Penn Virginia Corp. has agreed to acquire Lonestar Resources US Inc. in an all-stock transaction, adding to its existing South Texas Eagle Ford position.

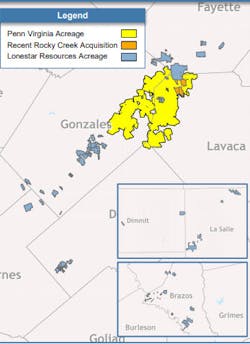

Lonestar’s Eagle Ford position lies across 11 Texas counties divided into three regions: The Western Eagle Ford (Dimmit, La Salle, and Frio Counties), Central Eagle Ford (Gonzales, Karnes, Fayette, Wilson, DeWitt, and Lavaca Counties) and Eastern Eagle Ford (Brazos and Robertson Counties). As of Dec. 31, 2020, the company operated 97% of its Eagle Ford position and some 94% of the net acreage was held by production.

The deal gives Penn Virginia 143,000 net acres, 38,000 boe/d, and 219 MMboe in proved reserves with an estimated 750 combined gross well locations with adjacent acreage allowing for longer laterals, Penn Virginia said in a July 12 statement.

Operational and G&A synergies are expected to exceed $20 million/year.

Lonestar shareholders will receive 0.51 shares of common stock of Penn Virginia for each share of common stock of Lonestar outstanding. Penn Virginia will assume Lonestar’s outstanding net debt calculated at $236 million as of June 30.

The deal, which is expected to close in second-half 2021, has been approved by the boards, but remains subject to customary closing conditions, including approval of Penn Virginia and Lonestar shareholders.

Darrin Henke will continue to serve as president and chief executive officer of the company and Lonestar will have the right to nominate one independent director to the Penn Virginia board. Edward Geiser, managing partner of Juniper Capital Advisors, will continue to serve as chairman of the board.

In January, Penn Virginia and Juniper closed a $188.4-million investment deal intended to improve Penn Virginia’s balance sheet and liquidity position, extend its second-lien term loan maturity, and increase its cash flow and drilling inventory with bolt-on assets in Lavaca and DeWitt counties from Juniper portfolio company Rocky Creek Resources.