Civitas Resources Inc. has agreed to acquire privately held Denver-Julesburg basin (DJ basin) operator Bison Oil & Gas II LLC for $346 million, consisting of 2.3 million CIVI shares, $45 million in cash, and the assumption of about $176 million in debt and other liabilities.

The deal adds 102 gross high-quality locations, of which 38 are fully permitted, and enhances Civitas margins with 2022E pro forma production increase of 6,000-9,000 boe/d to 156,000-167,000 boe/d (75% oil, 90% liquids), without incremental G&A expense, the company said.

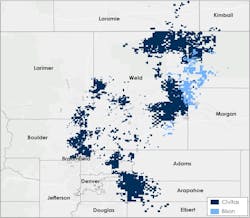

Bison Oil & Gas II holds leases covering about 40,000 net acres and to-date has drilled 30 horizontal wells across its core DJ position, according to the company’s website.

With the deal, Eric Greager has stepped down as president and chief executive officer, effective Jan. 31. Civitas’ Chairman, Ben Dell, has assumed the role of interim chief executive officer. Greager will serve as a technical consultant to Civitas for the next 12 months while the company searches for a new chief executive.

The company’s estimated total capital expenditures budget pro forma the transaction is $895 million to $1.04 billion compared to a previous Civitas 2022 estimated capex of $770-890 million.

The deal is expected to close in this year’s first quarter. Bison Oil & Gas is backed by Carnelian Energy Capital.