New partnership rules shake up shale deals

Sampat Prakash, Deloitte Consulting LLP, Houston

Rick Carr, Deloitte Consulting LLP, Houston

The natural gas industry has experienced dramatic changes over the past two years. A surge of supply resulting from the development of unconventional sources and from substantial increases in the worldwide availability of liquefied natural gas has flooded the market. At the same time, the economic recession significantly dampened the overall demand for natural gas in North America. The resulting supply/demand imbalance has kept natural gas prices low and challenged the profitability of many gas producers.

Given this low-margin environment, two trends have readily emerged among North American natural gas producers: a focus on operational excellence and the development of new business models to thrive in the new environment. This article will outline the key market changes that are driving a renewed focus on core assets, streamlined cost models, lean operations and the ability to leverage strategic relationships. In turn, these changes then define the corresponding business models that include strategic partnerships with domestic E&P leaders, acquisitions to enhanced technologies, and applications of these technologies to new regions outside of North America.

A changing supply and demand landscape

The current imbalance of supply and demand is expected to continue as production capacity grows while demand struggles to recover from recessionary effects. Prices will remain depressed, with a short- to medium-term price outlook that is below $7/MCF as indicated by the natural gas futures market. Despite all of these stresses on price, drilling activity has continued to hold strong, and in some asset areas, activity has increased as producers move to fulfill requirements to maintain leases or meet market expectations on exit rates.

Recent technology and supply developments in the natural gas industry have fundamentally shifted the supply and cost curves for natural gas. Technology improvements in drilling and multi-stage fracturing have made producing gas more economical and introduced a lower-cost approach while the globalization of LNG has provided additional low cost supplies that are poised to grow. Together, shale gas and LNG are abundant new sources of gas that can be produced at lower prices than gas from conventional sources and it is anticipated that both of these sources will continue to grow significantly in the long term.

Unconventional gas production from shale gas and coalbed methane is projected to double from 17% of total US production in 2008 to 34% in 2030. This increase will be supported by expected demand growth driven by the power (utilities) industry, with significant impacts from potential legislation around energy efficiency, carbon cap and trade, oil sands regulation, and coastal drilling regulations.

Recent events in the Gulf of Mexico and the continued push for cleaner fuels may drive even greater demand. The low-cost supply, increased production and modest growth all come together to provide a fairly consistent price outlook in the medium to long term compared to today's prices.

As a result of the significant and enduring changes to the natural gas market in North America, companies are executing strategies that reduce costs through a focus on operational excellence and by employing new business models in an effort to exploit low cost shale gas opportunities.

Low-cost operational excellence

As the prospects of a protracted low to moderate price environment stretch further into the future, one key strategy that is emerging amongst companies operating with reduced capital and looking to maintain profitability is an enhanced focus on low cost operational excellence. E&P companies are executing on four primary levers focused on core competencies within their operational excellence programs to drive sustainable change.

1. Rationalize the portfolio to focus on a core asset base

In the boom days of gas, many E&Ps had highly diversified portfolios and were on the lookout to seize as many opportunities for growth as possible. With prices currently in the $4/MCF range and constrained access to capital, these diverse asset bases have become expensive and burdensome to the balance sheet. The first action many producers have taken is divesting non-core assets to free up capital and retire dept to stabilize current operations and support the expansion of core assets.

A prime example is Devon Energy's strategic repositioning to focus on North American assets. In late 2009, Devon announced its plan to divest all non-core assets, allowing the company to continue to meet long-term debt obligations despite declining cash flows. This provided access to significant capital to improve North American operations and continue expansion of core assets, like the acquisition of BP's oil sands operations near the existing Jackfish asset in Alberta.

The examples in Figure 1 illustrate the first action many US independents have employed to divest conventional oil or gas plays to focus on unconventional, lower cost asset basins where they can drive competitive advantage through operational excellence in a low cost market.

2. Drive streamlined, sustainable low cost operating structures

In the current price environment, a focus on core assets and an influx of capital from non-core asset divestitures may not be enough to enable companies to support their cost structures. The price and supply-demand outlook threatens the long-term economic viability of certain assets and without a transformation of the underlying cost structure, higher cost operators will continue to struggle.

The predicted breakeven price for development of the major shale plays ranges from $3.38/MMBtu in the Eagle Ford to $10.26/MMBtu in the Western Extension of the Barnett, with the North American average at $6.86/MMbtu , immediately making apparent that price alone cannot drive sustained profitability for even the most productive shale asset. With a prolonged forward view of gas south of $7/MCF, sustaining high costs will be challenging.

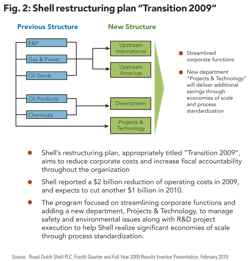

These realities are forcing companies (see Shell Restructuring Plan, Figure 2) to recognize the absolute necessity to drive a low-cost, sustainable structure. Unlike past E&P cost reduction efforts that resulted from market slumps, these programs have been characterized by an increased focus on transforming cost drivers rather than generic cost cutting efforts. Key areas that have changed

– and that will continue to change

– include:

- Drilling and completion well site cost optimization through improved technologies and multi-well pad drilling

- Continued standardization of back office business processes, enabling technologies and the continued evaluation of in source/outsource decisions and in some cases bringing work streams back in house

- Information technology overhaul with a complete total cost of ownership focus

- Supply chain, procurement and supplier program transformation with increased focus on strategic relationships, insource/outsource decisions, and reduced third-party spend

- Improved capital management, allocation, and planning driving increased return on capital employed, or ROCE

- Organization restructuring focused on a more business-centric, operations-oriented company that drives reduced infrastructure needs.

