Flat near-term pipeline plans buoyed by US growth

Planned worldwide pipeline construction to be completed in 2019 was relatively flat from the previous year, with higher expected crude and products project completions balancing smaller projected natural gas pipeline numbers. US projects grew as a portion of total planned build as operators sought expanded avenues for bringing burgeoning crude, NGL, and gas production to market. Plans for US construction in 2019 made up 44% of the total as compared with just 24% in 2018.

Future planned mileage slipped for the second straight year as international activity slowed somewhat.

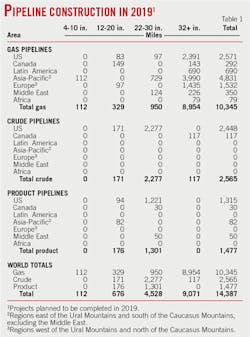

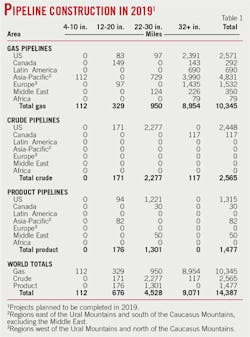

Operators plan to install 14,387 miles in 2019 alone (Table 1), with natural gas plans (10,345 miles) making up more than 72% of the total, based on data collected by Oil & Gas Journal. By contrast, gas pipelines made up about 81% of total planned construction a year earlier.

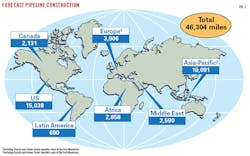

As 2019 began, operators had announced plans to build nearly 32,000 miles of crude oil, product, and natural gas pipelines extending into the next decade, a roughly 5% decrease from data reported the prior year (OGJ, Feb. 5, 2018, p. 73). The slide came despite the US strength and expanded long-term plans for gas pipeline construction in the Asia Pacific.

Combining both current-year and forward estimates (Fig. 1), increases in planned construction in the US and Africa were outweighed by decreases elsewhere.

Outlook

EIA forecast world liquid fuels consumption to increase by 18.9% through 2040 (using a 2015 baseline), a period that encompasses the long-term pipeline construction projections stated here. This rate of growth was down sharply from EIA’s year-earlier forecast, which called for a 34.4% increase from a 2012 baseline.

Demand growth will be strongest, according to its September 2017 International Energy Outlook (IEO), among non-OECD countries, growing at a base-case 1.3%/year rate compared with a 3% decrease in the OECD over the same period. This growth will be led by Asia, with its non-OECD countries making up 80% of the total worldwide growth expected as both China and India experience rapid industrial growth and increased transportation demand.

EIA changed its methodology for IEO 2018, focusing on how different drivers of macroeconomic growth may affect international energy markets in China, India, and Africa by updating its IEO 2017 reference case with new information to create side cases for each region.

Faster economic growth in China is expected to increase energy use, but the magnitude and rate depend on how quickly China transitions to a more service-oriented, personal-consumption based economy, with consumption increasing 25% with no transition versus 20% with a fast transition. Across all China cases the country remains by far the world’s largest producer of energy-intensive goods in 2040.

India is projected to have the world’s largest population and fastest-growing economy over the projection period in all cases, but Indian total energy use and energy use per capita remain lower than in China, the US, and other industrialized countries over the next two decades.

The EIA Annual Energy Outlook (AEO) 2018 forecast relatively flat US petroleum consumption through 2050, remaining below its 2004 peak in most cases. High economic growth and relatively low oil prices would prompt increased consumption, but all other scenarios predict flat or decreasing use. Consumption of petroleum and other liquids reaches a peak of 20.38 million b/d in 2019 (from a 2016 base of 19.64), dropping to 19.07 million b/d in 2035 before rising to 19.24 in 2040 and a new peak of 20.05 million b/d in 2050. This new long-term peak, however, is 2.5% lower than last year’s forecast consumption for 2050.

EIA projects US crude oil production leveling off between 11.5 and 11.9 million b/d through 2050. Production first reaches 10 million b/d in 2019 (2 years earlier than 2018’s forecast) and peaks at 11.81 million b/d in 2031-32, nearly 12% above last year’s peak production prediction. Continued development of tight oil and shale gas support growth in NGL production, which reaches 5 million b/d in 2023, a nearly 35% increase from 2017.

The agency projects US dry natural gas production to grow at roughly 6%/year through 2020, and reach 33.84 tcf by 2022, but taper off to <1%/year for the remainder of the projection. Demand from large chemical projects and new LNG liquefaction plants supports near-term production growth. EIA predicts 2050 production of 42.98 tcf.

OGJ tracks applications for gas pipeline construction to the US Federal Energy Regulatory Commission (FERC). Applications filed in the 12 months ending June 30, 2018 (the most recent 1-year period surveyed) were flat.

• 545 miles of gas pipeline were proposed for land construction. For the earlier 12-month period ending June 30, 2017, more than 529 miles were proposed for land construction.

