First-quarter oil firm earnings benefit from higher oil prices

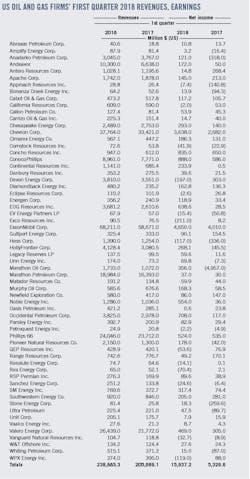

Oil and gas producers’ financial results have steadily improved in recent quarters alongside higher commodity prices. A sample of 62 US-based oil and gas producers and refiners posted combined net earnings of $15.9 billion for this year’s first quarter compared with first-quarter 2017 net earnings of $5.3 billion. Collective revenues totaled $238.8 billion, an increase of 16% from the year-ago level.

Brent crude oil prices averaged $66.76/bbl in this year’s first quarter, an increase of 24% compared with $53.78/bbl in the same quarter in 2017, and an increase of 9% compared with $61.39/bbl in fourth-quarter 2017. West Texas Intermediate crude averaged $62.88/bbl in this year’s first quarter compared with $51.83/bbl in first-quarter 2017 and $55.35/bbl in fourth-quarter 2017. Higher crude oil prices have been supported by steady demand growth, lower inventory levels, and strong compliance with production cuts by members of the Organization of Petroleum Exporting Countries.

The oil price recovery has sparked a resurgence in US production. During this year’s first quarter, US crude oil production averaged 10.23 million b/d compared with 9.01 million b/d in 2017’s first quarter and 9.94 million b/d in fourth-quarter 2017, according to data from the US Energy Information Administration.

Henry Hub natural gas spot prices averaged $3.07/MMbtu in this year’s first quarter compared with $3.01/MMbtu a year earlier, while US dry gas production climbed to 78.5 bcfd for the quarter from 71.25 tcf a year earlier.

According to Muse, Stancil & Co., refining cash margins in this year’s first quarter averaged $20.27/bbl in the Midwest, $16.02/bbl in the West Coast, $8.61/bbl in the Gulf Coast, and $2.88/bbl in the East Coast. In the same quarter of the prior year, these respective refining margins were $9.21/bbl, $16.29/bbl, $8.95/bbl, and $2.67/bbl.

Meantime, constraints related to the export of Canadian heavy crude due to a lack of pipeline capacity and delays in shipping by rail have weighed on the industry. A sample of 11 oil and gas producers and pipeline companies with headquarters in Canada posted combined net earnings of $2.76 billion (Can.) for this year’s first quarter compared with net income of $4 billion in same quarter last year.

Western Canada Select, the benchmark for heavy oil, averaged $38.67/bbl in this year’s first quarter and $37.26/bbl for the same quarter of 2017. Transport bottlenecks in Canada have widened the country’s oil discount compared with US light crude. The WTI-WCS differential widened markedly to 39% in this year’s first quarter from 28% in the same period in 2017.

US producers

ExxonMobil Corp. reported estimated first-quarter earnings of $4.65 billion compared with $4 billion a year earlier. Cash flow from operations and asset sales was $10 billion—the company’s highest quarterly cash flow since 2017. During the quarter, capital and exploration expenditures were $4.9 billion, up 17% from the prior year.

Upstream earnings for the most recent quarter were $3.5 billion, an increase of $1.2 billion from first-quarter 2017. The company’s production reached 3.9 million boe/d, down 6% from the same quarter in 2017 because of higher downtime in Canada and Papua New Guinea.

The major’s downstream earnings for this year’s first quarter decreased $176 million from a year ago, reflecting weaker non-US margins, reduced volumes due to higher US maintenance activity, and lower asset management gains.

Chemical earnings of $1 billion were $160 million lower than first-quarter 2017 because of lower margins on higher feedstock costs. Volumes were up due to the company’s Singapore acquisition, the startup of the Mont Belvieu facility, and strong demand.

Chevron Corp. reported earnings of $3.6 billion for this year’s first quarter compared with $2.7 billion in first-quarter 2017.

The company’s worldwide net production was 2.85 million boe/d in the most recent quarter, up from 2.68 million boe/d in first-quarter 2017. In the US, upstream operations earned $648 million in this year’s first quarter compared with $80 million a year earlier. International upstream operations earned $2.7 billion in this year’s first quarter compared with $1.44 billion a year ago.

