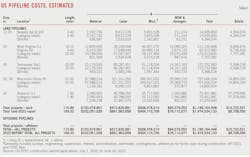

Land pipeline construction costs hit record $10.7 million/mile

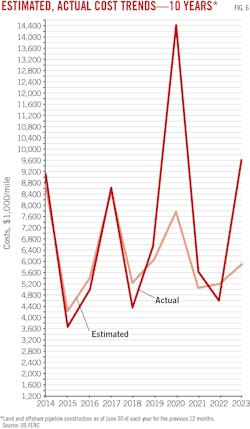

Sharply higher miscellaneous costs overwhelmed lower material costs to increase the price of building land pipelines by more than $2 million/mile. Both labor and right-of-way (ROW) costs also increased year-on-year. The increase in total estimated $/mile land pipeline construction costs moved them to a record $10.7 million/mile, 23% more than 2022.

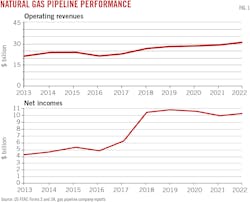

US oil and gas pipeline operators’ revenues, meanwhile, continued to grow in 2022, mirroring the ongoing recovery of the underlying industry. Net incomes for liquids pipelines rose by nearly 11%, to reach a new all-time high of $20.3 billion.

Natural gas pipeline operators’ net incomes also improved, edging 0.4% higher after falling for two straight years (Fig. 1). These companies’ investments in additions to gas plant slumped, however, dropping more than 7.5% as market uncertainty remained. Expenditures on operations and maintenance grew roughly 12%.

Applications for new pipeline construction were down, reflecting both the jump in costs and the increasingly uncertain regulatory environment which helped fuel them.

Property additions to liquid lines continued to plummet, falling more than 68% in 2022, as companies reacted cautiously to returned demand given the other economic variables at hand.

Details

Oil pipeline earnings as a percent of revenue continued to improve—approaching 54%—but remained below the levels reached in 2019. Natural gas pipeline operators’ net incomes as a share of revenue, however, continued to slide, settling to just under 33%, the lowest level since 2017.

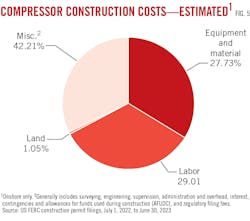

A more than three-fold increase in compression construction costs ($8,240/hp) was accompanied by an 80% drop in proposed work, to just below 100,000 hp of new projects.

Actual land pipeline construction costs for projects completed in the 12 months ending June 30, 2023, were roughly $3.7 million/mile greater than estimated costs. A sample size of one small project limits the breadth with which this data can be applied elsewhere, but the primary difference—sharply higher labor costs—is a theme echoed across the industry.

US pipeline data

At the end of this article, two large tables offer a variety of data regarding US oil and gas pipeline companies: revenue, income, volumes transported, miles operated, and investments in physical plants. These data are gathered from annual reports filed with FERC by regulated oil and natural gas pipeline companies for the previous calendar year.

Data are also gathered from periodic filings with FERC by those regulated natural gas pipeline companies seeking FERC approval to expand capacity. OGJ keeps a record of these filings for each 12-month period ending June 30.

Combined, these data allow an analysis of the US regulated interstate pipeline system.

- Annual reports. Companies that FERC classifies as involved in the interstate movement of oil or natural gas for a fee are jurisdictional to FERC, must apply to FERC for approval of transportation rates, and therefore must file a FERC annual report: Form 2 or 2A, respectively, for major or nonmajor natural gas pipelines; Form 6 for oil (crude or product) pipelines.

The distinction between “major” and “nonmajor” is defined by FERC and appears as a note at the end of the table listing all FERC-regulated natural gas pipeline companies for 2022 at the end of this article.

The deadline to file these reports each year is in April. For a variety of reasons, companies often miss that deadline and apply for extensions but eventually file an annual report. The deadline and numerous delayed filings explain why publication of this OGJ report on pipeline economics occurs later in each year. Earlier publication would exclude many companies’ information.

- Periodic reports. When a FERC-regulated natural gas pipeline company wants to modify its system, it must apply for a “certificate of public convenience and necessity.” This filing must explain in detail the planned construction, justify it, and––except in certain instances—specify what the company estimates construction will cost.

