OGJ Newsletter

GENERAL INTEREST — Quick Takes

OPEC accommodates current production quota levels

Members of the Organization of Petroleum Exporting Countries made no formal decision on changing the group's production quota, but instead concluded the scheduled Dec. 4 meeting in Vienna by saying the group will accommodate the current production level, which is more than 1 million b/d over the 30 million-b/d quota set last year.

Actual current production levels are estimated at 31.2 million b/d. During a news conference in Vienna, oil ministers told reporters that they did not get into specific numbers but are waiting to see what happens with oil prices in coming months. OPEC's next meeting will be in June 2016.

Emmanuel Ibe Kachikwu, Nigeria's Minister of State for Petroleum Resources, said during a news conference in Vienna that OPEC members decided for now not to act on the production ceiling.

Given an ongoing downturn in oil prices, he said OPEC members closely are monitoring oil demand and also monitoring the anticipated return of Iranian oil to world markets.

IHS: Oil sales 43% of Islamic State revenue

Islamic State, the jihadist occupier of parts of Syria and Iraq, makes 43% of its $80 million/month revenue from illicit sales of oil, estimates the monthly Conflict Monitor at IHS Aerospace, Defense, and Security.

The firm based its estimate for late 2015 on open-source intelligence, including social media.

"Unlike Al-Qaeda, the Islamic State has not been dependent on money from foreign donors to avoid leaving it vulnerable to their influence," said Columb Strack, senior IHS analyst and lead analyst for IHS Conflict Monitor.

The group has at least six main sources of revenue: production and smuggling of oil and gas; taxation of the profits of all commercial activities in areas under its control; confiscation of land and properties; trafficking of drugs and antiquities; criminal activities such as bank robbery and kidnap for ransom; and state-run businesses, such as running small enterprises that include transport companies and real estate agencies.

"According to information gathered from Arabic-language social media and our in-country source network, efforts to target the Islamic States sources of revenue are paying off," Strack said. Airstrikes by US-led coalition forces have focused on disrupting the Islamic state's oil income. IHS said the attacks have "significantly degraded" the group's refining capacity and oil transport capability.

"Although the Islamic State retains its capacity to produce oil, its loss of easy access to Turkey after its defeat at Tal Abyad and the efforts by Turkish authorities to stop smuggling activities along its border with Syria have gradually forced the group to rely increasingly on the internal markets in Syria and Iraq to smuggle and sell its oil," it said.

Woodside abandons pursuit to buy Oil Search

Woodside Petroleum Ltd. has called off its $11.6-billion (Aus.) bid to acquire Oil Search Ltd. (OGJ Online, Sept. 8, 2015).

Woodside said on Dec. 8 it had informed Oil Search's board that it had withdrawn its proposal to merge the companies. The company added that it was not pursuing any alternative transactions to combine the firms.

Oil Search had rejected the bid (a 1-4 scrip deal) soon after it was made, but Woodside's Chief Executive Officer Peter Coleman had continued to have talks with the Papua New Guinea government, which owns 10% of Oil Search, in the following weeks (OGJ Online, Sept. 14, 2015).

It is believed that the government rebuffed these overtures, saying that only a cash offer would be acceptable and that the price of such an offer would need to be well over the government's entry price into Oil Search last year of $8.20 (Aus.)/share. Woodside's scrip offer was originally worth $7.65 (Aus.)/share. Analysts now expect Woodside to look elsewhere for assets to acquire.

Survey: Alberta losing investor confidence

Policy changes enacted or planned by a new provincial government damage investors' confidence in the oil and gas industry of Alberta, according to the Fraser Institute, Vancouver.

In an analysis of the institute's recently published Global Petroleum Survey, which annually gauges barriers to exploration and production investment by jurisdiction, Kenneth P. Green and Taylor Jackson note that Alberta had the largest indicated decline in investor confidence (OGJ Online, Dec. 1, 2015).

