Innovation lacking in high-tech world of oil: New technologies needed to develop unconventional resources

It may have hit you when you noticed the “energy surcharge” line item on your recent gas bill or, more recently, when you paid more than $2/gal at the gas pump. Maybe you noticed that airfare has been steadily rising or that it costs more to heat or cool your home. You are probably wondering when it will end.

Oil prices in excess of $50/bbl have made headlines throughout the nation and, as Americans start to feel the repercussions, brought the oil and gas industry into the average citizen’s consciousness more than it has been since the oil embargo of the 1970s.

Most industry observers agree that high oil prices are here to stay, and some say we have entered a new age of volatility.

Using history as a guide, just as coal displaced wood - before the earth’s natural forests were depleted, and as oil displaced coal during the 20th century, oil will eventually be overtaken by less-costly alternatives. The transition to a new fuel - whenever that might be - will be driven by oil shortages and high costs of finding and development. However, any transition will only be possible with some form of technological progress.

So how will new technologies emerge before conventional oil reserves run out? Is the industry currently doing enough to develop new technologies? And how close are we to the “new” oil? There is no clear answer to these questions. However, we do know that technology will play an integral role.

Situation analysis

Supplies of oil, limited by geology, are increasingly being discovered in politically unstable parts of the world. At the same time, worldwide demand is rapidly increasing and regulations continue to become more stringent. These energy market drivers (Fig. 1) collectively constrain supply and contribute to higher costs.

Most experts think that world oil production is at or approaching its peak. Oilpatch investment banker Matthew Simmons has warned that we have entered into a new era because existing fields are in decline and - although new oilfield technologies have allowed many of the large, older fields to continue to produce - the production comes at higher costs.

New discoveries have been mostly limited to much smaller fields that peak and are tapped out at a faster rate than the large oil fields found in past decades. New reserves are not only hard to find, but are also becoming increasingly more expensive to develop.

The cost of developing new reserves in hard-to-get conditions is estimated at 100 percent higher than a decade ago. (We have a little more leeway in the area of natural gas, but many of the same dynamics apply.)

Oil prices are also influenced by supply interruptions and uncertainties, and many of the remaining large reserves are found in politically unstable areas, such as the Middle East. By 2020, 83 percent of global oil reserves will be held by Middle Eastern nations.

Could Russia be the next frontier for oil? It’s doubtful because Russia ranks only seventh in proven oil reserves, and its oil production peaked around 1999. Moreover, although Russian oil is cheap, its political instability does not render it much more attractive than Middle Eastern oil.

Why don’t we pour a little OPEC fuel on the fire? The weak US dollar has forced the Organization of Petroleum Exporting Countries to increase oil prices in order to cover the exchange rate risk related to the costs it incurs in other countries. This is exacerbated by OPEC’s fear of low oil prices and a reluctance to invest in new production capacity.

Growing demand

Global oil consumption reached approximately 82 million b/d in 2004 and growing. In 2001, oil consumption in the US made up about 25 percent of global consumption, followed by Japan at seven percent, China at six percent, and Germany at less than four percent. India, the ninth-largest consumer of oil, represents roughly three percent of global oil consumption.

Worldwide, oil consumption is growing at about three percent annually, according to the Energy Information Administration (EIA). The two countries with the highest rate of growth in oil consumption are China and India, whose combined populations account for one-third of the world’s people. In the next two decades, China’s oil consumption is expected to grow at a rate of 7.5 percent annually and India’s oil consumption is expected to grow at 5.5 percent annually.

There is more to the China story. China’s economy is expected to slow to about nine percent growth this year from double-digit levels of growth. Even with this lower growth rate, China’s shortfall in electricity capacity is an estimated 30 gigawatts, or the size of Turkey’s entire electric grid.

Absent a power grid, Chinese industrials must turn to small, relatively inefficient oil-fired generators for their power needs. Based on China’s growing economy and demand for energy, China is and will continue to be a major net energy importer.