Not all applications are approved. Not all that are approved are built. But assuming a company receives its certificate and builds its infrastructure, it must—again, with some exceptions—report back to FERC how its original cost estimates compared with what it spent.

OGJ monitors these filings from July 1 to June 30 each year, collecting them, and analyzing their numbers.

Reporting changes

The number of companies required to file annual reports with FERC may change from year-to-year, with some companies becoming jurisdictional, others nonjurisdictional, and still others merging or being consolidated out of existence. Such changes require care be taken in comparing annual US petroleum and natural gas pipeline statistics.

Only major gas pipelines are required to file miles operated in a given year. The other companies may indicate miles operated but are not specifically required to do so.

Reports for 2022 show a decrease in FERC-defined major gas pipeline companies: 101 companies of 185 filing, from 102 of 184 for 2021.

FERC-regulated major natural gas pipeline mileage grew in 2022 (Table 1), final data showing an increase of 339 miles, or 0.2%. Oil mileage also grew incrementally, adding 721 miles (0.4%).

Rankings; activity

Natural gas pipeline companies in 2022 grew revenues by roughly $1 billion (3.3%) for the second consecutive year. Net income, however, rose by just $37 million (0.4%), Even this, however, was a reversal of two straight years of losses.

Improved liquids pipeline earnings came on the back of a 7% increase in product deliveries, crude shipments having slipped 6.4% year-on-year.

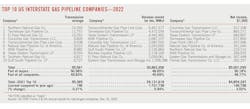

OGJ uses the FERC annual report data to rank the Top 10 pipeline companies in three categories (miles operated, trunkline traffic, and operating income) for oil pipeline companies and three categories (miles operated, gas transported for others, and net income) for natural gas pipeline companies.

Positions in these rankings shift year to year, reflecting normal fluctuations in companies’ activities and fortunes. But also, because these companies comprise such a large portion of their respective groups, the listings provide snapshots of overall industry trends and events.

For instance, earnings for the Top 10 oil pipeline companies fell 4.7% compared with the 11% overall increase for the segment, suggesting that the larger operators suffered headwinds not faced by the industry as a whole. The Top 10 companies’ share of the segment’s total earnings shrank accordingly, to 37.6% vs. the 43.8% share of earnings held in 2021.

The bulk of the lower earnings by the Top 10 most-profitable gas pipeline companies, was attributable to an $835.5-million (53%) dip in net income at Plains Pipeline LP. In fourth-quarter 2022, Plains formed a new entity—Plains Pipeline MidCon LLC—as a wholly owned subsidiary. This reorganization caused Plains to report a $415-million ‘unusual or infrequent items, debit’ as part of its FERC filing for the year.

Net income as a portion of natural gas pipeline operating revenues eased to 33% in 2022, the fourth straight decline but still above the 27% posted in 2017. The percentage of income as operating revenues for oil pipelines rose to 54%, the second consecutive increase but still below the all-time high of 60% in 2019 and other years going back through 2017.

Net income for major natural gas pipelines as a portion of gas-plant investment was steady at 4.6%. Net income as a portion of investment in oil pipeline carrier property grew to 13%, still below 2019’s recent high of 14.3%.

Major and nonmajor natural gas pipelines in 2022 reported total gas-plant investment of roughly $226 billion, the highest level ever, up from $219.5 billion in 2021, $213 billion in 2020, $206 billion in 2019, $197 billion in 2018, $171 billion in 2017, $158.5 billion in 2016, $158 billon in 2015, $152 billion in 2014, and about $147 billion in 2013.

Investment in oil pipeline carrier property also continued to grow in 2022, reaching more than $157 billion. Carrier property in 2021 was $156.5 billion, up from 2020’s total of $149 billion, $138 billion in 2019, $122 billion in 2018, $112 billion in 2017 and $99.5 billion in 2016, after reaching $93 billion in 2015, nearly $85 billion in 2014, and $68 billion in 2013.