The investment driver with the largest shift in sentiment from 2014 to 2015 for Alberta was political stability, according to the analysis.

The institute conducted its 2015 survey during May 29-July 31, after the election in which the New Democratic Party ousted the Progressive Conservative Party.

In a measure of policy-related investment barriers, Alberta's indexed score-with a high value indicating negative sentiment-deteriorated to 34.21 in 2015 from 26.57 in 2014. The province's ranking fell to 38th of 126 jurisdictions in 2015 from 16th of 156 jurisdictions in 2014.

These and other declines in confidence indicators "may not bode well for Alberta considering that the province's immediate geographical competitors are perceived to be either attractive jurisdictions to invest in or are improving," the analysts say.

According to the analysts, three policy areas "stand out as having the greatest potential impact on sector investment": a royalty review that might not be concluded until the end of 2016, a corporate income-tax increase to 12% from 10%, and the new government's "strong commitment to implement policies that will lower the province's [carbon dioxide] and other [greenhouse gas] emissions in order to contribute to climate-change mitigation efforts."

Alberta Premier Rachel Notley on Nov. 22 announced a climate-change mitigation plan that includes a cap on emissions from oil sands production and upgrading, an increased carbon tax, and a phaseout of coal-fired power generation (OGJ Online, Nov. 23, 2015).

Exploration & Development — Quick Takes

Norway reports on latest licensing round

Norway's 23rd licensing round received applications on 57 blocks or portions of blocks from 26 oil and gas companies, the Norwegian Petroleum Directorate reported on Dec. 4.

Blocks are in frontier areas where more exploration is needed to determine resource potential. Of the total, 3 are in the Norwegian Sea and 54 are in the Barents Sea.

NPD says several applications target a newly opened area that holds 34 blocks in the southeastern Barents Sea, which was clarified as Norwegian territory under the border agreement with Russia that came into effect from 2011. Acreage in the Hoop-Wisting area, opened in the 22nd round, also is on offer. Norway's Ministry of Petroleum and Energy plans to award the licenses before next summer.

The companies applying for licenses independently or in groups are: AS Norske Shell, BP Norge AS, Capricorn Norge AS, Centrica Resources (Norge) AS, Chevron Norge AS, ConocoPhillips Skandinavia AS, DEA Norge AS, Det norske oljeselskap ASA, DONG E&P Norge AS, E.On E&P Norge AS, Edison Norge AS, Faroe Petroleum Norge AS, Idemitsu Petroleum Norge AS, Inpex Norge AS, Kufpec Norway AS, Lukoil Overseas North Shelf AS, Lundin Norway AS, Moeco Oil & Gas Norge AS, OMV (Norge) AS, PGNiG Upstream International AS, Pure E&P Norway AS, RN Nordic Oil AS, Spike Exploration AS, Statoil Petroleum AS, Tullow Oil Norge AS, and Wintershall Norge AS.

The two newcomers are Japan's Inpex Corp. and Kuwait's Kufpec, the latter of which also applied in this year's Awards in Predefined Areas (APA) round.

Jez Averty, Statoil's senior vice-president, exploration, Norway, commented from his company's perspective, "The acreage offered is interesting and important and we hope we will earn the opportunity to drill as early as in 2017.

"Acreage in the 23rd round has significant volume potential, but, nevertheless, there is a debate where some say that these resources will not be commercial," Averty noted. "We believe otherwise and our application is proof enough of that. Statoil's preparations for our 23rd round application have included developing technology solutions that will reduce the breakeven price per barrel for the significant discoveries we hope to make in the Barents Sea."

Statoil in 2014 was operator for a group of 33 companies cooperating on seismic surveys in areas included in the 23rd licensing round (OGJ Online, Mar. 11, 2014). TGS-NOPEC Geophysical Co. conducted 2D and 3D multiline projects for the round as well (OGJ Online, Apr. 24, 2014).

In the 22nd licensing round, 36 companies applied for production licenses. APA 2015 saw 44 companies submitting applications, which NPD says may indicate that "smaller players" have prioritized APA ahead of the 23rd round.