• FERC applications for new or additional compression horsepower at the end of June 2018 fell sharply, totaling roughly 290,000 hp from nearly 600,000 hp in June 2017.

Bases, costs

For 2019 only (Table 1), operators plan to complete roughly 14,400 miles of oil and gas pipelines worldwide at a cost of nearly $150 billion. For 2018 only, companies had planned 14,560 miles at a cost of more than $95 billion.

For projects completed after 2019 (Table 2), companies plan to lay nearly 32,000 miles of line and spend roughly $332 billion. When these companies looked beyond 2018 last year, they anticipated spending roughly $215 billion to lay 33,650 miles of line. Land construction costs spiked in the meantime to $9.95 million/mile from $5.94 million/mile.

• Projections for 2019 pipeline mileage reflect only projects likely to be completed by yearend 2019, including construction in progress at the start of the year or set to begin during it.

• Projections for mileage after 2019 include construction that might begin in 2019 but be completed later. Also included are some long-term projects judged as probable, even if they will not break ground until after 2019.

Based on historical analysis and a few exceptions and variations notwithstanding, these projections assume that 90% of all construction will be onshore and 10% offshore and that pipelines 32 in. OD or larger are onshore projects.

Following is a breakdown of projected costs, using these assumptions and OGJ pipeline-cost data:

• Total onshore construction (14,387 miles) for 2019 only will cost roughly $138 billion:

—$1.0 billion for 4-10 in.

—$6.0 billion for 12-20 in.

—$40.6 billion for 22-30 in.

—$90.3 billion for 32 in. and larger.

• Total offshore construction (532 miles) for 2019 only will cost nearly $11.8 billion:

—$248 million for 4-10 in.

—$1.5 billion for 12-20 in.

—$10.0 billion for 22-30 in.

• Total onshore construction (30,931 miles) for beyond 2019 will cost more than $308 billion:

—$9.9 billion for 12-20 in.

—$78.4 billion for 22-30 in.

—$220 billion for 32 in. and larger.

• Total offshore construction (986 miles) for beyond 2019 will cost nearly $24 billion:

—$3.5 billion for 12-20 in.

—$20.5 billion for 22-30 in.

Action

What follows is a quick rundown of some of the major projects in each of the world’s regions.

Pipeline construction projects mirror end users’ energy demands, and though much of that demand continues to center on natural gas, both crude and NGL are a large part of pipeline construction plans. The following sections look at both natural gas and liquids pipelines.

US, Canada activity

Gas, NGL

Alaska LNG plans to build an 800-mile, 42-in OD pipeline with a capacity of 3.3 bcfd to carry natural gas from the Alaska North Slope (ANS) to southcentral Alaska for liquefaction and export. Multiple interconnection points along the pipeline will provide for in-state gas distribution. The pipeline will have a 2,075-psig (143-bar) operating pressure.

ExxonMobil Alaska Production Inc. and Alaska Gasline Development Corp. (AGDC) agreed in September 2018 to certain key terms including price and a volume basis in a gas-sales precedent agreement. The agreement occurred less than 1 year after US President Donald Trump and China President Xi Jinping witnessed the signing in Beijing of a five-party (China Petrochemical Corp., CIC Capital Corp., Bank of China, AGDC, and the state government of Alaska) joint development agreement to monetize Alaska’s natural gas.

Alaska LNG expects to load its first cargo in 2025 pending a final investment decision (FID) and construction starting in 2019.

The US Army Corps of Engineers Alaska District in June 2018 released the final supplemental environmental impact statement (SEIS) for the 733-mile proposed Alaska Stand Alone Pipeline (ASAP) project from the ANS to southcentral Alaska. The two proposed projects share a common mainline alignment for more than 80% of their route. ASAP lacks an LNG component. AGDC is advancing both projects, but only one will be built. Company officials believe ASAP’s SEIS will advance Alaska LNG permitting.

Large gas pipeline projects in Canada continued to focus on potential exports. Shell Canada Energy in October 2018 took FID on its 14-million tonne/year (tpy) liquefaction joint venture, LNG Canada, in Kitimat, BC, allowing work to begin immediately. TransCanada Corp. will build, own, and operate the 2.1-bcfd Coastal GasLink pipeline that will deliver gas to the plant. Coastal GasLink is a 420-mile project extending from Montney shale production near Dawson Creek, BC, to the LNG Canada plant. It will be expandable to 5 bcfd. Construction is expected to begin early 2019 to meet a planned 2023 in-service date.

GNL Quebec has been developing its Energie Saguenay project since 2014, involving construction of an 11-million tpy LNG plant at Port Saguenay to begin operations in 2025. Natural gas would be supplied via a 465-mile, 42-in. OD pipeline from northeastern Ontario to Port Saguenay to be built by Gazoduq Inc., connecting the plant to western Canadian production.

