Earthstone Energy Inc. has agreed to acquire the assets of privately held Bighorn Permian Resources LLC in a cash and stock deal valued at $860 million.

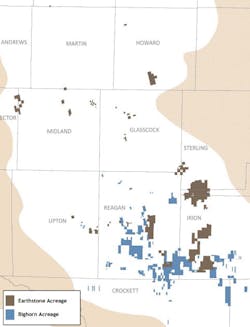

Earthstone will acquire about 110,600 net acres (98% operated, 93% WI, 99% HBP) in the Midland basin, primarily in Reagan and Irion counties. November 2021 average daily production was 42,400 boe/d (25% oil, 57% liquids).

Bighorn Permian Resources LLC was previously known as Sable Permian Resources. The company merged assets with American Energy - Permian Basin LLC and served as its parent company. Sable and certain of its affiliates filed for bankruptcy in the Southern District of Texas in June 2020 and emerged in February 2021.

The deal increases Earthstone’s existing footprint with 49 gross (35 net) Earthstone-identified drilling locations.

Production is expected to be held flat to moderate growth on an annual basis based on continuously running the four rigs currently operated by Earthstone and Chisholm in the Midland basin and the Delaware basin, respectively.

In December, Earthstone agreed to acquire assets of privately held Chisholm Energy Holdings LLC in New Mexico’s northern Delaware basin (OGJ Online, Dec. 16, 2021).

The $770 million cash portion of the Bighorn deal is expected to be funded with cash on hand and proceeds from a private placement of equity and borrowings under the company's senior secured revolving credit facility.

Earthstone obtained commitments from existing lenders to increase the borrowing base and elected commitments under its credit facility to a total of $1.325 billion from the current $625 million upon both the anticipated February 2022 closing of the previously announced Chisholm acquisition and the closing of the Bighorn acquisition.

Subject to closing conditions, the deal is expected to close early in this year’s second quarter with an effective date of Jan. 1, 2022.

In 2022, Earthstone expects a capital expenditure budget of $410-440 million. With the two acquisitions, the company plans 2022 production of 76,000-80,000 boe/d (40% oil, 68% liquids).