As an oil consumer, India shares many of the eye-opening grid and population dynamics as China. As with China, India will continue to be a significant net energy importer as a result of its fast-growing economy and increasing demand for energy.

Environmental regulations

Despite worldwide support for the Kyoto protocol, the US stepped away. However, even with the Bush administration’s “business-friendly” approach, there is bipartisan political support within the US for environmental protection.

For instance, witness the ongoing debate about tapping the Alaskan National Wildlife Reserve (ANWR). Also, although it was defeated 55 to 43 in the Senate, the McCain-Lieberman Bill illustrates a bipartisan interest in environmental concerns. The US Department of Energy (DOE) is budgeting significant funding to focus on developing new environmentally clean fossil fuel plants, with projects such as FutureGen and Vision 21.

Cinergy Corp., once a staid utility located in the US heartland, labeled its 2004 annual report to shareholders “Global Warming: Can We Find Common Ground?” As its CEO, Jim Rogers, stated, “I’m sure you might expect us to duck this issue. After all, we burn 25 to 30 million tons of coal each year. . .there is an unresolved but robust debate on the ‘science’ of global warming.” Rogers identified six signposts that have caused him to focus his $4.7 billion company’s strategy around the environment:

- Action by the states, including that eight states regulate greenhouse gas emissions, and 18 states have mandatory renewable energy portfolio standards;

- An increasing number of US senators who are concerned about global warming;

- The Kyoto protocol, which went into effect on February 16, 2005;

- A growing number of individual shareholders and shareholder groups that are asking companies such as Cinergy to quantify the risks associated with greenhouse gas emissions;

- Greenhouse gas emissions trading markets that are developing in Europe and the US; and

- Global warming becoming part of the media’s and society’s everyday consciousness.

Cinergy is no renegade. Duke Energy Corp. has announced plans to lobby for a tax on CO2 emissions that would reduce fossil fuel consumption and begin addressing global warming. In the words of Duke CEO Paul Anderson, “I feel the time has come to act - to take steps as a nation to reduce the carbon intensity of our economy. And it’s going to take all of us to do it.”

A reluctance to invest?

There is a need for the super majors to develop new fields quickly. Reserve replacement for the five super majors fell from 134 percent in 1999 to 113 percent in 2003. The next-tier majors - including Unocal Corp., Occidental Petroleum Corp., Marathon Oil Corp., and the big independents like Anadarko Petroleum Corp. - all have similar needs.

This strong need for reserves is further evidenced by the premium embedded in the recent announcement by ChevronTexaco Corp. that it intends to acquire Unocal, pending approval of government regulatory agencies. The deal values Unocal’s proven oil reserves at about $9/bbl, while ChevronTexaco’s own stated internal cost to find and develop oil is currently $6/bbl.

The DOE’s Office of Fossil Energy believes that “technology innovation will be the key to overcoming the constraints of an increasingly challenging resource base, domestically and around the world.”

But are companies acting quickly enough and investing enough capital?

Technological improvements continue to expand the definition of what is recoverable oil. For example, oil shale and tar sands, which are formations of oil-saturated rock and sand, have been uneconomical to produce until recently. Expanding technical capabilities may eventually allow for the widespread use of these new, previously unfeasible fuels.

Technology is also increasingly important in production. Most new growth in drilling for petroleum is expected to occur offshore, often from existing but idle, platforms. Technological advancements will increase the speed and depth of drilling and reduce costs through automation.

Look to the following areas for innovation:

- Liquefied natural gas - East Asian and North American gas imports are mostly via LNG - not pipelines. Given Asia’s growth and North America’s increasing gas consumption, the LNG market is expected to continue its well-publicized boom. This boom will foster innovation.

