Dallas Fed survey

Nearly 27% of oil-and-gas companies active in Texas and adjacent territories plan to cut back on capital spending in 2026, an increase of about 8 points from the previous two quarters.

That’s one of the key data points from the latest Dallas Fed Energy Survey, a quarterly report on how executives with exploration and development companies as well as oilfield services firms feel about business conditions in the central bank district. Another notable takeaway: Business leaders remain very much at odds with the Trump administration’s stance that $50/bbl of West Texas Intermediate (WTI) is a viable target price for the industry.

The second-quarter share of company leaders expecting to trim capex in the next year was the highest reading for that indicator since late 2023. A related question in this quarter’s survey suggests the drop is concentrated among large producers, which Fed analysts classify as producing more than 10,000 b/d: 75% of those companies said they now expect to drill fewer wells this year than they had planned to when the calendar turned to 2025. By contrast, only 34% of leaders from smaller companies said they have scaled back their plans.

The increase in firms planning to cut spending isn’t a massive red flag, however, when placed alongside the share of executives who told Fed researchers they will grow capex in 2026. That figure ticked down only slightly from early this year to just below 37% and was only a percentage point below its average reading from the previous four quarters. That suggests that a sizable share of Permian executives have remained confident about investing during a bout of election-related noise last year and tariff turmoil so far in 2025.

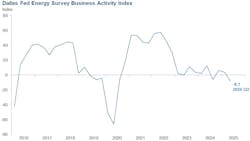

Overall, the Dallas Fed Energy Survey’s headline reading of business activity slipped into negative territory during the second quarter. (The bank conducted its survey June 18-26 and received responses from 136 businesses.) The collective outlook from industry leaders remained slightly negative—about 28% of respondents said their outlook worsened during the quarter while 21% said it had improved—but their sense of uncertainty increased. Nearly 60% of executives said they were more unsure about their outlook compared to March, a collective unease that showed up regularly in their comments to the Fed team.

“The Liberation Day chaos and tariff antics have harmed the domestic energy industry,” said one leader. “‘Drill, baby, drill’ will not happen with this level of volatility. Companies will continue to lay down rigs and frack spreads.”

Price chatter, outlook

The White House’s talk of wanting $50 oil to increase US energy independence also continues to rankle industry players.

“There is constant noise coming from the administration saying $50-per-barrel oil is the target,” one executive said. “Everyone should understand that $50 is not a sustainable price for oil. It needs to be mid-$60s.”

Analysts at Morningstar agree with that math. In their second-quarter market report released recently, a team led by Joshua Aguilar, director of resources equity research, said US producers are more exposed than before to a possible price war with OPEC+ as the latter ramps up production.

“We think the industry’s leap in efficiency gains has mostly materialized. We agree with exemplary capital allocator Diamondback that geologic headwinds now outweigh the benefits from technology and operational efficiency,” the Morningstar analysts wrote. “Permian producers in our coverage need WTI prices in the low $60s to drill new wells profitably.”

Asked about their yearend price expectations (WTI was changing hands around $70/bbl at survey time), executives’ average response was $68, with more than 60% indicating a target of $65-75.

In retrospect, the Dallas Fed’s March survey was conducted just before executives began to pare spending plans in the face of slipping prices (OGJ Online, Mar. 26, 2025). Throughout the first-quarter earnings reporting season, leadership teams said they would cut capex for the rest of this year and rely on efficiency gains to maintain (or sometimes even grow) production levels.

That trend may have run its course for some, however. Two weeks ago, Coterra Energy Inc. leader Tom Jorden said his team was reversing its May decision to reduce its Permian activity to seven rigs (OGJ Online, June 24, 2025). The improved stability in oil prices was a key driver of that decision, Jorden said.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.