Projects to move NGL to market made up a large part of US pipeline development plans. Permico Energia LLC plans to build a 510-mile, 24-in. OD NGL pipeline to ship West Texas Permian basin production to a newbuild 300,000-b/d fractionator near Corpus Christi, Tex. The project includes construction of a 350-mile system of downstream product pipelines accessing both an 8 million-bbl storage site and Gulf Coast industrial users, including the Mont Belvieu, Tex., market. The company expects to have the full system in operation by fourth-quarter 2020.

Oneok Inc. is building its Arbuckle II pipeline to move unfractionated NGL from Oklahoma to the company’s storage and fractionation at Mont Belvieu, Tex. The roughly 530-mile 24- and 30-in. OD pipeline will have an initial capacity of 400,000 b/d (to be expanded to 500,000 b/d) and is expected to be complete in 2020.

Phases 1 and 2 of Epic Pipeline LP’s 700-mile Epic Y Grade NGL pipeline, designed to move Permian and Eagle Ford production to market, are in service between DLK Black River Midstream and Benedum, Tex., roughly 205 miles. Phase 3, from Benedum to Corpus Christi, is expected to enter service second-half 2019, but will initially carry crude oil pending completion of Epic’s crude line.

Enterprise Products Partners LP is building a 571-mile pipeline to transport NGL from the Permian basin to Enterprise’s fractionation and storage complex in Mont Belvieu. The Shin Oak NGL pipeline will start at Enterprise’s Hobbs NGL fractionation and storage site in Gaines County, Tex. The 24-in. OD pipeline will have an initial design capacity of 250,000 b/d, expandable to 600,000 b/d. The project is supported by long-term customer commitments and is expected to be in service by second-quarter 2019.

Energy Transfer Partners is expanding its Lone Star Express pipeline by adding 352 miles of 24-in. OD pipe from its existing system near Wink, Tex., to its 30-in. pipeline south of Fort Worth. The new line is expected to be in service by early fourth-quarter 2020, transporting Permian and Delaware basin NGL production.

Targa Resources is building the Grand Prix pipeline from the Permian basin to Mont Belvieu. The line will include an extension into southern Oklahoma and is scheduled to be completed and fully in service during second-quarter 2019. Grand Prix’s capacity from North Texas, where the Permian and Oklahoma lines will meet for shipment via 30-in. OD line to Mont Belvieu, will be 450,000 b/d, expandable to 950,000 b/d. Capacity on the 24-in. line from the Permian basin will be 300,000 b/d, expandable to 550,000 b/d. Targa expects volumes shipped to Mont Belvieu via Grand Prix to reach 250,000 b/d during 2020.

Sunoco Pipeline and MarkWest Energy Partners LP’s 275,000 b/d, 306-mile Mariner East 2 pipeline, designed to move Marcellus shale NGL to the US Atlantic coast for shipment to Gulf Coast chemical producers and European markets, entered service at the end of 2018. The line uses new 20-in. and 16-in. OD pipelines in the same right of way as the existing Mariner East line. Mariner East 2 (20-in.) carries propane, ethane, and butane; 2X (16-in.) will carry all three of these as well as C3+, natural gasoline, and condensate, or any combination of these products, when it enters service late-2019.

Natural gas pipeline projects in the northeast US continued to face delays caused by strident opposition. EQT Midstream Partners’ Mountain Valley Pipeline (303 miles, 42-in. OD, northwestern West Virginia to southern Virginia) was scheduled for fourth-quarter 2018 startup but instead is navigating a variety of vacated or suspended permits and a lawsuit from the Virginia attorney general. The project is 70% complete and EQT maintains startup will now happen by end-2019.

National Fuel Gas Supply Corp.’s Northern Access Project (96.49 miles, 24-in. OD, McKean County, Pa., to Erie County, NY), announced more than 2 years ago, remains in limbo, blocked by a New York court.

Dominion in December 2018 suspended work on its Atlantic Coast (600 miles, 42-in. OD, West Virginia to North Carolina) pipeline due to stay of a previous environmental ruling. The company had already asked that three water crossing permits be voluntarily suspended until any outstanding issues could be resolved.

The Permian basin again was the area of most rapid growth in US hydrocarbon production over the past year, accompanied by an accelerated scramble to build new pipelines between Permian developments and both consuming centers and export destinations.

Kinder Morgan Texas Pipeline LLC (KMTP), DCP Midstream LP, and an affiliate of Targa Resources Corp. are building the 1.92-bcfd Gulf Coast Express Pipeline Project (GCX). GCX’s mainline portion consists of roughly 82 miles of 36-in. OD pipeline and 365 miles of 42-in. pipeline starting at the Waha Hub near Coyanosa, Tex., in the Permian basin and ending near Agua Dulce, Tex. GCX’s Midland Lateral includes about 50 miles of 36-in. pipeline and associated compression, connecting with the GCX mainline. KMTP expects GCX to be in service in October 2019.

