OGJ Newsletter

Market Movement

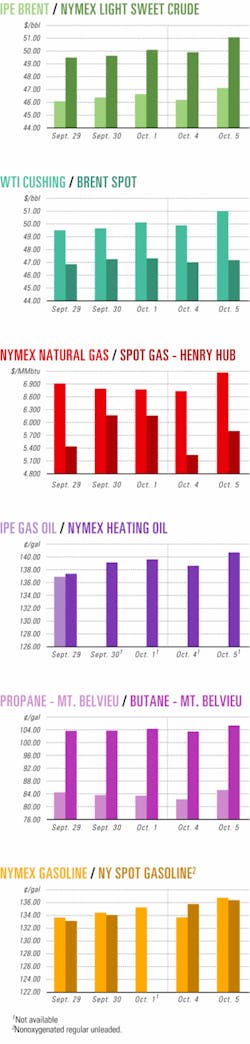

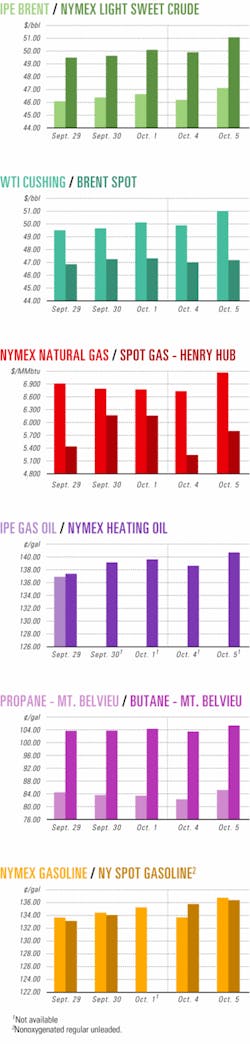

Crude futures price ratchets through record highs

After bumping above $50/bbl in intraday trades earlier in the week, the near-month benchmark crude contract closed above $50/bbl Oct. 1, at $50.12/bbl, for the first time in the 21 years that crude futures have been trading on the New York Mercantile Exchange.

By Oct. 5, the November crude contract had jumped to a new high closing of $51.09/bbl, then set another record closing of $52.02/bbl Oct. 6 after touching an all-time high of $52.15/bbl in that session.

Still, said Paul Horsnell, Barclays Capital Inc., London, "There is no more of a suggestion now than there was at $40[/bbl] that a cap on prices is yet in place. So far, there has not yet been anything substantial enough in either fundamentals or the flow of news that could create a firebreak for the move up. Indeed, the revelation that $50 oil is perhaps not after all the shatterer of worlds simply creates more headroom and a greater level of comfort."

Hurricane Ivan drives price

Horsnell said the recent escalation of energy futures prices is primarily the result of damage to offshore oil and natural gas production in the Gulf of Mexico by Hurricane Ivan, which went ashore in Alabama on Sept. 16.

On Oct. 6, the US Minerals Management Service said 478,126 b/d of oil and 1.8 bcfd of natural gas production in the gulf were still shut in. That's equivalent to 28.1% of daily oil production and 14.6% of daily gas production from the US sector of the gulf.

Cumulative production lost to the storm during Sept. 11-Oct. 6 totaled 16.1 million bbl of oil and 70.5 bcf of natural gas.

Some industry experts now say it could take 3 months to get Gulf of Mexico production back up to prehurricane levels. "Ivan brought US crude oil production down to a 54-year low in September, and we are beginning to wonder how bad the October number is likely to be. Indeed, we are even beginning to look a little anxiously at the prospects for the November number," said Horsnell.

Because of Ivan's impact on US oil and gas production, Banc of America Securities LLC, New York, on Oct. 4 raised its fourth quarter spot market price forecasts to $46/bbl for West Texas Intermediate, from $39/bbl previously; and to $5.65/Mcf for natural gas, from $5.50/Mcf earlier. It also increased its 2005 price projections to $38/bbl for WTI, from $35/bbl; and to $6.15/Mcf for gas, from $6/Mcf.

