OGJ Top 10 Independents No. 8: FieldPoint Petroleum plans to grow through acquisition spree

FieldPoint Petroleum Corp. is taking great strides to spark tenfold growth in the small exploration and production firm over the next 36-48 months through acquisitions.

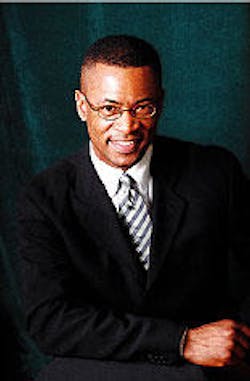

Ray D. Reaves, chairman and CEO of the Cedar Park, Tex.-based independent said that, over that time frame, the company will purchase $50-60 million in assets. Its assets currently are valued at $5 million.

"What's more important than the deals we've done are the deals that we haven't done," Reaves said.

Increasing production remains one of the industry's biggest challenges, Reaves contends.

Goals, focus

"FieldPoint's goal is to be a low-cost producer and to continue to replace its production at favorable pricing to ensure profitability," Reaves stated. "We have never lost sight of our original operating philosophy, which is to be a profitable oil and gas company that's conservatively managed with a specific strategy of acquiring pro ducing oil and gas properties offering further development potential."

FieldPoint is currently operating in Oklahoma, Texas, and Wyoming to maintain its strong focus on the Midcontinent and Rocky Mountains, where the company says it has had "tremendous" successes. FieldPoint's last acquisition in the Midcontinent region, for which it paid $1.35 million, will likely have a 32-month payout. Operations in the Rockies, meanwhile-where FieldPoint purchased 1,900 acres in Wyoming for $190,000-have paid out over 650% since 1996, Reaves noted.

FieldPoint's currently produces 68% oil and 32% natural gas. FieldPoint's main strategy is to acquire low-risk producing oil and gas properties offering further development potential via recompletions or new drilling.

The company plans to pursue an active drilling program starting in 24 months, Reaves said.

"FieldPoint understands the cyclical nature of the business," Reaves said, adding, "while most others grow at all cost."

Oil, gas prices

"We believe oil prices will be in an $18-23/bbl range for the next 12-18 months and gas prices to be in the $1.75-3.00/Mcf range for that time frame," Reaves said.

Reaves expects the recent dip in oil prices to last a while. When asked if he was concerned about a sustained period of low oil prices, Reaves said that sometimes "the trend is your friend."

Operating in a low oil price environment, however, will be challenging, Reaves contends.

"It will be very trying for large and small oil and gas companies that overpaid for their reserves," he noted.

FieldPoint Petroleum Corp.

Chairman and CEO Ray D. Reaves"We have never lost sight of our original operating philosophy, which is to be a profitable oil and gas producing company that's conservatively managed with a specific strategy of acquiring producing oil and gas properties offering further development potential."