KMTP, ExxonMobil Corp., and EagleClaw Midstream Ventures LLC, a portfolio company of Blackstone Energy Partners, are building the Permian Highway Pipeline (PHP) Project. The $2-billion pipeline is expected to be in service in late 2020, assuming timely receipt of the requisite regulatory approvals. It is designed to transport as much as 2 bcfd of gas through 430 miles of 42-in. pipeline from Waha to the US Gulf Coast and Mexico. Committed shippers include EagleClaw, Apache Corp., and XTO Energy Inc., a subsidiary of ExxonMobil, amongst others. KMTP will build and operate the pipeline.

Tellurian Inc. plans to develop a natural gas pipeline network including the previously announced Driftwood Pipeline (DWPL), a 96-mile, 48-in. OD pipeline expected to be in-service mid-2021, delivering 4 bcfd from Gillis, La., to Driftwood LNG. DWPL is in permitting with FERC.

Tellurian’s other two pipelines are expected to be in-service by end-2022. The Permian Global Access Pipeline would be a 625-mile, 42-in. OD pipeline transporting 2 bcfd from both the Waha Hub in Pecos County and other Permian and associated shale plays around Midland, Tex. to interconnects near Gillis, La. Proposed delivery systems include the Creole Trail Pipeline, Cameron Interstate Pipeline, Trunkline Gas Co., Texas Eastern, Transco, Tennessee Gas Pipeline, Florida Gas Transmission, and DWPL, among others.

The Haynesville Global Access Pipeline would cross 200 miles with 42-in. OD pipeline, transporting an additional 2 bcfd to the same interstate pipelines near Gillis.

NAmerico Partners LP’s proposed Pecos Trail pipeline would ship more than 1.85 bcfd through 468 miles of 42-in. OD pipe from the Permian basin to Corpus Christi by 2020.

Targa, NextEra Energy Pipeline Holdings LLC, an indirect, wholly owned subsidiary of NextEra Energy Resources LLC; WhiteWater Midstream LLC, a portfolio company of Denham Capital Management and Ridgemont Energy Partners; and MPLX LP plan to jointly develop the Whistler Pipeline project from the Permian basin to markets along the Texas Gulf Coast.

The project is designed to transport 2 bcfd of gas through 450 miles of 42-in. pipeline from Waha to NextEra’s Agua Dulce market hub, with an additional 170 miles of 30-in. pipe continuing from Agua Dulce to Wharton County, Tex. Supply will come from upstream connections in the Midland and Delaware basins, including direct connections to Targa plants through a 27-mile, 30-in. pipeline lateral, as well as a direct connection to the 1.4 bcfd Agua Blanca Pipeline—a joint venture of WhiteWater, WPX Energy, MPLX, and Targa—which crosses through the Delaware basin, including portions of Culberson, Loving, Pecos, Reeves, Winkler, and Ward counties. The project would have access to the Nueces Header and markets at Agua Dulce, as well as along a northern extension through Corpus Christi to the Houston Ship Channel.

Whistler, to be built by NextEra and operated by Targa, would enter service fourth-quarter 2020, subject to necessary agreements and approvals.

Crude

Enbridge Inc.’s $7.5-billion Line 3 Replacement (L3R) Program, which the company describes as its largest project ever, continues to face delays. L3R will replace the majority of Enbridge’s existing 34-in. OD Line 3 crude pipeline with new 36-in. OD pipeline on both sides of the Canada-US border, a total of 1,031 miles, doubling its capacity to 760,000 b/d.

On the Canadian side of the border Enbridge will replace most of the existing Line 3 between its Hardisty Terminal in east-central Alberta and Gretna, Man. In the US, Enbridge will replace Line 3 between Neche, ND, and Superior, Wisc.

Canada’s federal government approved L3R construction in late 2016. Enbridge originally expected the new line to enter service second-half 2017, but the company in December 2017 described its start date as uncertain and perhaps as late as November 2019, given mounting resistance inside the US. Enbridge will decommission the existing Line 3 once the new line is complete.

Plaintiff’s against L3R have asked the Minnesota Court of Appeals to overturn the state public utilities commission’s decision to grant the project a certificate of need. Multiple lawsuits have been filed against the line, the most recent wave beginning in August 2018 contesting the completeness of L3R’s environmental impact statement.

TransCanada’s Trans Mountain Expansion project (TMEP) to move crude west from Alberta would use 36-in. OD pipe to twin 980 km of the existing Trans Mountain pipeline. TMEP would add 300,000 b/d to the Trans Mountain pipeline system, bringing total capacity to 890,000 b/d. The Westridge marine terminal at Trans Mountain’s end in Burnaby, BC, would be expanded with three new berths. Planned storage additions include 14 new tanks at an existing terminal in Burnaby and five new tanks at an existing terminal in Edmonton.

