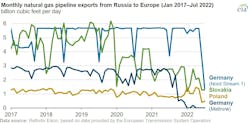

Russia’s natural gas exports by pipeline to the European Union (EU) and UK declined by almost 40% during the first 7 months of 2022 compared with the same period in 2021 and by almost 50% compared with the previous 5-year (2017–21) average, according to data from Refinitiv Eikon and published by the US Energy Information Administration (EIA).

In mid-July 2022, exports declined to 1.2 bcfd, the lowest level in nearly 40 years. Between 2016 and 2020, Russia had accounted for about one-third of EU and UK pipeline gas supplies, according to Eurostat.

Russia exports natural gas to the EU and UK through three major pipeline corridors, which account for about 16 bcfd of import pipeline capacity when combined with smaller interconnections, according to data from Gazprom:

- Offshore via the 55-billion cu m/year (bcmy) Nord Stream 1 pipeline into Germany (at Greifswald) and further to the Netherlands, France, UK, and other European countries.

- Belarus to Poland (at Kondratki) and Germany (at Mallnow, the westernmost point of the 33-bcmy Yamal pipeline).

- Ukraine to Slovakia (at Velke Kapusany), where the natural gas pipeline branches out to the Czech Republic, Austria, and Hungary via Slovak gas-system operator Eustream, transporting natural gas to northern and southern Europe.

To compensate for lower natural gas pipeline exports from Russia, the EU and the UK have been importing record-high volumes of LNG this year, particularly from the US. Europe has also been accelerating LNG terminal development (OGJ Online, Aug. 1, 2022).

The International Energy Agency (IEA) last month, however, called for coordinated action across Europe to prevent a major gas-supply shortfall (OGJ Online, Aug. 1, 2022). IEA emphasized that available additional supplies will be insufficient to close the gap in supplies from Russia and that Europe must reduce gas consumption and store the saved gas.

Russia’s natural gas pipeline exports to the EU and UK have been declining since 2020, initially as a result of reduced demand in Europe because of responses to the COVID-19 pandemic. In mid-2021, Russia began to limit its natural gas exports to Europe to long-term contracted volumes only and ended spot-market sales. Russia’s natural gas exports to the EU and UK averaged 16 bcfd in 2019, 12.4 bcfd in 2020, and 10.9 bcfd in 2021.

The most significant decline in Russia’s exports has been into Germany via Nord Stream 1. Exports on Nord Stream 1 declined to 1.4 bcfd in July 2022, only 20% of its 5.6-bcfd design capacity. Russia’s deliveries to Germany at Mallnow also declined significantly, starting in October 2021, according to EIA.

Pipeline flows from Russia into Slovakia averaged 1.8 bcfd so far in 2022, compared with the previous 5-year average of 4.2 bcfd for the same period. EIA said pipeline flows declined, in part, because a natural gas compressor station located in Ukraine was taken offline. Russia’s natural gas deliveries into Poland and neighboring countries via Belarus averaged 900 MMcfd from January 2021 through April 2022, declining to 200 MMcfd since then, according to EIA.