WEST AFRICA-1: Undiscovered oil potential still large off West Africa

For more than half a century the West Africa region, in particular the countries bordering the Gulf of Guinea and Congo Delta, has been one of the most exciting and attractive regions in the world for the oil industry.

A review of E&P literature as well as an assessment of the strategy of all major international oil companies reveals that this region has not only remained attractive in recent years but that in the future it will become even more important.

From an E&P perspective, the excellent exploration record and the start of many new fields over the last few years particularly in deep water are proof that the region has remained attractive. However, the facts that oil production will continue to expand in the coming years and that more oil is to be found clearly indicate that the region will become even more important in the future.

The countries that comprise West Africa include Nigeria and several non-OPEC countries. The latter group includes seven important producers, three small producers, and many nonproducers.

The important producers are Angola (defines the southern limit of West Africa), Cameroon, Congo (Brazzaville), Gabon, Equatorial Guinea, Ivory Coast, and Mauritania (defines the northern limit of West Africa). The small producers are Benin, Ghana, and Senegal. The nonproducers include Gambia, Guinea, Guinea Bissau, Liberia, Sao Tome and Principe, Sierra Leone, and Togo.

Considering the well-known challenges that face many of these countries that inevitably affect the oil industry, it is worth reflecting on two key points.

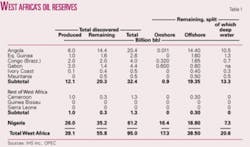

First, the number of exploration wells drilled in West Africa (including Nigeria) over the last 10 years (1996-2005) accounts for 5% of the world total, but in terms of volume the region contributed 21% of the total oil reserves discovered globally and 40% of the reserves discovered in deepwater provinces in the world.

Second, on the supply side, in the last 5 years (2001-05) West Africa excluding Nigeria was the second best performing non-OPEC region after the FSU; the region’s oil supply increased to 2.3 million b/d in 2005 from 1.6 million b/d in 2000.

Given that it took 40 years to reach 1.5 million b/d (1960 to 2000), the recent response is clearly strong. Nigeria, the largest producer in West Africa and an OPEC member, also saw its production capacity expand to 2.6 million b/d in 2005 from 2.2 million b/d in 2000, and this came despite unexpected capacity losses in 2003 in some parts of the Delta.

In the medium term, most studies conclude that the region will be able to deliver stronger growth than in the 2001-05 period. OPEC’s medium-term world oil supply forecast shows that West Africa’s oil production excluding Nigeria is expected to increase to 3.8 million b/d by 2012, driven by over 26 new deepwater developments. Nigeria’s production capacity will also rise to 4 million to 4.2 million b/d by 2012, driven by more than 15 developments in deep and shallow water.

This article is divided in two parts. Part one provides an overview of recent E&P trends in deep water, undiscovered oil potential, current production by type of environment, cost trends, and active players. Part two will provide a summary of the key projects to come on stream in West Africa and OPEC’s medium term oil supply outlook for the main producing countries.

If there is one conclusion to be drawn from this article, it is that despite the well-known challenges that face many West African countries, the region has delivered in the past and will deliver again.

History and recent trends

West Africa including Nigeria is a large, world-class petroleum province with over 140 billion bbl (2P) of oil and gas reserves discovered since the 1950s.

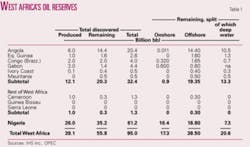

During the first 40 years, the success of E&P activities was excellent, focusing initially on the onshore and later on the shallow offshore. By the end of 2005, a total of 75 billion bbl of oil (2P) have been discovered in the onshore and shallow offshore, of which 38.6 billion have been produced (Table 1).

A shift to deepwater exploration (>500 m of water) began in the early 1990s, and this has also turned out to be a great success. Since the first well was drilled in 1995, a total of 21 billion bbl of oil reserves have been discovered, of which 500 million bbl have been produced (Table 2).

At the end of 2005, total remaining oil reserves (total cumulative discoveries less cumulative production) were estimated at 55 billion bbl, and 25 billion bbl of this were discovered just in the last 10 years (1996-2005). During this period, 567 exploratory wells were drilled, 493 of them offshore, resulting in 225 new oil discoveries (~100 in deep water and 102 in shallow water).