"We believe the cumulative crude oil production that will end up being shut in or 'lost' as a result of the damage caused by Ivan (reserves are not lost, but the shut-in production is pushed out to the end of the life of the field or reservoir) will equate to 7-10% of current total US crude oil inventories," said Robert S. Morris, Banc of America analyst.

Friedman, Billings, Ramsey & Co. Inc., Arlington, Va., raised its average spot market price forecast for West Texas Intermediate for 2004 to $41/bbl from $38/bbl and to $39/bbl from $30/bbl for 2005, citing the "combination of strong demand, limited spare production capacity, and a weak dollar."

The US Energy Information Administration on Oct. 6 reported US commercial crude inventories increased by 1.1 million bbl to 274 million bbl in the week ended Oct. 1.

Gasoline stocks rose by 600,000 bbl to 199.4 million bbl in the same period, but distillate fuel plummeted by 2.1 million bbl to 123.4 million bbl. "The culprit is, as before, Ivan and the reduction in refinery runs just as the seasonal heating oil inventory build should have been being rounded off," said Horsnell.

Natural gas prices up

Lost gulf production also pushed up natural gas futures prices, with the November contract closing at $7.16/Mcf Oct. 5 on NYMEX after trading as high as $7.23/Mcf in that session. But it fell back to $7.05/Mcf in profit-taking the next day. "US natural gas prices rose faster than prices for any other commodity over the past week," Horsnell said in an Oct. 6 report.

"Even with the impact of Hurricane Ivan, [US] natural gas storage should still exceed 3.2 tcf heading into this winter," said Morris. "However, even with this record high beginning-of-November storage level, North American natural gas supply and demand should still be just shy of being in balance looking ahead to 2005."

Moreover, he said, "Ivan has also heightened concerns regarding the ability of refiners to replenish heating oil inventories leading up to winter, which could provide added momentum to natural gas prices if a colder-than-normal winter ensues."

Industry Scoreboard

null

null

null

Industry Trends

GULF OF MEXICO (GOM) operators report that channel sands have emerged as a focal point in the deepwater play.

Along with this conclusion, an annual study of GOM deepwater performance by IHS Energy, Houston, showed that natural gas has dominated recent discoveries. The study, conducted with PetroSolutions, Houston, examined production data through November 2003 from 72 fields in more than 1,000 ft of water.

"We were surprised at the increased emphasis on channel gas reservoirs when all of the production performance measures clearly point to sheet sands as the target of choice," said PetroSolutions Pres. Tom Harris.

Harris speculated that the emphasis on channel gas reservoirs might be a function of seismic visibility along with robust gas prices and technology. The deepwater GOM continues to present more active fields than any deepwater arena worldwide, with a growing resource and production base, Harris said. Moreover, the industry has witnessed an eightfold increase in maximum flow rates during the last 20 years and an eightfold increase in monthly production volumes during the last 10 years.

In all, 550 completions for 467 wells were evaluated to derive the study's conclusions, including:

Of the fields studied, 67 are active. The number of active producing wells in these fields ranges from 1 to 41. The median field size is 3 active wells.

Flow rates per completion for sheet sands average 11,000 b/d of oil; channel sands average 6,000 bo/d, and channel levee sands average 4,000 bo/d.

One oil well has produced almost 50 million bbl of oil. Five gas wells have produced more than 100 bcf each, with rates exceeding 200 MMcfd.

Deepwater oil reservoirs initially are undersaturated. Three primary drive mechanisms have been recognized: fluid expansion, aquifer influx, and formation compressibility.

Based on geocellular modeling and petrophysical simulation for three fields, there appear to be areas of unswept oil in channel complexes and downdip oil column potential in several channel sands.

WORLDWIDE drilling rig utilization and day rates are expected to improve for offshore drilling contractors next year.

A credit ratings agency said robust offshore drilling activity is continuing in the Middle East and Southeast Asia, while a drilling recovery is accelerating in the Gulf of Mexico.

Standard & Poor's Rating Services analyst Brian Janiak said that elevated commodity prices along with increased exploration and production spending are spurring demand for all rig types.

"The current upturn in rates could be very favorable for credit quality for participants in the offshore drilling industry during the remainder of 2004 and into 2005," Janiak said during an S&P oil and gas conference in Houston Sept. 28.