Downstream, Chevron’s US operations earned $442 million in the most recent quarter compared with earnings of $469 million a year earlier, mainly because of lower margins on refined product sales and higher expenses from planned turnaround activity at the El Segundo, Calif., refinery. International downstream operations earned $286 million compared with $457 million a year earlier. The decrease in earnings was largely because of lower margins on refined product sales, partially offset by lower operating expenses.

ConocoPhillips reported first quarter earnings of $888 million compared with first-quarter 2017 earnings of $586 million. The increase was because of higher realized prices, reduced depreciation expense, and lower exploration expense, partially offset by a first-quarter 2017 financial tax accounting benefit related to the Canada disposition.

Production (excluding Libya) for this year’s first quarter was 1.2 million boe/d, a decrease of 360,000 boe/d from a year ago because of dispositions. Excluding the impact of dispositions, underlying production increased 42,000 boe/d, or 4%. The increase primarily came from a 20% ramp up of unconventional assets at Eagle Ford, Bakken, and Delaware, which more than offset normal field decline.

The Houston-based independent kept its 2018 capital budget at $5.5 billion but raised its production outlook slightly and now expects to pump 1.2-1.24 million boe/d this year.

EOG Resources reported first-quarter net income of $638.6 million compared with first-quarter 2017 net income of $28.5 million. The company increased first-quarter crude production by 15% compared with first-quarter 2017. EOG maintained its forecast for 16-20% crude growth for all of 2018.

Noble Energy Inc., which drills oil wells in the DJ basin as well as the Permian and Eagle Ford shale plays, reported first-quarter net income of $554 million, up from $36 million a year ago.

Total sales volumes across the company’s US onshore assets averaged 237,000 boe/d in this year’s first quarter, up 40% from first-quarter 2017. US onshore oil volumes totaled 103,000 b/d, up more than 30% from first-quarter 2017, with the increase primarily driven by the Delaware basin assets.

During the first quarter, the company invested $671 million in its upstream operations, with 75% deployed to its US onshore plays and 22% spent in Israel mainly for development of Leviathan field.

Hess Corp. reported a net loss of $117 million for the most recent quarter, the firm’s 14th consecutive quarterly loss. However, the loss narrowed compared with a net loss of $336 million in first-quarter 2017.

The company’s net production (excluding Libya) was 233,000 boe/d in the most recent quarter, down from 307,000 boe/d a year earlier. Lower volumes were primarily because of prior-year asset sales, the unplanned downtime at the Enchilada platform following a fire, and natural decline. These lower volumes were partially offset by higher production in the Bakken and from North Malay basin.

Hess’s average realized crude selling price, including the effect of hedging, was $59.32/bbl in this year’s first quarter, up 22% from $48.58/bbl in the same quarter a year ago.

Apache Corp. reported a 32% fall in first-quarter profits as the Houston independent failed to benefit from higher crude prices due to lower production. Apache said its total production fell 8.5% to 440,336 boe/d compared with a year earlier. However, production was largely helped by an increase in the Permian basin, which rose 24% compared with a year ago and was 41.6% of total production.

Refiners

Valero Energy Corp. reported net income of $469 million for the most recent quarter compared with $305 million for first-quarter 2017. The refiner reported first-quarter operating income of $922 million compared with $640 million in first-quarter 2017, driven primarily by higher distillate margins and partly offset by narrower discounts for medium and heavy sour crude oil vs. Brent.

Valero reported higher refining margins at its US Midcontinent and West Coast regions. Gulf of Mexico and North Atlantic margins narrowed slightly.

The company’s first-quarter refining throughput volumes averaged 2.9 million b/d, an increase of 93,000 b/d from first-quarter 2017. Valero’s refineries operated at 94% throughput capacity utilization in the most recent quarter.

Marathon Petroleum Corp. reported earnings of $37 million for this year’s first 3 months compared with $30 million in the previous year. The company’s refining and marketing segment reported a loss from operations of $133 million compared with a loss from operations of $70 million in first-quarter 2017, largely because of the February dropdown.

Marathon’s midstream segment, which largely reflects MPLX, reported record income from operations of $567 million, up from $309 million in the same quarter last year.

