OGJ Newsletter

Market Movement

Natural gas price furor likely to persist in 2001

The furor over high US natural gas prices won't die even after futures prices have fallen back from their current near-$10/ MMbtu highs.

If there is anything resembling a consensus gas price forecast for 2001, it has left $3-4/MMbtu well behind and has moved toward $5-6/ MMbtu. That alone would en- sure gas consumers' hackles will stayed raised over high prices throughout the year and probably into 2002.

Here's just a sample of price forecasts from some analysts:

- Salomon Smith Barney hiked its 2001 composite spot gas price forecast to $5/MMbtu from $4.25/MMbtu, citing natural gas storage levels that are at record low levels for this time of year and temperatures that are averaging 32% lower than a year ago and 25% colder than the 10-year average: "Although the curent weather outlook for January calls for normal to slightly above normal temperatures across the country, we believe that our $5/MMbtu forecast could still prove conservative."

- Energy Security Analysis Inc., Cambridge, Mass., noting that 2001 already shapes up as a year with a very cold winter, estimated an average gas price for the year of $5.33/Mcf: "If the summer of 2001 is a very hot one, this forecast will be too low."

- Raymond James & Associates Inc. (RJA) jumped its 2001 natural gas price forecast to $5.75/Mcf from $4.50/Mcf: "Even though this revised forecast is well above [Wall] Street consensus, we are convinced that there is a substantial likelihood that even this aggressive forecast will prove to be too low."

Supply crisis

Why are analysts hedging their bets against gas prices spiraling even higher than an already aggressive forecast?

Simply put, the stage has been set for a natural gas supply crisis and therefore a price spike of unprecedented magnitude this winter. It is impossible to determine the magnitude of that price spike at this point, because it is impossible to gauge now the degree to which high prices will crimp short-term demand.

Before the winter heating season started, RJA developed a model based on the following assumptions:

- Normalized winter gas demand would be up by over 9 bcfd.

- Industrialized gas consumption would be down by 1 bcfd.

- Fuel switching would trim another 1.5 bcfd from demand.

- A surge in US gas drilling would swell supply by 1 bcfd.

- US imports of LNG and Canadian gas would be up by 500 MMcfd.

Based on these assumptions, RJA reckons that gas storage levels at the end of the winter heating season "should fall well below anything we have seen in recent history."

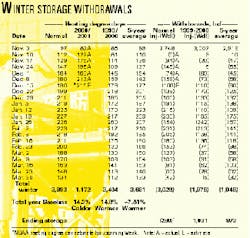

What that means is that a return to normal winter weather for the balance of the heating season suggests that gas storage will reach an infeasible-280 bcf at the end of the season (see table), RJA noted: "Keep in mind that we have never really tested the gas storage system below 600 bcf. This means that gas prices must continue to rise sufficiently through the second half of the winter to discourage between 5 and 10 bcfd in the final 90 days of winter."

Price-driven rationing

In other words, said RJA, "The US will likely see some form of price-driven rationing of natural gas in the second half of this winter."

And what price would drive rationing to the point of eliminating 5-10 bcfd of demand?

As RJA said, "Since this is completely uncharted territory, we have absolutely no idea how gas prices must go. What we do know is that gas prices between $5 and $9 [this forecast was made before gas futures prices approached $10/Mcf at the end of December] have failed to significantly slow down gas demand."

Consequently, the analyst predicts an average gas price of at least $8/Mcf in the first quarter before moderating for the rest of the year.

null

null

null

Industry Trends

DRILLERS' PROFITS ARE EXPECTED TO INCREASE APPRECIABLY IN 2001-02 DUE TO A TIGHT RIG MARKET.

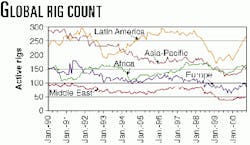

In November, the Baker Hughes international rig count of 700 was up 22% from November 1999, with gains about even be-tween land and marine rigs and 125 more units working (see chart).

And in December, the Baker Hughes US rig count increased by 19 to 1,107 working rigs-the highest level in almost a decade-as land drilling activity continues to in- crease at a rapid pace. The US land rig count stands at 940 rigs, the highest level since January 1991.

The price of natural gas, along with a relatively flat production rate, has created an unparalleled demand for rigs, resulting in these dramatic increases, according to Dain Rauscher Wessels. Some operators reportedly have waited 6-40 weeks for a rig, and day rates are soaring, increasing by as much as $2,000 for con- tracts starting in January 2001.

A glimmer of optimism for operators, however, is that about 26% of the Gulf of Mexico jack up fleet may become available for new contracts in January-February. This seasonal availability may give operators some negotiating leeway.

