Bakken, Barnett assets take center stage this month

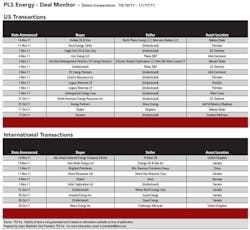

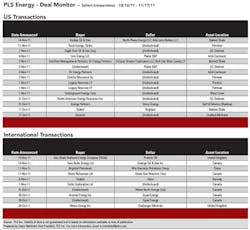

Norway's Statoil leads the pack of largest deals of the 30-day period from mid-October to mid-November. The company is set to acquire all of the outstanding shares of Austin, Tex.-based Brigham Exploration Co. for US$36.5 per share through an all-cash tender offer. The move is the latest effort by Statoil to become a major participant in the North American shale market, which has boosted domestic oil and gas production in the United States significantly in recent years. The total equity value is approximately US$4.4 billion, reflecting an enterprise value of around US$4.7 billion, based on June 30, 2011 net debt.

Analysts say the transaction price is good as long as WTI crude prices don't fall below about $55 per barrel, which Statoil says is the "break-even price" for operators in the Bakken and Three Forks shale plays, where Brigham's assets are concentrated.

The second-largest deal of the period is also involves unconventional assets. On Nov. 3, EV Energy Partners and certain other parties related to EnerVest signed agreements to acquire over $1.2 billion in Barnett assets in Montague, Wise, Denton, Parker and Tarrant counties, TX. Encana Oil & Gas (USA) Inc. is the seller of $975 million in North Texas assets. Assets were also acquired from Braden Exploration LLC and Red Oak Wise County LP.

Of the total volumes of 138.7 million cubic feet equivalent per day acquired in the transactions, Encana's portion accounted for the majority. The properties sold currently produce about 125 million cubic feet equivalent per day (MMcfe/d) and include the associated gathering pipelines on about 50,000 net acres of land in the Fort Worth Basin.

A note to investors from Global Hunter Securities puts the Encana portion of the transaction with an implied valuation of $7,800 per flowing mcfe, while the combined Encana and private portion of the transaction implies an $8,700 per flowing mcfe valuation. Overall, noted GHS, the transaction includes 82,000 net acres, implying a valuation of $14,732 per acre. The combined transaction includes 763 active wells as well as 300 identified PUD drilling locations.