- Getting it out of the ground - Innovations such as 3D seismic, a visualization tool that helps locate new drilling sites, can offset the demand by finding previously unreachable supplies. ExxonMobil Corp. developed new software that mimicked how the human brain’s neural network processes information. Using supercomputers, this tool integrated signs of gas, oil, or water from well easements into a “big picture” provided by high-definition seismic readings taken over hundreds of square miles. Predictions could then be made regarding a reservoir’s hydrocarbon locations. With this detailed picture as a guide, zones could be tested using flexible drilling technologies.

- Non-conventional fuel sources - Non-conventional reserves of oil are less than half of conventional reserves. However, non-conventional resources - a broader definition than reserves - are three times greater than conventional resources. Historically, the focus has been on refining “sweet crude oil.” But companies are getting better at refining “sour crude,” which has higher sulfur content. There is also a significant amount of investment into developing technologies to burn tar sands and emulsified bituminous fuels, once considered impractical due to the impact of their “grittiness” on machinery.

- Substitutes - Developing coal gasification technologies may allow existing oil- or natural gas-fueled power plants to run off cheaper and more abundant coal. President Bush announced a $1.2 billion initiative to lessen America’s dependence on foreign oil by developing technology for commercially viable hydrogen-powered fuel cells in his 2003 State of the Union Address. Other interesting technological areas include the use of biofuels.

- A power generation infrastructure - As evidenced by Cinergy’s 2004 annual report, environmental constraints are expected to have a profound impact on how we generate our power over the next 20 years. Environmental efficiency comes at a cost. New generations of power generation technology are emerging in the areas of clean coal, nuclear power plants that make better use of waste, and decentralized power plants that use technologies such as fuel cells and CHP (combined heat and power). The EIA, in its “World Energy Outlook,” puts the investment needed to modernize and expand the energy supply infrastructure between now and 2030 at $16 trillion, with $10 trillion of this expected to be in the electricity industry.

- Demand reduction - Improvements in automobile efficiency - especially in America - is an obvious source of innovation potential. Super-efficient cars no longer seem so far off with the success of hybrid cars like the Toyota Prius and the Honda Insight. The feasibility of a hydrogen-powered fuel cell car is some way off due in large part to the need to develop suitable infrastructure. However, the pace of development of “intermediate” technologies such as hybrids and clean diesel will accelerate if oil prices reach a high enough level.

Yet investment tends to lag

Oil price instability greatly influences spending in the oil industry and companies’ ability to utilize the latest technology. For instance, price uncertainty is as much of a key to production as the price of the oil itself, since companies will spend more on technology to produce oil if they feel comfortable with price stability.

Technology and innovation have made a major impact over the past two decades. Had there been no technological advances in the oilfield industry since 1985, it would take two domestic wells today to produce the same amount of oil that one well produced in 1985. However, research and development expenditures by government and industry have actually shrunk over the past decade.

One explanation is that after a period of low oil prices in the late 1990s, fear of low profits drove oil companies into mega-mergers aimed at cutting costs. Management, fearful of missing its quarterly earnings targets, hacked away at their R&D budgets in an attempt to cut costs. As long as oil companies seek the cheapest solutions, innovation will suffer.

Even now, major oil companies remain cautious about investing for fear of a replay of the boom-bust that occurred in the 1970s and 1980s. Oil prices are subject to price volatility and are influenced by many variables. The EIA’s “Annual Energy Outlook” for 2005 states that, “The future path of oil prices is a key uncertainty facing the world oil markets.”

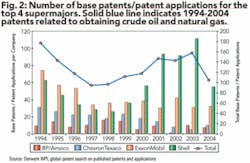

The caution exhibited by the major oil companies can be observed by examining the number of patents applied for in recent years. Fig. 2 illustrates that between 1994 and 2004, the rate at which the major oil companies applied for patents has decreased from 174 per year in 1994 to 104 per year in 2004.

