EIA raises forecast for 2025 global inventory buildup

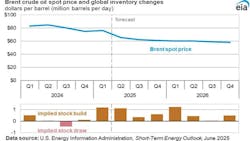

The US Energy Information Administration (EIA) forecasts in its June Short-Term Energy Outlook (STEO) that global oil inventory builds will average 0.8 million b/d in 2025, 0.4 million b/d higher than in last month’s STEO.

Higher global inventory builds for 2025 are due to a combination of reduced oil demand in the OECD in 2025 and an increase in supply growth from both OPEC+ nations and non-OPEC+ countries.

In May, the average spot price for Brent crude oil was $64/bbl, down $4/bbl from April and down $17/bbl from the same month last year. For the fourth month in a row, crude oil prices fell due to increasing global oil inventories, which were a result of slowing growth in global oil demand and the rapid rollback of OPEC+ voluntary production cuts that began in April.

On May 31, OPEC+ members agreed to continue planned production increases for a third month in July, with the possibility of adjustments based on market conditions. These elements lead EIA to predict that global oil production will surpass consumption during the forecast period, leading to a rise in global oil inventories and exerting downward pressure on oil prices.

“We expect Brent crude oil prices will average $66/bbl this year and $59/bbl next year. Global oil inventories increased over the first 5 months of 2025 and will continue to grow significantly over the forecast period. We expect they will increase by an average of 0.4 million b/d for the remainder of the year,” EIA said.

For the second half of the year, EIA expects that slowing global oil production growth—led by relatively flat US crude oil production—and rising oil consumption growth mean builds will moderate to 0.6 million b/d next year, with markets moving towards balance.

“Although the recent OPEC+ announcement added near-term supply to oil balances in our forecast, we made additional upward revisions to our Kazakhstan production forecast to accurately account for recent production levels from the Tengiz field. We also revised our forecast for Brazil because the Bacalhau Floating Production, Storage, and Offloading (FPSO) vessel is set to begin earlier than we had previously assumed in our forecast.”

Uncertainty

Significant uncertainty remains in EIA’s price forecast. “Although we do not currently forecast any major supply disruptions, oil supply risks remain. Wildfires around Canada’s major oil sands facilities in Alberta, elevated tensions in the ongoing Russia-Ukraine conflict, as well a potential force majeure on oil exports in Libya have the potential to disrupt supply.”

“Another source of uncertainty is the willingness and ability of OPEC+ members to coordinate future production targets in the face of falling oil prices and increasing oil supply from sources outside of OPEC+. In addition, uncertainty around the status of ongoing trade negotiations between the US and its trading partners could greatly affect oil prices. The status of sanctions on Russia and Iran remains uncertain, as does future development around Venezuelan oil assets, which have the potential to influence trade flows and affect oil prices.”

According to the EIA's forecast, oil consumption growth continues to be less than the pre-pandemic trend. It is projected that global liquid fuels consumption will rise by 0.8 million b/d in 2025 and by 1.1 million b/d in 2026, largely driven by demand from non-OECD countries. Specifically, non-OECD consumption is expected to increase by 0.9 million b/d in 2025 and 1.0 million b/d in 2026, whereas OECD consumption is anticipated to remain relatively stable throughout the forecast period.

“We expect India will increase its consumption of liquid fuels by 0.2 million b/d in 2025 and 0.3 million b/d in 2026, compared with an increase of 0.2 million in 2024, driven by rising demand for transportation fuels. We forecast China’s liquid fuels consumption will grow by 0.2 million b/d in both 2025 and 2026, up from an increase of 0.1 million b/d in 2024.”

The planned increases to OPEC+ production combined with supply growth outside of the group continue to drive strong global liquid fuels production growth in the forecast. Global liquid fuels production is expected to increase by 1.6 million b/d in 2025, 0.2 million b/d higher than in last month’s STEO, before increasing by 0.8 million b/d in 2026.

“Although OPEC+ recently announced its third consecutive planned monthly crude oil production increase for July 2025, we still anticipate OPEC+ members will produce below the current target path to limit increases in global oil inventories and attempt to support falling prices," EIA said.

“We expect OPEC+ will increase its crude oil production by 0.3 million b/d this year, compared with a decrease of 1.4 million b/d in 2024, before increasing by 0.5 million b/d in 2026. We expect countries outside of OPEC+ will drive global liquid fuels production growth this year, increasing production by 1.1 million b/d. However, OPEC+ drives growth next year in our forecast, as non-OPEC+ growth in our forecast slows to 0.2 million b/d, with growth from Brazil, Guyana, and Canada being partly offset by a slight drop in US production.”