TransCanada planned to begin construction in September 2017 and place the expansion into service late-2019. In January 2018, however, the company said the project could be as much as a year behind schedule due to permitting delays, moving its projected in-service date to as late as December 2020.

Canada’s Federal Court of Appeal in August 2018 declared TMEP’s regulatory review impermissibly flawed, effectively halting work on the project. The court based its decision on a failure to include project-related tanker traffic as part of its evaluation. It also cited KMI’s failure to consult with indigenous peoples. KMI earlier in 2018 had sold Trans Mountain to the Canadian government for $4.5 billion (OGJ Online, May 29, 2018).

TransCanada concluded on open season for its long-sought (originally planned to enter operations in 2012) 830,000-b/d Keystone XL pipeline in January 2018, securing about 500,000 b/d of firm, 20-year commitments and describing the results as sufficient for the project to proceed. It planned to begin primary construction in 2019, pending a final investment decision.

In November 2018, however, US District Judge Brian Morris vacated the March 2017 US Department of State record of decision authorizing the project and ordered further environmental reviews in response to a lawsuit by environmental organizations. Congressional Republicans finished 2018 by asking President Donald J. Trump to “take appropriate action necessary to move construction forward.” For its part, TransCanada in January 2019 filed documents indicating it hoped to start construction by June to complete the build by late 2020 and put the line in service in early 2021.

The delays and cancellations of pipelines designed to move Canadian oil to market combined with refinery maintenance to push Canadian crude prices lower, according to the EIA. In the Dec. 3, 2018, edition of its ‘Today In Energy’, the agency reported Western Canada Select in mid-October had traded at nearly $60/bbl less than Brent, the widest spread since 2012, noting that after several months of record and near-record US Midwest refinery runs, the late-October 4-week rolling average had fallen to 3.1 million b/d, its lowest level since 2015.

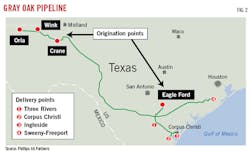

Permian basin growth also inspired a flurry of crude pipeline development. Phillips 66 and Enbridge Inc. are building the Gray Oak Pipeline, a 385,000-b/d system that will carry Permian basin production for export and to Texas refineries in Corpus Christi, Freeport, and Houston (Fig. 2). Shippers will have the option to select from origination stations in Reeves, Loving, Winkler, and Crane counties. The companies will evaluate expansion of the system based on shipper interest. The pipeline is expected to enter service by end-2019.

As previously mentioned, Epic is building a Permian-to-Corpus Christi crude pipeline, largely paralleling the path of its Y-grade project. The 700-mile line would carry as much as 550,000 b/d of crude from Orla, Tex., and include terminals in Pecos, Saragosa, Crane, Wink, Midland, Helena, and Gardendale counties servicing the Delaware, Midland, and Eagle Ford basins. The line is expected to be in service second-half 2019.

Magellan Midstream in December 2017 proposed a 645-mile, 24-in. OD pipeline from Crane, Tex., to Three Rivers and Corpus Christi, moving both Permian and Eagle Ford crude to the coast. The 350,000 b/d line would include a 200-mile branch from Three Rivers to Houston and is planned to enter operation in 2020.

Plains All American’s Cactus II pipeline would run 515 miles of 24-in. OD pipe from Wink, Tex., to McCamey and then from McCamey to Ingleside-Corpus Christi, expanding the current Cactus system’s capacity to 575,000 b/d from 390,000 b/d.

JupiterMLP has proposed a 650-mile, 36-in. OD crude pipeline from the Permian to Brownsville, Tex., with connections in the Three Rivers area to existing pipelines bound for Houston and Corpus Christi. The company also plans a terminal in Brownsville with 10 million bbl of storage, three docks, an offshore very large crude carrier loading site, and crude processing for up to 170,000 b/d. The system is expected to enter service fourth-quarter 2020.

ExxonMobil, Plains, and Lotus Midstream LLC are pursuing a 1-million b/d crude pipeline from Wink and Midland to Houston-Beaumont.

Latin America

Substantial growth of US gas exports to Mexico—expected to rise 15.1% in 2019 to more than 3 tcf (OGJ, Jan. 7, 2019, p. 23)—has prompted rapid construction of new transmission capacity both between the countries and inside Mexico. Infraestructura Marina del Golfo (IMG)—TransCanada Corp.’s joint venture with Sempra Energy subsidiary IEnova—built the 42-in. OD, 497-mile Sur de Texas-Tuxpan natural gas pipeline in Mexico. The pipeline begins offshore in the Gulf of Mexico at a border point near Brownsville, Tex., and extends along the coast to Tuxpan, Veracruz, Mexico, connecting with Cenegas’s pipeline system in Altamira and TransCanada’s Tamazunchale pipeline, among other transporters in the region.

Sur de Texas is supplied by gas from the 2.6-bcfd Valley Crossing Pipeline, built by Spectra Energy under a CFE contract. Valley Crossing extends 168 miles from Agua Dulce hub in Nueces County, Tex., to Brownsville.