Additionally, core shale producers are advantaged. With today's technology and the ability to drive cost out through improved standardized well site process, in many instances the cost of development wells in certain shale plays can be lower than conventional gas wells. This makes shale extremely desirable among E&Ps struggling to balance cash flows and provides a competitive advantage to those with a core focus on shale and a low-cost operational structure.

3. Enhance operations with a lean process focus

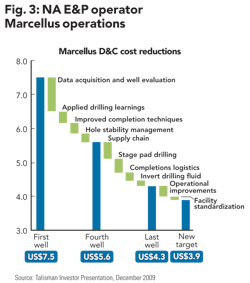

In addition to strategic asset divestitures, cost restructuring like that shown in Figure 3 will position E&P companies for long-term success in a low-cost environment. However, the ability to drive competitive advantage will require companies to drive efficiency improvements from lease to tie in.

Unconventional drilling technology has advanced significantly in the last decade including long horizontals, multi-well pads, and multi-stage fracs. Leading producers have adopted the view that unconventional production is like a manufacturing process where lean principles are driving reduced cycle times and direct costs on a per-well basis, resulting in increased productivity and returns on capital.

Leveraging principles of lean production used in many manufacturing operations, unconventional gas producers are delivering continuous performance improvement and driving waste from the E&P process. As a result, core competencies are formed that become a source of strategic and competitive advantage.

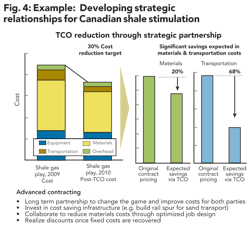

4. Leverage strategic supply relationships

The fourth strategy being used to drive competitive advantage is a focus on leveraging key supplier relationships (see Figure 4). Companies continue to compete for a limited number of crews and equipment. Market rates have risen exponentially as producers rush to develop shale assets, and it has become increasingly difficult for companies to secure coveted service providers.

These dynamics in the oilfield services market have given service providers increased margins for spot work, and many operators are charging premiums for long-term contracts, reflecting the opportunity cost of tying down crews that could command higher rates in the near term. Exacerbating this trend, many operators are pressed to meet production exit rates or lease agreements and have driven up prices in a rush to secure critical services that are short in supply.

In most cases, the crew and equipment can make a significant impact on the lifetime cost of a well. As a result, operators have begun to develop strategic relationships and advanced contracting strategies to succeed in plays where services are in high demand. This provides the operator with secure supply and top talent while offering the service provider incentives to make investments in the resource play and build their business base.

Some operator strategies include the identification of smaller service providers with proven track records in similar resource basins, whereby they can introduce them into constrained resource plays to provide a lower cost, proven alternative. Relationship opportunities can include:

- Long-term partnerships to improve costs and margins for both parties

- Investments in longer term cost saving infrastructure (e.g., build rail spur for sand transport)

- Optimized job or equipment design to reduce material and service costs

- Realization of reduced cost structures once fixed costs and investments are recovered

- Improved operational and safety performance through sharing of lessons learned and best practices

- Joint incentives and benefits through measured and tracked performance targets

Independent operators have traditionally had long-term relationships but as they mature, they are driving more formalized strategic programs to exploit mutual benefits with suppliers and continue driving operational excellence and competitive advantages in key asset plays.

The low-cost operational excellence strategy supported by these four key cost levers is producing a new and improved breed of unconventional- focused E&P companies that have assets that complement core technical competencies, operating structures that have undergone transformation to reduce costs in the long term, lean and efficient drilling and completion operations, and an integrated supply chain with strategic suppliers that drive low cost, increased utilization and efficiency. All of that positions these companies to leverage their competitive advantages in the North American market.

Introducing new business models

While the independents are building low-cost, lean organizations, larger international independents, majors, and national oil companies are taking notice. As they watch the transformation of small North American independents into industry movers, they are employing strategies and seeking new business models to gain entry into the unconventional assets that up until now have been mostly dominated by these smaller independents. These models, as described below, will provide access into a growing and profitable long-term market.

1. Partnering with independent producers

Until recently, natural gas plays have been dominated primarily by US independents that developed the technology and techniques needed to make unconventional production economical. The super majors and international E&P companies are increasingly attracted to these lower cost unconventional resource plays and are looking to gain access to these assets and leverage new extraction techniques and technologies.

Joint venture partnerships (JVs) provide a vehicle for larger E&Ps to explore unconventional plays, while the smaller independents welcome the investment capital and the joint development opportunities that come from partnering with a larger producer. This capital allows the producers to continue drilling operations while prices remain low and to position themselves strategically when prices finally recover.

