Oil, fundamental analysis

Crude prices skyrocketed overnight Thursday into Friday morning as Israel attacked Iranian nuclear and military facilities. The market had been rising this week on the optimism surrounding trade talks between the US and China, the world’s largest importer of oil. That momentum accelerated on the news of Israel’s actions, leading to a high of $77.60/bbl for WTI in the afterhours market following Thursday’s closing price of $68.04. The week’s Low was $64.20/bbl on Monday before the rally on the positive trade signal. Brent crude reacted in a similar fashion by posting the weekly High of $78.50/bbl overnight after a Low of $66.15 Monday.

Both grades are substantially higher week-on-week while the Brent/WTI spread has tightened to ($2.90). This singular event overshadowed positive CPI & PPI readings as well as gains in refined product inventories.

In addition to being a major oil producer, Iran sits on the northern end of the Straits of Hormuz, a key passageway for about 1/3 of global oil shipments. Iran-backed Houthi rebels have attacked tankers in the area in the past. Iran has launched counter drone strikes and Israel has stated its intentions to continue the conflict for several days in order to end Iran’s “path to a nuclear bomb."

Iran had made threats against US bases in the Middle East should conflict break out, leading the Trump administration to reduce embassy staff in Iraq and to permit military families to leave the region prior to Israel’s attacks.

Other developments this week seem inconsequential in light of this geopolitical development. And once the 'dust settles,' traders will get a better sense of whether actual disruptions do occur and, if so, for how long. Of course, any reduction in crude feedstocks during the peak travel season will be supportive of higher prices for longer. In the near term, prices may have risen higher than warranted on trader emotions.

Bank of America commodities experts believe that Saudi Arabia is preparing for a protracted oil price war to regain lost market share. While the kingdom has pursued this strategy in the past, US shale producers may be more vulnerable this time around as a recent survey by the Dallas Fed revealed that the industry needs $65/bbl or higher to drill profitably.

Interestingly, OPEC member production last month was less than the change in output quota that had been called for.

The Energy Information Administration (EIA)'s Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week decreased while refined products increased again. US refiners have increased production capacity as gasoline demand is rising. The Strategic Petroleum Reserve (SPR) gained 0.3 million bbl to reach 402.1 million bbl. Total US oil production held at 13.4 million /d vs. 13.2 million b/d last year at this time. In its Short-term Energy Outlook (STEO), the EIA forecasts a decline in US domestic crude oil production of 120,000 b/d for next year with lower shale crude but higher offshore supply.

The Israel/Iran-induced crude price shock has lifted oil company stocks but hurt those that consumer refined products such as airlines and cruise lines. The inflationary impact of higher energy prices is being felt in the equities markets while gold and the USD rise.

This comes on the heels of the May CPI reading of just +0.1% which was lower than the expected +0.2% and April’s 0.2% increase. Year-on-year inflation rose to +2.4%. The Fed’s preferred measure of inflation, the PPI, rose 0.1% last month to an annual rate of +2.6%, in line with expectations. Filings for jobless benefits last week held at 248,000 but were above the forecasted 244,000, still the most since last October. All three major US stock indexes are lower on the week due to inflationary concerns over higher energy costs.

The USD is lower week-over-week but has rebounded from Thursday’s 3-year Low.

Oil, technical analysis

July NYMEX WTI Futures have shot well passed the 8- and 13- and 20-day Moving Averages and the Upper-Bollinger Band limit on the geopolitical events. Volume is well-above average at 655,000. The Relative Strength Indicator (RSI), a momentum indicator, is well-overbought at 80. Resistance is now pegged at $74.00 while near-term Support is $73.50.

Looking ahead

“Too high, too fast?” will be the question for traders next week as the price reaction is not tied to actual disruption in global crude oil flows as yet. And you can’t ignore this huge technical move which is signaling a need to Sell. However, Israel has pledged to continue in the near-term with Iran sure to retaliate. Will oil infrastructure be damaged as a result? Only time will tell.

Natural gas, fundamental analysis

The Israeli attacks on Iran have also bolstered global natural gas prices over concerns that shipments of LNG through the Straits of Hormuz could also be disrupted. Qatar, the world’s No. 3 exporter of LNG sends cargoes through the Straits where about 20% of the world’s LNG shipments traverse. European natural gas prices spiked as a result.

Israel has ordered Chevron to shut-in the almost 1.0-bcfd Leviathan field citing security threats. This has led to reduced gas flows to Egypt which has its own gas shortfall amid rising summer demand. TTF futures in Rotterdam were at $26.15/MMbtu at one point Friday.

For July NYMEX Henry Hub futures, the week’s High of $3.77/MMbtu occurred Monday with the week’s Low of $3.45 on Wednesday. Supply last week was +0.5 bcfd to 112.9 bcfd vs. 112.4 bcfd the prior week. Demand was +2.2 bcfd to 98.4 bcfd vs. 96.2 bcfd the week prior, with the biggest increase in power generation.

Exports to Mexico were 7.3 bcfd vs. 7.2 bcfd the prior week. LNG exports were 14.4 bcfd vs. 14.5 bcfd the prior week due to maintenance outages. The EIA’s Weekly Natural Gas Storage Report indicated an injection of 109 bcf, above the forecasted +87 bcf. Total gas in storage is now 2.707 tcf, rising to 8.6% below last year and 5.4% above the 5-year average.

Natural gas, technical analysis

July 2025 NYMEX Henry Hub Natural Gas futures have slipped below the 8-, 13- and 20-day Moving Averages despite crude’s huge gain this week. Volume was 120,000 and lower than the recent average. The RSI is neutral at 47. Support is pegged at $3.45 (week’s Low) with Resistance at $3.65 (20-day MA).

Looking ahead

The seven successive triple-digit weekly storage injections are keeping natural gas from moving more in tandem with the rally in crude. While there is a storage deficit compared to year-ago levels, volumes are comfortably above the 5-year average. LNG export plant outages are also holding back onshore natural gas prices.

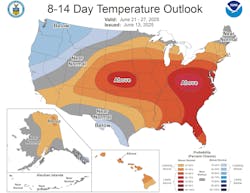

Near-term, prospects for increased power generation could be buoyed by the increased humidity caused by the series of thunderstorms that have moved across the US. Further out, summer heat begins to hit the Southeast and Middle Atlantic. The Tropics are quiet at this time as TS Dalila is projected to move west into the Pacific Ocean.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.