Another BLM office postpones an oil, gas lease sale

The US Bureau of Land Management's Eastern States office postponed its Dec. 10 oil and gas lease sale 3 days before it was to take place. Nine parcels that would have been offered will be included in the next quarterly lease sale on Mar. 17, 2016, the Dec. 7 announcement said.

The move came less than a month after BLM's Utah office postponed its quarterly lease sale a day before "to allow the time needed to better accommodate the high level of public interest in attending the sale (OGJ Online, Nov. 17, 2015)." That office apologized for the short notice.

Environmental activists who had planned to protest what they termed a "fossil fuel auction" outside the Washington, DC, lease sale on Dec. 10 immediately declared a victory.

Development plans decided for offshore Mozambique

Anadarko Petroleum Corp. and Eni SPA have reached an agreement with the Mozambique government to develop 24 tcf of natural gas reserves from the Prosperidade and Mamba reservoirs offshore the northern tip of Mozambique.

Prosperidade, estimated to hold 17-30 tcf or more of recoverable gas, includes the Windjammer, Barquentine, Lagosta, and Camarao discoveries and five subsequent appraisal wells (OGJ Online, Apr. 4, 2012). Eni estimates gas in place at the Mamba Complex at 75 tcf (OGJ Online, July 29, 2013).

The unitization and unit operating agreement (UUOA) cover Offshore Area 1 and Area 4, where both operators separately are developing 12 tcf from their respective blocks. The UUOA is subject to final approval by the Mozambique government.

Anadarko is the operator of 2.6-million-acre Offshore Area 1 with 26.5% working interest. Partners include Mozambique state-owned Empresa Nacional de Hidrocarbonetos EP (ENH) 15%, Mitsui E&P Mozambique Area 1 Ltd. 20%, Beas Rovuma Energy Mozambique Ltd. 10%, BPRL Ventures Mozambique BV 10%, ONGC Videsh Ltd. 10%, and PTTEP Mozambique Area 1 Ltd. 8.5%.

In addition, Anadarko has signed a memorandum of understanding with the Mozambique government to provide 100 MMcfd (50 MMcfd/train) from Offshore Area 1 for domestic use in Mozambique's LNG facilities.

Eni operates Area 4 with 50% indirect interest owned through Eni East Africa, which holds 70% of Area 4. Partners include Galp Rovuma 10%, Kogas Mozambique 10%, and ENH 10%. CNODC owns 20% indirect participation in Area 4 through Eni East Africa.

Drilling & Production — Quick Takes

US shale oil output to fall 116,000 b/d in December

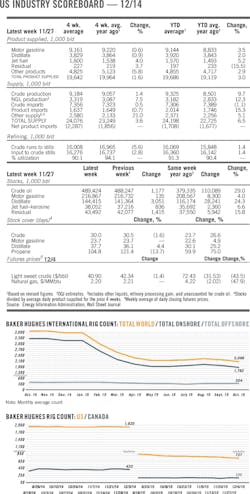

Crude oil production in December from seven major US shale plays is expected to drop 116,000 b/d to 4.86 million b/d, according to the US Energy Information Administration's latest Drilling Productivity Report (DPR). The agency projected a 118,000-b/d decline for November (OGJ Online, Nov. 9, 2015).

The DPR focuses on the Bakken, Eagle Ford, Haynesville, Marcellus, Niobrara, Permian, and Utica, which altogether accounted for 95% of US oil production increases and all US natural gas production increases during 2011-13.

Consistent with the trend since shale oil production began falling last spring, the Eagle Ford is expected to represent a bulk of the decline, down 77,000 b/d to 1.2 million b/d. EIA also projects the Bakken to drop 27,000 b/d to about 1.1 million b/d, and Niobrara to drop 24,000 b/d to 344,000 b/d.

Double-digit growth is again expected in the Permian, which EIA sees rising 14,000 b/d to about 2.4 million b/d.