"Globally, economic conditions and market fundamentals bode well for offshore drillers across the board." He noted, however, that activity in 2005 might not reach the cyclical peaks of 1997 and 2001.The North Sea region is lagging behind the recovery in other regions, and several North Sea rigs have been idled, Janiak said. In addition, concerns linger about labor issues in Norway.

Government Developments

IN NIGERIA, a cease-fire agreement and negotiations between government and rebel forces continued as of presstime last week. There was no indication of government action to halt the threat of a nationwide strike slated for Oct. 14.

Nigeria's primary union association threatened to strike if the government does not rescind the most recent 20%-plus hike in retail fuel prices. That same issue led to general strikes last year and in June.

On Oct. 1, Nigerian President Olusegun Obasanjo said the leader of the rebel Niger Delta People's Volunteer Force had agreed to cease hostilities. That was the date previously set by the rebel group for its "Operation Locust Feast" attack on foreign oil workers and oil infrastructure in the Niger Delta. No fighting was reported while talks continued.

Meanwhile, Royal Dutch/Shell Group reported it had not resumed full operations in the oil-rich Niger Delta (OGJ Online, Oct.1, 2004). Shell earlier shut in production of 30,000 b/d of oil and 27 MMcfd of natural gas and withdrew 300 workers from the delta because of fighting between government and rebel forces. Nigeria is the fifth largest exporter of crude. In March 2003, a large uprising in the delta caused a temporary shut-in of 40% of nationwide production, or 1 million b/d.

TRINIDAD AND TOBAGO government officials are talking with their counterparts from Algeria and Indonesia regarding construction of a regasification terminal in the US.

Trinidad and Tobago, already an important exporter of natural gas, is committed to making investments across the LNG value chain, said Trinidad and Tobago's Prime Minister Patrick Manning.

"We will invest in an LNG [regasification] terminal in the US, we will invest in shipping, and we will also invest in the marketing aspect of LNG," he said of the twin-island nation, the No. 1 supplier of LNG to the US. Earlier this year, Trinidad and Tobago signed a memorandum of understanding with McMoRan Exploration Co. subsidiary Freeport-McMoRan Energy LLC, New Orleans, for development of the company's proposed deepwater LNG terminal off Louisiana (OGJ, July 19, 2004, p. 21).

But now, Manning suggested, it's more likely that Trinidad and Tobago's investment in the US will be done in conjunction with Algeria, Indonesia, or both nations.

VENEZUELA AND ARGENTINA agreed to form an energy alliance called Petrosur.

Argentine President Nestor Kirchner and Venezuelan President Hugo Chávez announced the agreement at the end of a meeting of the South American common market, Mercosur.

The agreement calls for a strategic alliance between state-owned Petroleos de Venezuela SA (PDVSA) and Argentina's new state energy company, Enarsa.

PDVSA Pres. Alí Rodríguez Araque told the Venezuelan media that Petrosur would be part of his company but would be operated separately to form alliances with other state energy companies in Latin America.

Chávez has long proposed a regional organization of oil and gas producers, originally called PetroAmerica (OGJ Online, July 14, 2004). Among hurdles to development of a Latin American energy alliance is reluctance of Brazil's state-owned Petroleo Brasileiro SA to join.

Quick Takes

BRAZIL'S STATE-OWNED OIL COMPANY Petroleo Brasileiro SA (Petrobras) reported an onshore discovery of 42º gravity oil in the Recôncavo Baiano basin on BT-REC (Block) 11 in Bahia state. Exploratory well 1-SRC-2D-BA in Esplanada indicates recoverable volumes of 4.6 million bbl. The find, part of the Formação Água Grande reservoir, cut 27 m of oil-saturated sandstone at 800 m. The well was drilled at an angle from the same entry point as an earlier dry hole. Petrobras officials said they expect to determine commerciality of the discovery within 2 weeks. A partner in the block is Brazilian independent Starfish Oil & Gas Co. Light oil also was discovered offshore last year in the Espírito Santo basin (OGJ Online, June 6, 2003). These discoveries could decrease the amount of light oil Brazil must import to blend with its heavy oil for local refining.

