Regency, Alinda, GE form JV to finance, construct Haynesville Pipeline project

Regency Energy Partners LP, Alinda Capital Partners LLC, and an affiliate of GE Energy Financial Services will form a joint venture to finance and construct Regency’s Haynesville Expansion Project, a North Louisiana pipeline that will transport gas from the Haynesville Shale. Regency has secured commitments from shippers for 84% of the pipeline’s capacity.

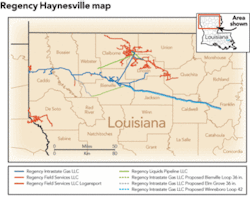

The initial 1.1 bcf/d Haynesville Expansion Project will more than double Regency’s pipeline system in North Louisiana and is expected to be in-service by the end of 2009. Regency will continue to develop and operate the system through the new joint venture.

Regency will contribute to the joint venture its $400 million Regency Intrastate Gas System (RIGS) in North Louisiana, in exchange for a 38% general partnership interest in the joint venture. GE Energy Financial Services and Alinda Capital Partners have agreed to contribute $126.5 million and $526.5 million in cash, to the joint venture in return for a 12% and a 50% general partnership interest, respectively. Regency will receive a cash payment equal to the total Haynesville Expansion Project capital expenditures paid through the closing date, subject to certain adjustments.

Byron Kelley, chairman, president and CEO of Regency noted, “The positive liquidity created for Regency will allow us to maintain our current distribution level during construction.”

“This joint venture deleverages Regency’s balance sheet, providing us with sufficient liquidity to execute our business plan in 2009,” said Kelley.

Dan Castagnola, managing director at GE Energy Financial Services and a member of Regency’s board stated, “…this project will improve the overall energy security and independence of the United States by alleviating a transportation bottleneck experienced by many producers in the Haynesville area.”

An affiliate of Regency will serve as the operator of the joint venture and an affiliate of Regency will provide all employees and services for the operation and management of the joint venture’s assets. Oversight of the business and affairs will be managed by a committee consisting of four members.

Regency will offer the joint venture the first option to acquire or pursue natural gas transportation and storage opportunities Regency identifies in Northern Louisiana.

As a condition to the closing of the joint venture, Regency is amending its revolving credit facility. The company is also entering into a $45 million unsecured revolving credit facility with GE, the proceeds of which may be used to pay for expenditures relating to the project made prior to the closing of the joint venture. Tudor, Pickering, Holt & Co. Securities Inc. acted as the financial advisor to the conflicts committee of Regency’s general partner.

The Haynesville Expansion Project consists of the construction of a 28-mile, 36” Bienville Loop, a 23-mile, 36” Elm Grove Pipeline and a 77-mile, 42” Winnsboro Loop. Regency expects to expand the pipeline’s interconnects with the Columbia Gulf, Texas Gas, Trunkline and ANR pipelines. Regency expects to add 1.1 bcf/d of capacity to the pipeline system.

Dana Gas unlocks fifth discovery in Egypt

Dana Gas, the Middle East’s first and largest regional private sector natural gas company, has made another gas discovery in one of the company’s concessions in the Egyptian Nile Delta. The Azhar-1 well is set to add up to 100 billion cubic feet (16 million barrels of oil equivalent) to the company’s reserves in Egypt.

This comes soon after the dry gas discovery at the West Manzala-2 well and three gas and condensate discoveries at the El Basant-1, El-Basant-2 and Salma-1 wells.

The Azhar-1 well is located in the West El Manzala Concession, roughly 10 kilometers from the company’s El Wastani gas processing facilities, and was spudded on December 6, reaching a total depth of 3,150 meters in the upper Sidi Salim formation.

The well revealed 18 meters of net pay in a good quality sandstone reservoir of the Qawasim formation. The initial production test from an 18 meter interval yielded production of 15.1 million standard cubic feet per day of gas and 444 barrels of condensate per day through a 32/64” choke.

The development plan for the discovery is currently being prepared. The company expects to drill a number of appraisal and development wells that will be tied into the nearby pipeline, which Dana Gas is currently constructing, to connect the recent El Basant discovery to the El Wastani Field. Production from Azhar-1 is expecting in mid-2009, which will take the Dana Gas El Wastani plant to full capacity.

Abraxas’ Lakeside well producing 250 bo/d in Brooks Draw, Wyoming

San Antonio, Tex.-based Abraxas Petroleum Corp.’s Lakeside #1H well in Converse County, Wyo. has produced an average of 250 bo/d during the first 10 days of production.

The Lakeside #1H was drilled to a total measured depth of nearly 12,500’, including a 3,800’ lateral in the Turner sandstone, and completed with isolation packers and a seven stage fracture stimulation. The well is currently constrained at a flowing rate of 200 bo/d with associated gas. During testing, the well produced in excess of 700 bo/d for short intervals. Abraxas Petroleum owns a 100% working interest in this well.

Abraxas’ leasehold position in the Brooks Draw area of the southern Powder River Basin includes roughly 14,000 net acres which are held by production (HBP).