TransCanada, however, has suspended work on its Tuxpan-Tula and the Tula-Villa de Reyes pipelines. The 36-in. OD, 155-mile Tuxpan-Tula pipeline would carry 886 MMcfd. Tula-Villa de Reyes would move 550 MMcfd 174 miles through 36-in. OD pipe. Work on the lines has progressed more slowly than anticipated, with CFE approving force majeure events on construction of each, but both it and TransCanada anticipate their eventual placement into service. Fermaca’s 220-mile, 42-in. Villa de Reyes-Aguascalientes-Guadalajara has also been delayed.

Pampa Energia subsidiary TGS plans to build 57 miles of 36-in. pipeline to move gas gathered in the Vaca Meurta shale between Bajada de Anelo and Sierra Chata to Argentina’s main transmission system. Producing companies include YPF SA, Tecpetrol, Dow Argentina, ExxonMobil Corp., Chevron, and Statoil. The pipeline is expected to enter service in 2019.

Asia-Pacific

OAO Gazprom and China National Petroleum Corp. (CNPC) in 2014 signed a 30-year natural gas supply contract reportedly worth $400 billion. The contract stipulates that 38 billion cu m/year (bcmy) will be supplied from Russia to China. It includes provisions for a price formula linked to oil prices and a take-or-pay clause. Gas will be delivered via the 2,465-mile Power of Siberia trunk line from Chayanda and Kovyktin fields. Work on the 56-in. OD line began in Yakutsk in September 2014, with construction of the Chinese section beginning June 2015.

The companies in December 2015 agreed on design and construction of the pipeline’s cross-border section under the Amur River. They expect to commission the pipeline’s first stage from Yakutia to Vladivostok in 2019 with the full line operational the following year, delivering 5 bcmy initially and 38 bcmy by 2024. Pipelay was 95.5% complete as of October 2018.

Negotiations are still underway between Russia and China regarding a potential western route between the two countries, moving gas into Xinjiang on Power of Siberia 2 (formerly Altai pipeline). The 1,612-mile line would use 56-in. OD pipe and could be complete as early as 2021 if talks conclude promptly. Capacity is estimated at 30 bcmy.

China is also addressing its gas demand domestically. Sinopec plans to build a 5,563-mile, 40-in. OD pipeline to move coal-to-gas sourced production from Xinjiang east to Guangdong and Zhejiang. Planned capacity is 30 bcmy.

Turkmengaz is leading the consortium of national governments planning to build, own, and operate the 1,800-km Turkmenistan-Afghanistan-Pakistan-India (TAPI) natural gas pipeline, planned to carry 33 bcmy by 2022 (Fig. 3).

The Asian Development Bank (ADB) in 2005 estimated TAPI’s cost at $7.6 billion, making the pipeline profitable only at throughputs of 30-33 billion cu m (bcm)/year. The estimated cost was nearly triple ADB’s 2002 estimate of $2.6 billion. Persistent delays have since raised TAPI’s projected cost to $10 billion.

TAPI would cross 200 km through Turkmenistan (starting from the 16-tcf Galkynysh gas field in eastern Mary province), 773 km through Herat and Kandahar provinces, Afghanistan, and 827 km through Multan and Quetta, Pakistan, to end at Fazilka in northern Punjab province, India

At maximum rates, the pipeline would carry 90 million standard cu m/day (MMscmd) of natural gas from Galkynysh (formerly South Yolotan-Osman) under 30-year commitments, with India, Pakistan, and Afghanistan originally set to have received 38, 38, and 14 MMscmd, respectively. Afghanistan, however, reduced its requirement to just 1.5-4 MMscmd, opening the possibility of India and Pakistan’s share growing to as much as 44.25 MMscmd each.

Line pipe began arriving in Turkmenistan in November 2018. Construction has yet to begin in Afghanistan. Pakistan says it will start work in 2019.

GSPL India Gasnet Ltd. is building a 2,052-km natural gas pipeline between Mehsana and Bhatinda. The project received its environmental permits from the Indian government in May 2013. GSPL expects the 42-in. OD pipeline to enter service in 2019 with a capacity of 30-MMscmd. The pipeline will carry production and imports from India’s east coast to consumers in central and northern parts of the country.

Construction began in July 2015 on the first phase of GAIL’s Jagdishpur-Dhamra natural gas pipeline. The 2,810-mile pipeline—2,111 miles of 36-in. OD trunkline and 699 miles of 12-30 in spur and feeder lines—will connect eastern India to the national grid. The initial phase will ship 7.4 MMscmd, with total capacity reaching 16 MMscmd.

The pipeline will cross Bihar, Jharkhand, West Bengal, and Uttar Pradesh states. It will pass through 13 districts in Bihar, supplying both a refinery there and a refinery in Barauni. It will also supply local gas networks in Barauni, Gaya, and Patna. Its 241-mile Phase 1 is expected to enter service early-2019, with the full line complete in 2020.