EIA projects natural gas production in December from the 7 plays to lose 365 MMcfd to about 43.96 bcf, with the Marcellus leading the way at a 213-MMcfd decline to 15.45 bcfd. The Eagle Ford is expected to drop 172 MMcfd to about 6.41 bcfd, and the Niobrara is expected to drop 66 MMcfd to about 4.11 bcfd.

Gas production from the Utica, meanwhile, is projected to increase 67 MMcfd to about 3.21 bcfd, while Haynesville output is projected to increase 24 MMcfd to about 6.34 bcfd.

Seneca joins IOG for Marcellus drilling campaign

A new joint venture has committed to drill 80 Marcellus wells in the Clermont-Rich Valley area of Pennsylvania on about 10,500 acres. Seneca Resources Corp., a wholly owned subsidiary of National Fuel Gas Co., has entered an asset-level JV with IOG CRV-Marcellus LLC, and affiliate of IOG Capital LP.

Under the terms, IOG will hold an 80% working interest and is obligated to participate in the first 42 wells. The company will have an option to participate in the remaining 38 wells that can be exercised on or before July 1, 2016. IOG's obligation on the first 42 wells is expected to reduce Seneca's net capital expenditures by up to $200 million in 2016, with a further $180-million reduction spread across 2017. Seneca retains 7.5% royalty interest and the remaining 20% working interest in the first 42 wells.

PROCESSING — Quick Takes

Shell plans new unit for Pernis refinery

Royal Dutch Shell PLC has approved a project to add a solvent deasphalting (SDA) unit at subsidiary Shell Nederland Raffinaderij BV's 404,000-b/d Pernis refinery in Rotterdam, the Netherlands.

Shell has taken final investment decision to build the SDA unit, which the refinery will use to remove heavier fractions from crude oil feedstock to help boost its production of lighter, higher-valued, finished petroleum products, Shell said.

Alongside equipping the refinery with more flexibility to change its production slate to a different product mix in response to current market conditions, the SDA unit also will improve the environmental performance of the plant's finished product slate, the operator said.

While addition of the SDA unit will require some modifications to existing units at the site, the new unit will not alter the refinery's current crude processing capacity.

Pending permit approvals, construction of the unit is planned to start in 2016 and due to be completed by yearend 2018, the company said.

Details regarding planned modifications to the refinery's existing units or Shell's capital investment for the project were not disclosed.

Axens details scope of work for Azerbaijani refinery

Axens SA, Rueil-Malmaison, France, has released additional details of its earlier contract award from State Oil Co. of Azerbaijan Republic (SOCAR) to build diesel fuel and gasoline hydrotreating units as part of the ongoing modernization and expansion project at the Heydar Aliyev (formerly New Baku) refinery at Baku.

First announced by SOCAR in late October (OGJ Online, Oct. 28, 2015), the contract calls for Axens' delivery of construction and technology licensing for the two new hydrotreaters that will help boost the refinery's production of fuels meeting Euro 5 quality standards.

For the planned 1.2 million-tonne/year (tpy) gasoline desulfurization unit, Axens will supply its proprietary Prime-G+ technology, while the proposed 3 million-tpy diesel hydrotreater will use its Prime-D technology, Axens said.

A value of the contract was not disclosed.

Designed to be implemented in stages during 2015-19, the modernization and upgrading program at Heydar Aliyev includes plans to renovate the refinery's primary crude processing, catalytic cracking, and catalytic reforming units.

Once completed, the revamp will increase the refinery's crude processing capacity to about 7.5 million tpy from its current 6 million-tpy capacity, resulting in 100% production of fuels conforming to Euro 5 standards as well as high-quality raw feedstock that SOCAR will transport via pipeline to an associated ethylene and polyethylene plant operated by its subsidiary Azerikimya Production Union.

