Russian share of European gas market to keep growing

Eugene Khartukov

Moscow State University for International Relations

Moscow

At the beginning of October 2018, Russian President Vladimir Putin estimated his country’s total 2018 natural gas deliveries to Europe at 200 billion cu m (bcm), an almost 3% increase over 2017’s record volumes. The Russian president noted that European countries would inevitably consume Russian gas because of its cost advantage.

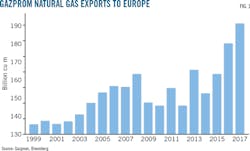

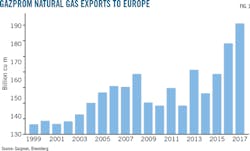

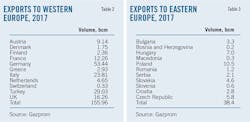

In 2017, Gazprom Group supplied a total of 193.3 bcm of gas to European countries under long-term contracts and nearly 194.4 bcm including spot gas sales. Western European countries (including Turkey) accounted for about 81% of these volumes, while Eastern European states took 19%. Table 1 and Fig. 1 show Gazprom’s gas exports to Europe.

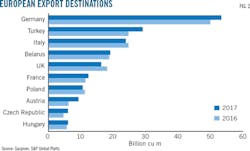

In 2017, Gazprom Export delivered 155.96 bcm to Western Europe (Table 2). Germany, followed by Turkey and Italy, was the largest buyer of gas from Russia, accounting for more than one-third of deliveries to Western Europe in 2017 (Fig. 2).

The Eastern European natural gas market, however, is important to Russia because of its geographic proximity. Russian gas accounts for more than a half of the region’s consumption. In 2017, Gazprom Export sold 38.4 bcm into Eastern Europe (Table 3).

Gazprom is the only legal gas-export company in Russia, no other Russian gas producer can use export pipelines and LNG export plants. Gazprom’s gas exports, therefore, are Russia’s gas exports. But they also include a mixture of Turkmen, Uzbek, and Kazakh supplies delivered via pipeline to Gazprom for the explicit purpose of export.

Export figures provided by Gazprom (178.3 bcm in 2016 and 194.4 bcm in 2017) are in Russian cubic meters. Russian cubic meters are measured at a 20° C. and 760 mm of mercury (Hg) as compared with standard European cubic meter at 15° C. and 760 mmHg. A cubic meter of standard Russian gas provides less heat than a cubic meter of gas consumed in Europe. Russian volumes should be adjusted downwards by 1.74% to make them comparable with European volumes.

Gazprom also does not include shipments to the Baltic states (Latvia, Lithuania, and Estonia) as exports to Europe, despite the countries being members of the European Union. Russia sold a combined 2.6 bcm to the three countries in 2016 and almost 3.7 bcm in 2017.

A total of 4-5% of gas sent from Russia to Western Europe is consumed during transit as fuel gas.

Nord Stream 2

Putin casts the Nord Stream 2 gas pipeline project as in the interest of both Russia and Western Europe, especially given growing European demand. The Russian leader said he hopes Europe will be able to defend its participation in the Nord Stream 2 gas pipeline project. Meanwhile, construction of the pipeline’s offshore segment started in Finland in September 2018.

The original Nord Stream pipeline was needed to avoid gas flow disruptions in Ukraine (and eventually Belarus). It runs on the bottom of the Baltic Sea from Portovaya Bay near the city of Vyborg to the German coast near Greifswald, stretching 1,224 km (nearly 761 miles), the longest offshore gas pipeline in the world. The system’s two lines carry a combined 55 bcm/year (bcmy). Gas shipment began Sept. 6, 2011.

Nord Stream 2 will have roughly the same specifications as Nord Stream and also end in Greifswald, but start near Ust-Luga. Nord Stream 2 AG signed financing agreements with Engie, OMV, Royal Dutch Shell, Uniper SE, and Wintershall Holding GMBH, for the pipeline.

Gazprom expects Nord Stream 2 to enter service end-2019. The total cost of the pipeline is estimated at €9.5 billion.

European market

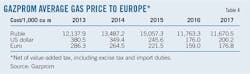

In 2017 Gazprom’s average export price increased by 17.8% year-on-year, to $200/thousand cu m (Table 4). As they are linked to oil prices, export prices of Russian gas followed the oil market. The clearest example of this was the price for Germany, the biggest buyer of natural gas from Russia. Prices for Russian gas at the Polish-German border, which exceeded $10.50/MMbtu in mid-2014 had dropped to less than $4.00/MMbtu by end-May 2016

Wood Mackenzie reported in March 2018 that Russia exported a record almost 190 bcm to Europe in 2017, a 12% increase on 2016 and a 37% share of the European gas market. Russian piped exports to Europe and Turkey will remain in the 160-180 bcm range over the next 5 years as Gazprom looks to pursue market share and maintain a more than 30% share of the European market, according to the consultant. Pipeline supplies to China will start by end-2019 and ramp-up through the early 2020s reducing Gazprom’s exposure to the European market.

Speaking at Gazprom Investor Day in New York on Feb. 6, 2018, Kiril Polous, Gazprom’s head of directorate, stated that the company’s share of the European gas market would increase to 35% in 2025 from 31% in 2015.

The Paris-based Observatoire Méditerranéen de l’Energie (OME) in 2017 predicted that exports of gas from Russia to Europe would grow to 207 bcm in 2030 from 139 bcm in 2005, resulting in a market share of 37% vs. 46.5%.

The author

Eugene M. Khartukov ([email protected]) teaches world oil and energy markets research at the Moscow State University for International Relations (MGIMO), Ministry of Foreign Affairs. Since 1984, Khartukov has led the Moscow-based World Energy Analysis & Forecasting Group, advising and consulting on oil and gas economics and policies and energy pricing to various Soviet-Russian ministries, international agencies, foreign governments, private oil and gas companies, consulting firms and financial institutions, and the administrations of Soviet-Russian leaders Mikhail Gorbachev, Boris Yeltsin, and Vladimir Putin. Since 1995 he has served as vice president (for Eurasia) of Petro-Logistics Ltd., Switzerland, becoming general director of the (International) Center for Petroleum Business Studies, Moscow, and professor of marketing, management and commerce at MGIMO the next year. Khartukov earned his PhD (1980), doctor of sciences (1993), and professor certification (1994) at MGIMO.