Fed Dallas: Oil, gas expansion accelerates as outlooks improve

Activity in the oil and gas sector accelerated in first-quarter 2022, according to oil and gas executives responding to the Federal Reserve Bank of Dallas’ Energy Survey. Data were collected Mar. 9-17, and 141 energy firms responded. Of the respondents, 91 were exploration and production (E&P) firms and 50 were oilfield services firms.

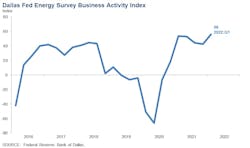

The business activity index—the survey’s broadest measure of conditions facing Eleventh District energy firms—jumped to 56 from 42.6 in the fourth quarter, reaching its highest reading in the survey’s 6-year history.

Oil production increased at a faster pace, according to executives at E&P firms. The oil production index rose sharply to 45 in the first quarter from 19.1 in the fourth quarter. Similarly, the natural gas production index advanced 14 points to 40.

Costs increased for a fifth straight quarter. Among oilfield services firms, the index for input costs increased to 77.1 from 69.8—a record high. Only one of the 50 responding oilfield services firms reported lower input costs this quarter. Among E&P firms, the index for finding and development costs advanced to 56 in the first quarter from 44.9 in the fourth. Additionally, the index for lease operating expenses also increased, to 58.9 from 42. Both indexes reached highs for the survey’s 6-year history.

Oilfield services firms reported improvement across all indicators. The equipment utilization index remained elevated but edged down to 50 in the first quarter from 51.1 in the fourth. The operating margin index advanced to 21.3 from 11.6. The index of prices received for services jumped to 53.2 from 30.3, a record high.

All labor market indexes in the first quarter reached record highs, pointing to strong growth in employment, hours, and wages. The aggregate employment index posted a fifth consecutive positive reading and increased to 28 from 11.9. The aggregate employee hours index jumped to 36 from 18. The aggregate wages and benefits index also rose, to 54 from 36.6.

Six-month outlooks improved significantly, with the index climbing to 76.3 from 53.2 last quarter, a record high. The outlook uncertainty index also jumped to 31.9 from -1.5, suggesting uncertainty became much more pronounced this quarter.

On average, respondents expect a West Texas Intermediate (WTI) oil price of $93/bbl by yearend 2022; responses ranged from $50/bbl to $200/bbl. Survey participants expect Henry Hub natural gas prices of $4.57/MMbtu at yearend. For reference, WTI spot prices averaged $103.07/bbl during the survey collection period, and Henry Hub spot prices averaged $4.65/MMbtu.

Special questions

Q: By what percent do you expect your firm’s crude oil production to change from fourth quarter 2021 to fourth-quarter 2022?

A: The median growth rate among large firms (with crude oil production of 10,000 b/d or more as of fourth-quarter 2021) was 6%, compared with 15% among small firms (less than 10,000 b/d). Twenty-five percent of executives at larger firms expect to expand crude oil production by more than zero but not more than 5%, with an additional 25% targeting no growth. Executives at small firms expect to increase crude oil production at much higher rates.

Q: In the top two areas in which your firm is active, what WTI oil price does your firm need to profitably drill a new well?

A: For the entire sample, firms need $56/bbl on average to profitably drill, higher than the $52/bbl price when this question was asked last year. Across regions, average breakeven prices to profitably drill a new well range from $48 to $69/bbl. Breakeven prices in the Permian basin average $52/bbl, $2 higher than last year. With the jump in oil prices, almost all firms in the survey can profitably drill a new well at current prices (Mar. 17 WTI spot price was $103/bbl).

Large firms need $49/bbl on average to profitably drill, lower than the $59 for small firms.

Executive comment

“Traditional lending and capital markets access for exploration and production companies are down across the board over the last several years and historically low compared to the commodity environment we are in today. Private-equity capital for oil and gas is down 70-80% over the last several years. Is this a response to low-carbon and/or ESG-related interest by banks and investors, or is it in part to the market adjusting to an administration that made it clear from day one they do not support new oil and gas development and have put appointments in key agencies in place that support this view? It is probably both, but that still tells smaller public and private independents that they cannot rely on external capital, and that they should restrain their budgets accordingly, at a time when supply growth would certainly help. Exploration and production companies need to keep engaging on why responsible oil and gas development and growth in energy-transition technology is the right combination to give consumers the best outcome, so there is more bipartisan support for sound energy policy.”

“The US needs to increase production by about 2 million b/d to balance global supply and demand in 2023. It is looking unlikely that this will happen, which will result in sustained higher energy prices until the American consumer is pushed into a recession. The industry leadership continues to be lackluster, swinging from demands for proration in 2020 to demands for the administration to call them to increase production in 2022. The compelling future of the upstream business needs to be to grow production to meet worldwide demand during the energy transition while maintaining returns on capital employed and the world’s highest environmental, social and governance (ESG) standards. Unfortunately, no leaders have this thesis.”