Petrobras also has discovered 13° gravity oil on Block 21 in the onshore portion of the Espírito Santo basin with its directionally drilled well 3-CCS-2D-ES (Córrego Cedro Sul) in the municipality of São Matheus. Preliminary estimates point to 50 million bbl of recoverable oil. The discovery occurred in the São Mateus and Mucuri formations, where 62 m of oil-bearing sandstone were found at 560 m. A treatment plant and terminal, which are nearly complete at Campo de Fazenda Alegre in the same basin, will make it easier to develop the new deposit should it be declared commercially viable.

Petrobras Energia SA, Petrobras's Argentine unit, found a natural gas and oil field in southern Argentina's Santa Cruz province. The discovery, on the El Martillo-El Campamento block, is in the Santa Cruz I area where Petrobras is exploring for oil with Compania General de Combustibles. The Puesto Oliverio X-1001 exploratory well, 180 km northwest of Rio Gallegos, tested 60,000 cu m/day of natural gas and recovered 50 cu m of light oil from 2,971-77 m. Exploration plans include two additional wells this year and two in 2005. Petrobas intends to invest $1.4 billion in Argentina during 2004-07, hoping to produce 340,000 b/d of oil by 2007.

El Paso Oil & Gas in Brazil has declared commercial Lagosta natural gas field on BS-1 block in the Santos basin off São Paulo state. El Paso declined to estimate reserves but said production might range from 500,000 cu m/day to 1 million cu m/day. Operator El Paso has a 60% stake in the block, and Petrobras holds 40%. According to the development plan for this field, to be submitted to the National Petroleum Agency in March 2005, Petrobras will deliver production to a pipeline at nearby Merluza gas field. Total SA subsidiary Elf Petroleum Nigeria Ltd. has extended western Usan field in Oil Prospecting License 222 off southeastern Nigeria. The Usan 5 well, 110 km off Nigeria, is in 750 km of water, 6 km west of the Usan 4 discovery well. Usan 5 is the fourth successful appraisal for the field (OGJ Online, June 10, 2002). "Oil was sampled at Usan 5 in several levels, confirming the presence of additional quantities of oil as well as further potential in previously untested reservoirs," Total said. OPL 222 concessionaire is Nigerian National Petroleum Corp. under a production-sharing contract operated by Elf Petroleum Nigeria, which holds 20% interest. The partnership of Thailand's PTT Exploration & Production PLC and Malaysia's state oil firm Petronas has secured an additional production-sharing contract for newly defined Block B-17-01 on the natural gas-rich Thai-Malay cotinental shelf in the South China Sea. The PSC calls for the 50:50 joint partners to spend at least $6 million in the first 5 years on geological and geophysical studies, seismic surveys, and the drilling of at least two exploration wells on the 3,475 sq km tract. Block B-17-01 forms part of the area relinquished from Blocks A-18, B-17, and C-19—three blocks lying in a 7,250 sq km area in the Malaysia-Thailand Joint Development Area. The Malaysia-Thailand Joint Authority will give the partners first priority in negotiating for the new block.

CONOCOPHILLIPS subsidiary Polar Tankers Inc. reported that Polar Adventure, the fourth of five vessels in its double-hulled tanker fleet, has begun service. Classed by the American Bureau of Shipping as an Endeavour Class tanker, Polar Adventure is designed to carry crude oil from Alaska to the US West Coast and Hawaii (OGJ Online, Sept. 12, 2003). Northrop Grumman Ship Systems, Avondale, La., is building the tankers in Polar Tankers' double-hulled fleet, all employed in the Alaskan crude trade. A final Endeavour Class tanker, currently under construction at Avondale, is scheduled for delivery in 2005.

BHP BILLITON LTD., Melbourne, plans to buy depleted Tubridgi field in Western Australia for $7.4 million from Origin Energy Ltd. and Pan Pacific Petroleum NL, both of Sydney. BHP intends to use the field for underground storage and wants the field's pipeline for access to gas markets. Terms call for Origin to receive $4.2 million for its 57% interest and Pan Pacific to receive $3.2 million for its 43% interest. The field, in Carnarvon basin, went on stream in 1991, feeding into the main Dampier-to-Bunbury gas trunkline. The field was shut in during the first half of 2004.

