The Enterprise Solution: Commodity XL

Michael Schwartz, CMO

Multi-Market Commodity and Enterprise Risk Management

Business Intelligence | Integrated Operations | Compliance & Control

Commodity and Enterprise Risk Management

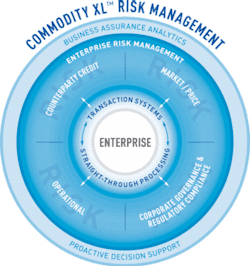

Triple Point’s flagship product, Commodity XL™, is the leading multi-market commodity and enterprise risk management solution for trading, marketing, logistics, scheduling, risk management and accounting in today’s volatile and complex environment:

- Comprehensive enterprise risk management

- Business intelligence

- Integrated physical and financial positions

- Multi-commodity management

- Service-oriented architecture (SOA)

A Proven and Winning Solution

Triple Point’s Commodity XL delivers a real-time, portfolio-wide view of position and risk and provides enhanced business intelligence for better and more proactive decision-making.

It streamlines trade processing, maximizes supply chain efficiencies, measures and manages market and credit risk, evaluates performance and ensures regulatory and accounting compliance.

Commodity XL is an award-winning solution that supports multiple commodities including power, oil, gas, coal, base and precious metals, agricultural products, biofuels and freight.

Triple Point’s Unique Integrated Risk Platform is Based on Mature, Market-Proven Technology Obtained in Its Acquisition of ROME and INSSINC

These acquisitions uniquely position Triple Point as the industry’s only provider of a fully integrated, enterprise risk management and compliance solution capable of managing the 4 key areas of financial exposure on a common platform: counterparty credit risk, operational risk, market/price risk and corporate governance and regulatory compliance risk.

Triple Point’s Commodity XL is the most comprehensive — in both breadth and depth — commodity management solution

Counterparty Credit Risk

Commodity XL for Credit Risk™ proactively measures, manages and mitigates the risks arising from counterparty default and provides an accurate depiction of credit exposure in both current market conditions and stressed scenarios.

- Liquidity Management

- Credit Analytics

- Credit Scoring

- Collateral Management

Operational Risk

Commodity XL provides straight-through processing (STP) and integrates front office controls, exchange trade execution, deal and confirmation and supply chain scheduling.

- Front Office Control

- Exchange Integration

- Integrated Invoicing and Settlement

- Integrated Supply Chains/Logistics

Market/Price Risk

Commodity XL provides the tools critical for effective trading and hedging of commodities in volatile markets and offers processes to ensure leadership-issued limits and controls are enforced.

- Multiple Commodity Exposure

- MTM

- FX Support

- VaR/Stress Test

Corporate Governance & Regulatory Compliance Risk

Commodity XL™ for Hedge Accounting and Fair Value Disclosure obtains and maintains beneficial hedge accounting treatment and performs derivative instrument fair value level assignments.

- FAS 133, IAS 39

- FAS 157, IFRS 7

- Sarbanes-Oxley

- Disclosure

Commodity XL — A Multi-Commodity Platform

In a highly inter-related global energy mix, Commodity XL enables clients to:

- Hedge inputs and outputs

- Aggregate risk across multiple commodities

- Handle complex trade types and derivative instruments

- Combine physical and financial management

Commodity XL Management Dashboard provides real-time graphical analysis for proactive executive decision-making.

About Triple Point Technology

Triple Point’s award-winning solutions are used by more than 25 percent of both Global 500 commodity trading and energy companies including Westar Energy, TVA, NYISO, ERCOT, Vertical, ConocoPhillips, UBS, Integrys, PETRONAS and Agroetanol. Founded in 1993 and headquartered in Westport, Connecticut, USA, Triple Point serves clients in Asia, Africa, Australia, Europe, North America and South America from its eight development and support centers strategically located around the world.

Triple Point Named to Deloitte Technology Fast 50 for a record-breaking ten straight years.

Commodity XL Differentiators

Triple Point Acquires INSSINC and ROME

Triple Point’s recent acquisition of INSSINC, the leading provider of treasury management and regulatory compliance solutions, and ROME Corporation, the industry leader in credit risk management solutions, positions it to uniquely offer a true enterprise risk management and compliance solution.

Counterparty Credit Risk Management

Commodity XL for Credit Risk™ proactively measures, manages and mitigates risk arising from counterparty default.

Hedge Accounting (FAS 133)

Commodity XL for Hedge Accounting™ manages the requirements under hedge accounting regulations including the detailed testing, documentation and reporting necessary to qualify for hedge accounting status.

Fair Value Disclosure (FAS 157)

Commodity XL for Fair Value Disclosure™ provides the tools to define, measure and manage fair value levels and meet disclosure requirements for FAS 157 compliance.

Business Intelligence

Commodity XL Management Dashboard™ mines vast amounts of trading, risk and supply chain data to provide unique and insightful analysis to key decision-makers.

Advanced Service Oriented Architecture (SOA)

Commodity XL is built on Triple Point’s n-tiered, Java EE compliant, highly flexible and scalable technology architecture and quickly integrates with any operating system, application server, middleware or database.

Triple Point Technology

301 Riverside Avenue

Westport, CT 06880

Telephone: +1.203.291.7979

Email: [email protected]

Web: www.tpt.com