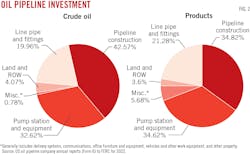

OGJ for many years has tracked carrier-property investment by five crude oil pipeline and five products pipeline companies chosen as representative in terms of physical systems and expenditures (Table 3). In 2003, we added the base carrier-property investment to allow for comparisons among the anonymous companies.

The five crude oil pipeline companies in 2022 increased their overall investment in carrier property by more than $457.5 million (2.3%).

The five products pipeline companies saw their overall investment in carrier property increase 2.9% in 2022, or more than $297 million.

Fig. 2 illustrates how investments in the crude oil and products pipeline companies were divided.

Construction mixed

Applications to FERC by regulated interstate natural gas pipeline companies to modify certain systems must, except in certain instances, provide estimated costs of these modifications in varying degrees of detail.

Tracking the mileage and compression horsepower applied for and the estimated costs can indicate levels of construction activity over 2-4 years. Tables 4 and 5 show companies’ estimates during the period July 1, 2022, to June 30, 2023, for what it will cost to construct a pipeline or install new or additional compression.

These tables cover a variety of locations, pipeline sizes, and compressor-horsepower ratings.

Not all projects proposed are approved. And not all projects approved are eventually built.

- Roughly 111 miles of pipeline were formally proposed to FERC for land construction in the 12 months ended June 30, 2023, with no offshore work submitted. The land level was down from the 169 miles submitted in 2022, but more than the 77 miles submitted in 2021. Roughly 367 miles were proposed in 2020. The 246 miles proposed for land construction in 2019, were well below the roughly 545 miles proposed in 2018.

- New or additional compression proposed by the end of June 2023 exceeded 98,000 hp, a fraction of the 502,000 hp applied for in 2022. Nearly 200,000 hp were proposed in 2021 and 680,000 hp in 2020. Compression proposals in 2019 totaled 292,000 hp, with 287,000 hp proposed the year before.

Putting the reduced US gas pipeline construction in perspective, Table 4 lists 5 land-pipeline “spreads,” or mileage segments, and 0 marine projects, compared with:

- 19 land and 0 marine projects (OGJ, Oct. 3, 2022, p. XX).

- 9 land and 0 marine projects (OGJ, Oct. 4, 2021, p. 52).

- 18 land and 0 marine projects (OGJ, Oct. 3, 2020, p. 42).

- 18 land and 0 marine projects (OGJ, Oct. 7, 2019, p. 46).

- 11 land and 0 marine projects (OGJ, Oct. 1, 2018, p. 60).

- 27 land and 1 marine projects (OGJ, Oct. 2, 2017, p. 71).

- 33 land and 0 marine projects (OGJ, Sept. 5, 2016, p. 89).

- 46 land and 0 marine projects (OGJ, Sept. 7, 2015, p. 114).

- 31 land and 0 marine projects (OGJ, Sept. 1, 2014, p. 122).

- 26 land and 2 marine projects (OGJ, Sept. 2, 2013, p. 117).

Only one spread in 2023 measured 50 miles or more, a 30- and 36-in. OD transmission line running 51 miles through Wisconsin and Illinois.

For the 12 months ending June 30, 2023, the 5 land projects filed would cost an estimated $1.2 billion, compared with the 19 land projects filed for $1.5 billion a year earlier. Estimated construction costs rose by roughly $2 million/mile.

These statistics cover only FERC-regulated pipelines. Many other pipeline construction projects were announced in the 12 months ending June 30, 2023, but were outside FERC’s jurisdiction.

Estimated 2022-23 $/mile costs for new onshore projects as filed by operators with FERC were a record $10.7 million/mile, exceeding the $9.95 million/mile estimates from 2017-18. In 2021-22 the average cost was $8.7 million/mile. In 2020-21 the average cost was $8.3 million/mile.

Cost components

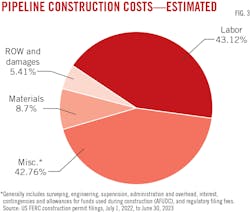

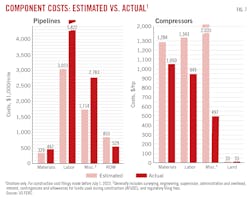

Variations over time in the four major categories of pipeline construction costs—material, labor, miscellaneous, and right-of-way (ROW)—can also suggest trends within each group.

