Study shows exploration, reserve replacement are down worldwide

Mikaila Adams, Associate Editor, OGFJ

Edinburgh-based Wood Mackenzie has conducted a “health check” of the international exploration business, and the author of the study recently visited Houston, the center of the global energy industry, to report the results.

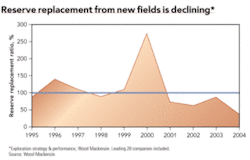

Andrew Latham, vice president of upstream consulting for the research-oriented UK consultancy, said that Wood Mackenzie’s study of 28 leading oil companies active in international exploration shows that companies are no longer replacing petroleum reserves through new field discoveries. This does not bode well for worldwide energy supplies at a time when demand is growing significantly, he said.

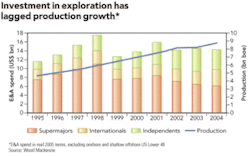

Latham noted that companies have reduced their exploration budgets due to growing technical risks and uncertain prices. However, as prices for oil and natural gas have increased dramatically in the past year, companies have not yet ramped up their exploration activities in response.

“The study group cumulatively created over $100 billion in value through their exploration activities over the last 10 years,” said Latham. “Oil companies, encouraged by this positive return on exploration expenditures, should increase their investment and improve their chances for reserve replacement. Otherwise these companies, which represent more than 30 percent of total world oil supply, face not replacing their production with new fields. This could, over time, lead to an increased dependence on OPEC supplies and place upward pressure on energy prices.”

While higher energy prices have seen increased exploration profit margins in recent years, inflationary pressures, increased competition for exploration areas, and capacity constraints are continuing to drive up finding costs for new reserves, which have risen 50 percent in the last 10 years. This upward trend is expected to accelerate sharply, said Latham.

The Wood Mackenzie report, “Exploration Strategy and Performance,” finds that only the top performers among the companies studied have been able to replace reserves while still creating value through exploration.

“Not only is exploration more expensive now, but it has become more difficult to achieve success, as the more accessible fields have been discovered,” said Latham. “While the industry has not discovered any world-scale new plays since 2000 - equivalent to deepwater Angola, deepwater Gulf of Mexico, the Pre-Caspian basin in Kazakhstan, and the giant gas fields in Australia - companies have been very successful in creating value.”

The study defines “value creation” as the achievement of over 10 percent full-cycle returns and limits its analysis to the 28 largest companies (most OPEC countries are excluded) conducting new field exploration.

Attractive contract terms, well-developed infrastructure, and new “pro-domestic” drilling government policies are making North America, and the deepwater Gulf of Mexico in particular, one of the world’s exploration hot spots, along with Angola, Brazil, and Nigeria. In fact, according to Latham, “North America is the only area growing...others are flat or declining.”

Although the supermajors remain the industry’s top spenders with high exploration success, their share of industry exploration investment peaked in 1998, and now sits at two-thirds of this level, leading to a 50-percent decline in overall reserves replacement.

Unlike a similar study done two years ago, improved margins meant all companies created value through exploration. Some, however, have achieved considerably more success than the others, including top performers BP, Petrobras, Apache, and Chevron.

Supermajor BP led the pack in value creation, according to the Wood Mackenzie report. Its performance was driven by a long-established strategy and by focusing exploration in key areas - especially deepwater Gulf of Mexico and deepwater Angola.

Petrobras’ success owes much to its preferential access to world-class opportunities in Brazil, investing more heavily in exploration than most of its national oil company peers, and driving greater value creation, despite average returns on investment.

In the independent category, Apache’s distinctive strategy of exploration closely integrated with its acquisitions and business development activity has helped the Houston-based oil and gas company excel in countries such as Egypt and Australia.

Chevron has turned around considerably, said Latham. Since the ChevronTexaco merger, the company has moved from a relatively mediocre performance in the late 1990s to top class value creation.

In terms of overall performance, most companies want new field exploration investment to fulfill the sometimes-conflicting objectives of delivering attractive returns and contributing substantially to reserve replacement. The study categorizes company overall performance in four categories - hunters, gatherers, grazers, and foragers.

Just 25 percent of the study group was categorized as hunters - those who have fully replaced production through new field exploration without compromising returns. Approximately half were considered to be foragers, achieving neither high returns nor full reserve replacement.

Although these trends help predict the outlook for exploration over the next several years, there are many factors that can change the equation, including new exploration acreage or opportunities in previously closed areas, emergence of new technologies, discovery of new plays and petroleum systems, and increased divergence in company growth strategies. OGFJ

S&P affirms corporate credit rating for Hilcorp, outlook is now negativeStandard & Poor’s Ratings Services has affirmed its “BB” corporate credit rating for Hilcorp Energy Co. and has revised its outlook on the company from stable to negative. At the same time, S&P assigned a “B” rating to Hilcorp’s $175 million senior unsecured notes.

The rating action partially reflects Hilcorp’s recent acquisition of oil and gas producing properties in the Rocky Mountain region, according to S&P, which added that the private E&P company had $275 million in balance sheet debt as of June 30.

“The transaction is a departure for the company, both in terms of geography and cost,” said S&P credit analyst Ben Tsocanos. Until now, the company has focused operations entirely in the Texas and Louisiana Gulf Coast region.

“The purchase price increases debt leverage, which was high compared with peers in the rating category prior to the acquisition, at a time when loss of production due to hurricane damage in the company’s core regions may hamper the ability to repay debt quickly,” said Tsocanos.

Houston-based Hilcorp is a privately-held limited partnership engaged in the acquisition, development, and production of crude oil and natural gas from onshore Texas and South Louisiana properties, and now in the Rockies. OGFJ