THE UK DEPARTMENT OF TRADE AND INDUSTRY approved a development plan for Gadwall oil field on Block 21/19 in the Greater Kittiwake Area. First oil is expected by February 2005. GKA is in the central North Sea surrounding the Kittiwake production platform, in which Dana Petroleum PLC and Venture Production PLC, both of Aberdeen, have a 50% interest each. Venture operates Gadwall, which is expected to produce 6.6 million bbl of oil and 4.4 bcf of natural gas during 10 years. Gadwall will be developed with a production well and injector well completed subsea and tied back to the Kittiwake platform. The Gadwall discovery well was drilled in 1996 and suspended. Completion of that well is expected in the fourth quarter. Petrobras plans to invest $6 billion on development in Espírito Santo state through 2010 to double its 1.2 billion bbl of oil reserves and triple its 25 billion cu m of natural gas reserves there by 2009. It expects 50% of the new reserves in the Espírito Santo basin to be light crude. Espírito Santo state currently produces 40,000 b/d of oil and 1.4 million cu m/day of gas. The first hike in output is expected in 2006, after the start of commercial operations from the P-34 floating production, storage, and offloading vessel on Jubarte heavy oil field and the start of commercial operations at recently discovered Golfinho off Espírito Santo, which has 28º-34º gravity oil. Unocal Thailand Ltd. has confirmed the commercial viability of South Gomin natural gas field on Block 13 in the Gulf of Thailand, following recent delineation drilling. Three wells drilled this year in the 319 sq km area encountered 195, 183, and 95 ft, respectively, of net gas pay. South Gomin field was discovered in 1998 when the South Gomin-1 well cut 269 ft of net gas-condensate pay. Unocal began follow-up drilling when Thailand's gas demand increased this year. Unocal, which has a 71.25% working interest in the field, said it would put South Gomin field on stream in late 2006.

EASTERN GAS PIPELINE CO. LTD. said construction plans are proceeding for the $700 million Intra Caribbean natural gas pipeline from Trinidad and Tobago to eastern Caribbean islands Barbados, Dominica, Grenada, Guadeloupe, Martinique, St. Lucia, and St. Vincent (OGJ Online, Sept. 29, 2003). A study has confirmed the project's feasibility. Plans have been presented to the Trinidad and Tobago and island governments and to potential customers for approval. EOG Resources Inc., Houston, has offered to provide more than 100 MMcfd of required gas. The pipeline is expected to begin deliveries in 2007. An extension north as far as Miami could be built later, sponsors say, with Venezuela as a cosponsor. Virtually all capacity in the Norwegian natural gas pipeline to continental Europe has been sold for the business year that begins Oct. 1, said officials at Gassco AS, the Norwegian gas transport operator. "We have a little space to spare in the pipelines to Germany, but everything else has been filled," said Jacob Fagerheim, a manager at the state-owned company. Gassco expects Norway to set an export record for the 2003 gas year that ends Sept. 30. Sales are expected to total 75 billion standard cu m (bscm), up 4 bscm from the previous year. January exports hit a record 7.5 bscm.

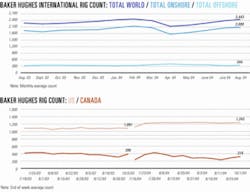

US DRILLING continued to increase, up by 4 units to 1,243 rotary rigs working the week ended Oct. 1, compared with 1,091 a year ago, Baker Hughes Inc. said. Offshore operations accounted for the increase, up by 11 rigs to 98 in US waters overall, including a gain of 10 to 93 in the Gulf of Mexico. Land drilling dropped by 7 rigs to 1,127 still working, while units in inland waters were unchanged at 18. Canada's rig count increased by 24 to 315, down from 396 a year ago.