The Gulf of Mexico continues to lead offshore drilling recovery in the near term, according to MMS data. By mid-December 2000, operators had already filed plans for 582 GOM drill- ing operations, 20% more than in 1999. The coming 2 years look to be equally active.

In addition, the Global Marine Summary of Current Offshore Rig Economics (SCORE), evaluating the economic viability of speculative construction of new offshore drilling rigs, is also up 50% over 1999, as December exploration and production budgets indicate an increase of 19-22% in capital spending being dedicated for E&P this year vs. 2000 (see p. 20).

US GAS CONSUMPTION WILL HIT 22.8 TCF IN 2001, UP 3.4% FROM 2000, ACCORDING TO IPAA.

Predicted production, however, will increase only 1.5%, to 19.01 tcf, during the same period. US operators are seeking to produce more gas more quickly, but to do so, "producers need to find yet more drilling rigs and competent personnel to operate those rigs," IPAA said. Meanwhile, the US must import more than 4 tcf of gas this year, up 8.6% from last year.

The industry's recovery from the 1998-99 depression will be "a long haul back," IPAA said. Producers will be hard-pressed this summer to rebuild gas storage to 3 tcf by next November. As a result, IPAA predicts a tight gas market through this winter and into the summer.

Government Developments

IPAA has called for relaxation of restrictions on access to US federal lands, particularly in the Rocky Mountains, to help ease tight supply of natural gas.

"Current government policies seem to stifle energy production rather than encourage growth and recognize its importance," said Barry Russell, IPAA president. "In the Rocky Mountains, for example, federal policies are limiting development of about 137 tcf of natural gas through a mix of prohibitions and permitting limitations. We believe these policies really need to be restructured so that supply can meet demand."

IPAA's complaints echoed those from natural gas association representatives and several senators in a Dec. 12 hearing on high gas prices by the Senate energy committee.

Increasingly frustrated with what the IPAA terms a "mosaic" of different regulations enforced by federal, state, and local agencies, the association, together with other producing organizations, formed a task force to study land-access issues and suggest regulatory reform.

Pres. Clinton has ordered the US Coast Guard and DOE to take extra measures to keep US harbors free of ice so that ships and barges can bring in heating oil.

He also directed them to work with states to relieve bottlenecks on roads, rivers, and pipelines. A year ago, frozen harbors prevented barges from delivering heating oil to New England, causing home heating oil prices to soar.

Clinton ordered the Department of Transportation to inform state and local governments and private companies how to get their fuel truck drivers waivers from hours-of-service rules.

And he approved the release of $300 million in federal funds to help low-income families buy fuel for heating.

In his Dec. 30, 2000, radio address, Clinton noted that weather forecasters said November and December were among the coldest on record.

"All this, along with the increased demand for energy that has accompanied unparalleled economic growth, is putting enormous pressure on the energy supplies Americans need to heat their homes and businesses."

Venezuela gets A new oil minister.

Veteran oil expert and attorney Alvaro Silva Calderon took the oath of office last month as Venezuela's new minister of energy and mines, replacing Al

Venezuelan Pres. Hugo Chávez said his choice of Silva Calderon demonstrates a continuation of his oil strategy aimed at strengthening OPEC and defending oil prices.

Prior to his appointment, Silva Calderon served as deputy minister responsible for the mines portfolio under Rodr

Silva Calderon told reporters he plans to continue the oil policy followed by his predecessor, "which has brought excellent results for the country thus far."

Quick Takes

Norsk Hydro has submitted development plans for fram west field.

Norsk Hydro's plans, submitted to the Norwegian Ministry of Petroleum and Energy, cover development and operation of the field located on Block 35/11 on PL 90 in the Norwegian North Sea.

The project will cost 4.2 billion kroner ($46 million). The field, which Norsk Hydro estimates contains 100 million bbl of oil and 3.5 bcf of gas, will come on stream in October 2003.

At plateau, Fram West will produce more than 60,000 b/d, said Norsk Hydro. According to the plan submitted last month, Norsk Hydro and its partners will develop Fram West with two subsea well templates, each with four well slots. Production will be transported to Troll C platform for processing. Oil will be transported to the Mongstad terminal on land, and gas will be reinjected for 6 years to boost production, then transported to the Kollsnes gas treatment facility.

In other development action, CNOOC elected to participate in the Phase I development of the Peng Lai 19-3 field on Block 11/05 in Bohai Bay, taking a 51% interest and reducing foreign partner Phillips China's share to 49%. The development is still subject to regulatory approval, expected in the first quarter (see map). Phillips approved expenditures for Phase I of the project in July (OGJ Online, July 24, 2000). The discovery well, Peng Lai 1, was spudded in May 1999. Phase I of Peng Lai 19-3 development will involve a wellhead platform and an FPSO vessel. First oil is expected in first quarter 2002. Phillips, which expects 35,000-40,000 b/d of oil from the field, is continuing feasibility planning and design for Phase II. It expects the second phase-to come on stream in 2005-to generate peak production of 120,000-150,000 b/d.

