Worldwide Construction Update: Four-year downward trend is reversed

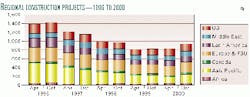

Oil and gas companies have let a declining number of contracts in the downstream sector to engineering and construction companies during the past 4 years (Fig. 1). Ongoing projects in refining, petrochemical, gas processing, and pipeline categories fell from 1,429 in October 1996 to 825 in October 1999, a drop of 58%.

The exploration and production industry benefited from rising crude prices in 1999; downstream sector operating budgets were caught between low refining margins and costly revamps

However, recent worldwide changes in reformulated fuel specifications, petrochemical economics, and natural gas markets should reverse the slump. In 2000, active engineering and construction projects indicate an upward trend, a 12% increase over last year.

Refining projects

Union Francaise des Industries of France (UFIP) disclosed last year that refining margins were insufficient to finance the estimated 1 billion francs per refinery needed for upgrade construction projects required to meet European 2005 fuel product specifications. The National Petrochemical & Refiners Association echoes that concern when predicting new US regulations will require an $8 billion investment by the refining industry to reach compliance with the US Environmental Protection Agency's (EPA) proposed gasoline and diesel reformulation specifications.

Nonetheless, industry planning and feasibility studies have begun evaluating new projects for crude refining. Due to environmental restrictions in the US, it is unlikely greenfield refining complexes will be constructed. Refiners will continue to use modern processing technologies and revamp projects to increase capacity for future transportation fuel demand.

According to the National Petroleum Council's (NPC) recent report (OGJ Online, June 30, 2000), additional desulfurization equipment must be installed at nearly every domestic refinery to reduce gasoline and diesel fuel sulfur. New or reworked equipment will be required for handling, blending, and distributing reformulated fuels to consumers.

Refiners may be forced to increase distillate hydrotreating unit capacity, in some cases by a factor of four, to process uncracked diesel or to install high-pressure hydrotreating units for cracked diesel. Support systems such as sulfur processing plants, hydrogen production, and utilities will be scrutinized for possible de-bottlenecking scenarios.

E&C companies will be in high demand. Meeting the US gasoline sulfur specifications will require approximately 48.8 million job hours, 20% of which will be spent in front-end engineering with the other 80% in detailed design, according to NPC's June 2000 study. Diesel sulfur reduction is estimated to consume another 24.4 million labor hours.

"Worldwide construction will pick up in the next couple of years," said Warren S. Letzsch, Stone & Webster "New environment regulation will force refiners to install or modify equipment to meet the new standards. A general revival of the Asian economies will help construction spending since this has been the most active region for new projects in recent years. This upsurge in spending should start in 2001 and last for a couple of years."

Tyumen Oil (TNK), Ryazan, Russia, agrees. TNK will spend at least $270 million to modernize refinery operations in order to produce low sulfur diesel fuel for the Moscow region. Petrogal of Portugal and Veba Oel of Germany will revamp various hydrodesulfurization units to meet sulfur emission standards, while Koch Petroleum Group LP in Texas will invest $28 million to revamp its gas oil hydrotreater to a fluid catalytic cracking (FCC) feed desulfurization unit.

Petroleos de Venezuela SA (Pdvsa) will draw on a $500 million line of credit to fund expansion of its Puerto La Cruz refinery. The plan is to produce 40,000 b/d of unleaded gasoline and 30,000 b/d of low-sulfur diesel, much of which will be exported to Latin American and Caribbean markets. Pdvsa expects the expanded operation to be on line by the third quarter of 2003.

Petrochemical sector

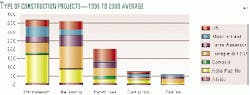

Petrochemical construction projects have dominated E&C forecasts in recent years (Fig. 2).

Middle Eastern and East African demand for propylene is predicted to increase approximately 4.7% by 2010, possibly triggering new propylene recovery unit construction projects.

BASF Sonatrach PropanChem SA plans to produce 350,000 tpd of propylene at its plant in Tarragona, Spain, starting early 2002, and Chemopetrol in Litvinov, Czech Republic, let a contract to Technip Benelux for an expansion project to be on stream in 2003.

Hellennic Petroleum's new $22 million, 100,000 tonne/day propylene complex in Aspropyrgos, Greece, should be fully operational by end of 2000.

As ethylene export patterns change, North America and the Middle East will begin production revamp or expansion projects to satisfy ethylene derivatives needs in Northeast Asia, India, South America, and Western Europe. Asian excess capacity for ethylene is expected to continue through 2001. Due to the delay or cancellation of projects during the region's financial crisis, beneficial economic operating capacity should be resumed by 2004.

On May 31, 2000, the Thai government gave tax and import duty exemptions for machinery and equipment required for eight petrochemical projects (see Worldwide Construction Update, p. 59), including two ethylene complexes totaling 1.5 million tonne/year. The estimated cost of the eight projects is $510 million.

As refinery profits are squeezed, petrochemical margins become more attractive and joint ventures/alliances may develop between refiners and petrochemical companies to take advantage of synergetic processes and off-gases. A recent paper, "DCC and Ethylene Plant Integration Options," presented by Ginger Keady at the Fourth FCC Forum sponsored by Stone & Webster and IFP, makes a case for one type of plant integration which would streamline operations while reducing capital equipment and operating costs.

