Chevron’s Permian production tops 1 MMboe/d, executives shift focus to cash flow

Key Highlights

- Chevron's Permian basin production exceeded 1 MMboe/d.

- Total global capex decreased by $500 million in first-half 2025, net production increased slightly to 3.4 MMboe/d.

- US production increased to nearly 1.7 MMboe/d, driven by gains in the Gulf of Mexico and Permian basin.

- Chevron expects to save $1 billion from integrating Hess operations faster than initially planned, with full integration by yearend.

Chevron Corp.’s production in the Permian basin topped 1 MMboe/d for the first time during the second quarter, hitting a target executives set for themselves more than 5 years ago. But the company is starting to cut outlays and moderate its growth in the key field and is focusing on taking home more cash.

“At some point, growth is less the objective than free cash flow,” chief executive officer Mike Wirth told analysts and investors on an Aug. 1 conference call when asked about Chevron’s broader shale portfolio. “And we’re approaching that point.”

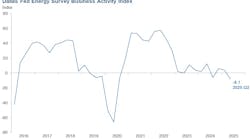

The Permian basin—where Chevron produces 2.5 times the barrels it does in the Denver-Julesburg basin and five times as many as in the Bakken—is in the lead when it comes to the focus on cash flow. Wirth said 2025 capital spending in the Permian basin will be “in the lower end” of the company’s guidance of $4.5-5 billion. That figure, he added, will drop in 2026 as the company’s teams look to merely sustain production.

As have many of their peers, Chevron leaders have focused on efficiency gains in recent quarters. The operator's total capex across the globe in first-half 2025 was down $500 million to about $7.6 billion but its net production totaled nearly 3.4 MMboe/d, an increase of a little more than 3% from last year’s corresponding quarter. In the United States, total production climbed to nearly 1.7 MMboe/d from 1.57 MMboe/d in the prior-year period. Executives said output rose in the Gulf of Mexico as well as the Permian basin while production in the Rockies slipped.

Chevron posted a net second-quarter profit of $2.5 billion, down from more than $4.4 billion in the same period of last year, while total revenues fell about 12% to $44.8 billion. The company’s average realized price for US upstream liquids was $47.77/bbl versus $59.85 last year and more than $55 in the first quarter. That pushed earnings at its US upstream division down to $1.4 billion compared to nearly $2.2 billion in second-quarter 2024.

At the recently acquired operations of Hess Corp., executives said production in second-half 2025 is expected to be 450,000-500,000 boe/d on capex of $2-2.5 billion (OGJ Online, July 18, 2025). Those numbers are generally in line with second-quarter guidance the Hess team gave early this year, when it said it was looking for output to be about 485,000 boe/d and capex to be about $1.275 billion.

Wirth and his team also told analysts that they now expect to generate $1 billion in savings from rolling Hess’ operations into Chevron’s by yearend. That’s 6 months faster than they had initially estimated when they announced the $53 billion acquisition plan in October 2023.

Shares of Chevron (Ticker: CVX) were down slightly to about $151 in midday trading Aug. 1, when the broader market was off about 1.5%. Over the past 6 months, shares are essentially unchanged; the company’s market capitalization is now about $307 billion.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.