OPEC: Oil demand to rebound substantially in the next few years

The Organization of the Petroleum Exporting Countries (OPEC) predicts that as the global economy recovers from the pandemic, oil demand will increase substantially in the next few years, adding that despite the energy transition, the world still needs to continue to invest in oil production to avoid contraction.

In its 2021 World Oil Outlook (WOO), released Sept. 28, OPEC forecasts that oil demand will increase by 1.7 million b/d in 2023 to 101.6 million b/d, adding to the already predicted strong growth in 2021 and 2022, and pushing demand back above the pre-pandemic 2019 level.

The WOO report presents OPEC’s medium- to long-term analysis and projections for the global economy, oil and energy demand, liquids supply and oil refining, as well as related policy and technology matters.

GDP growth, energy demand

After the 2021 recovery with global GDP growth forecast at 5.5%, it is expected that global GDP growth will slow to around 4% in 2022 and then move back to levels slightly above 3%, the report said. It is then expected to move slightly higher to reach 3.2% at the end of the medium-term period in 2026.

From a long-term perspective, global GDP growth between 2020 and 2045 is expected to increase at an average rate of 3.1% per year. Global growth through to 2045 will be largely driven by non-OECD countries, according to the outlook.

Based on 2017 purchasing power parity (2017 PPP), global GDP is projected to rise to almost $270 trillion in 2045 from around $125 trillion in 2020. Global energy demand is set to increase to 352 million boe/d by 2045 from 275.4 million boe/d in 2020.

OPEC forecasts that, despite decelerating oil demand growth in the second part of the forecast period and strong growth in other energy sources, such as other renewables, gas and nuclear, oil will retain the highest share in the global energy mix during the entire period. In 2020, oil accounted for 30% of global energy requirements. Alongside post-pandemic oil demand recovery, the share of oil is anticipated to gradually increase to a level of more than 31% by 2025, before it begins a decline and reach 28% by 2045.

Oil demand

According to the outlook, the global oil demand increase over the medium-term (2020–2026) is estimated at 13.8 million b/d. However, almost 80% of this incremental demand will materialize within the first 3 years (2021–2023), primarily as part of the recovery process from the COVID-19 crisis. OECD oil demand is expected to increase by almost 4 million b/d in the period to 2026. However, all of this increase will not be sufficient to return to pre-COVID-19 demand levels. Non-OECD demand is anticipated to increase by almost 10 million b/d over the medium-term, with around half of this increase needed to offset the demand decline in 2020, the report said.

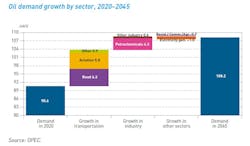

Global oil demand is forecast to rise by 17.6 million b/d between a long-term period of 2020 and 2045, growing to 108.2 million b/d in 2045 from 90.6 million b/d in 2020. Long-term projections highlight a contrasting demand picture between continued growing demand in the non-OECD and declining demand in the OECD. This trend is set to start already in the medium-term, before intensifying over the long-term.

The transportation sector is forecast to be the major contributor to future incremental demand, adding 13 million b/d between 2020 and 2045. More than 90% of this increase is projected to come from the road transportation and aviation sectors, though a large part of these increases is due to the sharp demand decline in these two sectors in 2020. However, adjusting long-term projections for the demand decline in 2020, the petrochemical sector remains the largest source of incremental demand to 2045, similar to last year’s outlook.

OPEC noted that long-term oil demand growth will be limited by growing penetration of electric vehicles (EVs). The total vehicle fleet is expected to reach 2.6 billion by 2045, increasing by around 1.1 billion from the 2020 level. EVs are set to approach 500 million by 2045, representing almost 20% of the global fleet. The outlook sees ICEs constitute about 76% of the global vehicle population by 2045, largely sustained by the fleet size increase in developing regions.

Oil Supply, investment

Supportive market fundamentals should incentivize a return to growth for US tight oil production from 2022, which is expected to rise to 14.8 million b/d in 2026 from 11.5 million b/d in 2020, the report said. Tight oil output is expected to peak at 15.2 million b/d in the late 2020s, with US total liquids hitting a maximum of around 20.5 million b/d around the same time. In the long-term, non-OPEC liquids supply declines, while OPEC sees an increase in its market share.

Meantime, cumulative investment requirements in the oil sector amount to $11.8 trillion in 2021-2045. Of this, 80%, or $9.2 trillion, is directed towards the upstream, the bulk of which is in North America, as US tight oil drives medium-term non-OPEC supply growth. Downstream and midstream investment, in order to expand and maintain the associated refinery, storage, and pipeline systems required to bring oil to market, necessitate another $1.5 and $1.1 trillion, respectively.