The exit of methyl tertiary butyl ether (MTBE) from the gasoline pool will require conversion of process units for alternative uses. Should ethanol win as replacement, additional large-scale investment of equipment will be necessary. Vertically integrated petrochemical companies will require ethanol receipt and storage facilities as well as blending tanks and control equipment at truck terminals. As an alternative, propylene and butylene units may give way to alkylation.

Gas processing

A large amount of excess processing capacity exists in most areas of Canada and the US. Plants have been shut down in recent years due to low margins and scarce markets. As electric power plants turn to natural gas as a cleaner, cheaper, and efficient fuel source, natural gas prices may continue to rise. Gas processing and transportation will become attractive again.

Along with an increased need for processed natural gas use in power generation, petrochemical feedstocks, residential heating, and industrial energy, growing global concern for the environment will ensure capacity demand for the foreseeable future.

Mexico plans to double natural gas production within its borders. This will take several years and will require conditioning or processing plants, transportation, and distribution facilities targeted primarily for electricity generation. Much of the gas produced from the Cantarell region is being flared, but the country's energy undersecretary, Andres Antonius, would like to change that. Petroleos Mexicanos SA will manage much of the oil field service, but private contractors will be invited to bid through the "aperatura" for midstream work.

Gas processing expansion in Trinidad continues despite demonstrations caused by labor unrest earlier this year. Prime Minister Basdeo Panday of Trinidad revealed plans to build two more production lines at Atlantic LNG, Point Fortin, using the Phillips process method. The complex currently produces 3 million tonnes/year of LNG.

New gas-to-liquids technology units are under construction or technical evaluation, partially motivated by the need for economies of scale and government restrictions against flaring.

Trinidad & Tobago's Implementation Minister Lindsay Gillette began plans to develop a 100 MMcfd gas-to-liquids project to convert natural gas into sulfur-free diesel and jet fuel. The proposed complex carries a $300 million price tag and is scheduled to start commercial operations by 2003.

Syntroleum's 10,000 b/d gas-to-liquids project hit a temporary snag when Methanex backed out of a 20% stake in the Western Australia Sweetwater project, but plans to prospect for another partner, initiate an equity offering, or divert funds from other projects are under way.

Sulfur recovery

Sulfur recovery units gain prominence as crude oil refiners turn to less-expensive, sour crudes.

Conoco Inc., Ponca City, Okla., plans a $22 million expansion of its sulfur recovery unit. Recent pipeline capacity to the refinery will bring Canadian sour crude in for processing, and increased sulfur recovery is needed to refine the crude while reducing SO2 emissions.

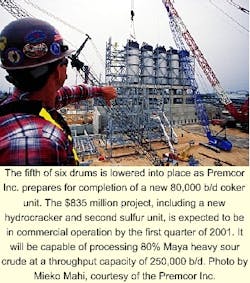

Construction of a second sulfur recovery unit at Premcor Inc.'s Port Arthur, Tex., business unit nears completion. This unit will enable the refinery to take advantage of Maya heavy sour crude from Mexico. In addition to reducing emissions, the complex plans to improve processing economics without increasing overall refinery capacity. Premcor will finish construction of the sulfur unit, along with a hydro cracker, coker, and sour water stripper, by the end of 2000. The existing unit, a Scot sulfur removal system, will continue to operate.

Pemex plans five sulfur removal plants at Cactus, Chiapas. The plants will obtain a collective capacity of 1,600 tonnes/day. Additional sulfur removal plants are nearing completion at other Pemex locations in Salina Cruz and Tula, Hidalgo.

Pipeline outlook

"Stranded gas" is becoming a familiar term. As technology is developed to reduce wasteful flaring and deliver gas products to markets, distribution methods become increasingly critical. New gathering pipelines and delivery systems are needed worldwide to deliver stranded gas to potential markets. Repairs are needed in some existing aged infrastructure; other pipelines require expanded capacity.

Russia's new energy strategy, named "Energy Strategy to 2020," spotlights gas transportation as an area of concern. Due to a proposed increase in gas production in Eastern Siberia and the Far East, the strategy calls for a pipeline from Kovykta to Irkutsk, possibly continuing into China. Within two decades, the plan is to construct 16,800 miles of new lines and replace 14,300 miles of existing lines due to corrosion.

Earlier this year the $4.6 billion Alliance natural gas and liquids pipeline was completed. The line runs from western Canada to the Midwest US and operates in competition with the TransCanada Pipelines Ltd. system.

ExxonMobil Corp., Petronas, and Chevron formed a consortium to build a 653-mile crude oil pipeline from Doba in southern Chad to the Cameroon coast. The World Bank approved $193 million in loans, Wilbros won the construction contract, and expected completion is 2001.

The US Federal Energy Regulatory Commission gave preliminary approval to the Gulfstream and Buccaneer pipeline projects. Both are intended to move natural gas from the Gulf of Mexico to Florida. Coastal's Gulfstream project price tag is $1.6 billion, while Williams and Duke Energy expect the Buccaneer line to total $1.5 billion.

Nigeria has proven gas reserves of 124 tcf but little domestic market. End uses include a pipeline to nearby countries and compressed gas shipment by tanker.