“We are very pleased with the initial production rates from the Lakeside #1H. We plan on testing the well for 30-60 days while monitoring pressure and production data. The well is currently producing more gas than we anticipated – therefore, in the future, we may be limited in the amount of oil we can produce per day in order to keep the gas below flaring limits until an outlet for the gas is constructed. Several different outlets are within a dozen miles; however, environmental surveys and construction of a right-of-way can usually only be accomplished during the summer and early fall,” said Bob Watson, Abraxas’ president and CEO.

“With regard to our acreage position at Brooks Draw, we have allowed and we may continue to allow some of our undeveloped acreage outside of our 3-D to expire as we believe that 3-D seismic may be one of the keys to unlocking this play. We have identified 15 additional locations on our 3-D with similar natural fractures as the Lakeside #1H,” he continued.

StatoilHydro awards Paradigm multi-year technology access contract

Paradigm, a provider of enterprise software solutions to the global oil and natural gas exploration and production industry, has entered into a multi-year agreement with StatoilHydro ASA, a Norwegian integrated technology-based international energy company.

Paradigm will deploy a broad suite of subsurface E&P asset management software applications on a globally accessible basis across StatoilHydro’s operations worldwide.

As exploration continues with ever increasing reservoir complexity, and data sets grow larger and larger, StatoilHydro Geoscientists, in every StatoilHydro office globally, will now be able to benefit from access to Paradigm petrophysics, depth conversion, interpretation and processing & imaging technology. This will allow StatoilHydro to easily deploy workflows and knowledge, developed in Norway, throughout all of their international offices around the world.

“StatoilHydro has entered into this agreement based on the long standing history between StatoilHydro and Paradigm, and the high quality of the results we are able to obtain when using Paradigm technology,” said Oddvar Vermedal, manager of global IT subsurface services for StatoilHydro. “StatoilHydro places a high degree of value on best-in-class technology, and establishing this global agreement with Paradigm is consistent with our E&P goals.”

Aker awarded Kollsnes contract

Aker Solutions has been awarded an EPC contract to modify and develop the gas plant at Kollsnes on the west coast of Norway. This plant is processing natural gas from Troll, Kvitebjørn, and Visund fields in the North Sea. Engineering and procurement will start immediately, and the work will be completed by the end of December 2011. The estimated value of the contract is NOK 1.5 billion (roughly US$218.6M).

Most of the fabrication work at Stord and all the installation work at Kollsnes will be performed in 2010 and 2011.

The Kollsnes gas plant are owned by the Gassled Joint Venture and operated by Gassco, with StatoilHydro as technical service provider.

Contract party in Aker Solutions is Aker Stord AS.

Tullow makes discovery offshore Ghana, partnership plans continued exploration

Tullow Oil plc’s Tweneboa-1 exploration well, drilled in the Deepwater Tano licence offshore Ghana, has discovered a highly-pressured light hydrocarbon accumulation.

The well encountered roughly 70 feet of of net pay and was drilled to a depth of 3,593 meters and is currently being deepened to further assess the discovery and the up-dip limit of a potential deeper fan system.

The Tweneboa-1 well, located on the Deepwater Tano License, was drilled, logged and cased to a depth of approximately 11,790 feet, and is being deepened to further assess additional prospective hydrocarbon-bearing zones. It was drilled using the Eirik Raude deepwater rig in a water depth of nearly 3,770 feet roughly 16 miles west of the Jubilee field.

Tullow (49.95%) operates the Deepwater Tano licence and is partnered by Kosmos Energy (18%), Anadarko Petroleum (18%), Sabre Oil & Gas (4.05%) and the Ghana National Petroleum Corp. (10% carried interest).

Once drilling activities are finished at the Tweneboa-1 well, the partnership expects to move the rig to continue activity in the Jubilee field. The partnership also plans to continue an active program offshore Ghana with initial appraisals of three recent discoveries at Odum and Mahogany Deep on the West Cape Three Points Block and Tweneboa on the adjacent Deepwater Tano License. In addition, the partnership expects to continue its exploration program with the Teak prospect on the West Cape Three Points Block and Onyina on the Deepwater Tano License.

Occidental, Mubadala sign agreement for Bahrain Field development

Occidental Petroleum Corp. and Mubadala Development Co., a business development and investment company based in Abu Dhabi, have signed an Interim Agreement with the National Oil and Gas Authority of Bahrain (NOGA) for the further development of the Bahrain Field. OXY, Mubadala, and NOGA will form a new joint operating company that will implement a plan to increase the Bahrain Field’s oil and gas production.

During this interim phase, Oxy and Mubadala will continue to have exclusive rights to finalize negotiations on a 20-year Development and Production Sharing Agreement (DPSA) for the Field.

Capital investment is expected to be roughly $1.5 billion on a gross basis over the initial five years of the DPSA with additional investments thereafter. The development plan is expected to increase oil production to over 100,000 bo/d and increase gas production capacity above today’s level of roughly 1,500 MMcfd.