Petrobras CLAIMS an oil discovery at a record water depth in the Campos basin.

Petrobras flow-tested 3,000 b/d of oil from a wildcat off Espirito Santo state, the first oil discovery in more than 2,000 m of water in the Campos basin.

The 1-BRSA-18-ESS well is about 160 km from shore in 2,243 m of water. It was drilled to 5,510 m. Petrobras said that, in the course of drilling, three discrete oil reservoirs were identified, one of which was 27 m thick. Tests were made at 4,450-4,484 m, confirming the presence of 35° gravity oil.

PetroChina plans to add 1.06 billion cu m/year of natural gas production capacity in 2001.

That will raise its gas production to 19 billion cu m/year, which will account for about 70% of China's total.

The company's gas production will be further raised to 43.3 billion cu m by 2005. Part of that production increase will feed a pipeline scheduled for construction next year between Xinjiang in the west and Shanghai in the east.

PetroChina will intensify its gas exploration, aiming to prove 100 billion cu m of gas reserves next year. By 2005, the company plans to cut its gas exploration costs to 60-80¢/boe, its development costs to $1.10/boe, and its operating costs to $3.50/boe. F

In other production news, Texaco North Sea UK and Korea Captain Co. began production from the second phase (Area B) of their Captain field development on Block 13/22a in the UK North Sea. The $500 million expansion project, completed within 25 months, will bring production to 85,000 b/d from 60,000 b/d during 2001. Area B was developed subsea, using a single unitized 18-slot manifold connected via pipelines to a processing platform, which was bridge-linked to the existing Captain platform. The new platform consists of a 4,000-tonne jacket, a 5,500-tonne topsides, and a 75-m bridge.

Statoil awarded a $50 million kroner contract to Wood Group Production Technology to supply downhole monitoring for Statoil's Veslefrikk, Asgard, Sleipner, and Kvitebjorn fields in the North Sea. The 3-year contract, which includes two 2-year extensions, will operate from Wood Group Production Technology's Norwegian bases in Stavanger and Bergen, with additional support from Aberdeen.

Agip expects its Nigerian oil output will be 450,000 b/d within 3 years, making it the third largest producer there. Company Managing Director Claudio Descalzi said Agip raised its production to 200,000 b/d last year from 150,000 b/d in 1999 by bringing several oil fields on stream through new drilling and production technology. In addition to bringing Biseni and Nibe fields on flow, Descalzi said Agip had reopened the Idu flow station, which had been shut for several years, as well as increased production from Beniboye and Kwale fields. He said the company had launched a plan to comply with the government's program to eliminate gas flaring and began an independent power project to help reduce electricity blackouts in the country. Descalzi said other developments included the start of work at Abo field by Nigeria Agip Exploration, the award of deepwater Block 244, and the renewal of Agip's operating licenses for 20 years.

Siam Gulf Petrochemical plans to build a condensate splitter in Thailand.

The company, an affiliate of Rayong Purifier, will invest 700 million baht ($16.7 million) to build a condensate splitter in the Thai southern province of Phetchaburi.

Industrial Finance Corp. of Thailand approved 1 billion baht of credit-half for constructing the plant and half in the form of a letter of credit. The plant will have capacity to process 30,000 b/d of condensate produced from gas fields in the Gulf of Thailand, into 600,000 tonnes/year of naphtha and 350,000 tonnes/year of low-sulfur diesel oil and other hydrocarbon products, such as butane, waxes, and resid.

Pending government approval of the environmental impact study, construction of the plant, located about 200 km south of Bangkok, is scheduled to begin early next year, with commercial production slated for October, said Supapong Krishnakan, managing director of Siam Gulf Petrochemical.

Elsewhere on the refining front, China's Zhenhai Refining & Chemical plans to expand its refinery at Zhenhai in Zhejiang province. Zhenhai will build a 30,000 b/d hydrotreater and a 20,000 b/d delayed coker by 2005. Currently, Zhenhai operates a 64,000 b/d diesel and gasoline hydrotreater and a 26,000 b/d coker. The expansion follows the completion of a 160,000 b/d crude distillation unit and a 40,000 b/d catalytic unit at Zhenhai in July 1999. Zhenhai is a subsidiary of Sinopec. Separately, Sinopec's subsidiary Gaoqiao Petrochemical and Infineum Singapore Pte. plan a 50-50 JV to produce lubricants additives in Shanghai. Their Shanghai Hilube Additives Co. will build a 100 million yuan, 20,000 tonne/year plant. Infineum is a 50-50 JV established in January between Royal/Dutch Shell and ExxonMobil.

