Energy Transfer signs $3.25-billion deal to add Permian gas pipeline, processing assets

Energy Transfer LP has agreed to acquire WTG Midstream Holdings LLC from affiliates of Stonepeak, the Davis Estate, and Diamondback Energy Inc. The deal—valued at $3.25 billion—is expected to provide Energy Transfer with increased access to growing supplies of natural gas and NGL volumes to enhance its Permian operations and downstream businesses.

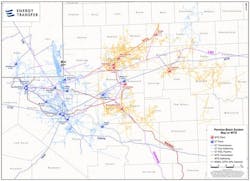

WTG Midstream owns and operates the largest private Permian basin gas gathering and processing business, Energy Transfer said in a release May 28.

WTG’s 6,000-mile pipeline network serves operators in the Midland basin including Martin, Howard, Upton, Reagan, and Irion counties. The company also operates eight processing plants with a total capacity of 1.3 bcfd and is constructing two new plants with an additional capacity of about 0.4 bcfd. The first new plant is expected to be in service in third-quarter 2024 and the second plant in third-quarter 2025.

The deal includes a 20% ownership interest in the BANGL NGL pipeline, a 425-mile NGL pipeline with an initial capacity of 125,000 b/d (expandable to over 300,000 b/d) connecting the Permian basin to markets on the Texas Gulf Coast.

Consideration for the transaction will be comprised of $2.45 billion in cash and about 50.8 million newly issued Energy Transfer common units. The deal, subject regulatory approval and closing conditions, is expected to close in this year’s third quarter.

Diamondback, through its wholly owned subsidiary Rattler Midstream LP, has owned a 25% stake in Remuda Midstream Holdings LLC (WTG Midstream) since October of 2021.