Materials can include line pipe, pipe coating, and cathodic protection.

“Miscellaneous” costs generally cover surveying, engineering, supervision, contingencies, telecommunications equipment, freight, taxes, allowances for funds used during construction (AFUDC), administration and overheads, and regulatory filing fees.

ROW costs include obtaining rights-of-way and allowing for damages.

For the 5 spreads filed for in 2022-23, project cost-per-mile rose in all categories except material, which fell by more than 50%. A near doubling of miscellaneous costs, however, more than eclipsed the potential material-cost savings. In 2021-22 miscellaneous costs were the only ones to decrease.

Miscellaneous charges in 2011 passed material to become the second most expensive cost category and in 2017 they passed labor costs to become the most expensive category of all. For the past 5 years, however, labor has reclaimed its throne, despite the spike in miscellaneous cost estimates experienced this cycle:

- Material—$933,933/mile, down more than half from $1,960,970/mile for 2021-22.

- Labor—$4,628,401/mile, a more than $700,000/mile increase from $3,909,311 for 2021-22.

- Miscellaneous—$4,589,154/mile, up more than $2-million/mile from the $2,386,528/mile estimated cost for 2021-22.

- ROW and damages—$581,043/mile, a second consecutive large increase from the, $449,490/mile cost for 2021-22 and the $337,818/mile for 2020-21.

The rise in estimated miscellaneous costs was prompted by higher contingency, administrative, and overhead estimates as regulatory, political, and environmental activism-related concerns mounted.

The average cost-per-mile for the projects rarely shows clear-cut trends related to either length or geographic region. In general, however, the cost-per-mile within a given diameter decreases as the number of miles rises. Lines built nearer populated areas also tend to have higher unit costs.

Additionally, road, highway, river, or channel crossings and marshy or rocky terrain each strongly affect pipeline construction costs.

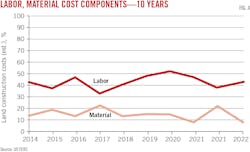

Labor is the most expensive category and the most volatile. Labor’s 2023 portion of estimated costs continued its descent from the recent high of 52.4% reached in 2020, falling to 43.1% from 44.9% in 2022, and 46.8% a year earlier. Labor’s portion of costs was 48.7% in 2019, 40.6% in 2018, 35.8% in 2017, 47% in 2016, 37.8% in 2015, 42.4% in 2014, and 38.8% in 2013.

Material costs’ portion of land pipeline costs plunged to a new low of 8.7% in 2023, down sharply from the 22.5% portion in 2022 and even the recent low of 9.9% reached in 2021. Labor’s 2022 share was the largest it had been since 2013, measuring 14.9% in 2020, 15% in 2019, 13.1% in 2018, 22.4% in 2017, 13% in 2016, 19.3% in 2015, 13.6% in 2014, and 23.2% in 2013.

Fig. 5 shows the cost split for land compressor stations based on data in Table 5.

Table 6 shows that the average cost per mile for any given diameter may fluctuate year-to-year as projects’ costs are affected by geographic location, terrain, population density, and other factors.

Completed project costs

In most instances, a natural gas pipeline company must file with FERC what it ended up spending on an approved and built project. This filing must occur within 6 months after a pipeline’s successful hydrostatic testing or a compressor’s being put in service.

Tables 7 and 8 show actual costs for pipeline and compressor projects reported to FERC during the 12 months ending June 30, 2023. Fig. 7, for the same period, depicts how total actual costs ($/mile) for each category compare with estimated costs.

The single final cost filing for the 12 months reflects the relatively limited number of projects that have been applied for over the past few years.

If a project was reported in construction spreads in its initial filing, that’s how projects are broken out in Table 7. Completed projects’ cost data, however, are typically reported to FERC for an entire filing, usually but not always separating pipeline from compressor-station (or metering site) costs and lumping various diameters together.

The 12 months ending June 30, 2023, saw almost 55,000 hp completed, roughly 87% less than the year before. Actual compression costs of $2,529/hp were similar to the year before and 46% lower than estimates, with costs in every category lower than or flat with what initially had been filed (Table 8).

US Pipeline Data Tables

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.