Phillips 66 commissions Sweeny NGL fractionator

Phillips 66 Co. has commissioned a 100,000-b/d NGL fractionator near its 247,000-b/d Sweeny refinery in Old Ocean, Tex. (OGJ Online, Apr. 15, 2015).

Supported by 250 miles of pipelines and a multimillion-barrel storage cavern complex, Sweeny Fractionator One is now producing purity ethane and LPGs that deliver via pipeline to local petrochemical customers as well as to the market hub at Mont Belvieu, Tex., Phillips 66 said.

The company said it expects to begin LPG deliveries to international markets once it completes the 150,000-b/d LPG export terminal at Phillips 66's existing marine terminal in Freeport, Tex.

The Freeport LPG export terminal, which will have an initial export capacity of 4.4 million bbl/month, remains on schedule for startup during second-half 2016, Phillips 66 said.

At a combined capital investment of more than $3 billion, Sweeny Fractionator One and the Freeport LPG export terminal will connect to a 100,000-b/d de-ethanizer unit to be installed at the Old Ocean site that will upgrade US propane for export (OGJ Online, Feb. 7, 2014).

Phillips 66 already has secured long-term, fee-based commitments for the use of Sweeny Fractionator One and the export terminal, the company confirmed earlier this year.

Despite an October announcement that it would lower its 2016 capital budget by $1 billion from 2015 (OGJ Online, Oct. 12, 2015), Phillips 66 continues to evaluate additional midstream capacity expansions.

"We plan to add more capacity in the future to supply our customers LPGs based on affordable North American NGLs," said Bob Herman, executive vice-president for Phillips 66's midstream division.

While further details regarding future projects were not disclosed, the company previously planned to build a 110,000-b/d Sweeny Fractionator Two, which if approved, would have been scheduled for startup in 2017 (OGJ Online, Dec. 11, 2014).

In response to market conditions as a result of lower global crude oil prices, however, the company said earlier in the year that it would delay timing of investment decisions on a series of second-phase midstream projects in Texas, including the second Sweeny fractionator (OGJ, June 1, 2015, p. 70).

TRANSPORTATION — Quick Takes

Tesoro to acquire Great Northern Midstream

Tesoro Corp., San Antonio, has agreed to acquire Great Northern Midstream LLC, a crude oil logistics provider that owns and operates a recently constructed crude oil pipeline and gathering system, and transportation, storage, and rail-loading facilities in the Williston basin of North Dakota. The purchase price was not disclosed.

The deal includes the 97-mile BakkenLink crude oil pipeline, which connects to several third-party gathering systems, as well as a proprietary 28-mile gathering system in the core of the Bakken, supported by acreage dedication. The deal also includes a 154,000-b/d rail-loading and 657,000-bbl storage facility in Fryburg, ND, which can provide outbound deliveries to the West, East, and Gulf Coasts.

The assets are in close proximity to the Tesoro High Plains pipeline system (OGJ Online, Nov. 1, 2013). Once integrated with the High Plains system, it is expected to provide Tesoro's West Coast facilities with cost-effective access to crude oil and provide producers additional market access.

"We expect the enhanced system to serve as an additional platform for growth and we intend to offer the business for sale to Tesoro Logistics in 2016," said Greg Goff, Tesoro chairman, president, and chief executive officer.

The deal is expected to close in first-quarter 2016.

MPLX, MarkWest complete combine

MPLX LP, a Findlay, Ohio-based master limited partnership formed by Marathon Petroleum Corp. in 2012, and MarkWest Energy Partners LP of Denver have completed their previously announced $15.8-billion merger by which MarkWest became a wholly owned subsidiary of MPLX (OGJ Online, July 13, 2015).

Effective of the deal's close, Frank M. Semple was named vice-chairman of MPLX's general partner and has been elected to its board. Semple previously served as MarkWest's chairman, president, and chief executive officer.

Separately, John C. Mollenkopf was named executive vice-president and chief operating officer, MarkWest assets, of MPLX's general partner. Mollenkopf previously served as MarkWest's executive vice-president and chief operating officer.