BP-Apache's $7 billion deal is month's largest

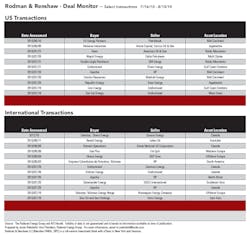

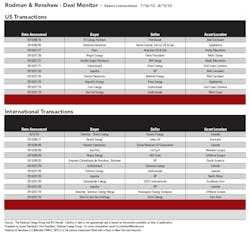

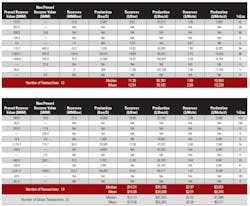

By far the biggest upstream petroleum transaction of the past month was the deal between BP and Apache Corp. On July 20, the companies announce an agreement whereby Apache would acquire all of BP's oil and gas operations, acreage, and infrastructure in the Permian Basin of West Texas and New Mexico, and in Egypt's Western Desert. Apache also will obtain substantially all of BP's upstream natural gas business in western Alberta and British Columbia. Apache will pay $7 billion for the assets, which include estimated proved reserves of 385 million barrels of oil equivalent.

"This is a rare opportunity to acquire legacy positions from a major oil company, with oil and gas production, acreage, infrastructure, seismic data, field studies, exploration prospects, and other essential aspects of our business," said G. Steven Farris, Apache's chairman and CEO. "We seldom have an opportunity like this in one of our core areas let alone three."

In another transaction involved BP, a consortium of Colombia's national oil company, Ecopetrol, and Talisman of Canada, will acquire BP Exploration Co. (Colombia) Ltd. (BPXE), a wholly owned BP subsidiary that holds BP's oil and gas exploration, production, and transportation interests in Colombia.

BPXE's assets include interests in five producing fields in four association contracts, four separate pipeline interests, and two offshore exploration blocks. Net proved reserves total some 60 million boe, and production is about 25,000 boe/day.

The sale of all these assets by BP is part of the company's plan to divest up to $30 billion of assets over the next 18 months.

One other deal of note is Midland, Tex.-based Concho Resources' acquisition of all the oil and gas assets of Marbob Energy Corp. and certain affiliates for $1.65 billion in cash and Concho securities. Marbob is a privately-held E&P company with operations in the Permian Basin of Southeast New Mexico. The acquisition includes a significant acreage position in the emerging Bone Spring play in Southeast New Mexico.

"Marbob's Bone Spring acreage, when coupled with our existing acreage, gives [us] over 100,000 net acres in one of the most exciting emerging plays in the industry today," said Timothy Leach, Concho's chairman and CEO.