Recently, many JVs have been characterized by larger operators taking advantage of partnerships to gain access to unconventional asset plays. In 2009, European majors invested nearly $5.6 billion in US shale assets, and North American assets represented nearly 50% of global M&A activity in the upstream sector, fueled by unconventional resources and a continued low-price climate, which provided an opportunity for better deals. Over the last 12 months, there have been 8 significant deals, at a value of $14 billion. Most notable are:

- Anadarko and Mitsui announce a $1.4 billion joint venture in the Marcellus where Mitsui gains 32.5% interest in ~100,000 net acres, and Mitsui funds 100% of development costs in 2010, and 90% thereafter, amounting to an additional $3-$4 billion investment in the asset.

- Reliance Industries partnering with Atlas Energy in a $1.7 billion joint venture in the Marcellus, and Pioneer Energy in the Eagle Ford shale, for $1.3 billion, bringing Reliance's total spend on shale plays to $3 billion.

These deals highlight the appeal of joint ventures – they provide independents with an attractive source of funding during periods of lower prices, and provide majors with an opportunity to enter a new, low-cost asset play.

2. Entry through a strategic acquisition of an independent

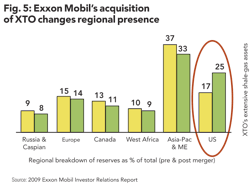

Another effective business strategy is to acquire technology through an outright acquisition. This is especially attractive in shale plays, where the majority of premium shale acreage has already been secured by independents, which renders organic growth a difficult prospect. These acquisitions provide super majors with immediate access to unconventional assets and proprietary technologies.

The upstream M&A market was quiet at the start of 2009 but closed out the year with a total of $150 billion of activity, up 35% from 2008. Nearly a third of this activity came from shale acquisitions in North America, including:

- ExxonMobil's March 2010 acquisition of XTO Energy, an independent with extensive exposure to shale plays, for $41 billion (see Figure 5). This acquisition gave ExxonMobil immediate exposure to large amounts of shale-gas acreage in the US, which is now a much more significant component in ExxonMobil's portfolio. This strategy is in line with ExxonMobil's vision of natural gas playing an increasingly vital role in future power generation and "clean" fuels.

- Royal Dutch Shell announced in May an agreement to pay nearly $5 billion for East Resources Inc., one of the biggest players in the Marcellus Shale, thus acquiring rights to 1.25 million acres.

These acquisitions will provide the opportunity for the super majors to significantly advance their positions and competencies in the unconventional shale market domestically and provide the option to leverage extraction technologies and techniques internationally.

3. Leveraging technology from the US in other regions

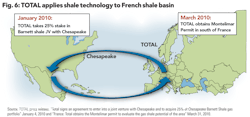

The third and maybe most intriguing model focuses on taking an established core competency in unconventional development to other regions and asset basins. More specifically, companies will seek to apply unconventional techniques and technologies developed in the US to overseas assets (see Figure 6). Europe and Asia are major demand markets for natural gas and largely dependent on Russia and LNG. Both regions provide growth opportunities for taking the US developed technology and unconventional expertise to new regions and assets to develop new economical gas sources. Several super majors and international oil companies have already begun pursuing this model. We have seen nearly a dozen events in the last 24 months, most notably:

- ConocoPhillips and a Polish independent, Lane Energy, have acquired permits to explore the Baltic Basin and announced that the first of two test wells planned for 2010 was successfully spudded in mid-June

- In June of 2010, Chevron announced it acquired rights to explore for natural gas in the Grabowiec concession, located in southeastern Poland. The confirmation follows Chevron's December announcement that the company was awarded three five-year exploration licenses to explore for unconventional gas resources in three other regions of Poland.

- Statoil purchased a 32.5% interest in Chesapeake Energy's Marcellus shale acreage, covering 1.8 million net acres for $1.25 billion cash and $2.125 billion as a 75% carry on drilling and completion of wells from 2009 to 2012, and the deal also includes provisions for global exploration of shale gas by Chesapeake in 15 countries

- Shell and PetroChina announced in January 2010 that they have begun jointly assessing a shale gas field in the Sichuan basin.

Shale gas production will quickly become a global approach to gas development where independents, super majors, and national oil companies will benefit. This will not only drive growth and opportunities through the exploitation of core competencies and technology, but will also provide the platform for additional technology development through introduction to new regions.

Conclusion

The landscape for natural gas exploration and production has changed dramatically in reaction to depressed prices and an imbalance of supply and demand – a phenomenon that has been complicated by shifting roles for producers of all stripes, including independents, international oil companies and national oil companies.

A new breed of E&P company focused on core competencies and unconventional assets with a low-cost, lean structure and a new way of dealing with strategic suppliers is emerging as the dominant player in the low price gas market. Hoping to ride on this wave of change, larger international companies are leveraging these producers to drive increased growth and value through new business models that rely on transferring knowledge to new asset plays and regions through a variety of mechanisms, including JVs, acquisitions, and strategic partnerships overseas. OGFJ

About the authors

Meltem Demirors, a business analyst at Deloitte Consulting LLP, helped research and develop this paper.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com