Chord strikes deal to buy Enerplus, add scale in Williston

The oil-and-gas acquisition boom has reached the Williston basin as Chord Energy Corp., Houston, agreed to acquire Enerplus Corp., Calgary, in a stock-and-cash deal that values Enerplus at about $3.9 billion.

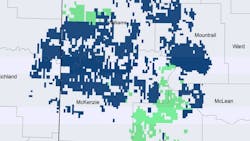

If closed later this year as planned, the deal will create one of the largest producers in the Williston, with operations in Montana and North Dakota that will span more than 1.2 million acres and produce about 260,000 boe/d (56% oil). Enerplus also has assets in the Marcellus that produce roughly 25,000 boe/d.

Executives said the two organizations’ combined inventory supports about 10 years of development at the current pace.

“This combination checks all the boxes between operating, financial, and strategic goals,” Chord president and chief executive officer Danny Brown said on a Feb. 21 conference call. “It enhances scale and asset quality. Additionally, it delivers accretion on all key financial metrics, which is boosted by significant synergies.”

Brown will continue to lead the combined company while Enerplus president and chief executive officer Ian Dundas will move into a senior advisory role. The teams are forecasting that the union will generate $150 million in annual savings by 2026, with those benefits being realized in three roughly equal chunks.

Oil and gas M&A

Deal activity has been intense since last fall's announcements from ExxonMobil and Chevron that they planned to buy Pioneer Natural Resources and Hess, respectively. Here, a snapshot of select proposed combinations from a range of producing regions.

Dec. 11 - Occidental inks $12 billion CrownRock deal

Dec. 17 - TG Natural Resources acquires Haynesville-focused Rockcliff for $2.7 billion

Jan. 4 - APA signs $4.5 billion deal to acquire Permian-focused Callon

Jan. 11 - Chesapeake to buy Southwestern for more than $7 billion

Jan. 16 - Talos Energy to acquire QuarterNorth Energy for $1.3 billion

Jan. 22 - Sunoco to acquire NuStar Energy in $7.3 billion deal

Speaking with analysts, Brown said Chord doesn't need to lever up to aquire Enerplus and suggested the company is open to other “strategic initiatives” to grow its presence in the Bakken. The company—which emerged in its current form via the mid-2022 merger of Oasis Petroleum Corp. and Whiting Petroleum Corp. (OGJ Online, Mar. 7, 2022)—last year paid ExxonMobil’s XTO subsidiary $375 million for about 62,000 Williston acres.

“The strong pro forma balance sheet we have is going to give us a lot of flexibility […] from a return-on-capital standpoint to weather resiliency with commodity price fluctuations or to pursue different growth opportunities,” Brown said. “We’ll take those things as we see them in the future.”

The combined Chord-Enerplus also will look to improve its drilling efficiency. Brown said Chord “made significant progress” last year in completing three-mile-lateral wells, which now takes its teams about 11 days to drill. Taking that know-how to Enerplus, which Brown said “is in the early innings” of this work, as well as preparing for Chord’s first four-mile laterals will be high operational priorities.

Word of Chord’s acquisition plans come a few weeks after Reuters reported that Devon Energy Corp. had approached the Enerplus board with a buyout offer.

Chord shares (Ticker: CHRD) slipped about 2% Feb. 22 to $164; they are still up slightly over the past 6 months. Shares of Enerplus (Ticker: ERF) increased 10% to about $18.10; they had been changing hands below $14 early this month.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.