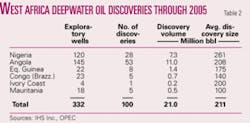

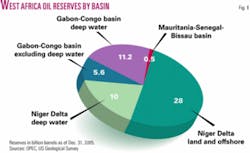

Most of the recent exploration and success took place in three prolific provinces (Fig. 1): the Niger Delta Tertiary system (central West Africa-Gulf of Guinea), the Gabon-Congo Province (southern West Africa), and the Mauritania-Senegal-Bissau Province (northern West Africa).

The Niger Delta is the richest, covers more than 300,000 sq km, and is unique given that it has only one petroleum system, the “Tertiary Niger Delta System,” the majority of which lies in Nigeria and extends onshore, offshore, and into deep water.

The province, which includes the Rio del Rey basin, is also the main source of hydrocarbons in Cameroon, Equatorial Guinea, and Sao Tome and Principe. In fact, it is the main system in most countries that border the Gulf of Guinea and in Ivory Coast to the west.

At the end of 2005, remaining oil reserves in this province (including Rio del Rey) were estimated at 38 billion bbl (2P), of which the onshore and shallow water portions hold 29 billion bbl. In the deepwater portion, where most of the recent success has taken place, 9 billion bbl have been discovered in over 30 fields.

The Gabon-Congo Province is the second richest. It stretches south of the Gulf of Guinea along the West African coastline from Gabon to Angola out to more than 3,000 m of water. It is composed of several basins, the most important of which is the Congo basin.

At the end of 2005, total remaining oil reserves for this large province were estimated at 16 billion bbl (2P), of which 11.7 billion bbl were discovered in the deepwater part of the Congo basin in Angola in over 50 discoveries. Further success has taken place in deepwater Congo (Brazzaville), although this part has been less explored compared with deepwater Angola. In Angola are two other basins, Kwanza and Namibe, but limited exploratory activity has located only limited hydrocarbons.

The Mauritania-Senegal-Bissau (MSB) Province covers 600,000 sq km along the northern West Africa offshore margin and extends from Guinea to Mauritania. This province is composed of several basins, the most prospective being the Senegal basin.

The basins in the MSB province are thought to contain the necessary elements of successful petroleum systems, but exploration has been successful only in limited areas. One accumulation off Senegal is thought to contain 800 million bbl of heavy oil but remains unproven, while in Mauritania some discoveries totaling 500 million bbl (2P) have been made in deep water.

Undiscovered oil potential

It is probably impossible to find a technical publication or study that would not conclude that the explored basins, emerging deepwater basins, and unexplored basins of West Africa, in particular the offshore parts, still have significant volumes of oil yet to be found.

A fair review of the literature indicates that the onshore portions of the provinces are mature but continue to offer exploration opportunities, the shallow water portions have material upside, while the deepwater portions, in particularly the Niger Delta basin, represent the biggest opportunity. The estimates may range significantly for key basins and hydrocarbon plays, but the bottom line is that all indicate a relatively large amount of oil yet to be found.

The only source available that gives detailed estimates for undiscovered oil reserves on a country basis based on a common methodology is the US Geological Survey.

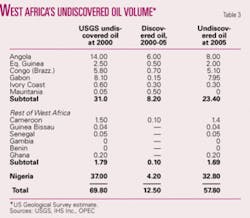

In 2000 the USGS published the World Petroleum Assessment of undiscovered resources covering many basins. One of the conclusions of this global and unique study was that the Gulf of Guinea and Congo Delta areas off West Africa hold some of the greatest volumes of undiscovered oil in the world (Table 3).

The study contains assessments of mean undiscovered volumes in assessed portions of many countries, and based on the reported number for each country the total estimated undiscovered volume of oil in West Africa (including Nigeria) was 70 billion bbl. However, some 12 billion bbl were discovered in 2001-05, leaving presumably some 58 billion bbl yet to be discovered.

It is worth mentioning that the USGS country estimates do not include reserves growth, which in the case of prolific basins such as the Niger Delta could represent another 10% to 30% of the remaining hydrocarbons (5 to 15 billion bbl).

Oil production

In 2005, West Africa produced 4.9 million b/d of oil, of which Nigeria accounted for 2.6 million b/d, from 200 fields and 2,400 producing oil wells in the region excluding Nigeria and from 241 fields and 2,600 producing oil wells in Nigeria.

By type of environment, 1.13 million b/d of the oil production in West Africa (excluding Nigeria) came from 8 large projects grouping several fields.