The US Department of Justice and EPA announced a settlement with Koch Petroleum Group that will reduce air emissions from three refineries in Minnesota and Texas. Under the deal filed last month in US District Court in Minneapolis, Koch will spend $80 million to install pollution-control equipment at two refineries in Corpus Christi, Tex. and one near St. Paul, Minn., reducing emissions from stacks, leaking valves, wastewater vents, and flares. Koch also will pay a $4.5 million penalty to settle Clean Air Act violations and other environmental claims at its Minnesota refinery. EPA said the agreement will cut nitrogen oxide and sulfur dioxide emissions from the three refineries by 5,200 tons/year through 2008, via the use of upgraded technologies.

Start-up of A west-east Thailand pipeline will remove a natural gas bottleneck from Myanmar's Gulf of Martaban.

Thailand has begun operation of the 154-km, 30-in., Ratchaburi-Wang Noi onshore pipeline that enables the Petroleum Authority of Thailand (PTT) to increase its reception of gas from Offshore Myanmar's Yadana and Yetagun fields to nearly 800 MMcfd (see photo).

About 280 MMcfd of the Myanmese gas is being delivered through the $247.9 million line to the 2,000-Mw Wang Noi combined-cycle complex, one of the country's largest power generators. The new line was linked from the Myanmar gas transmission system at the Thai border province of Kanchanaburi to Ratchaburi-a distance of 260 km.

Saipem Asia and Mitsui built the 300 MMcfd Ratchaburi-Wang Noi pipeline, which can be expanded to 500 MMcfd. About 500 MMcfd of Myanmese gas goes to the Thai government-owned Ratchaburi generating station and Tri Energy's 700-Mw combined cycle plant in the same province.

Over the past 2 years, PTT's offtake of Myanmese gas fell far below the contractual rates-525 MMcfd from Yadana and 200 MMcfd from Yetagun-due to the delay in the construction of the Ratchaburi power plant (with the ultimate capacity of 3,645 Mw).

PTT said its take of Myanmese gas will grow to 900 MMcfd in 2001 to feed the three power stations.

The increased takes will help PTT's negotiations with gas producers on changes to their long-term gas supply contracts. (OGJ Online, Aug 24, 2000).

In other pipeline news, Seven Seas Petroleum said it has signed a contract with Cosacol Ltda. to build the 36-mile La Dorada-Guaduas pipeline in Colombia. The line will connect Guaduas oil field in Colombia's Magdalena basin to existing export pipeline infrastructure. Robert A. Hefner III Seven Seas chairman and CEO said, "With the first shipment of pipe for the pipeline already in Colombia, and the construction contract in place, we remain on schedule to commence...production by mid-2001." Seven Seas is negotiating with Sipetrol and Cimarrona LLC, its partners in Guaduas oil field, regarding their participation in the pipeline and field development. Seven Seas said the partners have forfeited their right to participate in the line, which it plans to build alone. Sipetrol and Cimarrona disagree.

Mexico's Energy Regulatory Commission (CRE) has issued Sempra Energy International a permit for construction of the 135-mile Mexican segment of the North Baja pipeline project. Sempra Energy, Proxima Gas SA de CV, and PG&E are developing the $230 million, 215-mile Arizona-to-Mexico pipeline. In October, PG&E National Energy Group (NEG) filed an application with FERC to build the 80-mile US portion of the pipeline. The companies signed agreements for more than half of the pipeline's 500 MMcfd capacity, and discussions are continuing with other potential customers. The project will begin at an interconnection with El Paso Natural Gas near Ehrenberg, Ariz., and extend across southeastern California and northern Baja California, Mexico, terminating at an interconnection with an existing pipeline system. NEG will direct the permitting and development of the US leg of the pipeline, while Sempra Energy International will direct the permitting and development of the Mexican leg. The initial design calls for a 36-in. line for the first 12 miles, a 30-in. line for the rest, and one compressor station in Arizona.

Petronet has awarded a contract for an Indian LNG terminal.

Petronet LNG awarded a consortium led by Ishikawajima-Harima Heavy Industries the engineering, procurement, and construction contract for the 5 million tonne/year regasification terminal at Dahej, on the Gujarat coast in India.

The consortium, whose other members are Ballast Nedam International BV, the Netherlands, Toyo Engineering India, Itochu, and Mitsui, won the $312 million contract.

The Dahej terminal is one of two Petronet will build to import 7.5 million tonnes/year of LNG from Qatar's RasGas. The other terminal, which will have a capacity of 2.5 million tonnes/year, will be at Kochi, in Kerala, in the extreme south of India.

The first shipment will be landed by late 2002. Petronet also named Foster Wheeler Energy project manager consultant at Dahej.