GSPL India Transco Ltd., Indian Oil Corp. (IOC), HPCL, and Bharat Petroleum Corp. are building a 992-mile, 24-in. OD pipeline from Mallavaram to Bhilwara, with completion expected in 2020. The pipeline is designed to move 30 MMscmd from India’s east coast to consumers in central and northern parts of the country.

IOC is also building a 729-mile, 28-in. OD pipeline from Ennore to Tuticorin to move regasified LNG. Completion is expected in 2019, but the line has faced increasing local opposition along its route.

The long-discussed Iran-Pakistan natural gas pipeline was given a new lease on life by the need to link a planned LNG terminal at Gwadar, Pakistan, with consuming markets (Fig. 3). A 700-km, 42-in. OD pipeline would run from Gwadar LNG east to Nawabshah and access to the Sui Southern Gas Co. (SSGC) network by as early as 2020. An 81-km leg from Gwadar to the Iranian border could complete the pipeline once the larger line has entered service. Pakistan has been slow to build its section of the line due to lack of funding. The Iranian section of the line is built.

Russia, meanwhile, has agreed to build a pipeline in Pakistan connecting an LNG terminal in Karachi with Lahore (Fig. 3). The 42-in. OD, 683-mile pipeline would carry 1.2 bcfd north from the coast starting in 2023. Financing was approved in early 2018, with deadline for a final agreement between the countries set for April 2019. The Pakistani government in July 2017 asked SSGC to build a section between Nawabshah and Karachi.

Europe

Gazprom and Germany’s BASF SE in August 2015 signed a memorandum of intent stipulating cooperation on building the Nord Stream 2 gas pipeline. The companies would build strings No. 3 and No. 4, connecting the Russian (Ust-Luga) and German (Greifswald) coasts under the Baltic Sea and doubling the line’s 55-bcmy capacity by 2019. E.On, Shell, and OMV AG each previously agreed to participate in construction of the two strings.

Offshore pipelay is underway in Germany and Finland’s exclusive economic zones. The 759-mile line is using 48-in. OD pipe. A total of 186 miles had been laid as of end-November 2018.

Russia in late 2014 decided against building the 930-km South Stream natural gas pipeline across the Black Sea from Russia to Bulgaria, citing delays on the part of the European Union in taking the steps necessary to move forward. Gazprom Chief Executive Alexei Miller and Mehmet Konuk, chairman of Botas Petroleum Pipeline Corp., signed a memorandum of understanding Dec. 1, 2014, to instead build an offshore gas pipeline from the Russkaya compressor station (also South Stream’s starting point), under construction in the Krasnodar Territory, across the Black Sea to Turkey (OGJ Online, Dec. 2, 2014).

The new pipeline, TurkStream, has the same 63 bcmy overall capacity, with 14 bcmy to be used in Turkey and the balance shipped to a border crossing with Greece. The 448-Mw Russkaya station will provide as much as 28.45 MPa of pressure. The line’s offshore section consists of four 15.75-billion cu m/year strings. Gazprom hired Allseas’ Pioneering Spirit to conduct the 900-km offshore pipelay, completed during November 2018. Gazprom plans to put the line in service in late 2019.

Partners in the Shah Deniz consortium made a final investment decision (FID) in December 2013 on Stage 2 development of the Caspian Sea natural gas field offshore Azerbaijan, triggering plans to expand the South Caucasus Pipeline (SCP) through Azerbaijan and Georgia, build the Trans Anatolian Gas Pipeline (TANAP) across Turkey, and begin work on the previously selected Trans Adriatic Pipeline (TAP) for shipment into Europe.

SCP expansion twinned the existing Baku-Tbilisi-Ceyhan (BTC) pipelines through Azerbaijan and Georgia, as well as adding two compressor stations to boost capacity by 16 bcmy. The project included 441 km of new 56-in. OD pipe; 385 km through Azerbaijan and another 56 into Georgia, at which point the expansion was connected to the existing SCP. The first additional compressor station is 3 km inside Georgia, collocated with an existing BTC station near Rustavi. The second new station is at a greenfield site on the existing line 139 km downstream, west of Tsalka Lake, Georgia. SCP’s current capacity is 7 bcmy. BP completed work and placed the expansion in service first-half 2018.

TANAP runs 1,800 km using 48- and 56-in. OD pipeline to move as much as 30 bcmy and also entered service first-half 2018.

The Shah Deniz II consortium in June 2013 selected the Trans Adriatic Pipeline (TAP) as the project’s European transport option. TAP will transport as much as 20-billion cu m/year of natural gas from Shah Deniz II through Greece and Albania to Italy, from where it can be shipped further into Western Europe.