Within the technology area related to obtaining crude oil and natural gas, the four super majors account for less than 10 percent of all patent activity. Innovation in the field is diverse and not limited to the super majors but shared by smaller “off the radar screen” companies. While R&D spending at the oil majors has been declining for more than 20 years, much of the slack has been taken up by oilfield service companies. The possibility exists that while the super majors themselves are not filing for many patents, they may be acquiring the technology developed by others - or acquiring the smaller companies altogether.

Another explanation is that the major service companies have determined that it is in their best interest to invest in R&D. These companies are spending between three percent and four percent of their revenues on R&D. This is triple or quadruple the rate of the oil majors, which spend only 0.5 percent of upstream revenue.

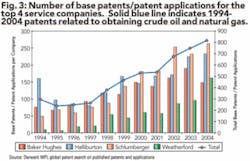

The number of patents a handful of service companies applied for in recent years (Fig. 3) greatly outnumbers the number of patents the major oil companies applied for during the same timeframe (Fig. 2). In 1994, Baker Hughes, Halliburton, Schlumberger, and Weatherford, collectively, applied for 297 patents. In 2004, this figure more than doubled to 810.

Conclusion

Due to the declining supply of easily accessible oil, growing reliance on the oil reserves on politically unstable parts of the world, and the ever-increasing world oil consumption, the call for innovation is increasing.

Past technical advancements have been substantial, increasing the oil production of a single well and making previously unrecoverable oil economically feasible to recover and process. However, given the current situation, industry needs to make even greater technical leaps and invest more heavily in R&D.

Patent application data indicates that oil majors are shifting the burden of research to oilfield service companies. In 2004 alone, Baker Hughes, Schlumberger, Halliburton, and Weatherford published between 150 and 270 patents and patent applications each, while Shell published only 55. This could be explained by a mindset at the oil majors of satisfying the quarterly demands of Wall Street and a fear of the unstable prices of the 1970s and 1980s.

At a time when industry innovation is sorely needed and fattening oil prices are providing the super majors with funds to invest in R&D, innovation is being pushed down to their vendors, the oilfield service companies. Absent new technological innovation fostered by the oil majors, expect consumers and entrepreneurs to conserve and innovate - especially around conservation.

Certainly, electrical utility CEOs from Cinergy and Duke would not make greenhouse gas emissions from hydrocarbons an important part of their strategy if they did not see coal as a growing part of their future. This is a signal for significant innovation in coal-related technologies.

Hydrogen fuel cells are the subject of a great deal of media attention at the moment. However, hydrogen is currently a secondary source of energy - meaning that its production is predicated on the use of other energy carriers. In other words, like electrical power plants, hydrogen requires a primary source to initially produce this energy (from oil, natural gas, or coal).

In this process, greenhouse gas is created and fossil fuels are still used. Moreover, given that automobiles have life cycles of more than 10 years (and growing) and that hydrogen delivery requires a new infrastructure with its own technical challenges, market penetration for fuel-cell vehicles will take a long time to achieve. However, storage of energy in a large, transportable medium, such as silicon, for unlimited periods of time would help bridge the gap.

It is also likely that a certain amount of innovation is occurring “off the radar screen” in smaller entrepreneurial companies and in countries that are most likely to be affected by energy price run-ups.

China and India have robust economies and large well-educated population bases. It should not be surprising if some of the next great technological leaps in energy consumption and conservation come from the East - not the West. OGFJ

The authors

Chris Bakewell is a principal in CRA International’s intellectual property practice (formerly InteCap, a subsidiary of Charles River Associates). He assists clients with the valuation and strategic management of intellectual property and has more than 13 years of experience as a management consultant and hands-on manager in the energy industry. Bakewell has an MBA from the University of Maryland at College Park.

Chris Horsley is a consulting associate in CRA International’s intellectual property practice. He focuses on intellectual property issues, with experience in the oil and gas industry. Horsley, a CPA, holds an MS degree in finance from the University of Houston and an MPA in accounting from the University of Texas at Austin.

Ashley Futerfas, an associate in CRA International’s intellectual property practice, also contributed to this article.