BHP Billiton Petroleum (Americas) Inc., part of the Melbourne conglomerate, awarded a 2-year drilling contract valued at $157 million to GlobalSantaFe Corp.'s newbuild ultradeepwater semisubmersible, Development Driller I, for work in the Gulf of Mexico. The multiwell exploration and development program is expected to commence in April 2005. The rig is optimized for development drilling and subsea completion projects. Its design includes 18,000 sq ft of usable deck space and more than 7,000 tonnes of variable deck load. The rig's dynamic positioning and self-contained mooring systems can be supplemented with as many as eight additional mooring lines for increased flexibility in varying conditions. Two semisubmersible rigs—the Jack Bates and the Ocean Patriot—have arrived off Victoria to begin multiwell drilling campaigns. They join the Ensco-102 jack up, which is drilling development wells on Sydney-based Origin Energy Ltd.'s Yolla gas field on Production License T/L1 in the Bass basin off Tasmania. The Ensco rig will next move to drill the Trefoil-1 wildcat well in the same permit area about 40 km from Yolla field. The Jack Bates, previously in Norway, will spud its first well, Callister-1, on PL Vic/P51 in the Otway basin off Victoria for Santos Ltd. in early October. The rig will then move to adjacent deepwater PL Vic/P52 for Santos to drill its Amrit-1 wildcat in more than 1,000 m of water.

The Ocean Patriot arrived in Victoria's offshore Gippsland basin from New Zealand. Its first well, Moby-1 on PL Vic/P47 adjacent to theproucing Patricia-Baleen gas fields, will be spudded for Bass Strait Oil Co. Ltd., Melbourne. The rig then will drill the Bass Strait Oil Zane Grey-1 wildcat on PL Vic/P42, also in the Gippsland basin. Other wells in the semi's program include Perth-based Apache Energy Ltd.'s Longtom-1 in Gippsland basin PL Vic/P54 to appraise an existing gas find and probe deeper in the stratigraphic section for another potential gas sand. Ocean Patriot also will drill an appraisal well in Basker oil field for Anzon Energy Australia Ltd., Sydney, which acquired 100% interest in the permit, Vic/P19B, earlier this year. If the appraisal is successful, the rig will return to drill probably two development wells in 2005. Santos also will employ the Ocean Patriot when the rig is moved next year to the Otway basin to drill development wells in Casino gas field in PL Vic/P44.

DOMINION EXPLORATION & PRODUCTION INC. plans to restart production from Devils Tower field in the Gulf of Mexico between late October and mid-November. The deepwater spar is on Mississippi Canyon Block 773, about 40 miles southeast of New Orleans. Production from three wells was interrupted Sept. 5 by Hurricane Ivan. A fourth well near completion will begin production at the same time. Dominion, with 75% interest, operates Devils Tower, and Pioneer Natural Resources Co. holds 25%. A new completion rig to bring the spar's four remaining wells into production is to be available in 90-120 days. Tradestar Corp., Hot Springs, Ark., signed a letter of intent with United Production & Exploration, Houston, to acquire, drill, and develop 2,500 acres in the Barnett Shale area of north-central Texas. Tradestar CEO Tom Feimster said the companies plan to reenter two existing wells vertically and one existing well horizontally. Total daily production from these three wells is expected to reach 6 MMcfd of gas, said Feimster. He did not give an anticipated production timetable. Oil & Gas Development Co. Ltd. (OGDCL), Islamabad, reported that Chanda field, which began production July 17 in northern Pakistan, is expected to produce 10 MMscfd of gas and 2,000 b/d of oil (OGJ, Mar. 10, 2003, p. 45). Production gradually will be increased to 13-15 MMscfd of gas and 3,000 b/d of oil, OGDCL said. The company also plans to install a sulfur recovery unit at its Dakhni plant to boost its gas processing capacity to 40 MMscfd from the current 20 MMscfd.

A JOINT VENTURE of Suncor Energy Inc., Enbridge Inc., and EHN Wind Power Canada Inc.—a unit of Corporacion Energia Hidroeléctrica de Navarra SA of Spain—has submitted to the Ontario government a proposal to build a 75 Mw wind-power project near Ripley, Ont. The JV would install wind turbines east of Lake Huron in Huron-Kinloss Township and connect them to the provincial power grid. The JV submitted the proposal in response to Ontario's request for projects to help the province reach its goal of producing 5% of Ontario's electric power from renewable sources by 2007.