EQT enters northeast Marcellus in $2.9-billion deal with Alta Resources

EQT Corp. has agreed to acquire all membership interests of Alta Resources Development LLC upstream and midstream subsidiaries for $2.925 billion (65% equity/35% cash), establishing a position in the northeast Marcellus shale.

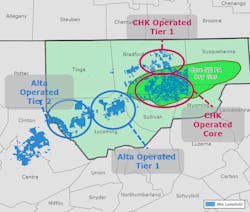

Assets to be acquired include 300,000 core net Marcellus acres (98% held by production), predominantly in Pennsylvania’s Lycoming and Bradford counties. According to Alta’s website, the privately held company operates 900 wells in the Marcellus. Of the acreage, 222,000 net acres are operated, and 78,000 net acres are non-operated. Current net production is 1.0 bcfed (100% dry gas). Also included in the sale is 300 miles of owned and operated midstream gathering systems and a 100-mile freshwater system with 255 million gal of storage capacity.

Pittsburgh-based EQT plans a maintenance program on production with one rig and “shows a decline of capex intensity of 10% in 2022E and through 2026E on average in order to keep overall production flat,” Cowen analysts said in a May 6 note on the deal.

The net production is expected to add some $300-400 million of annual free cash flow and a total of $2.0 billion of free cash flow through 2026, an improvement of 55% compared to pre-transaction outlook, EQT said in the May 6 release.

The deal comes on the heels of other acquisitions in the area by EQT. In October 2020, EQT announced a deal to acquire Appalachian basin upstream and midstream assets from Chevron USA Inc. for $735 million in 2020 (OGJ Online, Oct. 28, 2020). That deal closed Nov. 30, 2020. On Apr. 1, 2021, the company closed an acquisition of certain oil and gas assets from Reliance Marcellus LLC, pursuant to the exercise of a preferential purchase right triggered upon Northern Oil and Gas Inc.'s acquisition of Reliance's Marcellus assets. For $69 million, the company acquired some 40 MMcfed of current production and 4,100 net acres in the core of the southwest Pennsylvania Marcellus.

The total purchase price for the Alta transaction consists of $1.0 billion in cash and some $1.925 billion in EQT common stock issued directly to Alta's shareholders. EQT expects to fund the cash consideration with cash on hand, drawings under its revolving credit facility and/or through one or more debt capital markets transactions, subject to conditions. Bank of America NA and JPMorgan Chase Bank NA have jointly provided $1.0 billion of committed financing in connection with the transaction and EQT has access to over $1.4 billion under its unsecured credit facility, the company said.

The transaction is expected to close in this year’s third quarter, subject to customary closing conditions, including approval by EQT's shareholders of the issuance of the common stock consideration.