The project will use 36- and 48-in. OD pipe, with service expected to begin in 2020. The 36-in. pipe will make up the line’s 115-km offshore section, with the 48-in. pipe used onshore. Total planned length is 878 km. As of November 2018 TAP was more than 80% complete, the bulk of the remaining work consisting of its offshore section between Albania and Italy.

Shah Deniz II adds 16 bcmy of gas production to the roughly 9 bcmy of Shah Deniz Stage 1. Field development, some 70 km offshore Baku in the Azerbaijan sector of the Caspian Sea, includes two new bridge-linked production platforms; 26 subsea wells to be drilled with 2 semisubmersible rigs; 500 km of subsea pipelines built at up to 550 m of water; the 16 bcmy upgrade to SCP; and expansion of the Sangachal Terminal.

The Poland-Lithuania Gas Interconnector (GIPL), designed to connect the Polish and Lithuanian gas transmission systems, will enter service in 2021. The 28-in. OD pipeline will include 310-357 km between Holowczyce, Poland, and the Lithuanian border, and another 177 km from the border to Jauniunai, Lithuania. Line pipe was tendered in August 2018.

Middle East

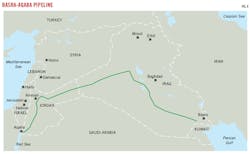

Iraq began technical work in 2014 on twin 1,043-mile pipelines—one crude oil, one associated fuelgas—running from Basra to the Red Sea at Aqaba, Jordan. The oil pipeline would use 56-in. OD pipe to move 1-million b/d, crossing 422 miles inside Iraq with the balance in Jordan.

Jordan will keep 150,000 b/d for domestic refining. Iraq is pursuing the project to decrease its dependence on the Persian Gulf as an oil export route.

Iraq decided in August 2017 to cancel the parallel gas pipeline, citing high costs and associated delays. The pipeline was to have fueled the crude line’s pumps, with alternative sources now being sought. Iraqi and Jordanian leadership met in January 2019 to finalize the oil pipeline.

The National Iranian Gas Co. (NIGC) continues construction of its 1,147-mile Iran Gas Trunkline IX (IGAT 9), running from Asalouyeh to West Azerbaijan province, Iran, providing for the potential shipment of South Pars gas to European customers. Completion is expected in 2020. Mid-2018 press reports described work as 70% done.

NIGC plans to build the 186-mile Iranshahr-Chabahar pipeline by end-2019, having signed an interministerial construction contract in April 2018. The pipeline will use 149 miles of 56-in. OD line and 37 miles of 36-in. OD line, delivering natural gas to power the Chabahar free trade and industrial zone.

Oman Gas Co. (OGC) plans to build a 350-km, 36-in. OD pipeline to deliver natural gas from Saih Nihayda in central Oman to an industrial and maritime hub being developed in Duqm. OGC signed Petrojet as contractor in late 2016 and expects the 25-MMscmd pipeline to enter service in 2019.

The National Iranian Gas Export Co. (NIGEC) in 2016 hired Iranian Offshore Engineering and Construction Co. (IOEC) and Pars Consultant Engineering Co. to perform survey and basic engineering work on a 380-km pipeline intended to carry Iranian gas to Oman.

The onshore section of the pipeline would use 200 km of 56-in. OD pipe in Iran, with the offshore section running 180 km of 36-in. OD pipe from Kuhe Mubarak, Iran, to Sohar Port, Oman. The onshore pipe would deliver gas from the IGAT VII pipeline.

The two countries reached agreement on the project in February 2017. Delivery of 28 million cu m/day to Oman would begin in 2019. In addition to domestic consumption, Oman—which lies beyond the Straits of Hormuz—is considering liquefaction and export.

Africa

Uganda and Tanzania plan to build the 897-mile, 24-in. OD heated East Africa Crude Oil Pipeline (EACOP), bypassing Kenya en route from fields in Uganda to the Tanzanian port of Tanga. The pipeline, engineered by Gulf Interstate Engineering Co., would transport roughly 300,000 b/d to the Indian Ocean for export.

Total SA suggested this route as an alternative to mitigate security concerns regarding a Kenyan passage. China National Offshore Oil Corp. Ltd. and Tullow Oil are developing the project with Total. The line is expected to enter service in 2021.

The Tanzania Petroleum Development Corp plans to build an 1,100-mile, 24-in. OD gas pipeline from Dar es Salaam to Uganda, with construction beginning in 2021 and completed in 2024. The line would pass through Tanga to Mwanza. A second possible route would follow EACOP’s corridor.

Ethiopia and Djibouti plan to build a 700-km, 40-in. OD natural gas pipeline to transport Ogaden basin gas to a floating LNG liquefaction plant offshore Djibouti. China’s Poly-GCL is developing the project with a scheduled 2021 startup date. The 3-mtpy plant, fed by the 2-billion cu m/year pipeline, would be sited at Damerjog port near the Djibouti-Somalia border and expandable to 10 mtpy. Gas would be sourced from Calub and Hilala fields, being developed by China Oil HBP Group.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.