Angola was the largest deepwater producer with the most projects on stream (5 projects: Xikomba, Kizomba A and B, Girassol, and Jasmin), followed by Equatorial Guinea (2 projects: Zafiro and Ceiba), and Ivory Coast (1 project: Baobab).

It is interesting to note that the number of deepwater oil discoveries on stream is low relative to the total number of deepwater discoveries made to date. Some 900,000 b/d of the total production (excluding Nigeria) came from 13 developments grouping over 100 shallow water fields and more than 50% of the total onshore production of 300,000 b/d from 3 development areas grouping several fields (Table 4).

In Nigeria, 1.2 million b/d came from 14 onshore projects grouping some 200 fields. The shallow offshore accounted for 1.3 million b/d of total country oil production. Some 30 fields were producing, but 4 projects accounted for 40% of the 1.3 million b/d of production. At the end of 2005, two deepwater projects were on stream (Abo and Bonga), which produced around 130,000 b/d. Bonga was still ramping up to its design capacity of 200,000 b/d.

Overall, most of the production increase came from deepwater fields discovered in the last decade. The region’s first deepwater discovery came in 1995 off Equatorial Guinea, and its first oil was produced 2 years after. However, 10 years later (2005) total deepwater oil production from the region reached 1.3 million b/d, to represent 36% of global deepwater production.

Cost environment

According to various estimates, West African countries are characterized for being low-cost producers, and this is another reason that makes the region attractive even though technical costs have been rising in the last few years.

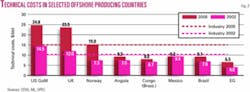

The technical cost (sum of finding, development, and production costs per barrel) in Angola, Congo (Brazzaville), and Equatorial Guinea averaged $8.70/bbl in 2005 compared with the global industry average of $14.90/bbl. Technical costs in Nigeria were estimated to be in the range of its West African neighbors.

In the last 10 years, production costs among West Africa’s largest producers have remained flat and even declined even though production from deepwater fields has risen rapidly.

The conventional wisdom is that deepwater fields tend to have higher production costs than shallow water fields and that therefore costs should rise, but this does not appear to be the case thanks to the geology, reservoir properties, technology, and good cost management. However, looking at finding and development (F&D) costs, the average cost in Angola, Congo, and Equatorial Guinea show an increase in 2005 vs. 2002 of 50% to 75% primarily due to higher rig and materials costs (Fig. 2).

Active players

International operators produce most of the oil in West Africa.

Many of these have been in the region since the early days of exploration, but new companies have also gained access including national oil companies and independents.

It’s worth mentioning that no international oil company has ever exited West Africa completely; in fact most continue to increase their presence in existing or new countries by expanding existing projects and taking new ones.

In terms of oil production share, in 2005 the top international companies (BP, Chevron, ConocoPhillips, Eni, Exxon, Shell, Statoil, and Total) produced 4.3 million b/d or 88% of the total oil, but their entitlement (net oil) was 2.7 million b/d or roughly 55%. International independents and local companies (nongovernment owned) produced the rest, and these amounted to over 70 companies (Fig. 3).

Most of the companies operate under favorable production-sharing contracts that allow even the most challenging fields in deepwater Nigeria and Angola to be developed at a good financial return; only a handful of fields remains under different arrangements (Block 0 in Angola and Yombo field off Congo-Brazzaville are concession agreements), but these, too, have favorable conditions.

In contrast to conventional wisdom, all contracts have remained relatively stable in recent years, but the general terms have been renegotiated in close coordination with the operators to reflect evolving global and local conditions. Importantly, the upward trend in production is a clear reflection that the industry has been working effectively in the region.

Next: Expect West Africa’s oil production increases to continue, second only to Russia among non-OPEC suppliers.

The authors

Mohammed Sanusi Barkindo is acting for the secretary general at the OPEC Secretariat in Vienna. Prior to coming to the Secretariat, he was the Nigerian government’s national representative to OPEC. He has a BS in political science from Ahmadu Bello University, an MBA from Southeastern University, and a postgraduate diploma in petroleum economics and management from Oxford University.

Ivan Sandrea ([email protected]) is principal oil supply analyst for OPEC. He previously worked as a global E&P analyst for Merrill Lynch in London, and before that was an exploration geologist for British Petroleum in Venezuela, Norway, and Egypt. He holds a BS in geology from Baylor University, an MS in petroleum geology, and an MBA from Edinburgh University.