Penn Virginia plans more Eagle Ford growth, name change

On the heels of an acquisition that has grown its sales by more than 50% and its proved reserves by nearly 60%, Penn Virginia Corp. is prepping a name change and prepared to keep growing in the Eagle Ford – be that by drilling more efficiently or striking other deals.

President and chief executive officer Darrin Henke and his team will soon run Ranger Oil Corp., which – having acquired Lonestar Resources US Inc. – has sales of about 38,000 boe/d and, says Henke, the capacity to be a consolidator in the Eagle Ford market (OGJ Online, July 14, 2021). Shareholders’ vote to approve the Lonestar purchase came about 9 months after Penn Virginia and investment firm Juniper Capital Advisors completed a deal that exchanged $150 million in cash and about $38 million of exploration assets from Juniper for a roughly 60% stake in Penn Virginia. The Lonestar acquisition, which was valued at $370 million when announced in July, adds 250 well locations to Penn Virginia’s roughly 500.

Henke took over as Penn Virginia’s leader from John Brooks in August of last year with a mandate that included better capitalizing on the company’s assets (OGJ Online, Aug. 17, 2020). The Eagle Ford basin, he said, still offers a lot of opportunities both for new exploration and for consolidation among players already there.

“Some think the Eagle Ford has passed its prime,” Henke said. “But there’s still a tremendous amount to do, and a lot of inventory.”

Henke is keeping an eye out for other deals such as Lonestar, which came with acreage contiguous to Penn Virginia’s and a low price for future upside. He said he’s not picky about growing east or west or about the oil-gas mix of any deals. (Penn Virginia’s second-quarter sales mix was 81% oil, 11% natural gas liquids and 8% natural gas.) His preference is for inventory that matches well with the company’s current holdings and that Ranger Oil can drill “in the next few years.” Asked about a recent report that Chevron is looking to unload its Eagle Ford oil and gas assets for more than $1 billion, Henke said he “can’t see that deal making sense” for Ranger since it would likely need to be in cash and one of his goals to is to reduce the company’s leverage ratio to from its current level of about 1.5x to 1.0 by early next year.

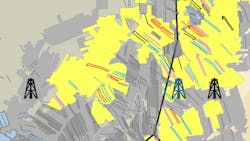

On the operations side, the Penn Virginia/Ranger team is looking to capitalize on its inventory by drilling longer wells rather than launching a much greater number of new projects. (It added 11 wells in the first half and had another nine in various stages at end July.) The company’s average well lateral length drilled this year is forecast to rise 16% to about 7,700 ft and that number is projected to grow nearly 40% in 2022 as Henke and his team extend their network onto Lonestar’s acreage. First up in that plan is a roughly 770-acre plot in northwestern Lavaca County that is surrounded by Penn Virginia operations. That property near Moulton has the potential to add 45,000 net lateral ft and $33 million in PV-10 to the company’s work in the area.

A similar contiguous opportunity lies a few miles northeast, straddling the Lavaca-Fayette county line and providing what a recent company presentation called “ample running room for future drilling on high-return oil-weighted inventory.” Incorporating those operations and others – the Lonestar portfolio is estimated to have a PV-10 value of $700 million – means Penn Virginia will more regularly be able to drill wells of 10,000-12,000 ft rather than its average lateral length of about 8,300 ft. That will help Henke et. al further lower their total well cost per lateral foot, which they’re forecasting will be about $750 this year, down from $1,079 in 2019.

Henke said the combined Penn Virginia-Lonestar operation will only run Penn Virginia’s two full-time rigs in 2022 but expects to be just as efficient as the 2.5 combined rigs the companies are running this year. The merged organization expects to have 25% more lateral feet in its portfolio by the end of next year, which will help it meet its goal to generate $150 million in 2022 free cash flow – even as capital spending climbs by about a quarter from this year’s $210-240 million. Fourth-quarter capex is expected to come in at $65-75 million.

Henke’s plan received a stamp of approval early this month from Truist analyst Neal Dingmann, who lifted his price target for Penn Virginia shares to $40 from $34 – they were changing hands around $28 (Ticker: PVAC) at the time – and said the Lonestar deal and higher prices will help lift the company’s valuation relative to its larger peers.

Henke acknowledged that the biggest key to closing that valuation gap lies in producing good returns – which includes improving the environmental aspects of LoneStar assets to Penn Virginia’s levels – and remaining disciplined with capital even as other acquisition opportunities surface. With the 1-year anniversary of the Juniper funding announcement nearing, Penn Virginia is still something of a show-me story.

“We could be more aggressive but investors are not rewarding it,” he said. “The marketplace wants to see significant cash flow generation.”

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.