Phillips 66 announced first-quarter earnings of $524 million compared with first-quarter 2017 earnings of $535 million. Refining earnings were $91 million during the quarter compared with earnings of $371 million during fourth-quarter 2017. The decrease reflects lower volumes and higher costs due to heavy turnaround activity, partially offset by higher realized margins.

HollyFrontier Corp. reported first-quarter net income of $268 million compared with a net loss of $45.5 million for the same quarter last year. The first quarter results reflect special items that collectively increased net income by a total of $130.8 million, including a lower of cost or market inventory valuation adjustment that increased pretax earnings by $103.8 million.

Within the refining segment, crude charges averaged 415,260 b/d for the current quarter compared with 371,070 b/d for first-quarter 2017. Consolidated refinery gross margin was $12.83/bbl, a 70% increase from first-quarter 2017.

Canadian firms

All financial figures in this section are presented in Canadian dollars unless noted otherwise.

Suncor Energy Inc. reported first-quarter operating earnings of $985 million compared with $812 million in the prior year quarter, reflecting improved crude pricing, increased refining margins, refinery utilization of 98%, and strong in situ production, partially offset by higher maintenance expenses.

Suncor’s net earnings were $789 million in the most recent quarter compared with net earnings of $1.35 billion in the same quarter a year ago. The revaluation of US dollar denominated debt incurred an unrealized aftertax foreign exchange loss of $329 million in this year’s first quarter, while there was a gain of $103 million for such items in the prior year’s same quarter. Net earnings in the prior year’s same quarter also included an aftertax gain of $437 million related to asset sales.

Suncor’s total upstream production was 689,400 boe/d in this year’s first quarter compared with 725,100 boe/d in the same quarter last year.

The firm’s oil sands production was 404,800 b/d in the first quarter compared with 448,500 b/d in the same quarter last year. First-quarter upgrader utilization declined to 80% from 95% in the same quarter a year ago. The decrease in production and upgrader utilization was because of lower production from oil sands base due to a weather-related outage early in the quarter, partially offset by strong in situ production.

During the quarter, refinery utilization reached 98%, and crude throughput was 453,500 b/d—the highest ever in a first quarter.

Cenovus Energy reported a net loss of 654 million in the first quarter compared with net earnings of $211 million in the same quarter a year ago. During the quarter, Cenovus incurred realized risk management losses from continuing operations of $469 million compared with losses of $79 million in the same quarter a year earlier.

The company’s financial results were also negatively affected by wider light-heavy oil price differentials, planned turnarounds at two jointly owned US refineries, and an impairment on some assets in the Deep basin.

In responding to wider price differentials and transportation constraints, Cenovus temporarily slowed oil sands production at Christina Lake and Foster Creek in February and March and stored excess barrels in its reservoirs. Nevertheless, oil sands volumes nearly doubled compared with the same period a year earlier because of the company’s May 2017 asset acquisition.

Canadian Natural Resources Ltd. reported net earnings of $583 million for this year’s first quarter compared with net earnings of $245 million a year ago. The company, which operates in Western Canada, the North Sea, and offshore West Africa, achieved record production volumes in the first quarter averaging 1.1 million boe/d, representing 28% increases from the prior year quarter levels.

Imperial Oil Ltd. reported estimated net income of $516 million in the first quarter, an increase from net income of $333 million in the same period of 2017, helped by its refining and chemicals businesses. The prior year’s results also included a $151-million gain on the sale of a surplus property.

Upstream, however, Imperial recorded a net loss in the first quarter of $44 million compared with a net loss of $86 million in the same period of 2017. The narrowing loss reflects the impact of higher Canadian crude realizations of about $90 million, partially offset by unfavorable foreign exchange effects and lower production volumes.

Downstream, Imperial’s net income was $521 million in the first quarter, up from $380 million in the same period of 2017. Earnings increased mainly due to stronger margins of about $310 million, partially offset by the absence of the $151-million gain on the sale of a surplus property in 2017. Chemical net income was $73 million in the first quarter, up from $45 million in the same quarter in 2017, mainly because of stronger margins.

TransCanada’s comparable earnings for this year’s first quarter were $870 million compared with $698 million for the same period in 2017. The increase reflects earnings from intra-Alberta pipelines, higher volumes on the Keystone pipeline system, increased earnings from Columbia Gas, and Columbia Gulf growth projects.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.